The past six months have been a windfall for Victoria's Secret’s shareholders. The company’s stock price has jumped 96.7%, hitting $36.99 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Victoria's Secret, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Victoria's Secret Will Underperform?

We’re happy investors have made money, but we don't have much confidence in Victoria's Secret. Here are three reasons why VSCO doesn't excite us and a stock we'd rather own.

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Victoria's Secret’s demand was weak over the last six years as its sales fell at a 3.4% annual rate. This was below our standards and signals it’s a low quality business.

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Victoria's Secret’s demand has been shrinking over the last two years as its same-store sales have averaged 1.3% annual declines.

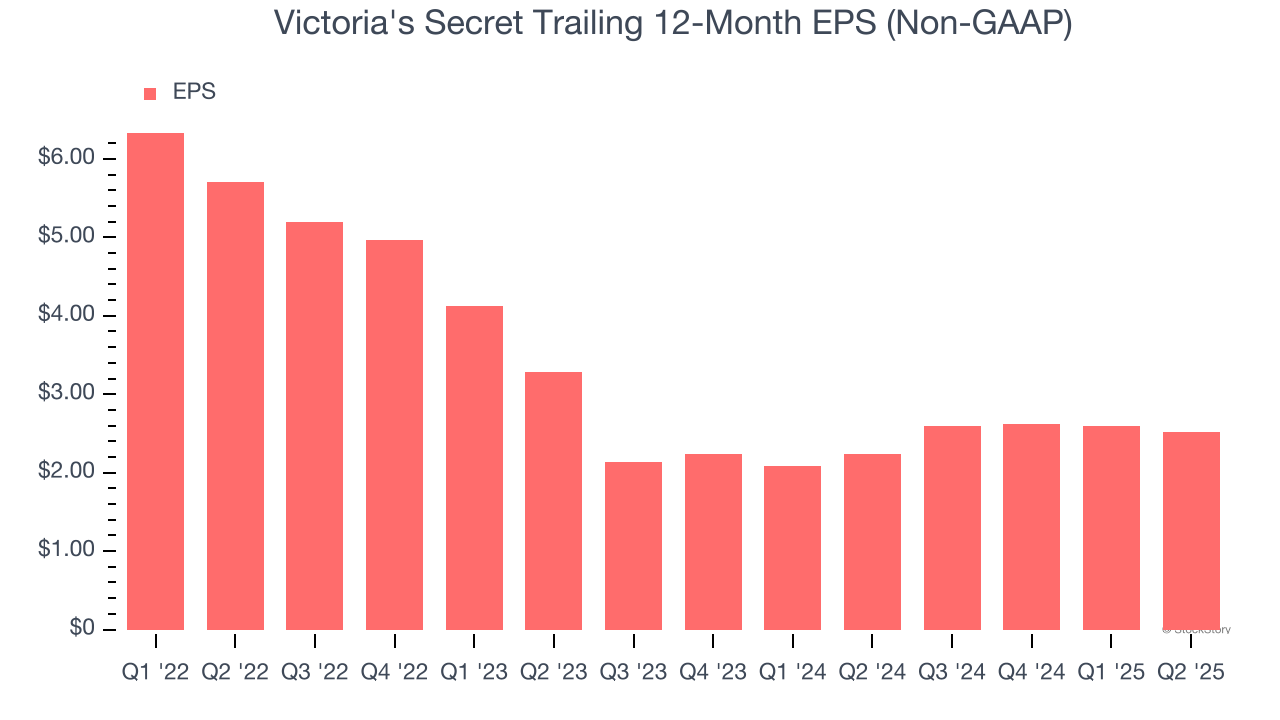

3. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Victoria's Secret’s full-year EPS dropped 90%, or 23.9% annually, over the last three years. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS because it could imply changing secular trends and preferences. If the tide turns unexpectedly, Victoria's Secret’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Victoria's Secret doesn’t pass our quality test. After the recent rally, the stock trades at 18.9× forward P/E (or $36.99 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Victoria's Secret

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.