Unity Software (U) shares plummeted nearly 30% on Wednesday after the game software specialist posted a market-beating Q4 but issued downbeat guidance for the current quarter.

The post-earnings plunge pushed U’s relative strength index (14-day) down to about 26, signaling deeply oversold conditions that often trigger a relief rally.

Still, investors are cautioned against buying the dip in Unity stock that’s now down more than 50% versus its year-to-date high.

Margin Profile Warrants Selling Unity Stock

U stock remains unattractive because a material $89 million net loss in the fourth quarter indicates the company is finding it hard to control its operating costs despite multiple rounds of layoffs.

The NYSE-listed firm has seen its free cash flow margin crash from 32.1% to 23.6%, reinforcing concerns about its ability to achieve sustainable profitability in 2026.

Moreover, rising competition from entrenched ad-tech rivals like AppLovin (APP) could make it even more challenging for Unity Software to stage a comeback this year.

Note that Unity is trading firmly below its major moving averages (MAs), which further confirms that bears will likely remain in control in the near term.

Why U Shares Remain a High-Risk Proposition

Investors are warned against investing in Unity shares amid the ongoing SaaS-pocalypse, especially after the recent launch of “Project Genie” from Alphabet's (GOOG) (GOOGL) Google.

This powerful tool can generate interactive 3D worlds directly from text or images, which threatens U’s core value proposition as the go-to platform for real-time 3D content creation.

Investors fear that accessible AI-driven alternative could erode Unity Software’s competitive edge, especially since the company is already struggling with high costs and profitability.

Meanwhile, U is still trading at a stretched forward price-to-earnings (P/E) ratio of nearly 260x, which dwarfs the multiple even compared to the likes of Nvidia (NVDA).

Wall Street May Revise Estimates on Unity Software

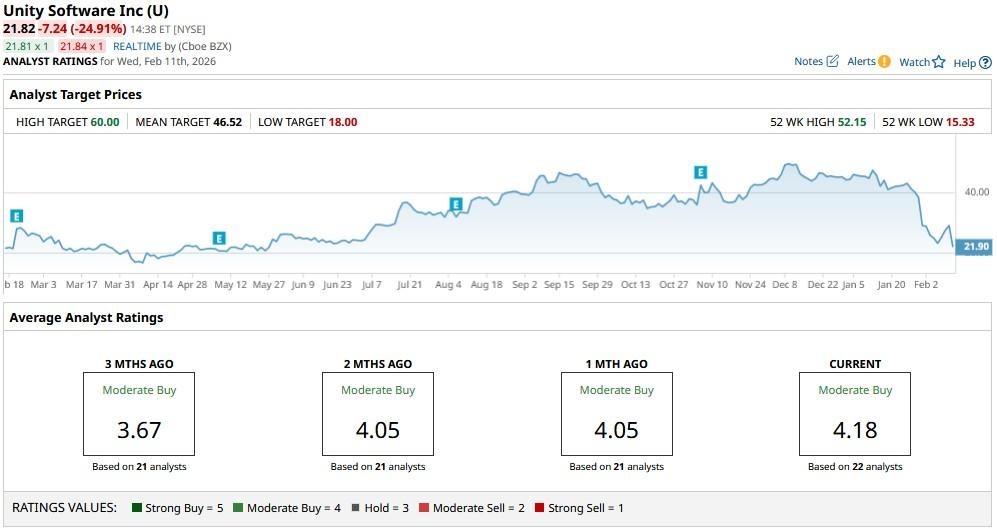

Heading into the earnings print, Wall Street analysts had a consensus “Moderate Buy” rating on U shares.

But it’s well within reason to assume that some of them will downwardly revise estimates after Unity Software guided for a weaker-than-expected $107.5 million adjusted EBITDA in the current quarter.

The lowest price objective on the game software firm sits at $18 currently, indicating potential downside of more than 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Astera Labs Plunges Below Key Support Levels. Should You Buy the Dip in ALAB Stock?

- Can a New CEO Save Workday Stock from the Software Apocalypse?

- A Crypto Collapse Sends Robinhood Stock Back into Oversold Territory. Should You Buy the Dip?

- Unity Software Stock Is Back in Oversold Territory. Is There Any End in Sight for the Bloodshed in U Shares?