QuantumScape (QS) had a blockbuster 2025 with shares currently up more than 100% and up more than 200% versus their year-to-date low set in the first week of April.

Still, there’s reason to expect QS stock to push higher in the new year, especially since the company is expected to report its first revenue in 2025.

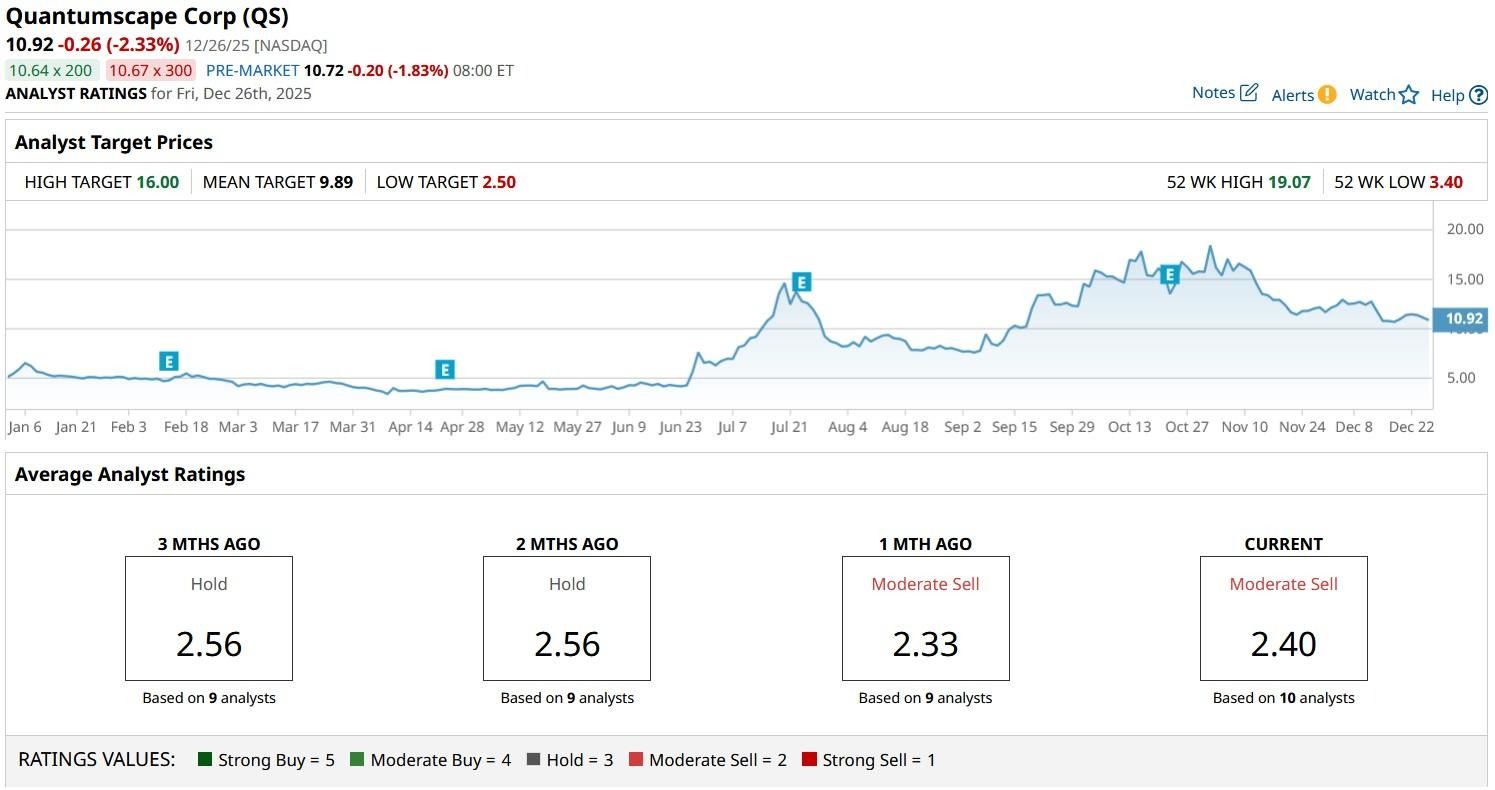

At the time of writing, QuantumScape shares are down roughly 40% versus their October high – suggesting valuation may not be as high as many believe either.

Is It Worth Owning QuantumScape Stock for 2026?

QS shares remain attractive for the coming year as licensing agreements with automakers, including Volkswagen (VWAGY), are expected to help QuantumScape generate roughly $5 million in revenue in 2026.

According to Grand View Research, the global solid-state battery market will grow at a compound annualized rate (CAGR) of more than 56% through the end of this decade.

This means QuantumScape has ample room for future growth, especially as EV adoption continues to rise in the coming years.

With its “QSE 5” technology offering faster charging and higher energy density than conventional lithium ion cells, this Nasdaq-listed firm is poised to capture early leadership in a sector that could redefine electric mobility.

Where Options Data Suggests QS Shares Are Headed

Investors should also note that the put-to-call ratio in QuantumScape stock is skewed to the upside currently, with a bullish reading of 0.33 for contracts expiring Jan. 2.

From a technical perspective as well, QS shares are trading decisively above their 200-day moving average (MA) at the time of writing, suggesting bulls remain in control over the longer term.

In short, while risks remain, the combination of technological edge, strategic partnerships, and accelerating industry adoption signal 2026 could prove another strong year for QuantumScape investors.

How Wall Street Recommends Playing QuantumScape

Despite aforementioned positives, however, Wall Street believes the upside is already priced into QS shares.

The consensus rating on QuantumScape stock currently sits at “Moderate Sell” with the mean target $9.89 indicating potential downside of about 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- QuantumScape Gained 100% in 2025 and Is Set to Generate Revenue for the First Time in 2025. Options Data Suggests You Should Play QS Stock Like This for 2026.

- Micron Stock Stole the Show in 2025. Options Data Says It Will Trade at These Levels in 2026.

- Risk Topography Signals a Contrarian Opportunity for Microchip (MCHP) Stock Options

- A Less-Costly Way to Buy Costco to Gain Leveraged Upside in COST Stock