Fast-food company Yum China (NYSE: YUMC) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.8% year on year to $2.82 billion. Its non-GAAP profit of $0.40 per share was 9.2% above analysts’ consensus estimates.

Is now the time to buy Yum China? Find out by accessing our full research report, it’s free.

Yum China (YUMC) Q4 CY2025 Highlights:

- Revenue: $2.82 billion vs analyst estimates of $2.72 billion (8.8% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.40 vs analyst estimates of $0.37 (9.2% beat)

- Adjusted EBITDA: $318 million vs analyst estimates of $304.9 million (11.3% margin, 4.3% beat)

- Operating Margin: 6.6%, in line with the same quarter last year

- Free Cash Flow was -$116 million compared to -$15 million in the same quarter last year

- Locations: 18,101 at quarter end, up from 16,395 in the same quarter last year

- Same-Store Sales rose 3% year on year (-1% in the same quarter last year)

- Market Capitalization: $17.89 billion

Joey Wat, CEO of Yum China, commented, "Our fourth quarter performance capped off 2025 on a high note. Thanks to our team's hard work, we delivered same-store sales growth for three consecutive quarters and same-store transactions growth for twelve consecutive quarters. System sales growth sequentially improved to 7%, and operating profit increased 25% year-over-year in the fourth quarter. KFC has unlocked new consumption occasions through its KCOFFEE cafe and KPRO side-by-side modules. Pizza Hut has enhanced its value-for-money proposition and developed the WOW model to expand into previously untapped locations, especially in lower-tier cities."

Company Overview

One of China’s largest restaurant companies, Yum China (NYSE: YUMC) is an independent entity spun off from Yum! Brands in 2016.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $11.8 billion in revenue over the past 12 months, Yum China is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because there is only so much real estate to build restaurants, placing a ceiling on its growth. For Yum China to boost its sales, it likely needs to adjust its prices, launch new chains, or lean into foreign markets.

As you can see below, Yum China grew its sales at a tepid 5.1% compounded annual growth rate over the last six years.

This quarter, Yum China reported year-on-year revenue growth of 8.8%, and its $2.82 billion of revenue exceeded Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, similar to its six-year rate. This projection is underwhelming and implies its newer menu offerings will not lead to better top-line performance yet.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Yum China sported 18,101 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 11.7% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

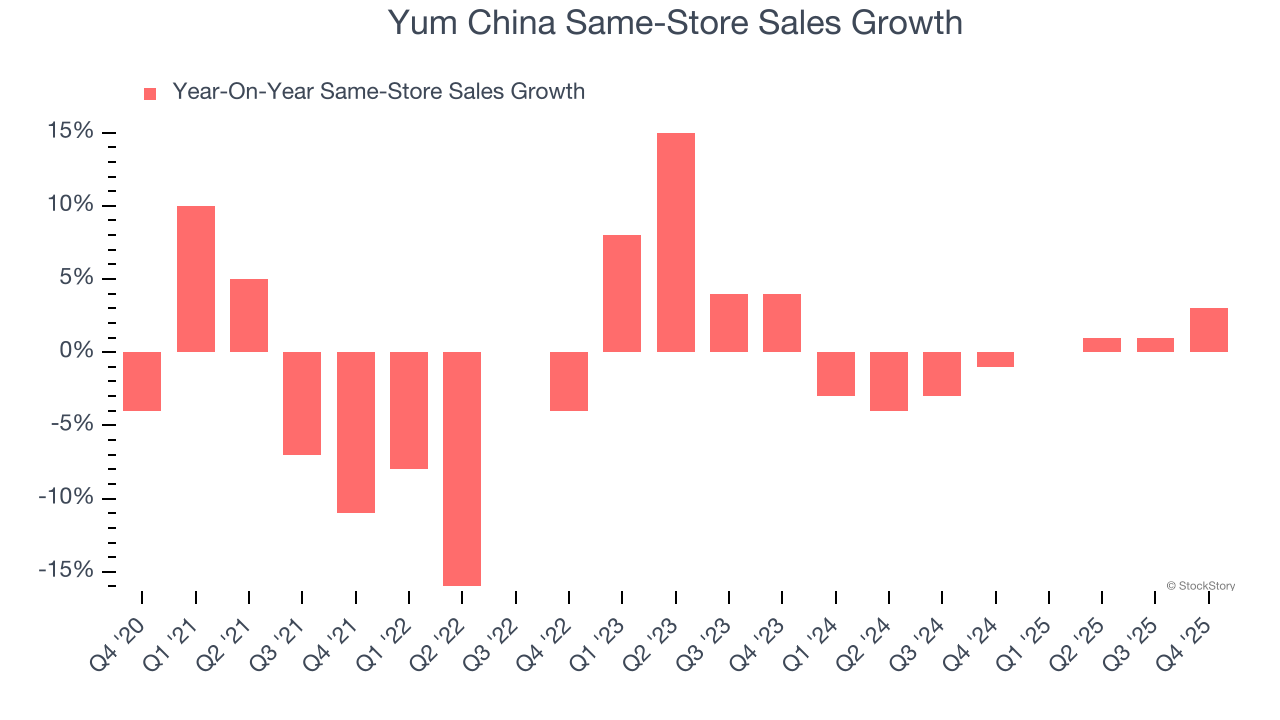

Yum China’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. Yum China should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Yum China’s same-store sales rose 3% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Yum China’s Q4 Results

We were impressed by how significantly Yum China blew past analysts’ revenue expectations this quarter. We were also excited its same-store sales outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.9% to $53.23 immediately following the results.

Yum China put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).