Omaha, Nebraska-based Union Pacific Corporation (UNP) is one of North America’s largest freight rail operators, serving as the parent company of Union Pacific Railroad, which runs a vast network across the western two-thirds of the United States. Founded in 1862, the company played a central role in building the first U.S. transcontinental railroad and remains a critical link in the national supply chain. With a market cap of $149.8 billion, it transports a diversified mix of commodities, including agricultural products, industrial chemicals, energy materials, automotive shipments, and intermodal containers.

The railroad giant has notably underperformed the broader market over the past year but has surpassed in 2026. UNP stock prices have surged 5.1% over the past year, compared to the S&P 500 Index’s ($SPX) 15.6% gains. However, in 2026, the stock has surged 10%, surpassing SPX’s 1.7% rise.

Narrowing the focus, UNP has also underperformed the sector-focused State Street Industrial Select Sector SPDR Fund’s (XLI) 26.5% returns over the past 52 weeks and 12% gains on a YTD basis.

On Jan. 27, Union Pacific released its fiscal 2025 fourth-quarter earnings and its shares dipped 2.1% in the next trading session. The company posted operating revenue of about $6.1 billion, down 1% year-over-year and modestly below consensus forecasts, driven by softer freight volumes. Adjusted EPS came in at $2.86, marginally under the expected figure.

For the current year ending in December, analysts expect UNP to deliver an adjusted EPS of $12.49, up 7.1% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates two over the past four quarters, it surpassed the projections on two other occasions.

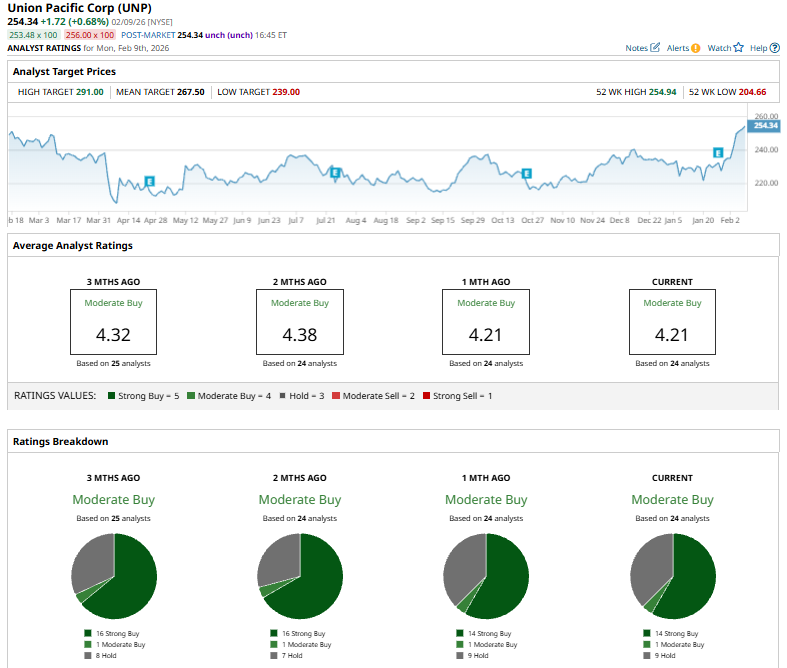

Among the 24 analysts covering the UNP stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buys,” one “Moderate Buy,” and nine “Holds.”

This configuration is notably bearish than two months ago, when 16 analysts gave a “Strong Buy” recommendation on UNP.

On Jan. 29, Brian Ossenbeck of JPMorgan Chase & Co. (JPM) reiterated a “Neutral” rating on Union Pacific while trimming his price target to $265 from $270, reflecting a more cautious near-term outlook on the stock.

Union Pacific’s mean price target of $267.50 represents a 5.2% premium to current price levels. Meanwhile, the street-high target of $291 suggests a 14.4% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.