Data security company Varonis Systems (NASDAQ: VRNS) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 9.4% year on year to $173.4 million. Guidance for next quarter’s revenue was better than expected at $165 million at the midpoint, 0.9% above analysts’ estimates. Its non-GAAP profit of $0.08 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Varonis Systems? Find out by accessing our full research report, it’s free.

Varonis Systems (VRNS) Q4 CY2025 Highlights:

- Revenue: $173.4 million vs analyst estimates of $168.2 million (9.4% year-on-year growth, 3.1% beat)

- Adjusted EPS: $0.08 vs analyst estimates of $0.03 (significant beat)

- Adjusted Operating Income: $4.55 million vs analyst estimates of $1.54 million (2.6% margin, significant beat)

- Revenue Guidance for Q1 CY2026 is $165 million at the midpoint, above analyst estimates of $163.5 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.08 at the midpoint, missing analyst estimates by 76.6%

- Operating Margin: -17.5%, down from -11.1% in the same quarter last year

- Free Cash Flow Margin: 13.4%, down from 17.9% in the previous quarter

- Market Capitalization: $3.45 billion

Yaki Faitelson, Varonis CEO, said, “We are excited by the performance of our SaaS business, which saw ARR growth of 32%, excluding conversions, and is being driven by the automated value proposition we deliver to our customers. We look forward to continuing our momentum and ending 2026 as a fully SaaS company, which will unlock many more benefits as we capture our growing market opportunity. We continue to believe in the path to achieving our 2027 financial targets.”

Company Overview

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ: VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

Revenue Growth

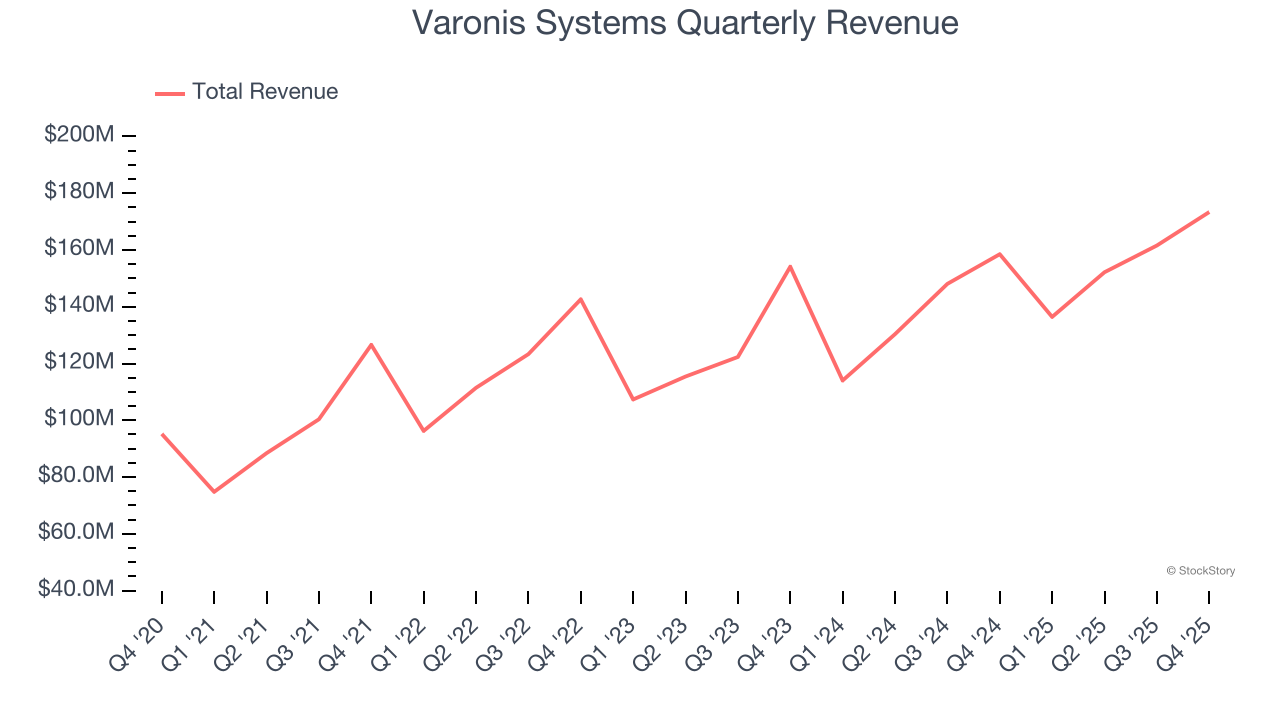

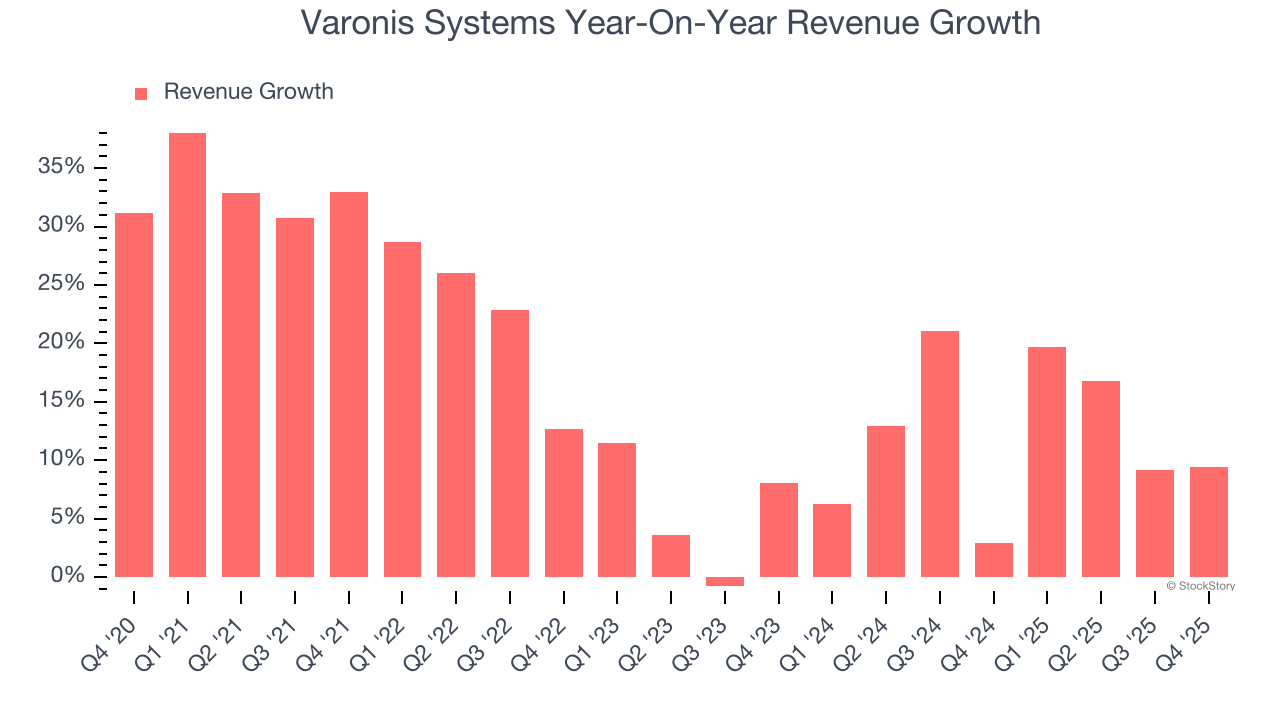

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Varonis Systems grew its sales at a 16.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Varonis Systems’s recent performance shows its demand has slowed as its annualized revenue growth of 11.8% over the last two years was below its five-year trend.

This quarter, Varonis Systems reported year-on-year revenue growth of 9.4%, and its $173.4 million of revenue exceeded Wall Street’s estimates by 3.1%. Company management is currently guiding for a 20.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.4% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

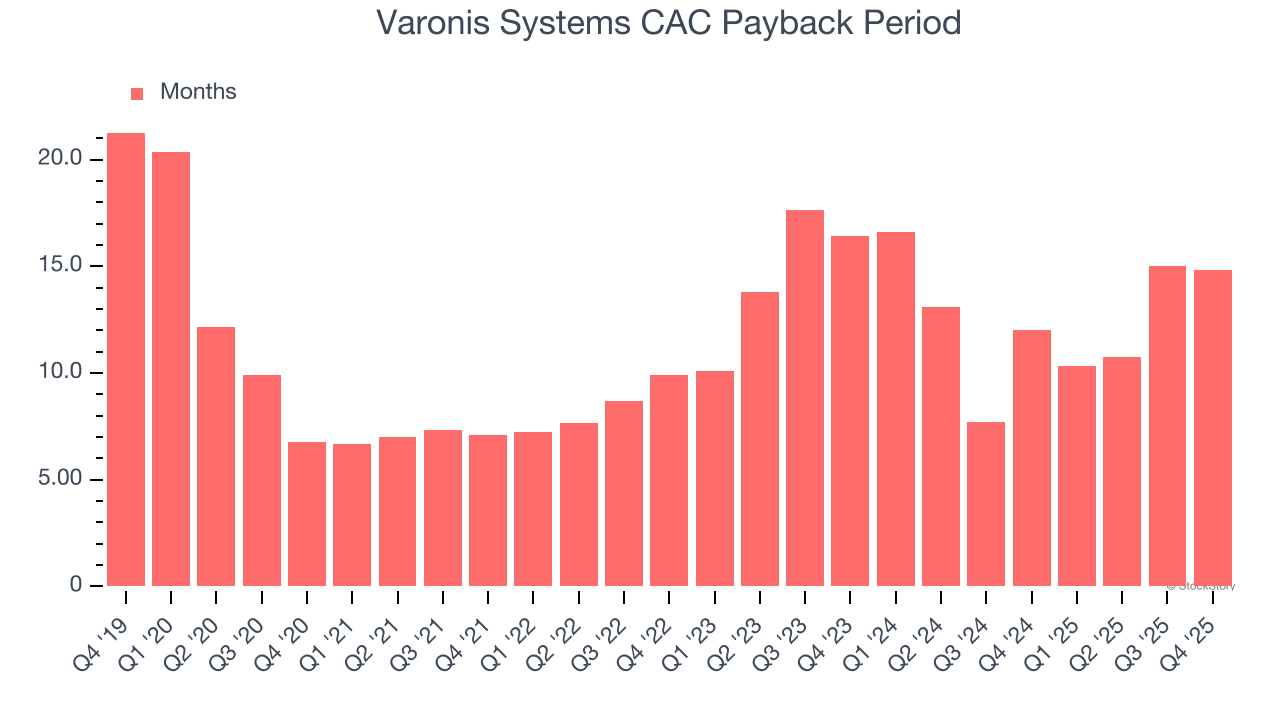

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Varonis Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 14.8 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Varonis Systems’s Q4 Results

It was great to see Varonis Systems expecting revenue growth to accelerate next year. We were also happy its revenue and adjusted EPS in the quarter both outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $26.52 immediately after reporting.

The latest quarter from Varonis Systems’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).