Water control and measure company Badger Meter (NYSE: BMI) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 7.6% year on year to $220.7 million. Its GAAP profit of $1.14 per share was 1.5% above analysts’ consensus estimates.

Is now the time to buy Badger Meter? Find out by accessing our full research report, it’s free.

Badger Meter (BMI) Q4 CY2025 Highlights:

- Revenue: $220.7 million vs analyst estimates of $232 million (7.6% year-on-year growth, 4.9% miss)

- EPS (GAAP): $1.14 vs analyst estimates of $1.12 (1.5% beat)

- Operating Margin: 19.5%, in line with the same quarter last year

- Free Cash Flow Margin: 23%, similar to the same quarter last year

- Market Capitalization: $4.85 billion

MILWAUKEE--(BUSINESS WIRE)--Badger Meter, Inc. (NYSE: BMI), a global leader in smart water management solutions, today announced a series of executive leadership changes effective January 1, 2026. Ken Bockhorst, Chairman, President and Chief Executive Officer, stated: “I am excited to announce key executive leadership changes that align our strategic priorities with a management structure designed to expand our market leadership in cellular Advanced Metering Infrastructure (AMI), while growing...

Company Overview

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE: BMI) provides water control and measure equipment to various industries.

Revenue Growth

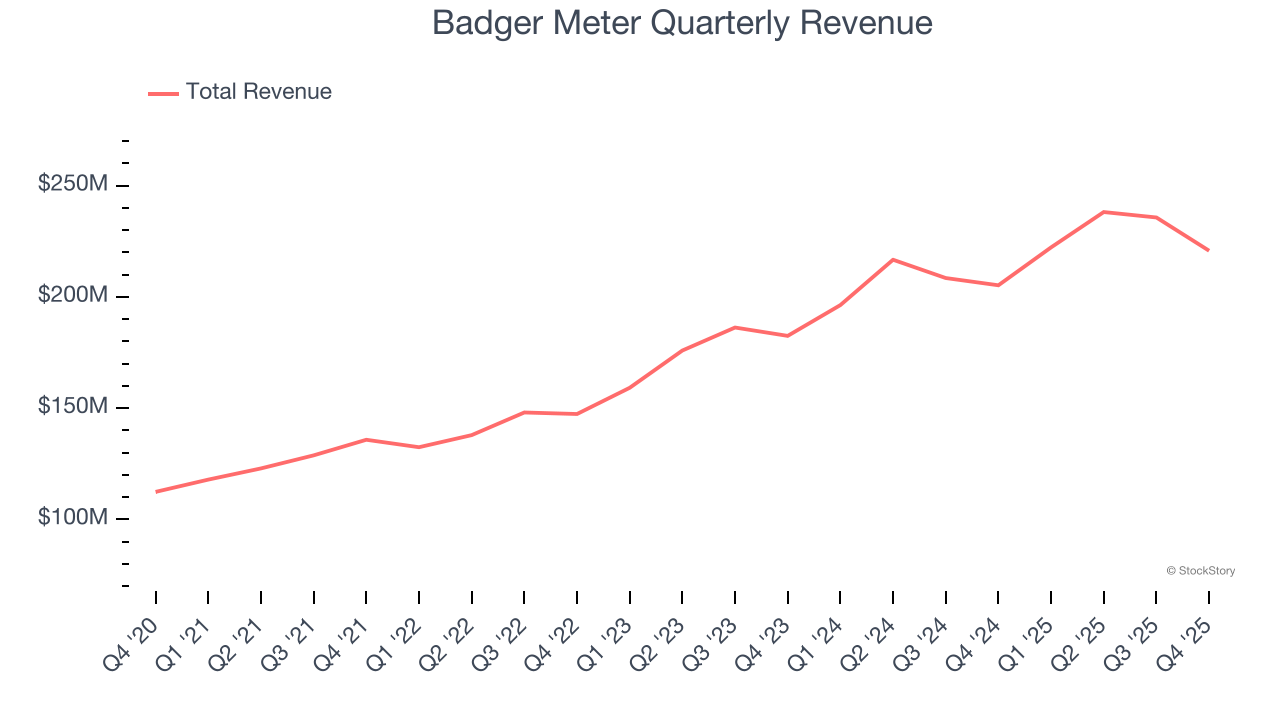

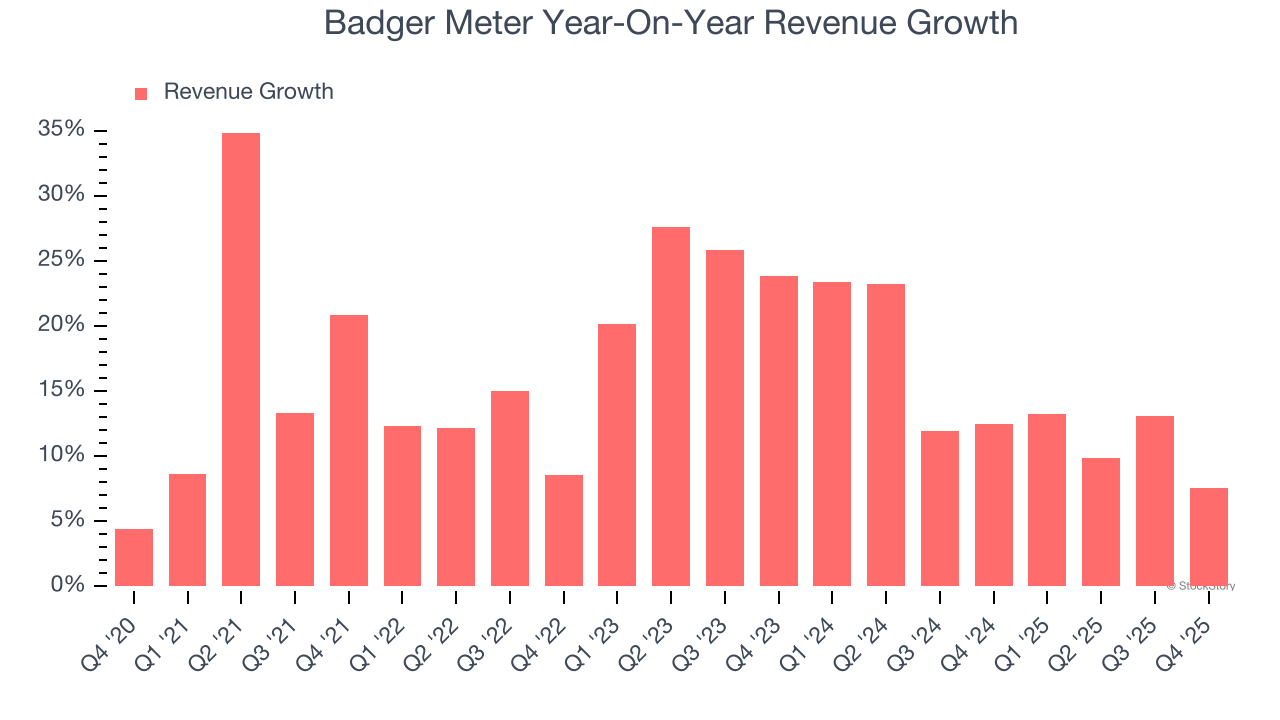

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Badger Meter grew its sales at an incredible 16.6% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Badger Meter’s annualized revenue growth of 14.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Badger Meter’s revenue grew by 7.6% year on year to $220.7 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and suggests the market is forecasting success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

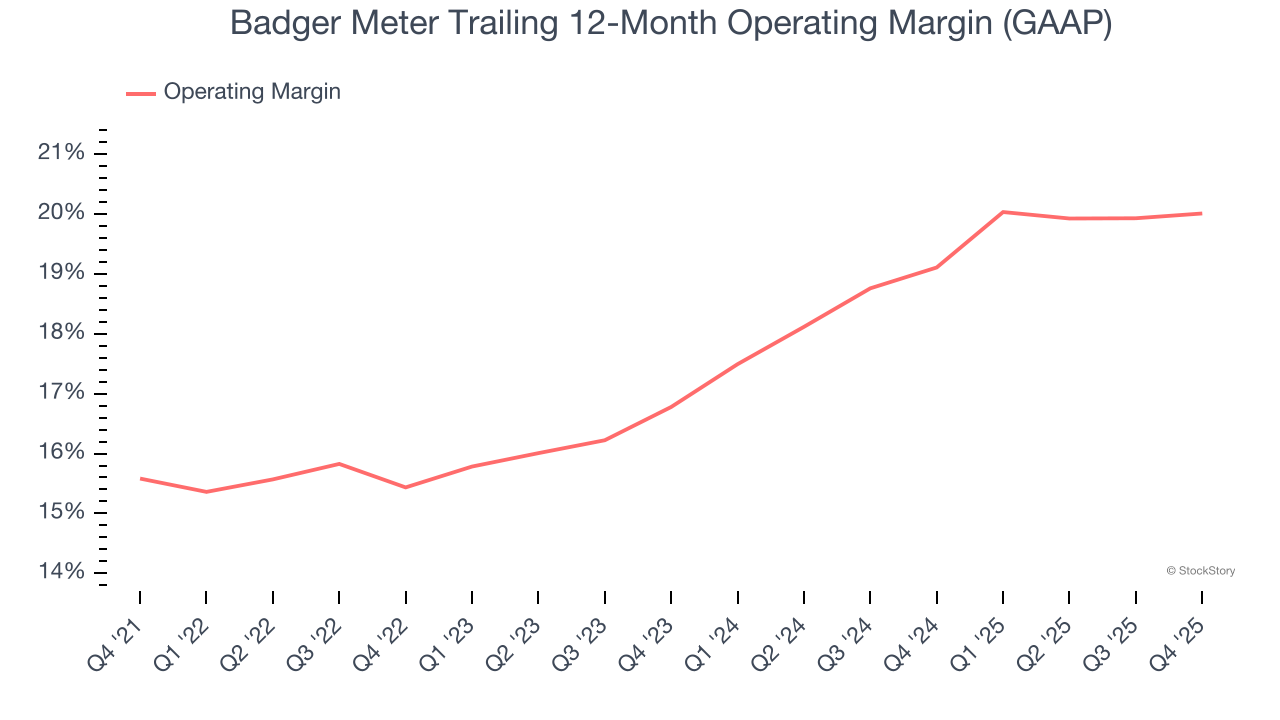

Badger Meter has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Badger Meter’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Badger Meter generated an operating margin profit margin of 19.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

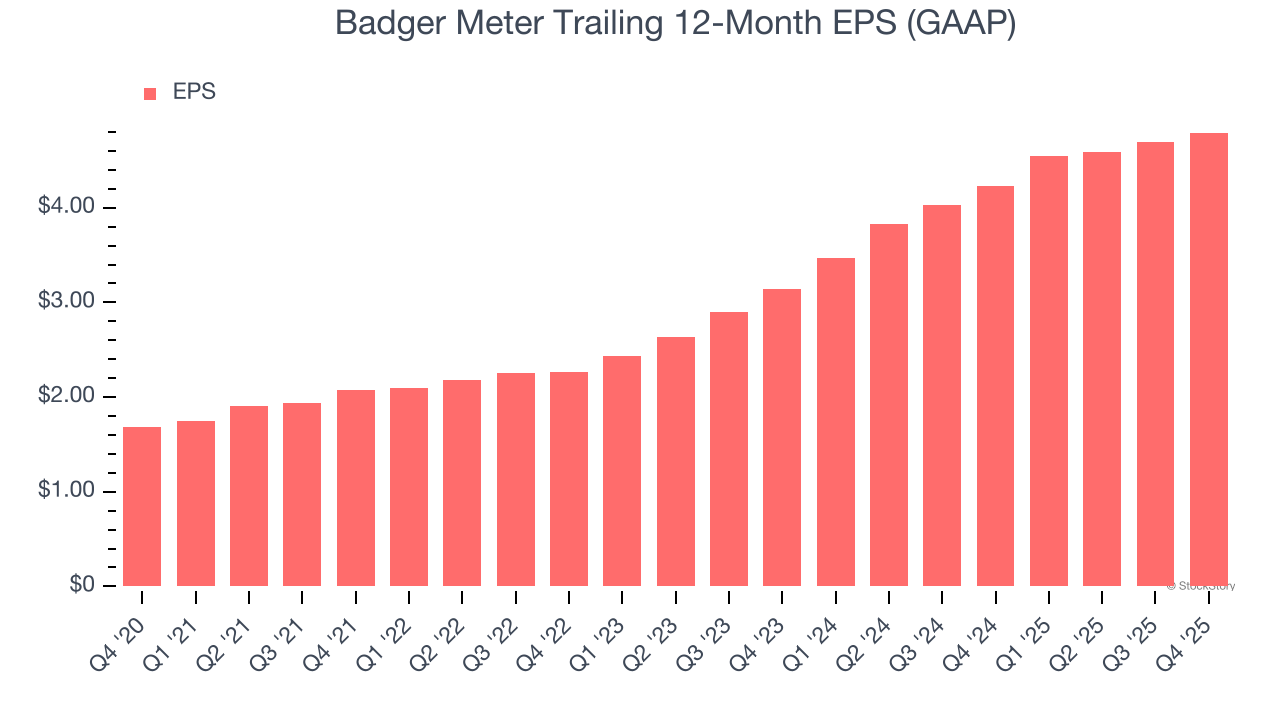

Badger Meter’s EPS grew at an astounding 23.2% compounded annual growth rate over the last five years, higher than its 16.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Badger Meter’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Badger Meter’s operating margin was flat this quarter but expanded by 4.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Badger Meter, its two-year annual EPS growth of 23.5% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Badger Meter reported EPS of $1.14, up from $1.04 in the same quarter last year. This print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects Badger Meter’s full-year EPS of $4.79 to grow 10.6%.

Key Takeaways from Badger Meter’s Q4 Results

Revenue missed by a fairly large amount. Despite an EPS, we think that overall, this quarter could have been better. The stock traded down 6.9% to $153 immediately following the results.

Badger Meter didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).