With a partial government shutdown looking very likely, the price of gold has been soaring recently. Two top-performing ETFs-Direxion Daily Junior Gold Miners Bull 2X (JNUG) and the Direxion Daily Gold Miners Bull 2X (NUGT)—give investors a convenient way to profit from this trend.

And although Congress may find a way relatively soon to end the shutdown, several other factors that have pushed gold much higher over much longer periods are unlikely to dissipate in the near-to-medium term. Among these positive catalysts are the weakening U.S. dollar, high government debt globally, the sanctions imposed by the U.S. against Russia, and elevated tensions between America and its allies.

The Performance of JNUG and NUGT

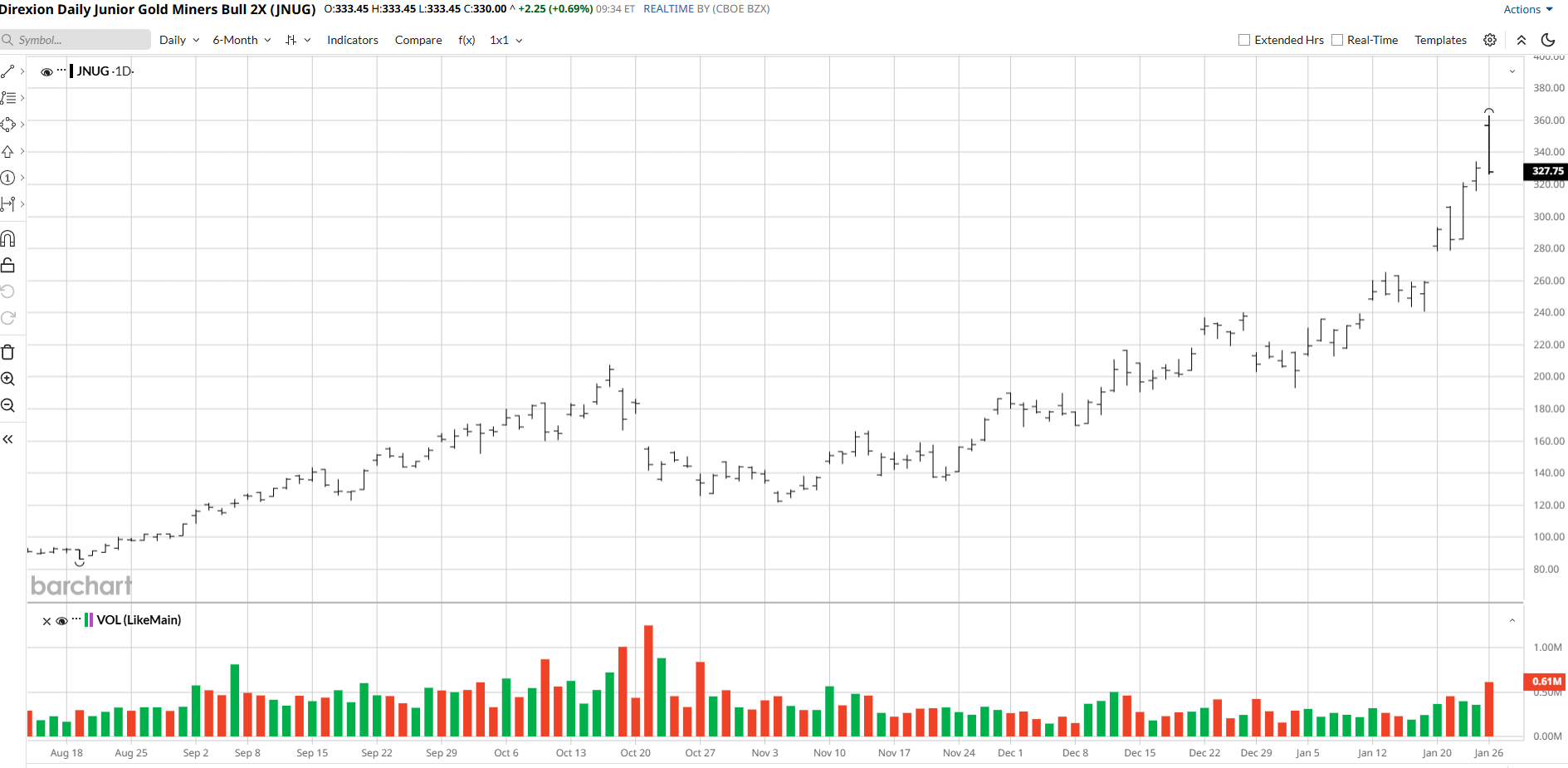

In the month that ended on Jan. 26, JNUG jumped 41%, while it advanced 150% in the three months that ended on that date. It soared 696% in the preceding year. Barchart's Technical Opinion rates it as a “Strong Buy.”

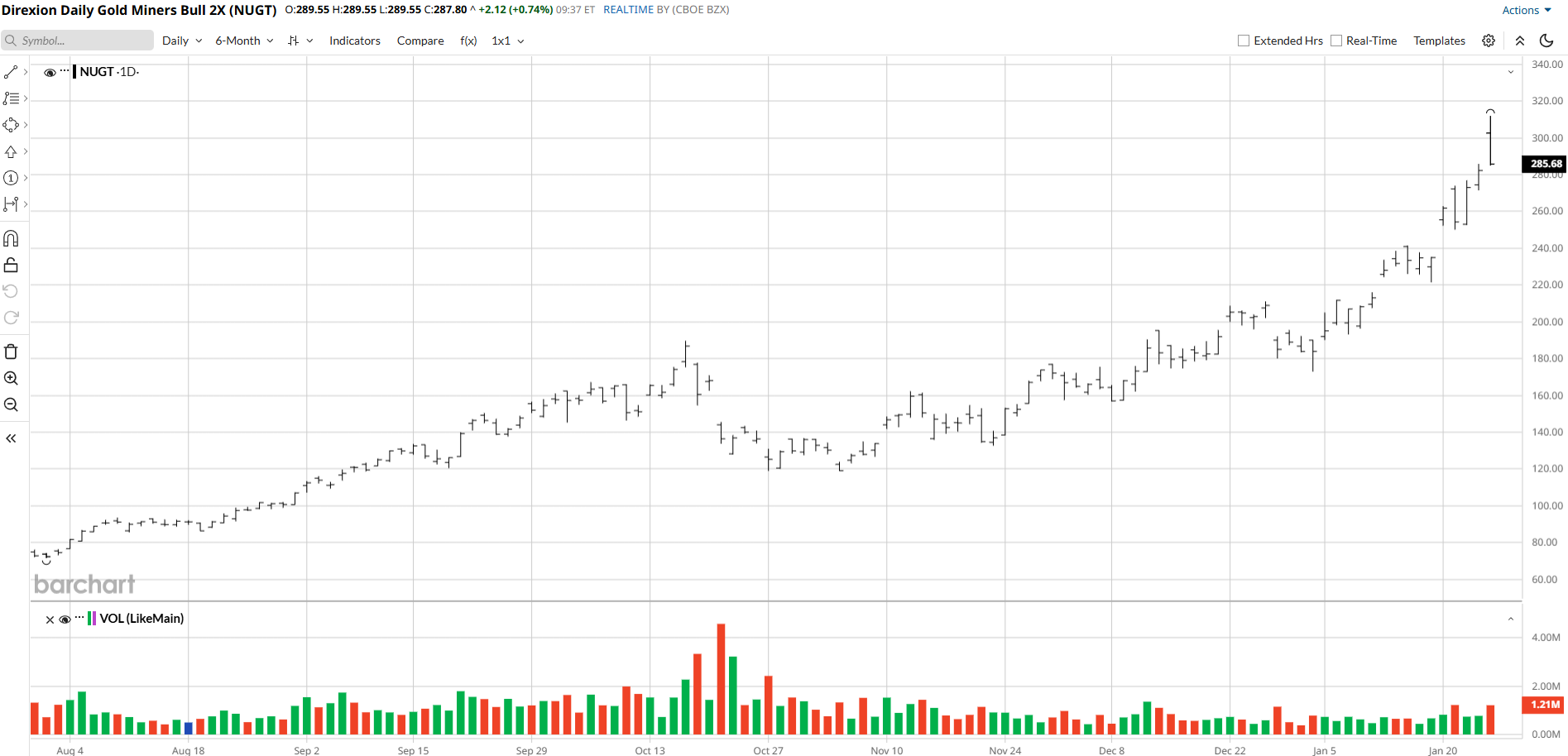

In comparison, in the month that ended on Jan. 26, NUGT jumped 39% and advanced 132% in the previous three months. It soared 588% in the preceding year. Barchart's Technical Opinion also rates it as a “Strong Buy.”

A Partial Government Shutdown Appears to Be Imminent

Another shutdown was always on the table, as there were unresolved issues after the last shutdown concluded.

However, many of those concerns have been overshadowed by current events in Minnesota. Senators from both parties are feeling the pressure from their constituents about the conduct of Immigration and Customs Enforcement (ICE) and Customs and Border Protection (CBP) agents in Minnesota. On Jan. 7, an ICE agent killed Renée Good, and agents from CBP killed Alex Pretti on Jan. 24. These two high-profile incidents come after numerous other reports of excessive force when dealing with peaceful protestors.

A growing number of Democratic lawmakers are refusing to support a six-bill funding law that includes appropriations for ICE. The Democrats are demanding that new restrictions on ICE be placed in the legislation, while Republicans counter that President Donald Trump should instead make changes to ICE's procedures. The spending plan can't pass without Democratic votes, and a partial shutdown will begin on Saturday unless senators make a bipartisan deal.

As of the morning of Jan. 26, the probability of a shutdown on prediction market Kalshi was at about 78%.

Domestic political instability like this is an extremely powerful catalyst for gold prices.

Other Factors Behind Gold's Meteoric Rally

Three years ago, an ounce of gold was worth $1,923, and it has soared above $5,000 today. One of the factors that has boosted gold both in the last three years and recently has been elevated levels of government debt globally.

Another positive catalyst for gold has been the reduced popularity of the dollar and geopolitical instability. The latter trend has been sparked partly by America's enactment of sanctions on Russia, a development that led some nations to hold a significantly lower proportion of their reserves in currencies and a meaningfully higher percentage of their reserves in gold. Last October, multibillionaire hedge fund owner Ray Dalio warned that new sanctions on Russia's oil companies would boost gold prices further, and his forecast turned out to be very much on target.

Further, President Donald Trump's tariffs and America's increasing alienation from its traditional allies are widely seen as having weakened the dollar, and when the dollar weakens, gold tends to rise against the dollar. Finally, stubbornly high U.S. inflation, along with fears that many governments globally will intentionally keep inflation elevated to reduce their debt burdens, are cited as reasons for gold's spike.

None of these factors, many of which have been active for years, looks likely to weaken significantly anytime soon. Indeed, just today Bloomberg reported that its Dollar Spot Index had reached its lowest point “since March 2022.”

Consequently, JNUG and NUGT may be worth buying and holding long after the likely partial government shutdown ends.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Government Shutdown Panic Swirls, Consider These 2 Top-Performing Gold ETFs to Buy Now

- 2 International Dividend ETFs To Watch as the 'Sell America' Trade Gains Popularity

- The Great ‘Dollar Dump’ of 2026: How To Capitalize on the Greenback's Retreat

- Our Top Technical Strategist Explains How to Invest in the 'Age of Electricity'