Advanced Micro Devices (AMD) shares had a blockbuster 2025 as the company succeeded in positioning itself as the price-to-performance leader in artificial intelligence (AI) chips.

Still, a senior Mizuho analyst, Vijay Rakesh, believes the semiconductor titan remains undervalued and poised to push higher on continued AI spending in 2026.

At the time of writing, AMD shares are trading at nearly 3x their price in the first week of April.

AMD Stock Seen Rallying Another 30%

Mizuho believes AMD has successfully pivoted to a yearly hardware update cycle, which keeps it competitive with Nvidia’s (NVDA) Blackwell architecture.

Advanced Micro Devices has been dismantling Intel’s (INTC) once-untouchable lead in server CPUs as well, with its share of that market expected to surpass 50% next year.

Moreover, the company’s multi-year OpenAI deal is nothing short of a “game-changer,” set to add another $22 billion to its annual revenue by the end of this decade, according to Vijay Rakesh.

In his research note, he dubbed these tailwinds sufficient to drive AMD stock to $277 or up nearly 30% from here in 2026.

How Do AMD Shares Compare to NVDA?

Advanced Micro Devices is worth owning also because recent reports suggest it will soon resume chip shipments to China, releasing an estimated $500 million (at least) in additional revenue for 2026.

AMD shares outperformed Nvidia by a significant margin this year – yet, they remain cheaper to own on a price-sales (P/S) basis.

More importantly, even after a meteoric rally in 2025, the AI stock has its 100-day relative strength index (RSI) set at 54 only, indicating the upward momentum is far from exhaustion.

All in all, AMD is an early stage story with much more room for future growth than NVDA, and that alone is a strong enough reason to stay invested.

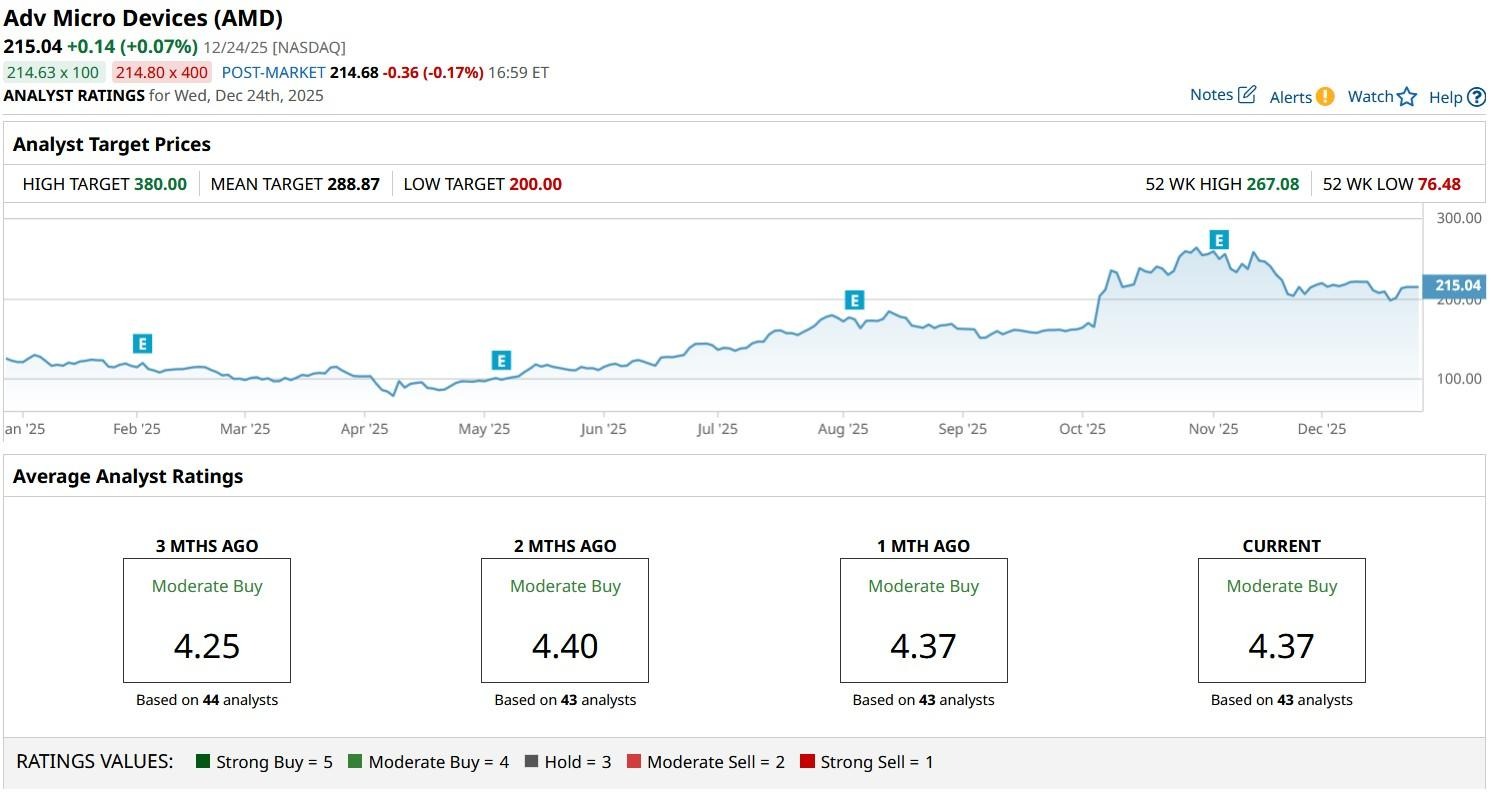

What’s the Consensus Rating on Advanced Micro Devices?

Other Wall Street analysts seem to agree with Mizuho’s bullish view on Advanced Micro Devices.

According to Barchart, the consensus rating on AMD stock remains at “Moderate Buy” with price targets going as high as $380, indicating potential upside of a whopping 75% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Activist Investor Toms Capital Is Buying Up Target Stock. Should You?

- These Are the Key Levels to Watch for IonQ Stock Heading into 2026

- Archer Aviation Stock Crashed in 2025. Will 2026 Be the Year Shares Take Flight Again?

- QuantumScape Gained 100% in 2025 and Is Set to Generate Revenue for the First Time in 2025. Options Data Suggests You Should Play QS Stock Like This for 2026.