As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the software development industry, including Bandwidth (NASDAQ: BAND) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 9 software development stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.1% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.1% on average since the latest earnings results.

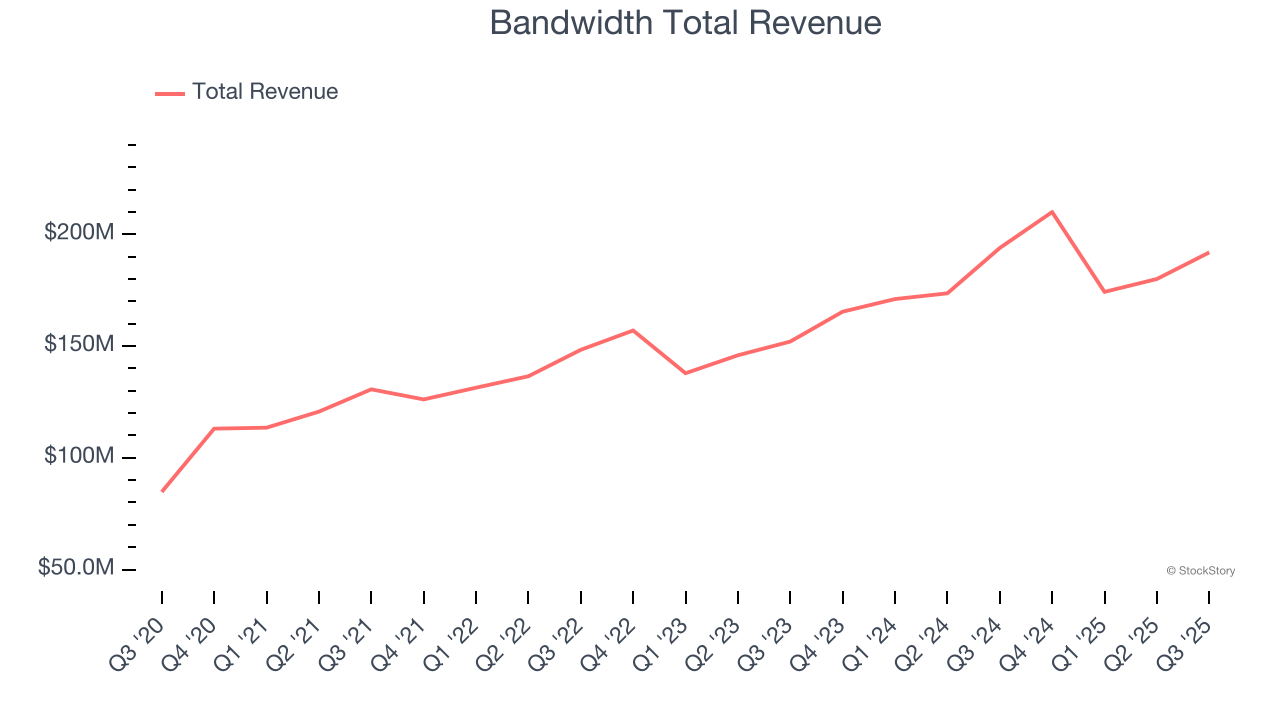

Bandwidth (NASDAQ: BAND)

Powering communications for tech giants like Microsoft, Google, and Zoom, Bandwidth (NASDAQ: BAND) provides cloud-based communications software and APIs that enable businesses to embed voice, messaging, and emergency services into their applications and platforms.

Bandwidth reported revenues of $191.9 million, down 1% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance beating analysts’ expectations.

Bandwidth delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 14.3% since reporting and currently trades at $14.37.

Is now the time to buy Bandwidth? Access our full analysis of the earnings results here, it’s free for active Edge members.

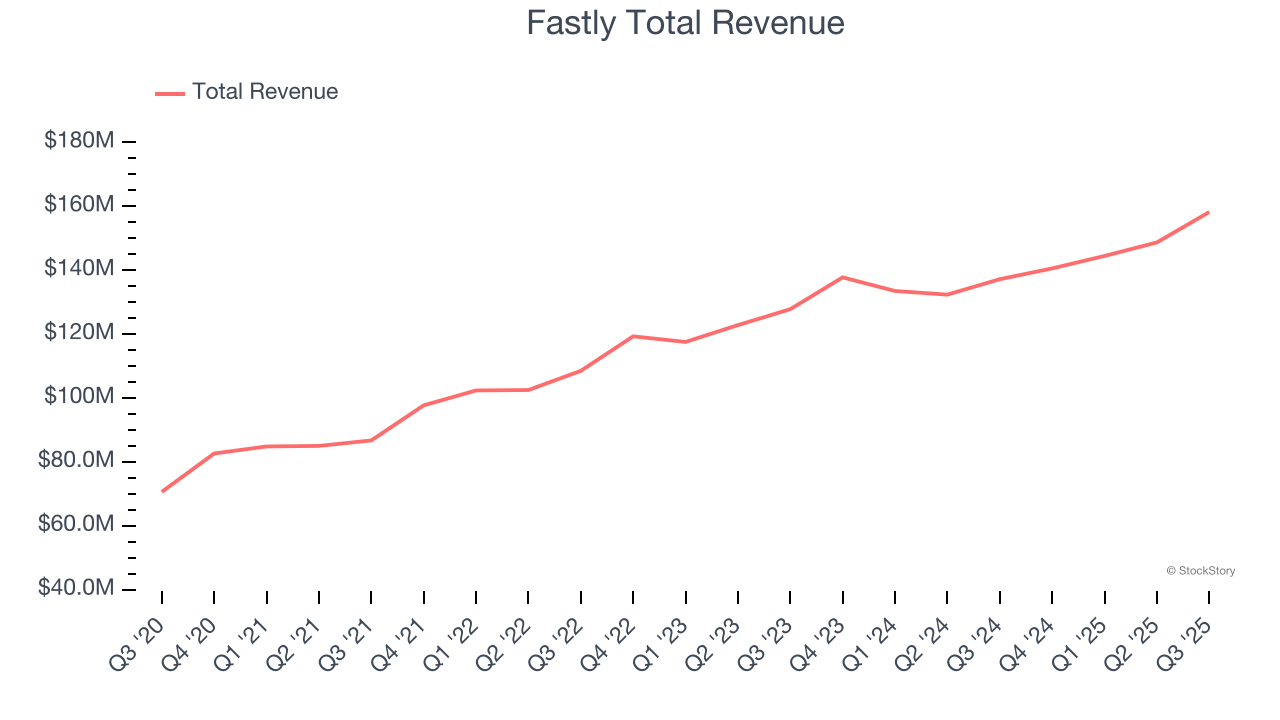

Best Q3: Fastly (NYSE: FSLY)

Taking its name from the core advantage it delivers to customers, Fastly (NYSE: FSLY) operates an edge cloud platform that processes, secures, and delivers web content as close to end users as possible, enabling faster digital experiences.

Fastly reported revenues of $158.2 million, up 15.3% year on year, outperforming analysts’ expectations by 4.7%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Fastly scored the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 39.5% since reporting. It currently trades at $11.26.

Is now the time to buy Fastly? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: F5 (NASDAQ: FFIV)

Originally named after the F5 tornado, the most powerful on the meteorological scale, F5 (NASDAQ: FFIV) provides security and delivery solutions that protect applications across cloud, data center, and edge environments for large organizations.

F5 reported revenues of $810.1 million, up 8.5% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and revenue guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 19.6% since the results and currently trades at $233.40.S

Read our full analysis of F5’s results here.

Datadog (NASDAQ: DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ: DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

Datadog reported revenues of $885.7 million, up 28.4% year on year. This result surpassed analysts’ expectations by 3.9%. It was an exceptional quarter as it also put up a solid beat of analysts’ annual recurring revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

The company added 210 enterprise customers paying more than $100,000 annually to reach a total of 4,060. The stock is up 19.3% since reporting and currently trades at $185.45.

Read our full, actionable report on Datadog here, it’s free for active Edge members.

Twilio (NYSE: TWLO)

Known for the clever "Twilio Magic" demo that had developers creating functioning communications apps in minutes, Twilio (NYSE: TWLO) provides a platform that enables businesses to communicate with their customers through voice, messaging, email, and other digital channels.

Twilio reported revenues of $1.3 billion, up 14.7% year on year. This number topped analysts’ expectations by 3.8%. Overall, it was an exceptional quarter as it also logged accelerating customer growth and an impressive beat of analysts’ EBITDA estimates.

The company added 43,000 customers to reach a total of 392,000. The stock is up 11.8% since reporting and currently trades at $125.65.

Read our full, actionable report on Twilio here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.