In a recent interview with CNBC, Wedbush analyst Dan Ives suggested that the next stage of the artificial intelligence (AI) revolution will be "physical AI," and only a couple of companies will stand to benefit from this shift. Aside from Nvidia (NVDA), which doesn’t come as a surprise, Ives believes Tesla (TSLA) could also be the best physical AI play in the world, arguing that the company’s ambitions extend far beyond electric vehicles (EVs).

Let’s find out what makes Ives so confident about Tesla.

Dan Ives on His Top “Physical AI” Picks

In the CNBC segment, Ives discussed that AI is rapidly evolving beyond software and cloud-based applications into what Ives describes as “physical AI.” This new phase of AI focuses on real-world deployment—autonomous vehicles, robotics, and intelligent machines operating in physical environments rather than just digital platforms. Ives refers to Tesla not simply as an EV manufacturer but as a leader in embodied AI. He points to developments such as autonomous driving technology and robotics programs as major factors that could change how investors value the company over time.

Tesla’s Vision: From Electric Vehicles to “Amazing Abundance”

Tesla's long-term vision centers on AI and robotics, which will significantly enhance production and reduce costs across industries. In its recent Q4 earnings call, Musk emphasized that Tesla’s investments in autonomy, robotics, batteries, solar energy, and AI chips are interconnected pieces of a larger technological ecosystem. He described it as an era of “amazing abundance.” Tesla continues to advance its Full Self-Driving (FSD) technology, with unsupervised autonomous rides already taking place in Austin without safety monitors or chase vehicles. The company believes and predicts that autonomous vehicles will eventually dominate transportation, with robotaxis serving as shared assets rather than privately driven cars.

Furthermore, Tesla's humanoid robot Optimus is arguably the best example of physical AI in operation. The company wants to transform the Model S and Model X production space into an Optimus factory, with the long-term objective of producing up to one million robots per year at its Fremont facility. Musk claimed that Tesla is also looking into the potential of constructing a large-scale semiconductor fabrication facility known as a "TerraFab" to decrease supply-chain risks and assure adequate compute power for self-driving cars and robotics.

The Present Isn’t Rosy, but the Future Looks Bright

As always, Musk largely avoided detailed commentary on margins, revenue trends, or delivery declines, instead focusing mostly on long-term objectives in autonomy, robotics, and AI infrastructure.

Tesla’s core automotive business continues to struggle, with Q4 revenue dropping 11% to $17.7 billion and full-year automotive revenue falling 10% to $69 billion. Despite double-digit revenue in the energy generation, storage, and services segments, total revenue declined 4% year-on-year (YoY) in both the fourth quarter and the entire year. Additionally, adjusted earnings fell 28% in 2025. Gross margin fell to 18% in 2025 from the highs of 25% in 2021.

Despite near-term pressures such as margin fluctuations, higher operating expenses, and continued spending on AI initiatives and new products, including CyberCab, Semi, and MegaPack energy systems, Tesla forecasts capital expenditures to exceed $20 billion by 2026. The investment will go toward six new factories, AI compute infrastructure, robotaxi deployment, battery supply chains, and Optimus production. Musk views this heavy investment phase as necessary to position Tesla for what it sees as the next era of growth, rather than as a short-term expansion cycle.

This is Why Ives Sees Tesla as the Leading Physical AI Bet

Dan Ives’ bullish view stems from Tesla's unique ability to operate across the entire stack, including AI models, custom chips, robotics, vehicles, manufacturing, and energy systems. As autonomy and robotics advance, Tesla's addressable market might expand far beyond vehicle sales to include transportation services, industrial automation, and intelligent energy systems. The main concern for investors now is whether Tesla can effectively execute on its lofty promises and whether they are ready to hold on to the stock until that happens.

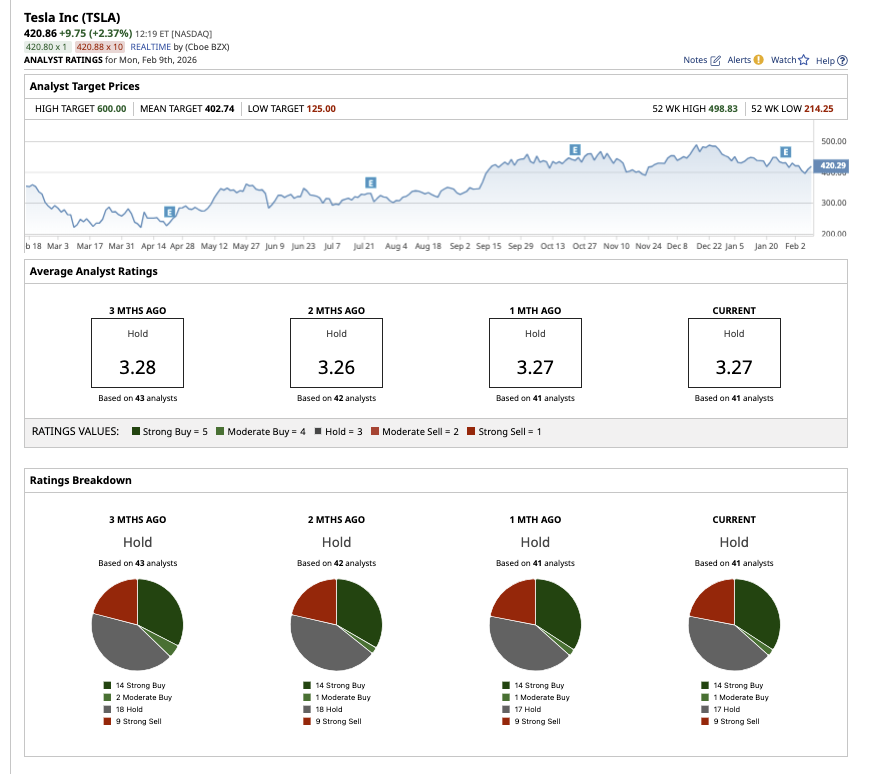

What Does Wall Street Say About TSLA Stock?

Overall, analysts are cautiously optimistic, rating TSLA stock a “Hold.” Out of the 41 analysts covering the stock, 14 rate it a “Strong Buy,” one recommends a “Moderate Buy,” 17 rate it a “Hold,” and nine recommend a “Strong Sell.” TSLA has surpassed its average analyst target price of $402.74. The high price estimate of $600 implies that the stock can rise by 43% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Super Bowl Is Over, And Cathie Woods Is Ditching This Key Sports Betting Stock

- Should You Buy BOBS Stock After the Bob’s Discount Furniture IPO?

- Airbnb’s (ABNB) Upcoming Earnings Present a ‘Binary’ Opportunity

- Nasdaq, Inc. Stock Is Off Its Highs, Despite Strong Results - Short Put Plays Work Here