Furniture company La-Z-Boy (NYSE: LZB) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 3.1% year on year to $570.9 million. The company expects next quarter’s revenue to be around $500 million, close to analysts’ estimates. Its non-GAAP profit of $0.92 per share was 1.1% below analysts’ consensus estimates.

Is now the time to buy La-Z-Boy? Find out by accessing our full research report, it’s free.

La-Z-Boy (LZB) Q1 CY2025 Highlights:

- Revenue: $570.9 million vs analyst estimates of $558.6 million (3.1% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.92 vs analyst expectations of $0.93 (1.1% miss)

- Adjusted EBITDA: $41.17 million vs analyst estimates of $63.5 million (7.2% margin, 35.2% miss)

- Revenue Guidance for Q2 CY2025 is $500 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 5.2%, down from 9.1% in the same quarter last year

- Free Cash Flow Margin: 18.6%, up from 6.7% in the same quarter last year

- Market Capitalization: $1.61 billion

Company Overview

The prized possession of every mancave, La-Z-Boy (NYSE: LZB) is a furniture company specializing in recliners, sofas, and seats.

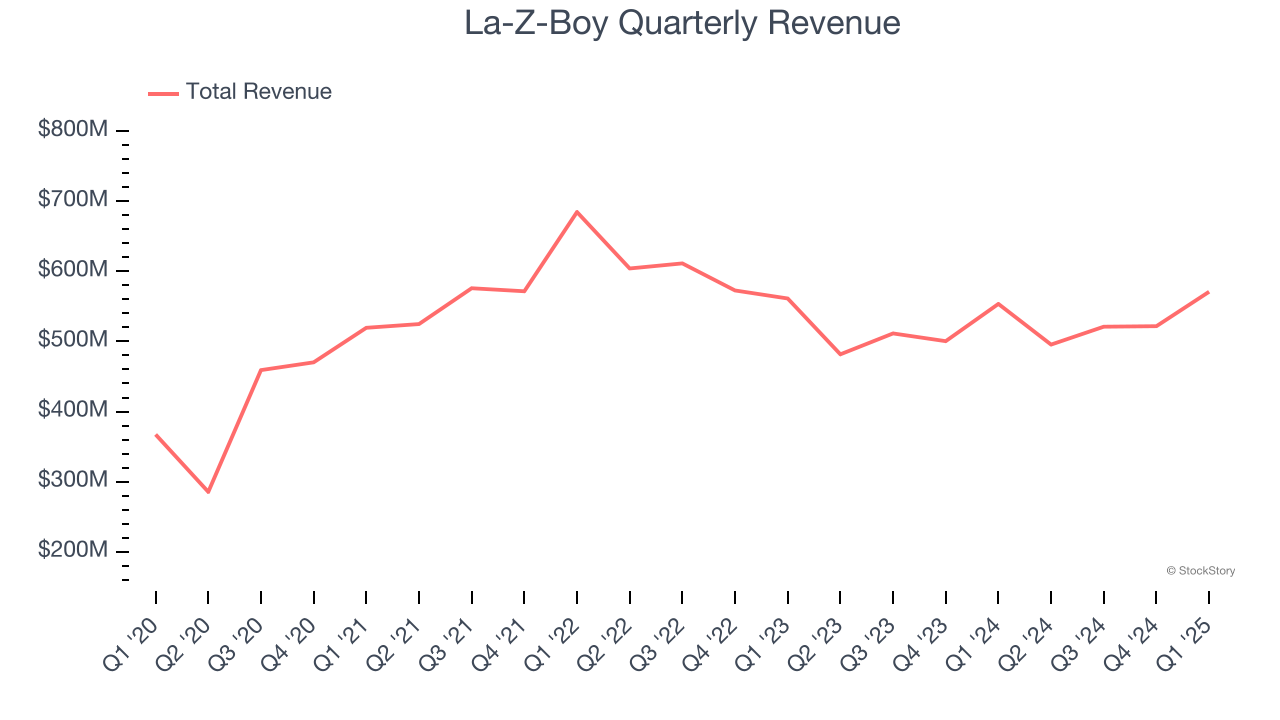

Revenue Growth

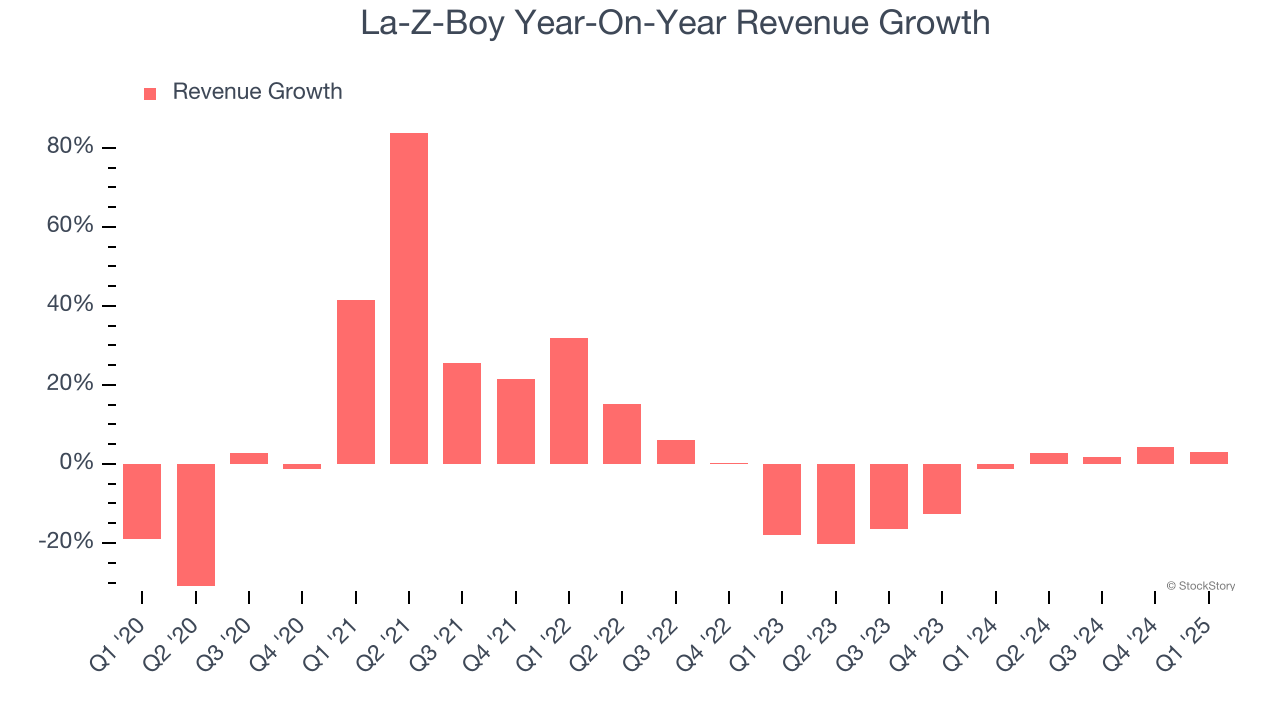

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, La-Z-Boy grew its sales at a sluggish 4.4% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. La-Z-Boy’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.3% annually.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 23.8% and 76.2% of core revenues. Over the last two years, La-Z-Boy’s Wholesale revenue (sales to retailers) averaged 18.3% year-on-year declines while its Retail revenue (direct sales to consumers) averaged 15.7% declines.

This quarter, La-Z-Boy reported modest year-on-year revenue growth of 3.1% but beat Wall Street’s estimates by 2.2%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

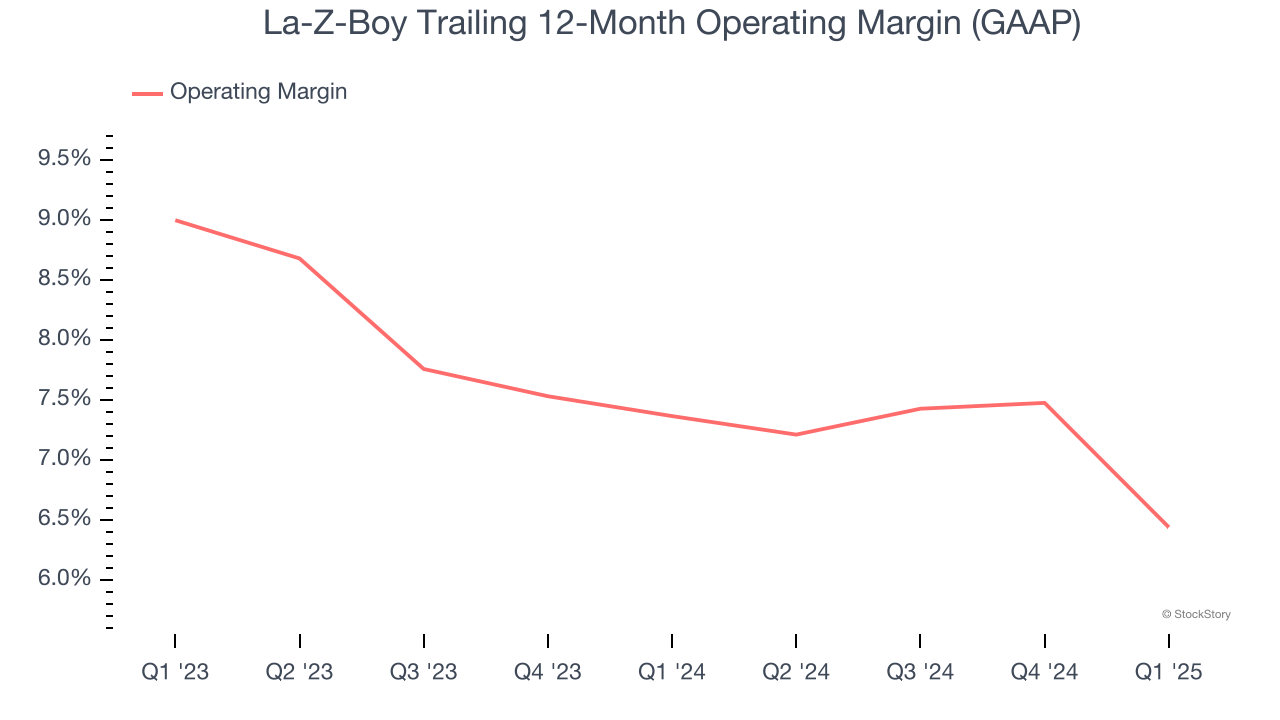

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

La-Z-Boy’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 6.9% over the last two years. This profitability was paltry for a consumer discretionary business and caused by its suboptimal cost structure.

In Q1, La-Z-Boy generated an operating margin profit margin of 5.2%, down 3.9 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

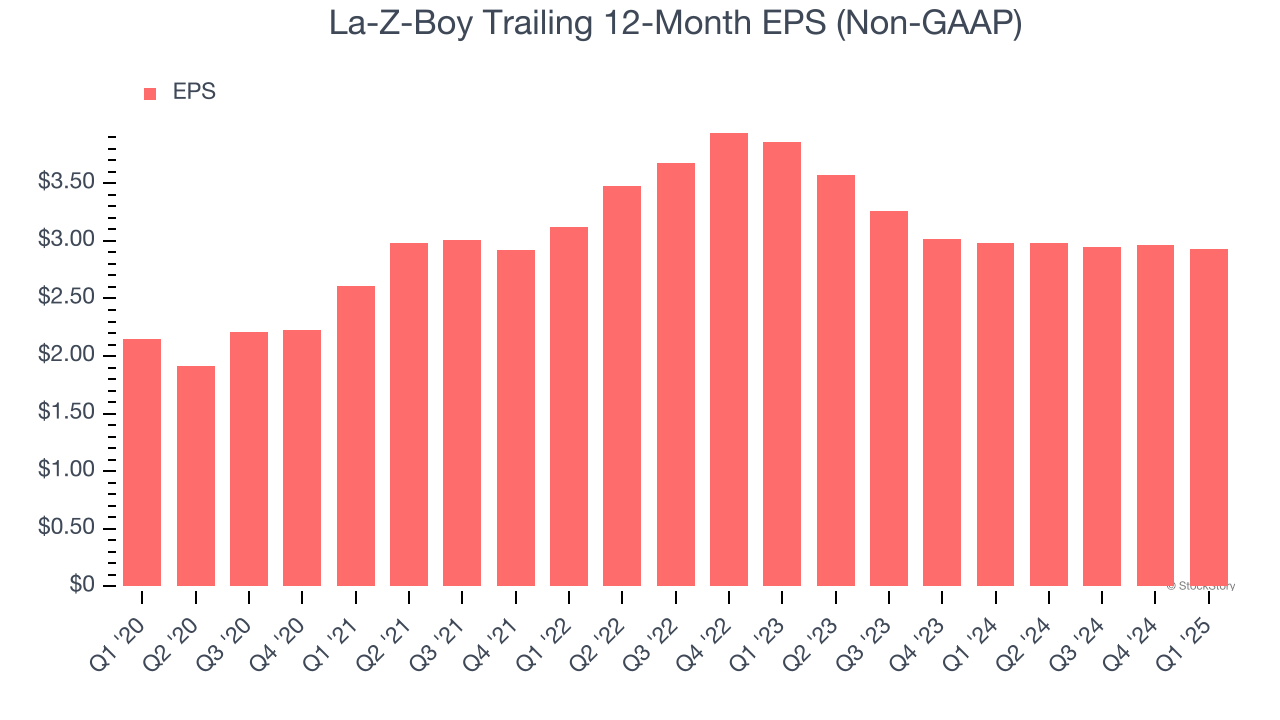

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

La-Z-Boy’s EPS grew at an unimpressive 6.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q1, La-Z-Boy reported EPS at $0.92, down from $0.95 in the same quarter last year. This print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects La-Z-Boy’s full-year EPS of $2.93 to grow 12.1%.

Key Takeaways from La-Z-Boy’s Q1 Results

It was encouraging to see La-Z-Boy beat analysts’ revenue expectations this quarter. On the other hand, its EPS and EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $38.94 immediately after reporting.

Big picture, is La-Z-Boy a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.