Electronic design automation company Cadence Design Systems (NASDAQ: CDNS) announced better-than-expected revenue in Q4 CY2025, with sales up 6.2% year on year to $1.44 billion. The company expects the full year’s revenue to be around $5.95 billion, close to analysts’ estimates. Its GAAP profit of $1.42 per share was 17.2% above analysts’ consensus estimates.

Is now the time to buy Cadence Design Systems? Find out by accessing our full research report, it’s free.

Cadence Design Systems (CDNS) Q4 CY2025 Highlights:

- Revenue: $1.44 billion vs analyst estimates of $1.43 billion (6.2% year-on-year growth, 1% beat)

- EPS (GAAP): $1.42 vs analyst estimates of $1.21 (17.2% beat)

- Free Cash Flow Margin: 2.9%, down from 20.7% in the previous quarter

- Market Capitalization: $81.51 billion

Company Overview

Powering the chips behind everything from smartphones to AI accelerators for over 35 years, Cadence Design Systems (NASDAQ: CDNS) provides essential computational software, hardware, and intellectual property used by engineers to design and verify advanced electronic systems and semiconductors.

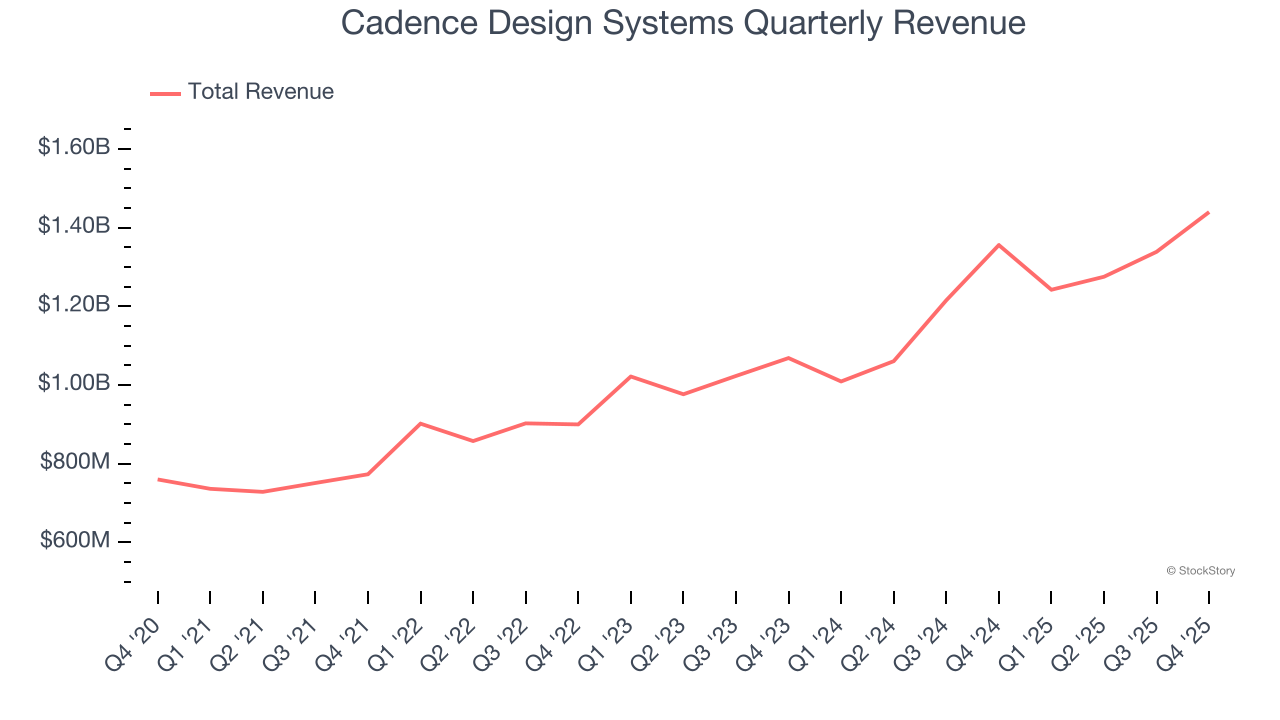

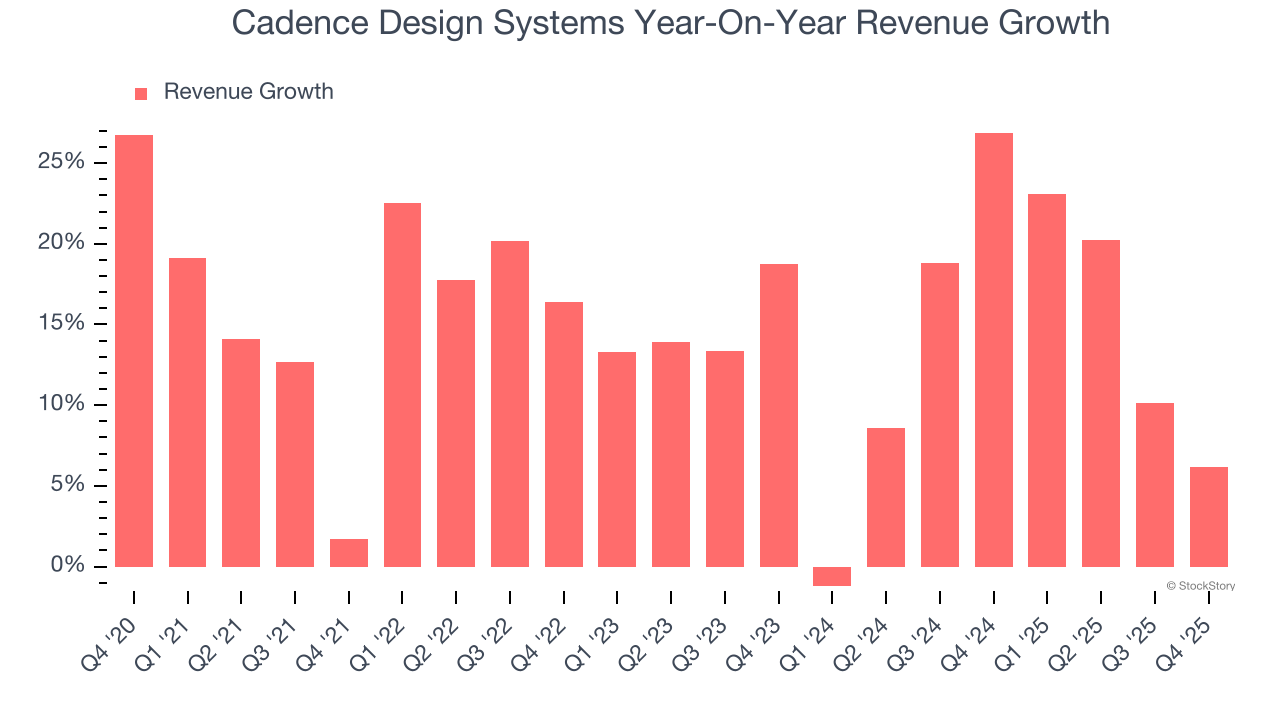

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Cadence Design Systems grew its sales at a 14.6% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded. Luckily, there are other things to like about Cadence Design Systems.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Cadence Design Systems’s annualized revenue growth of 13.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Cadence Design Systems reported year-on-year revenue growth of 6.2%, and its $1.44 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 12.1% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Cadence Design Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 8.6 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Cadence Design Systems’s Q4 Results

It was good to see Cadence Design Systems narrowly top analysts’ revenue expectations this quarter. Zooming out, we think this was a decent quarter. The stock traded up 4.5% to $295.57 immediately following the results.

So should you invest in Cadence Design Systems right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).