Financial services firm Stifel Financial (NYSE: SF) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 14.4% year on year to $1.56 billion. Its non-GAAP profit of $2.71 per share was 8% above analysts’ consensus estimates.

Is now the time to buy Stifel? Find out by accessing our full research report, it’s free.

Stifel (SF) Q4 CY2025 Highlights:

- Assets Under Management: $224.5 billion (17.1% year-on-year growth)

- Revenue: $1.56 billion vs analyst estimates of $1.52 billion (14.4% year-on-year growth, 2.9% beat)

- Pre-tax Profit: $307.9 million (19.7% margin)

- Adjusted EPS: $2.71 vs analyst estimates of $2.51 (8% beat)

- Market Capitalization: $12.86 billion

Chairman and Chief Executive Officer, said “2025 marked a record year for Stifel and demonstrated the strength of our platform and long-term strategy. While we remain attentive to market and geopolitical risks, we are confident in our ability to navigate uncertainty and continue to deliver for clients and shareholders.”

Company Overview

Tracing its roots back to 1890 when the firm was established in St. Louis, Stifel Financial (NYSE: SF) is a financial services firm that provides wealth management, investment banking, and institutional brokerage services to individuals, corporations, and institutions.

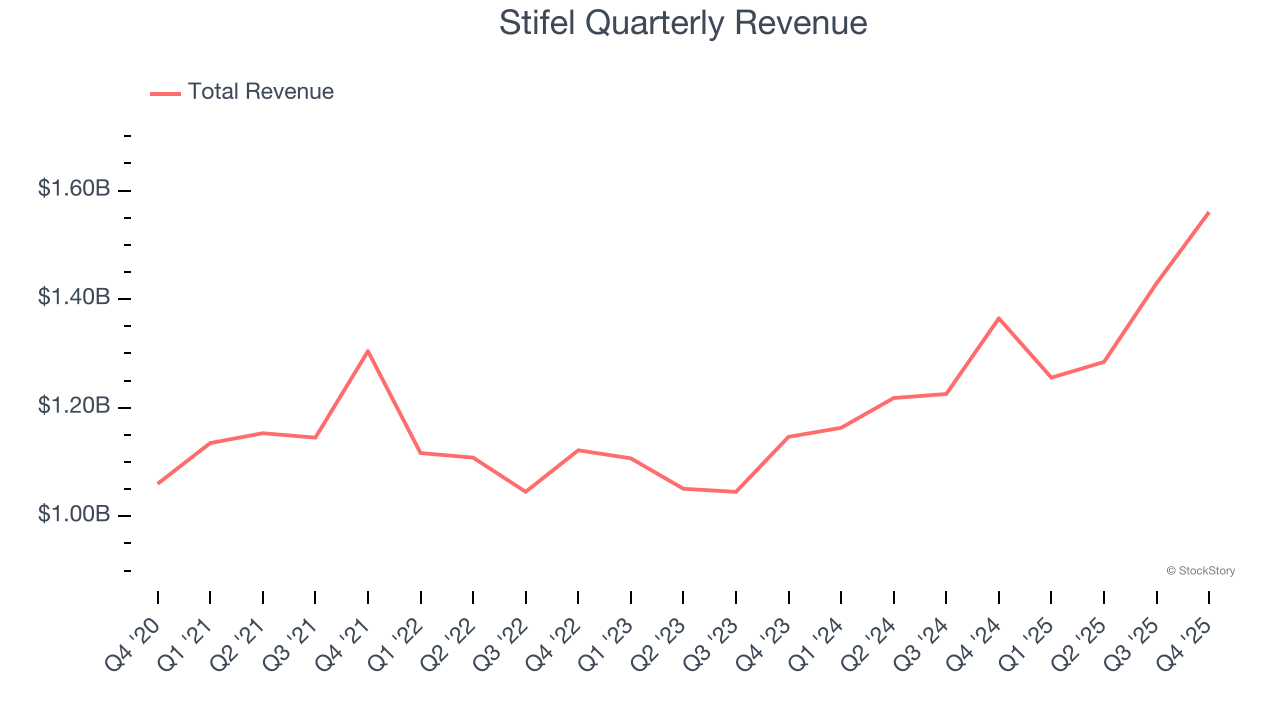

Revenue Growth

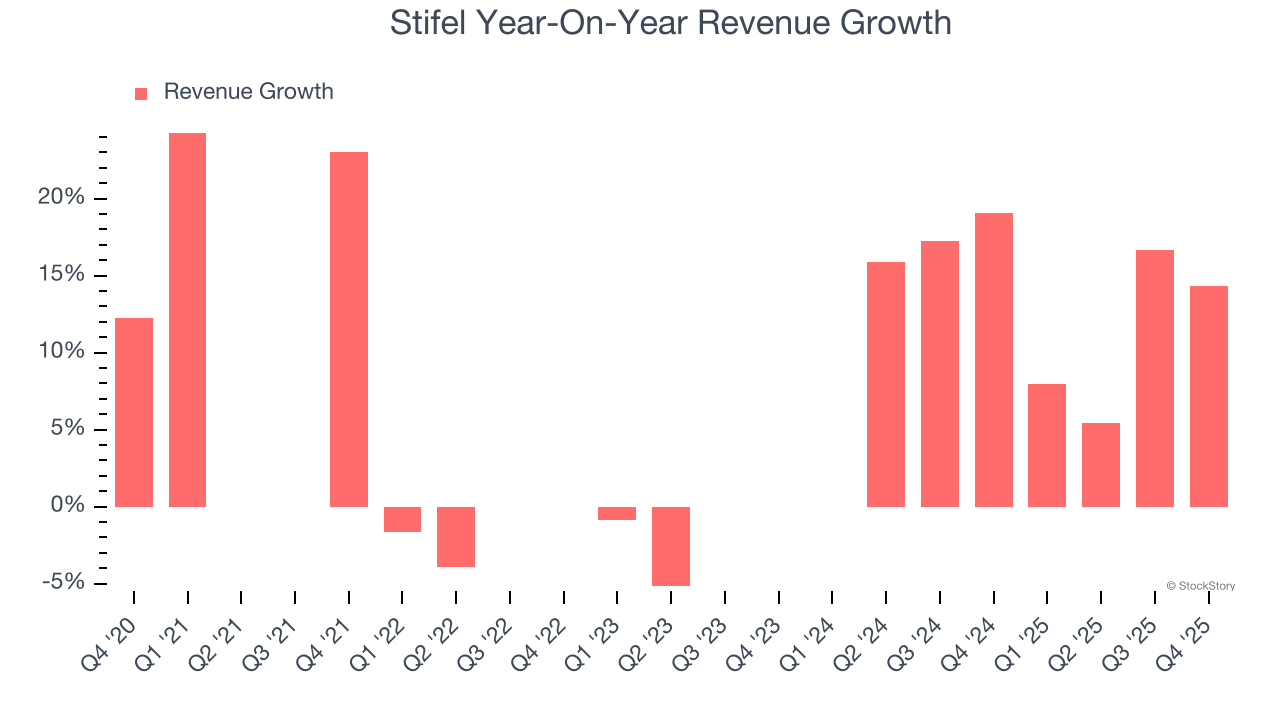

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Stifel’s 8.1% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Stifel’s annualized revenue growth of 12.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Stifel reported year-on-year revenue growth of 14.4%, and its $1.56 billion of revenue exceeded Wall Street’s estimates by 2.9%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

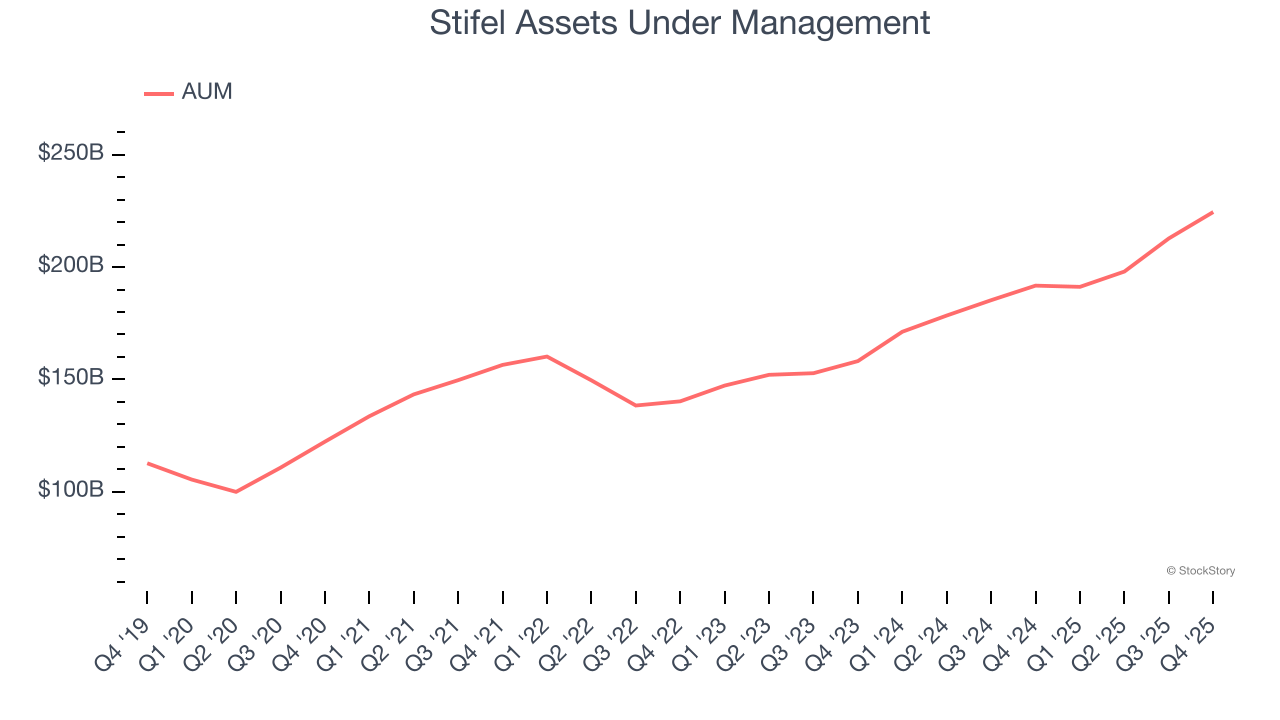

Assets Under Management (AUM)

Assets Under Management (AUM) is the total capital a firm oversees or manages on behalf of clients. Fees on this AUM, typically a small percentage, are contractually recurring and provide a high level of stability to revenue even if investment performance lags (although too much poor investment performance eventually hurts fundraising ability).

Stifel’s AUM has grown at an annual rate of 13.5% over the last five years, a step above the broader financials industry and faster than its total revenue. When analyzing Stifel’s AUM over the last two years, we can see that growth accelerated to 16.4% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Keep in mind that asset growth can be erratic and seasonal, so we don't rely on it too heavily for our business quality analysis.

Stifel’s AUM punched in at $224.5 billion this quarter. This print was 17.1% higher than the same quarter last year.

Key Takeaways from Stifel’s Q4 Results

It was good to see Stifel beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.8% to $129.88 immediately after reporting.

Stifel had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).