Specialty flooring retailer Floor & Decor (NYSE: FND) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 2% year on year to $1.13 billion. On the other hand, the company’s full-year revenue guidance of $4.96 billion at the midpoint came in 1.4% below analysts’ estimates. Its GAAP profit of $0.36 per share was 3.3% above analysts’ consensus estimates.

Is now the time to buy Floor And Decor? Find out by accessing our full research report, it’s free.

Floor And Decor (FND) Q4 CY2025 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.13 billion (2% year-on-year growth, in line)

- EPS (GAAP): $0.36 vs analyst estimates of $0.35 (3.3% beat)

- Adjusted EBITDA: $119.4 million vs analyst estimates of $117.9 million (10.6% margin, 1.3% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $2.08 at the midpoint, missing analyst estimates by 2.2%

- EBITDA guidance for the upcoming financial year 2026 is $575 million at the midpoint, below analyst estimates of $586.8 million

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 4%, up from 0.4% in the same quarter last year

- Same-Store Sales rose 4.8% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $7.54 billion

Brad Paulsen, Chief Executive Officer, stated, “We are pleased to deliver fiscal 2025 fourth quarter diluted earnings per share of $0.36, in line with the midpoint of the earnings guidance provided on our third quarter earnings conference call. For the full fiscal year, diluted earnings per share was $1.92, compared with $1.90 in the prior year. I’m incredibly proud of what our teams accomplished in 2025. Despite pressure on comparable store sales driven by softness in existing home sales activity, we expanded our market share, navigated tariff complexities, increased our gross margin rate, opened 20 new warehouse stores, and delivered year-over-year earnings growth. This performance reflects the resilience of our model and our unwavering commitment to disciplined execution and strategic investments in our future.”

Company Overview

Operating large, warehouse-style stores, Floor & Decor (NYSE: FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

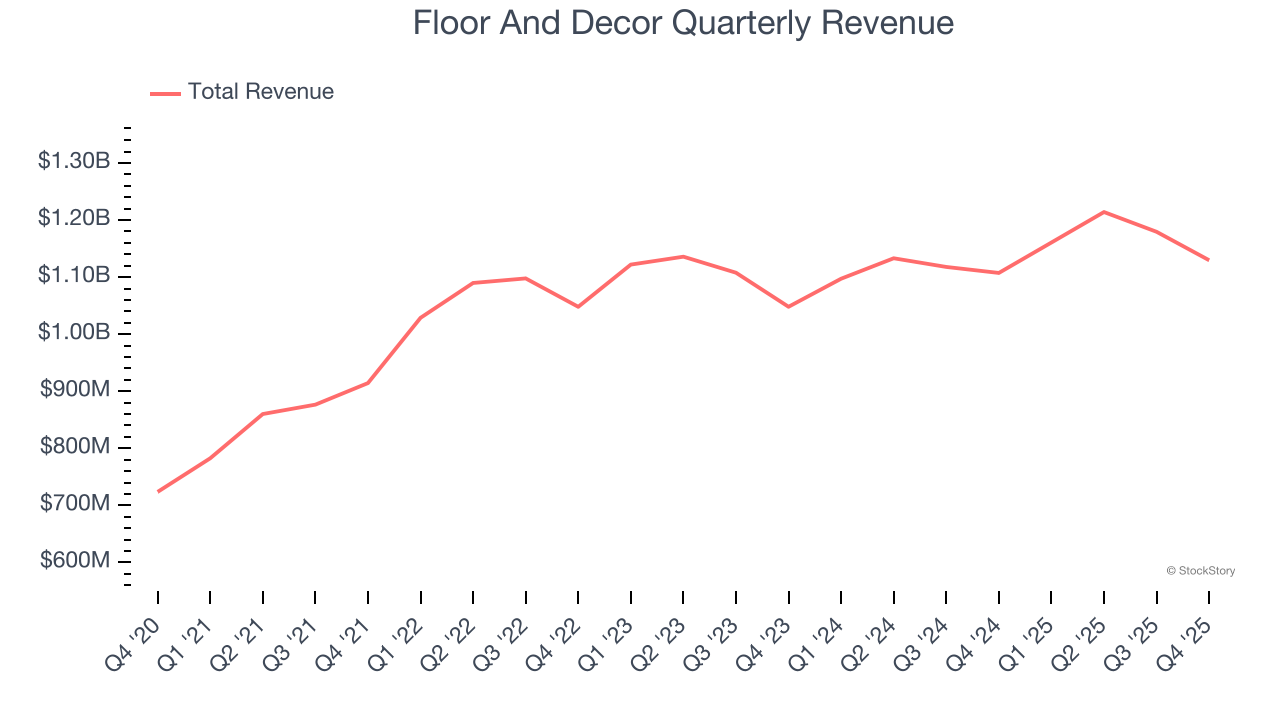

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.68 billion in revenue over the past 12 months, Floor And Decor is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Floor And Decor’s sales grew at a sluggish 3.2% compounded annual growth rate over the last three years.

This quarter, Floor And Decor grew its revenue by 2% year on year, and its $1.13 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, an acceleration versus the last three years. This projection is commendable and implies its newer products will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

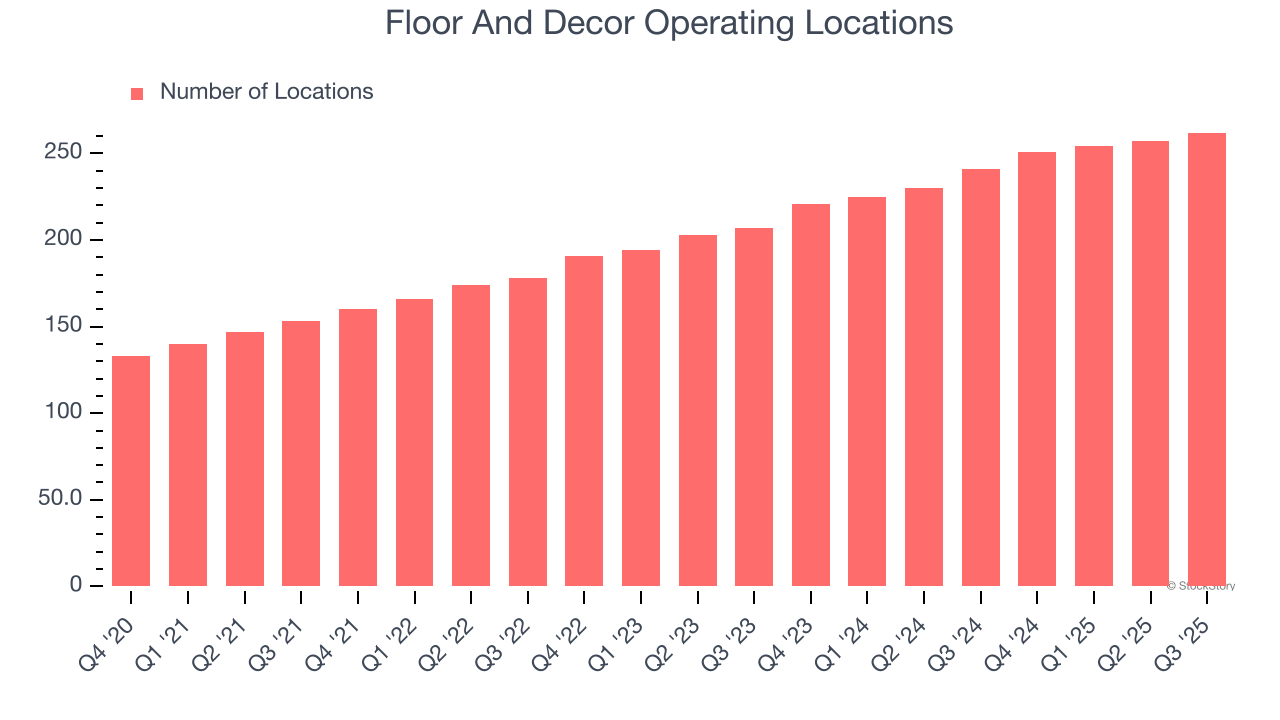

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Over the last two years, Floor And Decor opened new stores at a rapid clip by averaging 13.2% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Floor And Decor reports its store count intermittently, so some data points are missing in the chart below.

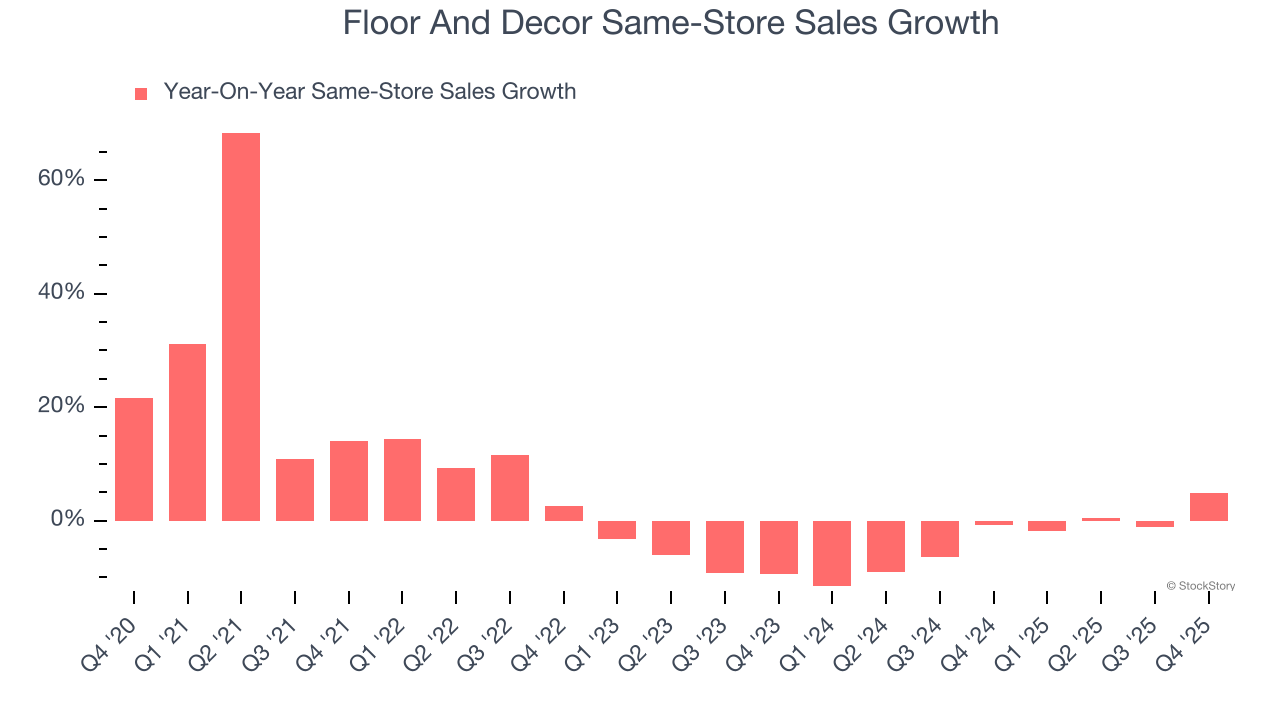

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Floor And Decor’s demand has been shrinking over the last two years as its same-store sales have averaged 3.2% annual declines. This performance is concerning - it shows Floor And Decor artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Floor And Decor’s same-store sales rose 4.8% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Floor And Decor’s Q4 Results

It was good to see Floor And Decor narrowly top analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter, but it seems like a better-than-feared result that is driving shares higher. The stock traded up 6.9% to $70.64 immediately after reporting.

Big picture, is Floor And Decor a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).