Valued at a market cap of $18.6 billion, LyondellBasell Industries N.V. (LYB) is a chemical company based in Houston, Texas. It produces essential materials used in packaging, automotive components, construction materials, medical supplies, and consumer goods.

This chemical company has considerably underperformed the broader market over the past 52 weeks. Shares of LYB have declined 22.2% over this time frame, while the broader S&P 500 Index ($SPX) has surged 14.4%. However, on a YTD basis, the stock is up 37.3%, outpacing SPX’s 1.4% return.

Narrowing the focus, LYB has also lagged behind the State Street Materials Select Sector SPDR ETF’s (XLB) 20.1% rise over the past 52 weeks. Nonetheless, it has outperformed XLB’s 18.2% YTD uptick.

On Jan. 30, shares of LYB plunged 1.9% after its Q4 earnings release. The company reported a 9.2% year-over-year decline in sales and other operating revenues to $7.1 billion. Its adjusted EPS, which stood at $0.77 in the same quarter last year, shifted to an adjusted loss of $0.26. Adjusted EBITDA also decreased 39.3% year-over-year to $417 million, as margins were pressured across most segments due to higher NGL feedstock and natural gas costs, increased maintenance expenses, and seasonally weaker demand that limited product pricing.

For fiscal 2026, ending in December, analysts expect LYB’s EPS to grow 78.2% year-over-year to $3.03. The company’s earnings surprise history is disappointing. It missed the consensus estimates in three of the last four quarters, while surpassing on another occasion.

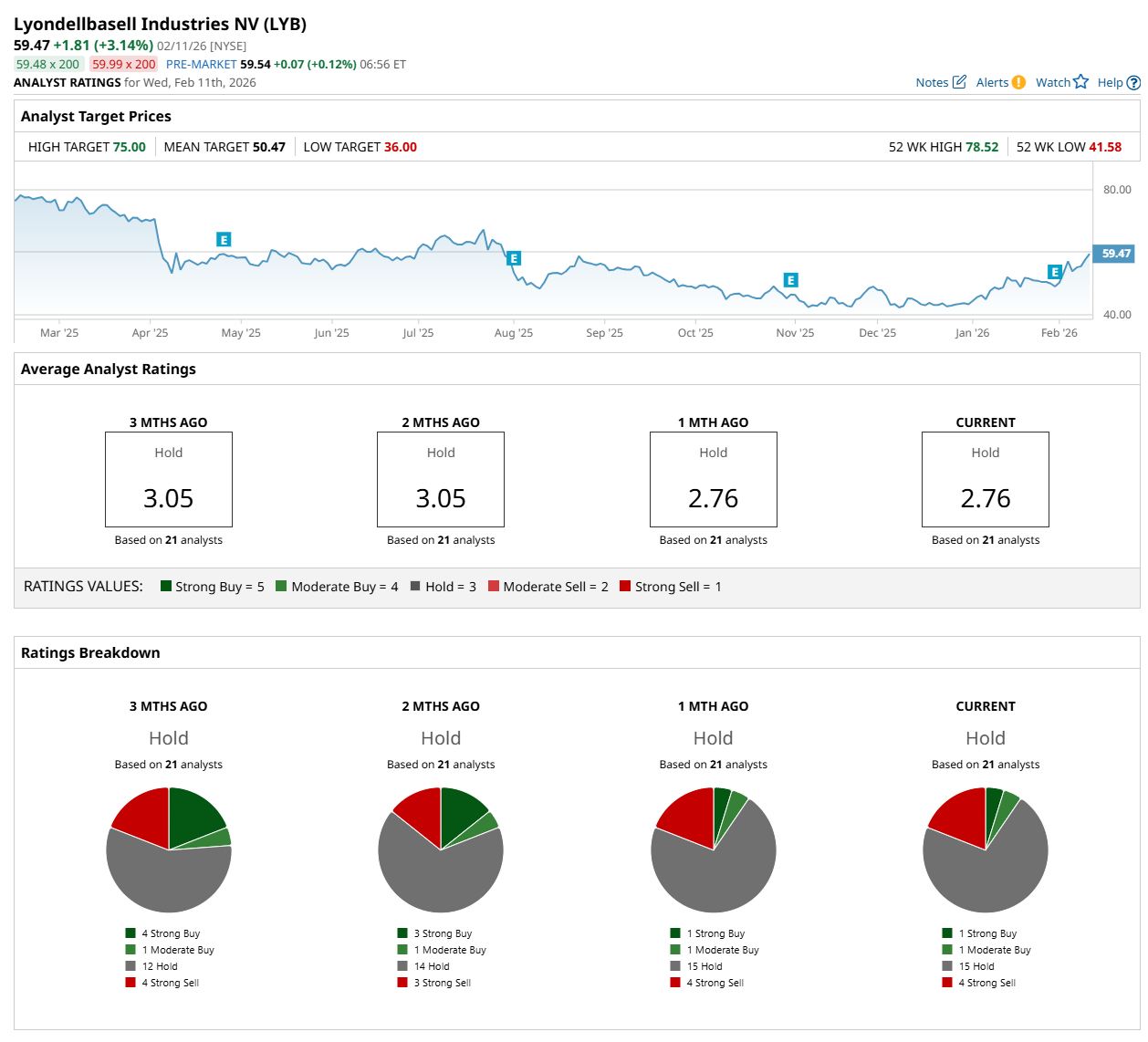

Among the 21 analysts covering the stock, the consensus rating is a "Hold,” which is based on one “Strong Buy,” one “Moderate Buy,” 15 "Hold,” and four “Strong Sell” ratings.

The configuration is less bullish than two months ago, with three analysts suggesting a “Strong Buy” rating.

On Feb. 3, RBC Capital maintained a “Sector Perform” rating on LYB and raised its price target to $51.

While the company is trading above its mean price target of $50.47, its Street-high price target of $75 suggests a 26.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What Does Alphabet’s $31.5 Billion Bond Sale Really Mean for GOOGL Stock Investors?

- As Salesforce Acquires AI Startup Cimulate, Should You Buy, Sell, or Hold CRM Stock?

- Investors in Search of Alpha Are Fleeing Tech Stocks for These 3 High-Yield Sectors Instead

- 200 Years Later, This Stock Is Still Setting New All-Time Highs