Power resiliency solutions provider American Superconductor (NASDAQ: AMSC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 21.4% year on year to $74.53 million. On the other hand, next quarter’s revenue guidance of $80 million was less impressive, coming in 1.8% below analysts’ estimates. Its non-GAAP profit of $2.75 per share was significantly above analysts’ consensus estimates.

Is now the time to buy American Superconductor? Find out by accessing our full research report, it’s free.

American Superconductor (AMSC) Q4 CY2025 Highlights:

- Revenue: $74.53 million vs analyst estimates of $69.03 million (21.4% year-on-year growth, 8% beat)

- Adjusted EPS: $2.75 vs analyst estimates of $0.15 (significant beat)

- Adjusted EBITDA: $5.02 million vs analyst estimates of $3.2 million (6.7% margin, 56.8% beat)

- Revenue Guidance for Q1 CY2026 is $80 million at the midpoint, below analyst estimates of $81.5 million

- Adjusted EPS guidance for Q1 CY2026 is $0.17 at the midpoint, below analyst estimates of $0.20

- Operating Margin: 4.5%, up from 2.8% in the same quarter last year

- Free Cash Flow Margin: 3.2%, down from 8.7% in the same quarter last year

- Market Capitalization: $1.36 billion

"AMSC delivered an outstanding third quarter," said Daniel P. McGahn, Chairman, President, and CEO, AMSC.

Company Overview

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

Revenue Growth

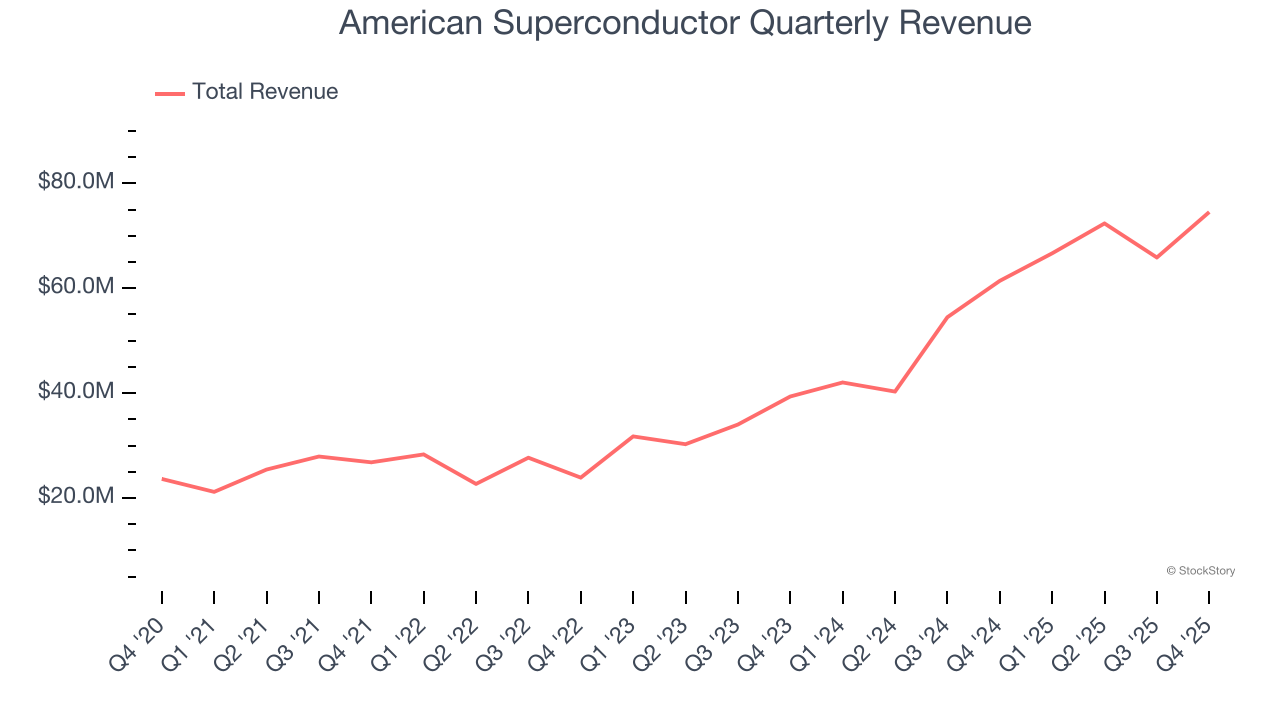

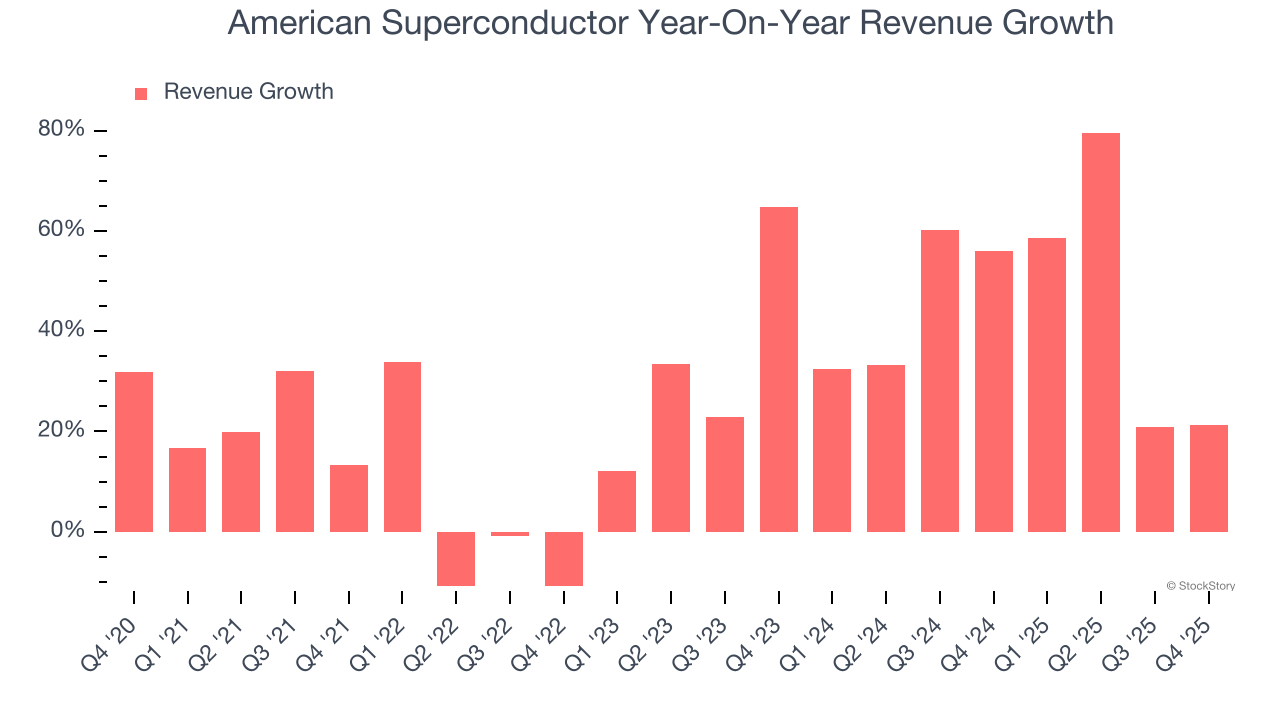

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, American Superconductor’s sales grew at an incredible 27.1% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. American Superconductor’s annualized revenue growth of 43.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, American Superconductor reported robust year-on-year revenue growth of 21.4%, and its $74.53 million of revenue topped Wall Street estimates by 8%. Company management is currently guiding for a 20% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 24.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and implies the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

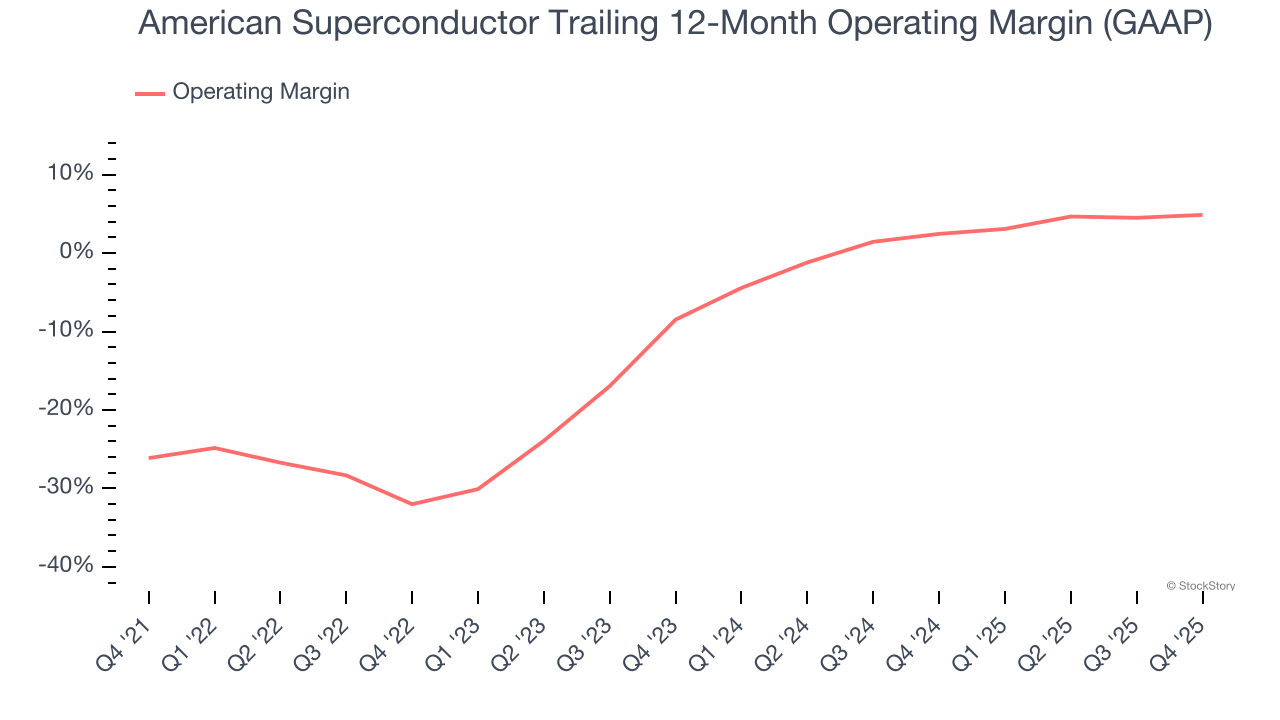

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although American Superconductor was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.4% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, American Superconductor’s operating margin rose by 31 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q4, American Superconductor generated an operating margin profit margin of 4.5%, up 1.7 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

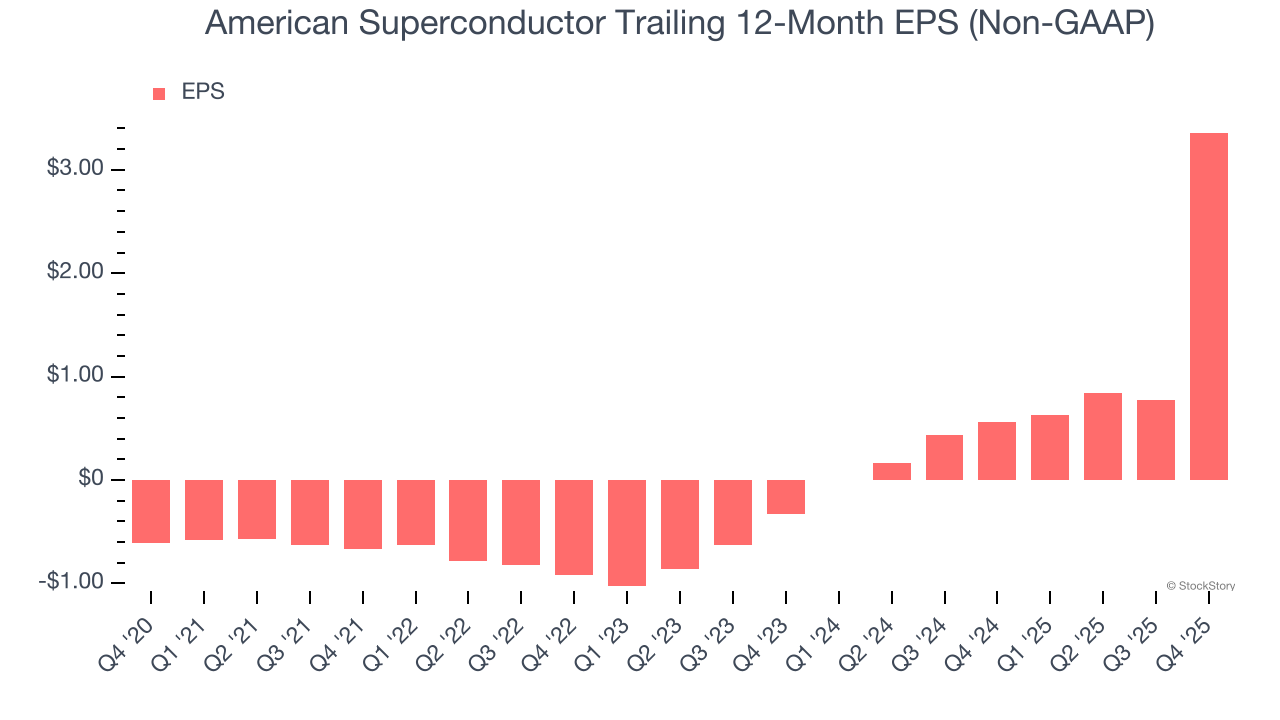

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

American Superconductor’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For American Superconductor, its two-year annual EPS growth of 249% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, American Superconductor reported adjusted EPS of $2.75, up from $0.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects American Superconductor’s full-year EPS of $3.36 to shrink by 70.3%.

Key Takeaways from American Superconductor’s Q4 Results

It was good to see American Superconductor beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 19.7% to $32.96 immediately after reporting.

American Superconductor may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).