Luxury ski resort company Vail Resorts (NYSE: MTN) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 4.1% year on year to $271 million. Its GAAP loss of $5.20 per share was 0.6% below analysts’ consensus estimates.

Is now the time to buy Vail Resorts? Find out by accessing our full research report, it’s free for active Edge members.

Vail Resorts (MTN) Q3 CY2025 Highlights:

- Revenue: $271 million vs analyst estimates of $274.3 million (4.1% year-on-year growth, 1.2% miss)

- EPS (GAAP): -$5.20 vs analyst expectations of -$5.17 (0.6% miss)

- Adjusted EBITDA: -$128.2 million (-47.3% margin, 2.9% year-on-year decline)

- Operating Margin: -77.4%, in line with the same quarter last year

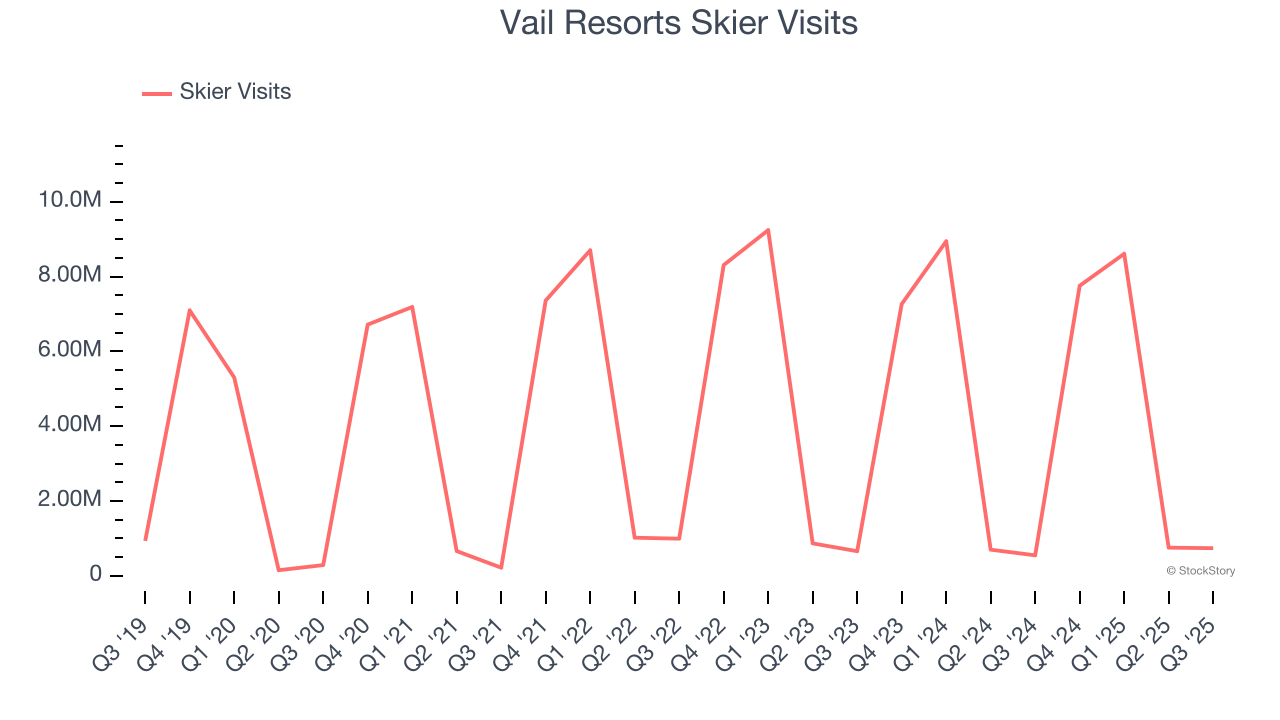

- Skier Visits: 739,000, up 191,000 year on year

- Market Capitalization: $5.23 billion

"Our first quarter results were in line with our expectations and importantly, we're seeing encouraging early momentum from our key initiatives to drive visitation during the 2025/2026 ski season, deepen our guest engagement, and create exceptional guest experiences," said Rob Katz, Chief Executive Officer of Vail Resorts.

Company Overview

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE: MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Revenue Growth

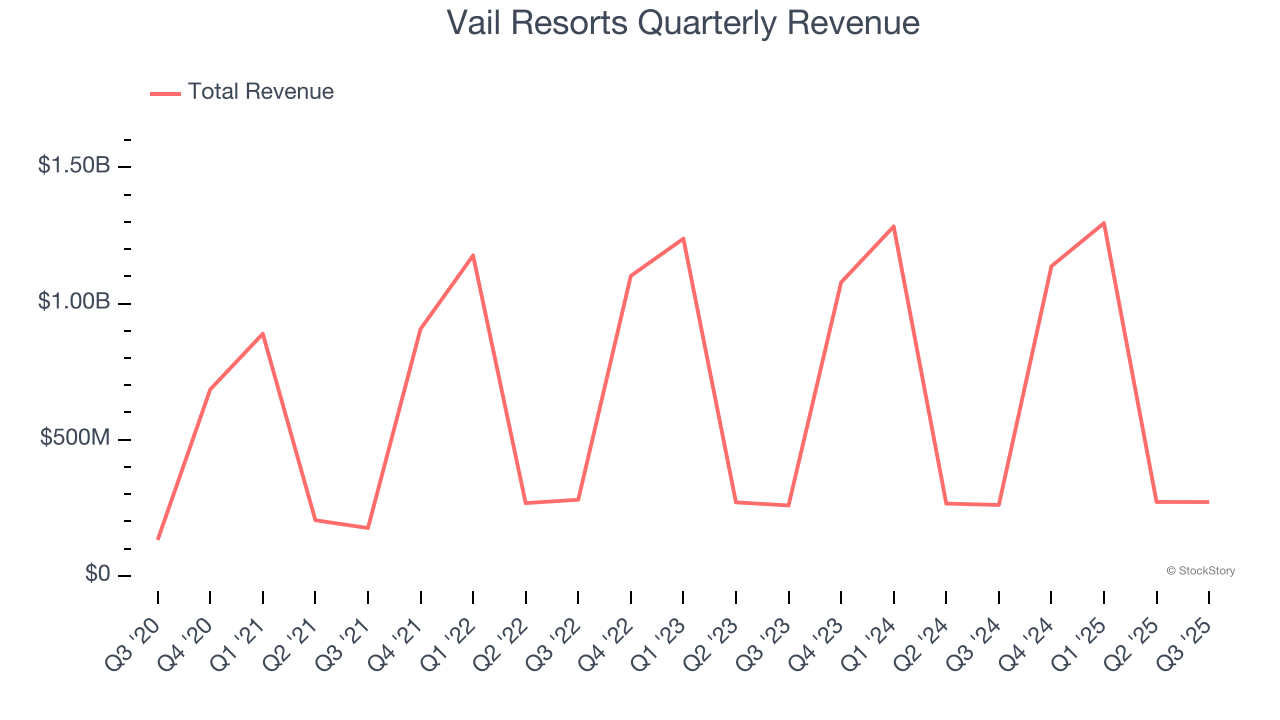

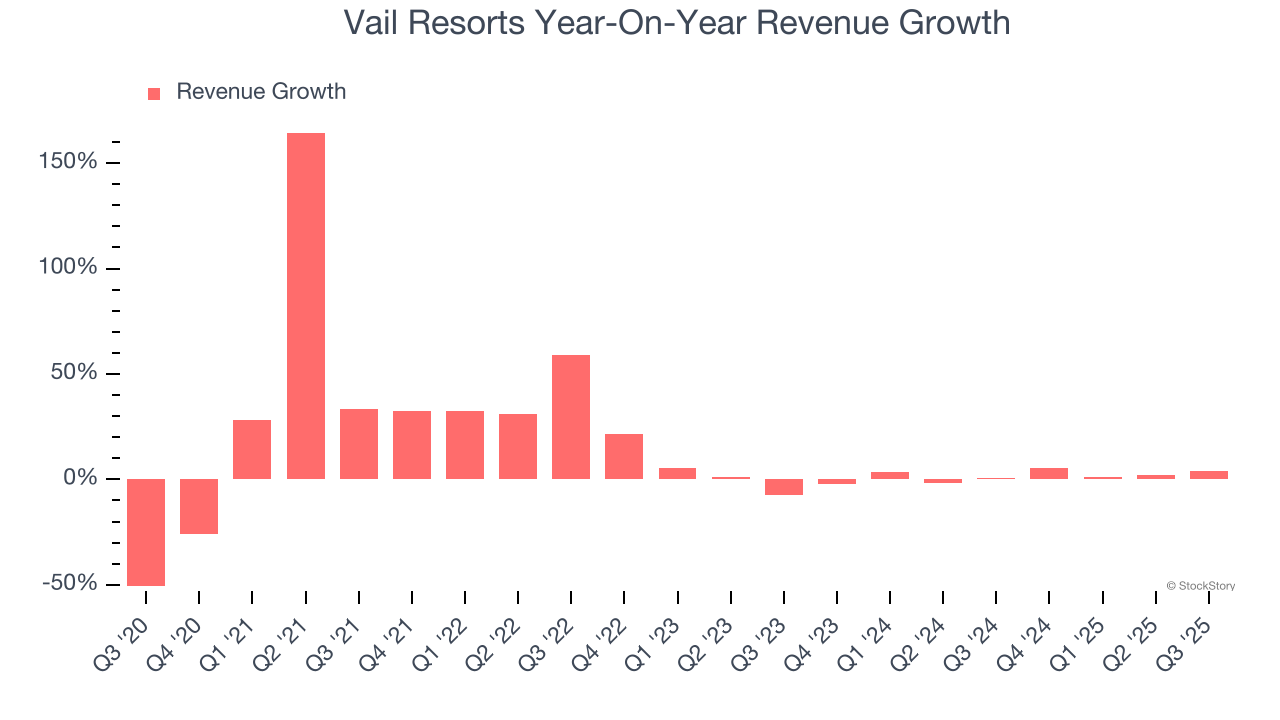

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Vail Resorts grew its sales at a 10.2% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Vail Resorts’s recent performance shows its demand has slowed as its annualized revenue growth of 1.8% over the last two years was below its five-year trend. Note that COVID hurt Vail Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Vail Resorts also discloses its number of skier visits, which reached 739,000 in the latest quarter. Over the last two years, Vail Resorts’s skier visits were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Vail Resorts’s revenue grew by 4.1% year on year to $271 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

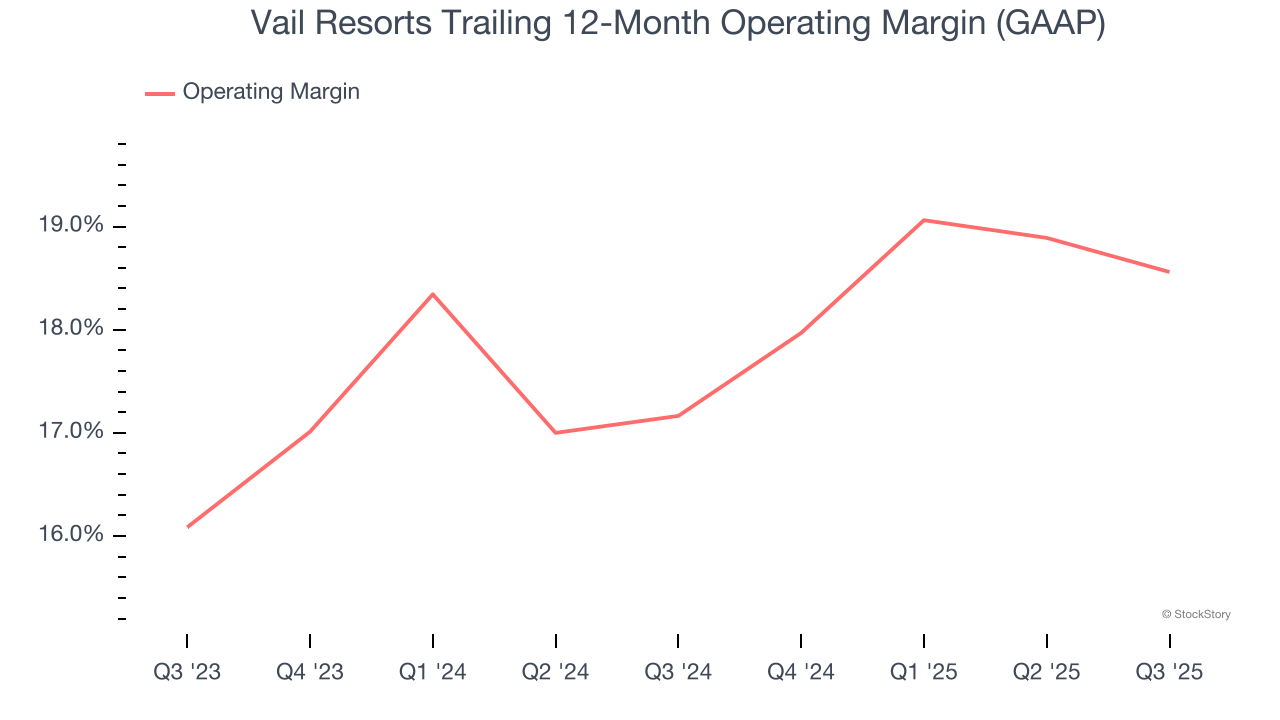

Vail Resorts’s operating margin has been trending up over the last 12 months and averaged 17.9% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Vail Resorts generated an operating margin profit margin of negative 77.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

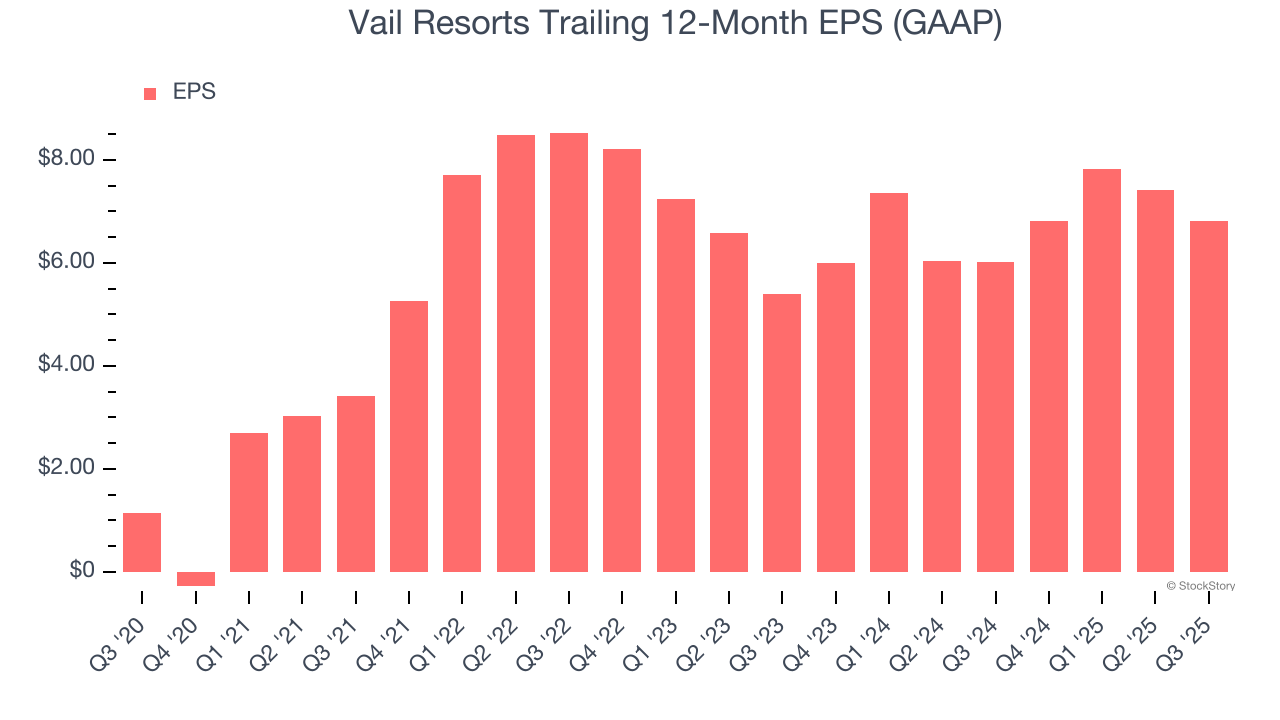

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Vail Resorts’s EPS grew at a solid 43% compounded annual growth rate over the last five years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Vail Resorts reported EPS of negative $5.20, down from negative $4.61 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Vail Resorts’s full-year EPS of $6.82 to stay about the same.

Key Takeaways from Vail Resorts’s Q3 Results

We were impressed by how significantly Vail Resorts blew past analysts’ skier visits expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, this was a mixed quarter. The stock remained flat at $142.00 immediately following the results.

Is Vail Resorts an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.