Wrapping up Q3 earnings, we look at the numbers and key takeaways for the real estate services stocks, including Howard Hughes Holdings (NYSE: HHH) and its peers.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q3: Howard Hughes Holdings (NYSE: HHH)

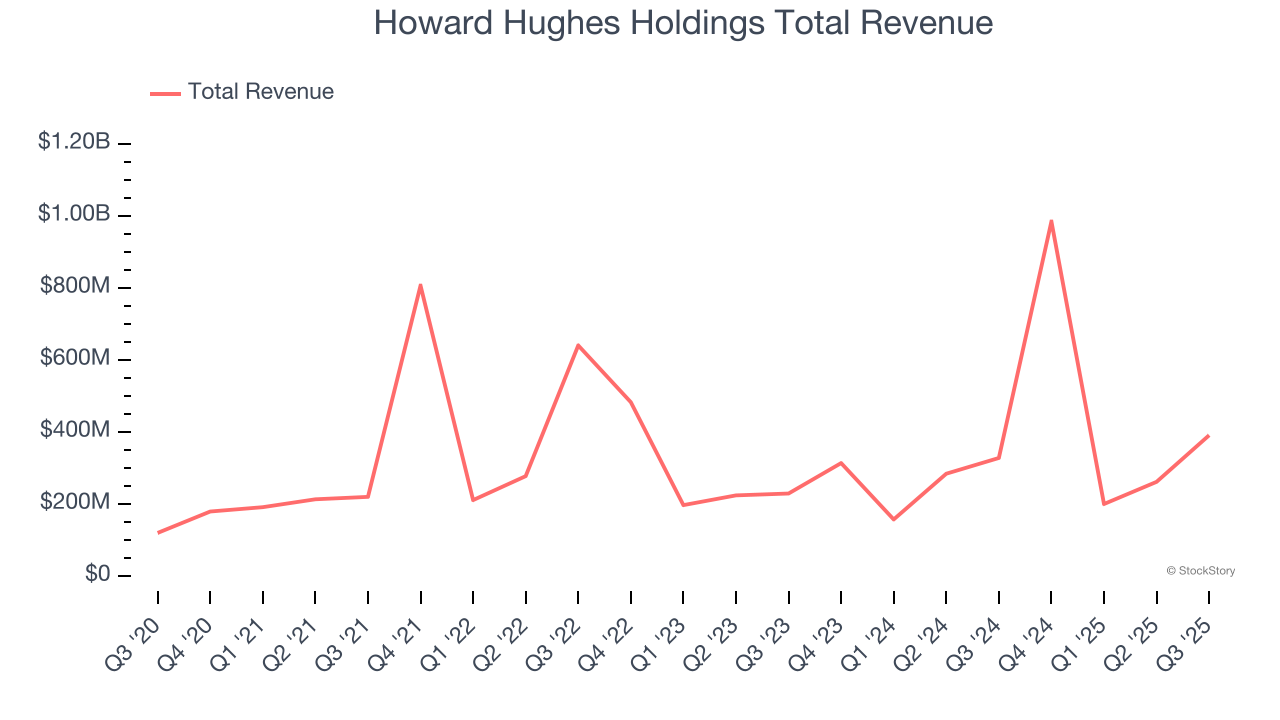

Named after the eccentric business magnate and aviator whose legacy lives on in real estate development, Howard Hughes Holdings (NYSE: HHH) develops, owns, and manages master-planned communities and commercial properties across the United States.

Howard Hughes Holdings reported revenues of $390.2 million, up 19.3% year on year. This print exceeded analysts’ expectations by 15.7%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS and revenue estimates.

“Our third-quarter performance underscores the strength of our real estate platform as Howard Hughes continues its transition into a premier holdings company,” commented David R. O’Reilly, Chief Executive Officer of Howard Hughes.

Howard Hughes Holdings achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 1.9% since reporting and currently trades at $81.61.

Is now the time to buy Howard Hughes Holdings? Access our full analysis of the earnings results here, it’s free.

The Real Brokerage (NASDAQ: REAX)

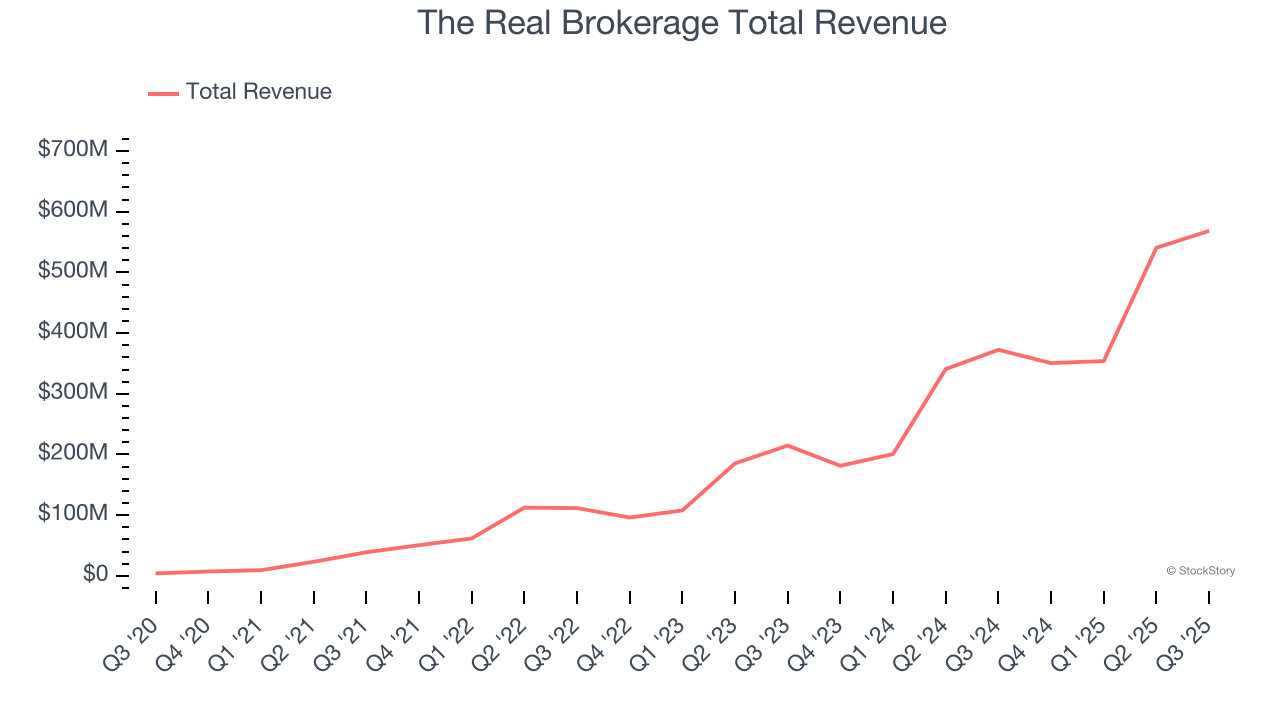

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $568.5 million, up 52.6% year on year, outperforming analysts’ expectations by 6.5%. The business had a stunning quarter with EPS in line with analysts’ estimates and an impressive beat of analysts’ EBITDA estimates.

The Real Brokerage delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 5.2% since reporting. It currently trades at $3.75.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Offerpad (NYSE: OPAD)

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE: OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $132.7 million, down 36.2% year on year, falling short of analysts’ expectations by 5.1%. It was a disappointing quarter as it posted a miss of analysts’ homes sold estimates.

Offerpad delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 49.3% since the results and currently trades at $1.17.

Read our full analysis of Offerpad’s results here.

Marcus & Millichap (NYSE: MMI)

Founded in 1971, Marcus & Millichap (NYSE: MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

Marcus & Millichap reported revenues of $193.9 million, up 15.1% year on year. This number was in line with analysts’ expectations. It was an exceptional quarter as it also put up EPS in line with analysts’ estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 10.4% since reporting and currently trades at $26.40.

Read our full, actionable report on Marcus & Millichap here, it’s free.

Compass (NYSE: COMP)

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE: COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Compass reported revenues of $1.85 billion, up 23.6% year on year. This result surpassed analysts’ expectations by 3.2%. Overall, it was a very strong quarter as it also logged EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The stock is up 69.1% since reporting and currently trades at $13.16.

Read our full, actionable report on Compass here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.