Aerospace and defense company Mercury Systems (NASDAQ: MRCY) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 10.2% year on year to $225.2 million. Its non-GAAP profit of $0.26 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Mercury Systems? Find out by accessing our full research report, it’s free for active Edge members.

Mercury Systems (MRCY) Q3 CY2025 Highlights:

- Revenue: $225.2 million vs analyst estimates of $205.7 million (10.2% year-on-year growth, 9.5% beat)

- Adjusted EPS: $0.26 vs analyst estimates of $0.09 (significant beat)

- Adjusted EBITDA: $35.57 million vs analyst estimates of $23.52 million (15.8% margin, 51.2% beat)

- Operating Margin: -3.8%, up from -6.6% in the same quarter last year

- Free Cash Flow was -$4.37 million compared to -$20.9 million in the same quarter last year

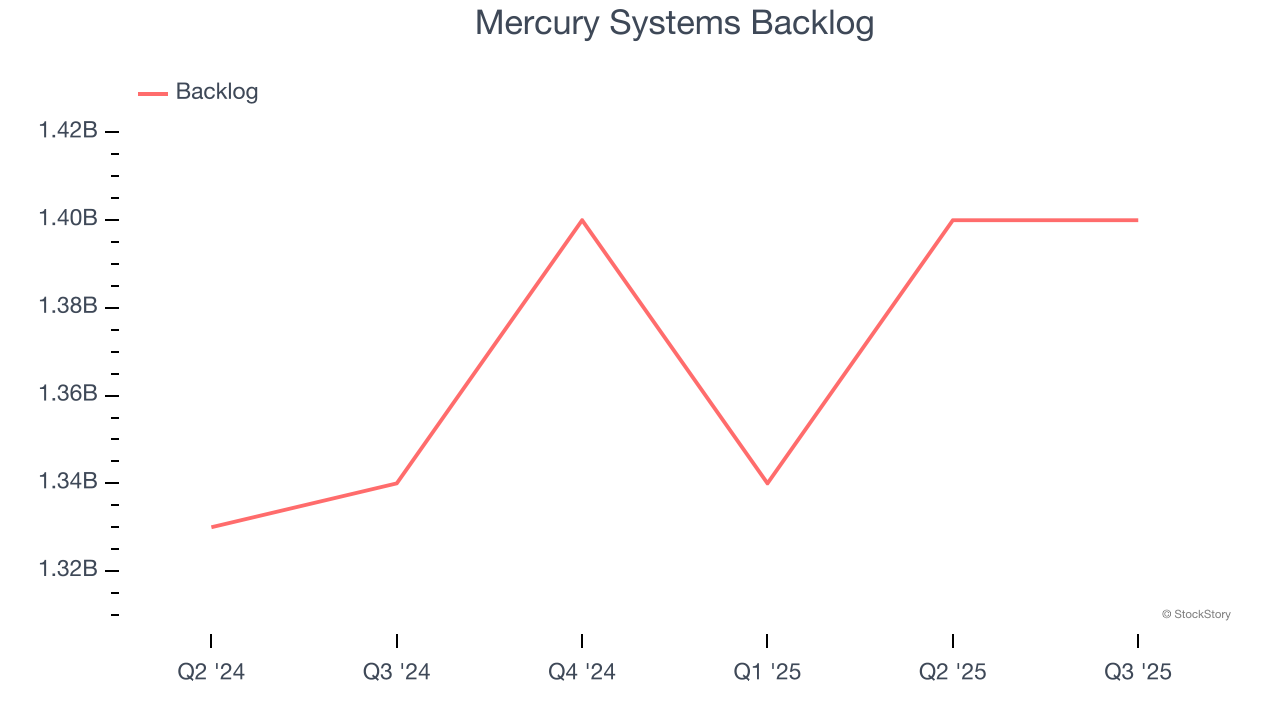

- Backlog: $1.4 billion at quarter end, up 4.5% year on year

- Market Capitalization: $4.67 billion

“We delivered Q1 results that were ahead of our expectations, with solid year-over-year growth in backlog, revenue, adjusted EBITDA, and free cash flow. Our ability to accelerate deliveries on a number of our customers’ high-priority programs once again contributed to strong results this quarter,” said Bill Ballhaus, Mercury’s Chairman and CEO.

Company Overview

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Revenue Growth

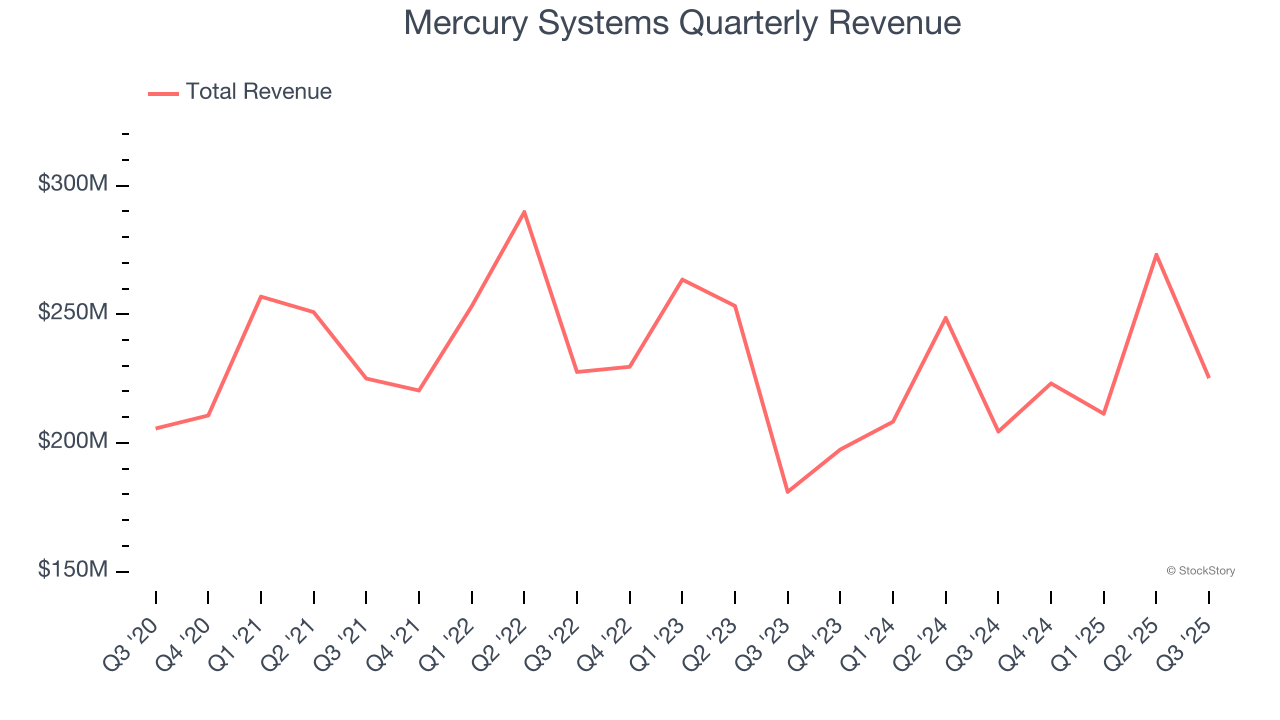

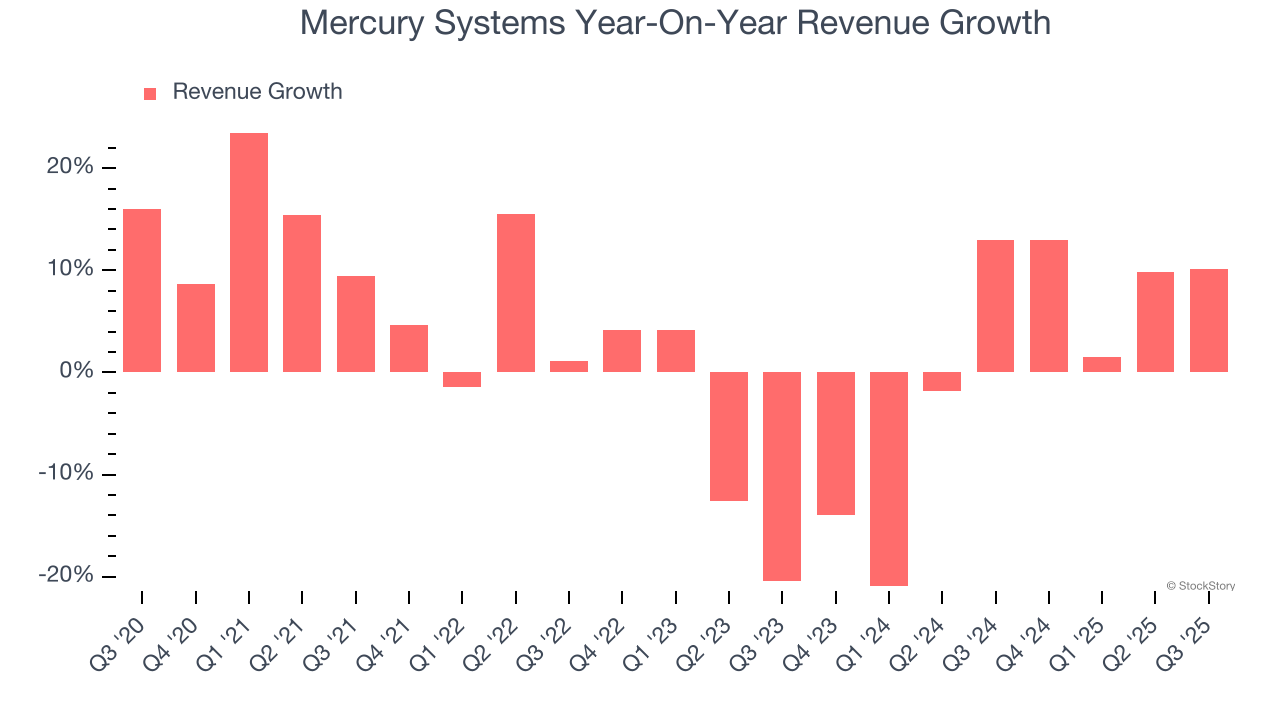

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Mercury Systems’s sales grew at a sluggish 2.5% compounded annual growth rate over the last five years. This was below our standards and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Mercury Systems’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Mercury Systems also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Mercury Systems’s backlog reached $1.4 billion in the latest quarter and averaged 4.9% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Mercury Systems’s products and services but raises concerns about capacity constraints.

This quarter, Mercury Systems reported year-on-year revenue growth of 10.2%, and its $225.2 million of revenue exceeded Wall Street’s estimates by 9.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

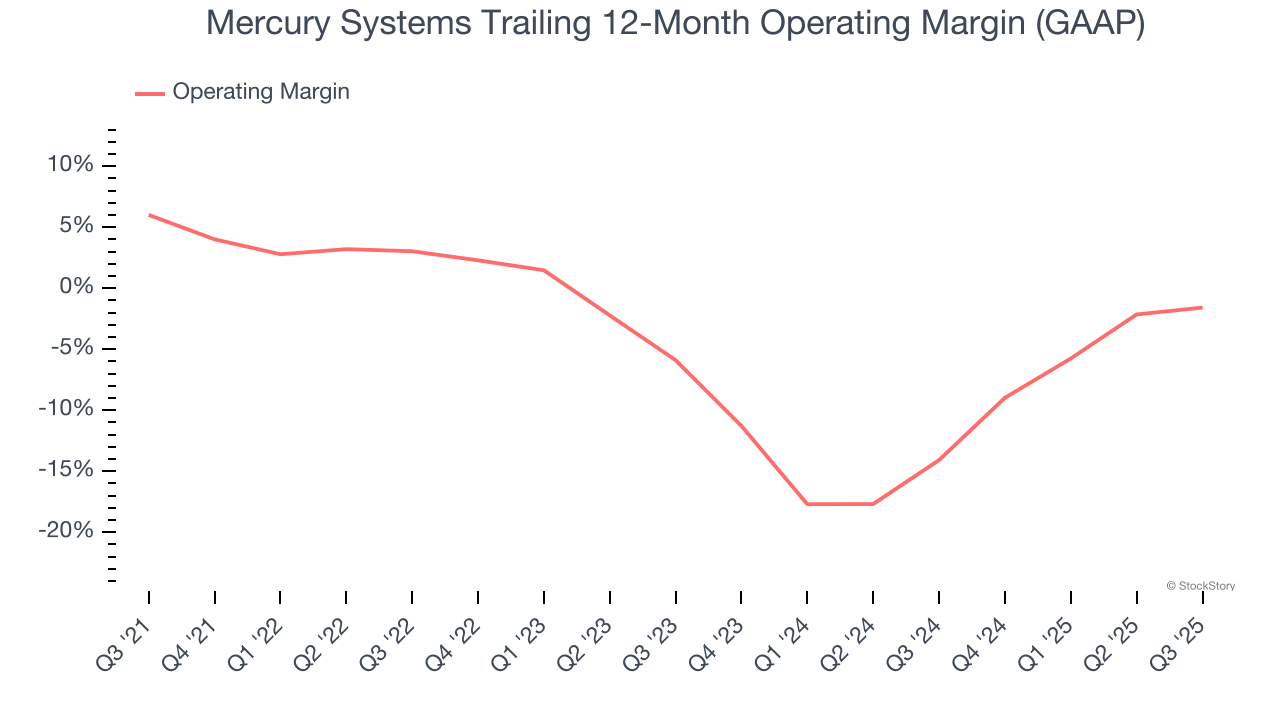

Operating Margin

Mercury Systems’s high expenses have contributed to an average operating margin of negative 2.2% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Mercury Systems’s operating margin decreased by 7.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Mercury Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Mercury Systems generated a negative 3.8% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

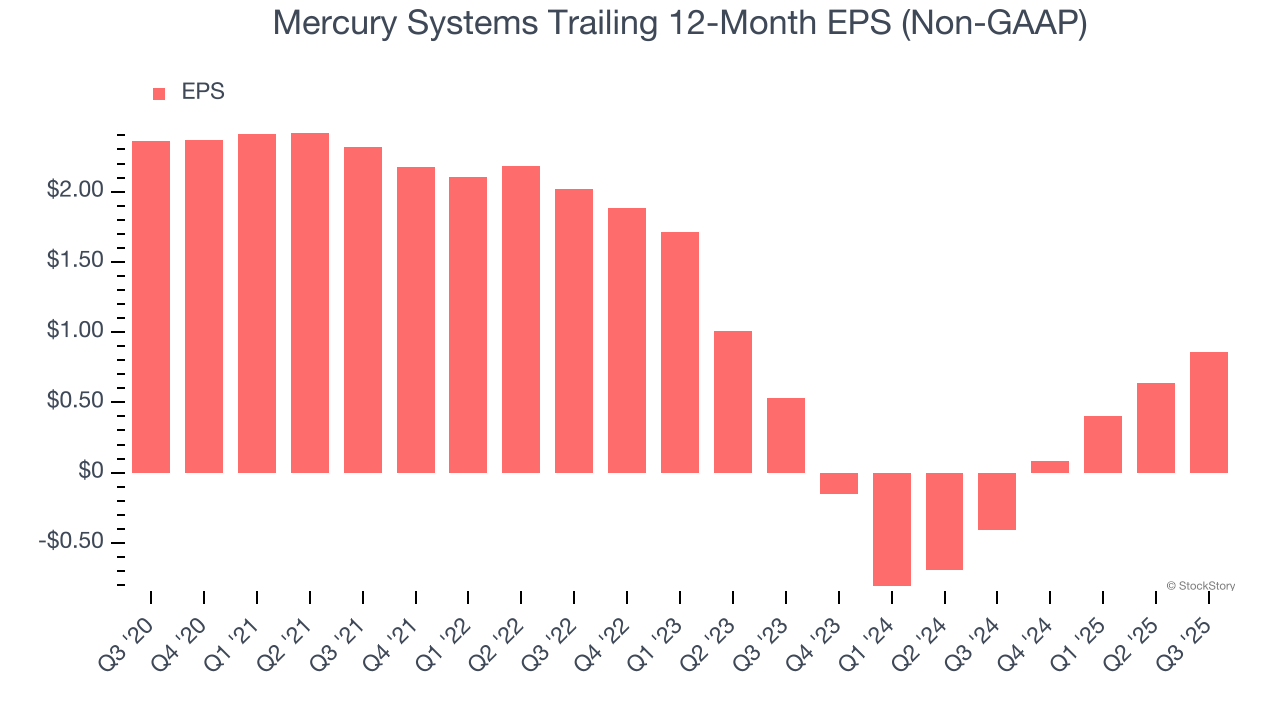

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Mercury Systems, its EPS declined by 18.3% annually over the last five years while its revenue grew by 2.5%. This tells us the company became less profitable on a per-share basis as it expanded.

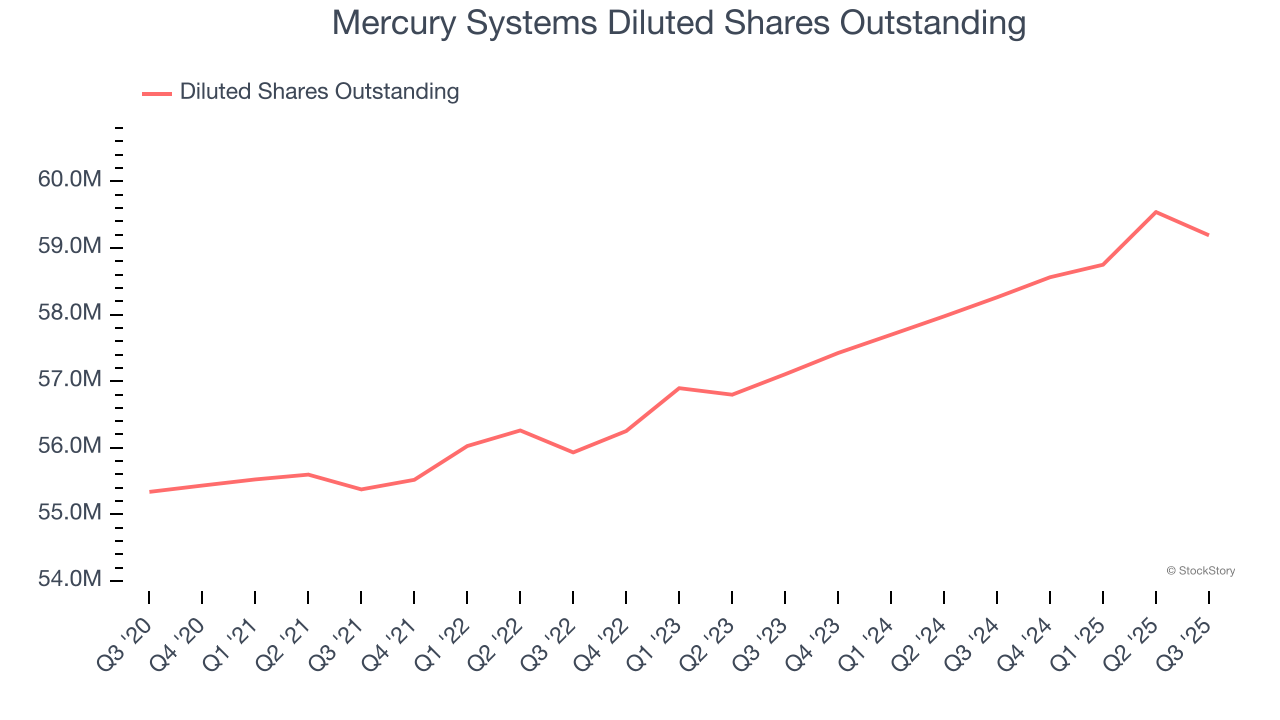

Diving into the nuances of Mercury Systems’s earnings can give us a better understanding of its performance. As we mentioned earlier, Mercury Systems’s operating margin expanded this quarter but declined by 7.6 percentage points over the last five years. Its share count also grew by 7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Mercury Systems, its two-year annual EPS growth of 27.4% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Mercury Systems reported adjusted EPS of $0.26, up from $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mercury Systems’s full-year EPS of $0.86 to grow 24.1%.

Key Takeaways from Mercury Systems’s Q3 Results

It was good to see Mercury Systems blow past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 5.8% to $80 immediately following the results.

Mercury Systems put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.