Artificial intelligence (AI) is an infrastructure race. As models grow larger and workloads grow heavier, the real pressure point is power — how efficiently data centers can feed energy to racks packed with GPUs running nonstop. That’s where power management solutions step out of the shadows, quietly becoming mission-critical to the AI boom.

At CES 2026, AI chip giant Nvidia (NVDA) officially unveiled its futuristic Rubin platform, extending the momentum already built by Blackwell. With Blackwell already setting the pace and Rubin waiting in the wings, the company expects the combined sales of these two platforms to approach a staggering $500 billion in 2026. Rubin, in particular, raises the bar — combining Vera CPUs, Rubin GPUs, and Nvidia’s in-house networking while slashing AI inference costs versus Blackwell.

But every leap in GPU performance demands smarter power delivery. That’s where Monolithic Power Systems (MPWR) enters the frame. The company supplies the power control modules that keep AI servers stable and efficient. Wells Fargo recently nudged its price target for MPWR stock to $1,125 from $1,100, betting that as Nvidia’s platforms scale, the real leverage may lie with this “picks-and-shovels” provider powering the revolution.

Let’s take a closer look at MPWR stock, which investors could consider now.

About Monolithic Power Stock

Founded in 1997, Monolithic Power Systems has steadily built its reputation as a force behind modern electronics. The Washington-based semiconductor company specializes in high-efficiency power management ICs, supplying critical solutions across a wide range of global technology markets.

Public since 2004, Monolithic has spent the past two decades methodically expanding beyond core PMICs into power converters, controllers, motor drivers, and battery management systems. Today, its portfolio spans thousands of SKUs embedded across data centers, automotive platforms, industrial systems, and consumer devices. With a market capitalization of $49.5 billion, Monolithic stands as a disciplined compounder that's less about headline hype and more about engineering depth, execution, and durable relevance in an increasingly power-hungry world.

MPWR’s stock story is one of patience rewarded. Over the past two decades, the stock has delivered returns of more than 5,800%, an extraordinary run built on execution rather than hype. After its inclusion in the S&P 500 ($SPX) in 2021, the stock is up roughly 160%. Just last month, MPWR earned another badge of maturity with its entry into the Nasdaq-100, reinforcing its growing institutional relevance.

Momentum has remained strong over the past year. Shares gained 73% over the past 52 weeks, surging to an all-time high of $1,123.38 in October. While the AI megatrend has clearly amplified investor enthusiasm, Monolithic’s growth trajectory predates the current cycle, rooted in its expanding role across data centers, automotive, and industrial markets.

From a technical lens, the setup looks steady and improving, though not stretched. The 14-day RSI, which was near the oversold territory in November, has rebounded to around 62, suggesting selling pressure has eased rather than overheated. The MACD oscillator tells a similar story of transition. After briefly slipping below the signal line, the MACD line is now edging back above it, with the histogram firmly in positive territory, hinting that momentum is stabilizing and a renewed uptrend may be quietly taking shape.

MPWR stock has enjoyed a powerful run, but that momentum comes with a valuation that demands attention. The stock is priced at roughly 62 times forward adjusted earnings and 18 times sales, levels well above both sector medians and its own historical averages. It’s a rich price tag, no doubt. Still, the Street continues to look past the multiples, anchored by confidence in the company’s ability to deliver sustained double-digit growth as demand for efficient power solutions accelerates.

At the same time, Monolithic has not forgotten its shareholders. The company has paid dividends for over a decade, most recently distributing $1.56 per share, or $6.24 annualized. With a 0.62% yield and a 46.38% payout ratio, the dividend adds a steady, if understated, layer of return.

Monolithic Power’s Q3 Earnings Snapshot

Monolithic Power’s third-quarter report was released on Oct. 30, and the numbers spoke with solid confidence. Revenue came in at $737.2 million, climbing 19% year-over-year (YOY) and landing comfortably ahead of Wall Street expectations. This was not a one-off beat, either — it was broad-based, powered by real demand across multiple end markets.

Storage and computing revenue jumped nearly 30% annually to $186.6 million, reflecting sustained investment in data centers and high-performance computing. Automotive rose 36% YOY, while industrial revenue climbed 26%, signaling resilience beyond pure AI-driven demand. Communications added steady growth of 11%, consumer revenue advanced 12%, and even the enterprise data segment edged higher, reinforcing the idea that momentum is spreading rather than narrowing.

Profitability kept pace. Non-GAAP net income rose to $227.1 million, or $4.73 per share, up meaningfully from the prior year. Cash generation remained robust, with operating cash flow at $239.3 million, and the balance sheet strengthened further as cash, equivalents, and short-term investments increased to $1.26 billion by quarter-end. That financial flexibility gives Monolithic Power the room to keep investing while staying agile.

Management framed the quarter as evidence of something bigger — Monolithic’s evolution from a chip-centric supplier into a full-service, silicon-based solutions provider. Continued investment in new technologies, expansion into adjacent markets, and a more diversified global supply chain are all designed to solve customers’ toughest power challenges, and to do so at scale.

Looking ahead, Monolithic Power will report Q4 results after the market closes on Feb. 5. The company expects Q4 revenue between $730 million and $750 million, with non-GAAP gross margins in the 55.2% to 55.8% range. For investors, Monolithic is steadily sharpening its role at the center of modern electronics and AI infrastructure.

Analysts monitoring the power management chips company expect adjusted EPS for Q4 to be $3.63, up almost 15% YOY. Fiscal 2025 EPS on an adjusted basis is anticipated to rise 26% annually to $13.50, before surging by 19% annually to $16.07 in fiscal 2026.

What Do Analysts Expect for Monolithic Power Stock?

Wells Fargo is growing more confident in Monolithic Power, upgrading the stock to an “Overweight” and nudging its price target to $1,125. Analyst Aaron Rakers views 2025 as a necessary reset year — marked by Nvidia broadening its supplier ecosystem — rather than a structural setback.

Looking ahead, the firm expects momentum to reaccelerate, particularly within Monolithic Power’s enterprise data segment, where AI-driven demand is becoming clearer and more durable. Wells Fargo is modeling 39% YOY revenue growth in 2026 for Monolithic Power, but the tone of the analyst note suggests room for upside as visibility improves. In short, Monolithic Power is emerging from a transition phase and reentering a growth cycle, quietly aligned with Nvidia’s expanding AI infrastructure buildout.

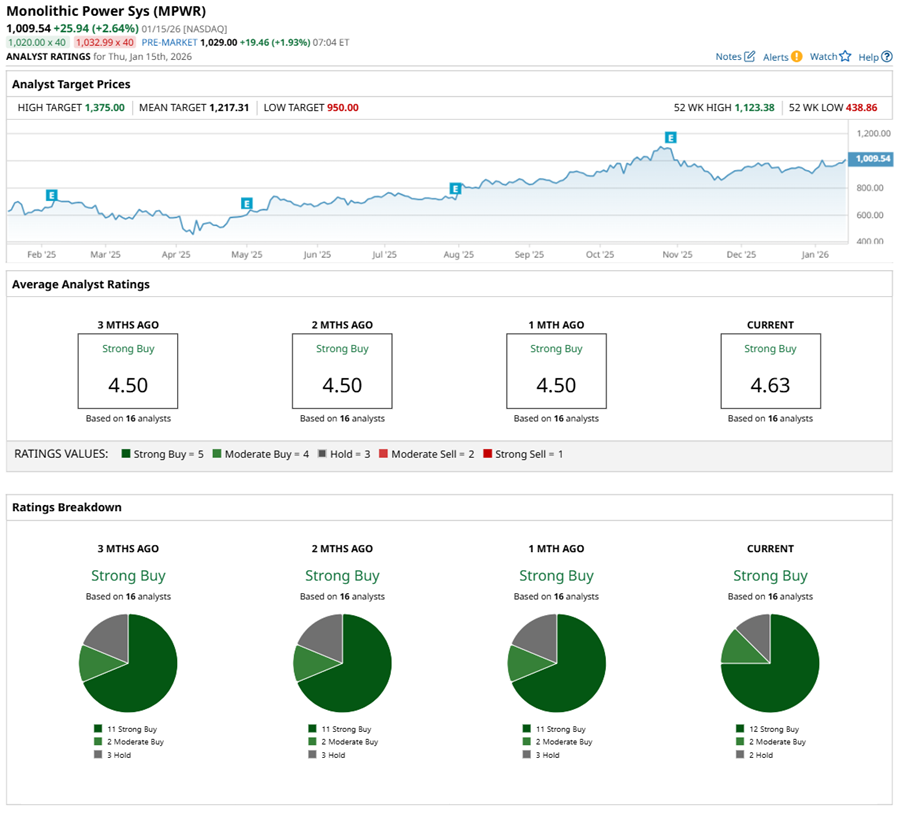

Wall Street analysts are upbeat about MPWR, with the stock carrying a “Strong Buy” consensus rating. Out of 16 analysts, 12 rate it a “Strong Buy,” two call it a “Moderate Buy,” and the remaining two analysts play it safe with a “Hold.”

The mean price target of $1,219.23 implies upside potential of 18% from here. Meanwhile, the Street’s highest projection of $1,375 suggests MPWR stock could rise as much as 33%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?