Don't be misled by Splash Beverage Group (NYSE: SBEV) stock's smallcap price; this company is growing much faster and has significantly more inherent value than its recent sub two-dollar price represents. In fact, there's much evidence validating the case that SBEV is in its best position ever to accelerate an already impressive growth rate. Supporting that premise are signed distribution and retail placement agreements with many of the world's largest wholesalers and retailers, including a handful with several of the biggest Anheuser-Busch (NYSE: BUD) product distributorships. On the retail side, deals with industry giants such as Walmart (NYSE: WMT) and Target (NYSE: TGT) add to the revenue-generating potential.

Those aren't the only deals driving the SBEV value proposition. Other distribution and retail agreements leverage the strength of market-dominant broad-line partners, facilitating a pathway for Splash to penetrate other national and regional chains. Those do more than accelerate SBEV's growth; they provide a competitive edge that will assist the company in getting its products on more shelves across the country and tap into a beverage market expected to reach $1.8 trillion next year.

The most attractive part of SBEV from an investor's standpoint is that they have multiple shots at revenue-generating goals targeting different market opportunities. Strengthening that potential is that all of its products are sector innovators, with brands like TapouT performance hydration and recovery drink, SALT, Copa Di Vino, and Pulpoloco offering more than just premium quality; they are also produced, packaged, and marketed in an eco-friendly way. In fact, some of SBEV's packaging technology - especially CartoCan, with its applications scalable across any beverage SKU - could be worth billions on its own. More on that later.

Video Link: https://www.youtube.com/embed/Xajh4HAtrPs

An Award Winning Product Portfolio

The focus today is on SBEV's brands. The individual products within the company's portfolio can each deliver millions in sales per quarter, but combined, the long-term view is that they can generate billions. That's not being overly optimistic. SBEV and its brands are managed by members of the same development team that took the RedBull Energy drink from zero to billions. But here's the difference: SBEV is focused on bringing already-marketed brands under its management. In other words, while it took time for RedBull to get its market footing, SBEV's products have a running start and the potential to earn leadership positions in their respective segments. That's no accident.

It results from Splash Beverage Group earning its worth as an innovator in the beverage industry by leveraging its growing portfolio of alcoholic and non-alcoholic beverage brands. But as important as brand strength, SBEV management knows how to monetize them through a proven strategy of rapidly developing early-stage brands, creating a national market, and then capitalizing on the high visibility of that brand and maximizing the market opportunity from products being innovators in their categories. Examples are easy to find.

SALT Tequila is one, and it continues to score national deals allowing it to target a significant niche in the tequila markets, one expected to surge to an over $18.5 billion market by 2028. SBEV's SALT is a 100% agave, 80-proof tequila brand that is already attracting a substantial consumer base in a flavored spirits market experiencing double-digit percentage growth. Offering premium chocolate, berry, and citrus-flavored tequila, SALT Tequila is ideally and uniquely positioned to do more than exploit that potential; it can dominate the category. Incidentally, a 42-store deal with Walmart's wholly-owned Sam's Club, among others, is making that a mission in progress.

SBEV Innovation: Product Taste To Packaging Technology

SALT isn't the only category innovator; Copa Di Vino and Pulpoloco sangria are also changing the landscape in their respective segments. Single-serve Copa Di Vino wine earned national attention by being the only product featured twice on the popular investment show Shark Tank. A testament to Copa's taste, position, and potential, every "shark" wanted a piece of that deal. Notably, it was more than just the great taste they were after; its value as a leader in package sealing technology was also individually recognized for its potential to open near-limitless monetization opportunities for SBEV. Its eco-friendly specifications are so revolutionary that Copa Di Vino can remain fresh for up to a year, compared to competing brands having a sell-by date of months or even days.

Then there's Pulpoloco, SBEV's sangria made in Madrid, Spain. It, too, is earning an increasing share of attention. But more than great taste, there's an inherent value kicker. This best-in-class product has an innovative and marketable packaging technology that many have called the most socially conscious and eco-friendly packaging on the market: CartoCan. SBEV holds exclusive rights to the unique packaging technology, which is excellent news as CartoCan has the potential to be the most sought-after packaging in the beverage industry. That's an ambitious but well-supported presumption. Why?

Because in addition to being 100% biodegradable, the innovative packaging technology is 30% more eco-friendly than aluminum or PET, uses 30% less total raw materials to create, and the raw materials used come entirely from renewable sources. That includes using only wood fibers from forests managed in an exemplary fashion, which has led to CartoCan packaging earning the exclusive right to bear the Forest Stewardship Council (FSC) label. And like Copa, the CartoCan keeps Pulpoloco shelf-stable for at least a year, keeping the vibrant character of its taste profile well-protected during that time.

A third value driver has earned significant market traction: TapouT performance, hydration, and recovery drink.

TapouT Is A Standout Performer

This asset has been accruing significant market traction. TapouT is a true performance beverage focusing on active hydration that encompasses activation, electrolyte restoration during exercise, and complete recovery following a workout. Unlike other marketed sports drinks, TapouT is formulated to provide an optimized mix of the vitamins, minerals, antioxidants, electrolytes, and sugars necessary to drive cellular hydration in the muscles and other body parts requiring fluids, fueling them during the activity and facilitating their replenishment during the body's recovery process. Similar to SBEV's other products, its differences are advantages.

TapouT performance drinks aren't formulated as protein drinks to help people bulk up or as caffeinated energy beverages giving a false boost at the start of a workout. Instead, TapouT performance drinks are consciously balanced to provide the optimal nutrients and hydration for best performance and recovery. Still, while different, it does fit into a billion-dollar market segment that expands its reach beyond the general water, fortified water beverages, protein drinks, and energy drinks categories.

While it may enjoy crossover sales, TapouT is marketed as a balanced performance beverage that boosts hydration, performance, and recovery from one drink source. Its primary target market is focused on earning business from the active consumer looking for a balanced blend of nutrients, such as electrolytes and vitamins, that will optimize performance and speed up recovery after intense physical exertion. In other words, SBEV is creating a category through marketing a better, more genuine product that provides beneficial results without gimmicky caffeine-induced side effects.

Having excellent products matters, but investors want proof they are as good as claimed. SBEV is delivering better than expected.

Surging Revenues Prove The SBEV Strategy

Revenues in 2021 were more than 2000% higher than those posted the prior year. That trend continued in 2022, with SBEV posting record sales in Q2 and then besting them again in Q3 with a 73% increase over the same period in the prior year. Deals signed throughout 2022 and more in 2023 suggest the revenue growth will continue, and proof of that could be shown through its imminent Q4 and full-year 2022 financials.

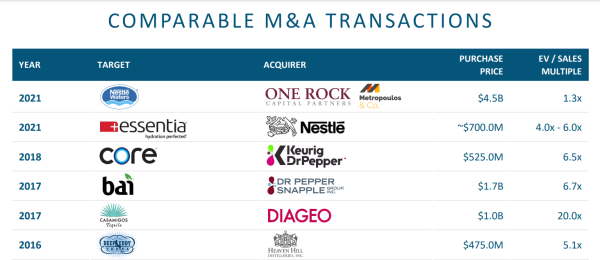

Remember, revenues generated aren't the only value drivers when appraising SBEV. By continuing to develop its portfolio and acquiring new profitable brands, they are adding potentially massive value to its balance sheet, with valuation multiples averaging about 7x revenue being a reality in the sector. Even better, the beverage industry is one of the most resilient, showing itself virtually recession-proof and maintaining pricing power compared to consumer discretionary - spirits included.

Thus, valuing SBEV's sum of its parts, current share prices offer more than a compelling value proposition; it presents a timely one. And keep in mind that a result of SBEV firing on all cylinders isn't just contributing to near-term growth; it keeps long-term vision in focus as well. With a history of management exceeding expectations and considering that SBEV operates in a sector resilient to recessionary pressures, investing in that vision and taking advantage of company shares looking appreciably undervalued may be both a wise and well-timed consideration.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Splash Beverage Group, Inc. for a period of one month ending on 4/15/23. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/