Stock photography and footage provider Shutterstock (NYSE: SSTK) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 12% year on year to $220.2 million. Its non-GAAP profit of $0.67 per share was 40.4% below analysts’ consensus estimates.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it’s free.

Shutterstock (SSTK) Q4 CY2025 Highlights:

- Revenue: $220.2 million vs analyst estimates of $252.3 million (12% year-on-year decline, 12.7% miss)

- Adjusted EPS: $0.67 vs analyst expectations of $1.13 (40.4% miss)

- Adjusted EBITDA: $46.79 million vs analyst estimates of $65.57 million (21.2% margin, 28.6% miss)

- Operating Margin: -1.1%, down from 5.3% in the same quarter last year

- Free Cash Flow Margin: 11.8%, down from 26.1% in the previous quarter

- Market Capitalization: $613.4 million

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "I'm thrilled to announce that Shutterstock achieved record setting Revenue and Adjusted EBITDA in 2025. Revenue grew 6% driven by double digit growth of our Data, Distribution, and Services business, while Adjusted EBITDA margins for the year matched a previous high of 27.5% and Adjusted Free Cash Flow significantly expanded year over year. These achievements were despite continued challenges in our Content business. I want to thank our employees and contributors for their focus and commitment during this past year."

Company Overview

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Revenue Growth

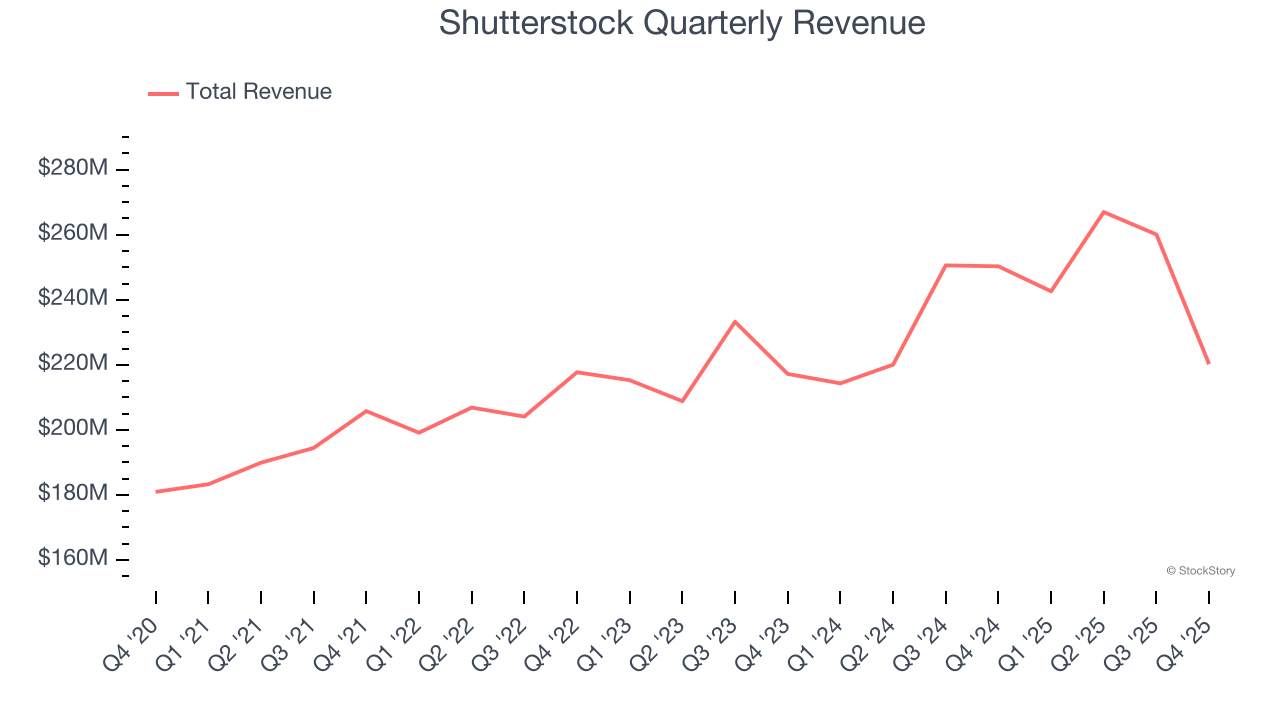

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Shutterstock’s 6.1% annualized revenue growth over the last three years was tepid. This was below our standard for the consumer internet sector and is a rough starting point for our analysis.

This quarter, Shutterstock missed Wall Street’s estimates and reported a rather uninspiring 12% year-on-year revenue decline, generating $220.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

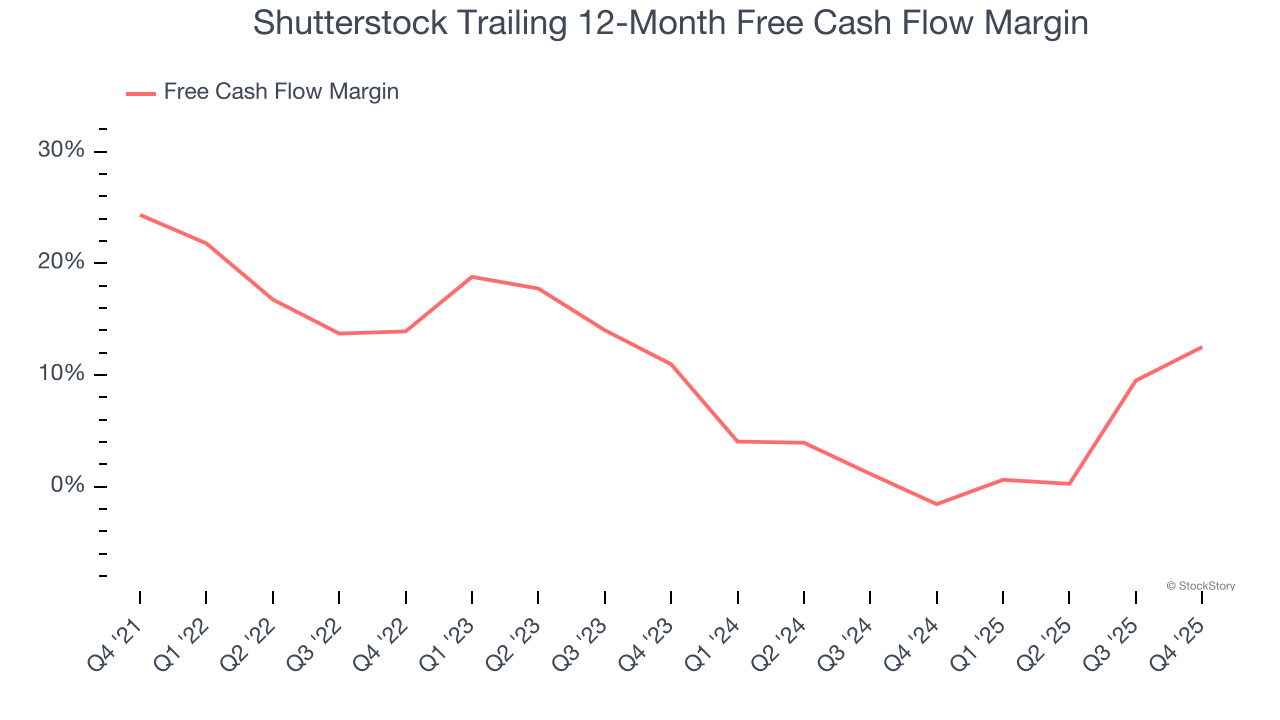

Shutterstock has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.7% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that Shutterstock’s margin dropped by 1.4 percentage points over the last few years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Shutterstock’s free cash flow clocked in at $25.9 million in Q4, equivalent to a 11.8% margin. This result was good as its margin was 12.1 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Key Takeaways from Shutterstock’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 11.4% to $15.27 immediately after reporting.

Shutterstock’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).