I heard someone say this recently, and it spoke to me: “Market timing is about trying to catch the lightning; risk management is about checking the radar so you aren't standing in a field during a storm.”

You might think I’m talking about the stock market. But I’m actually referring to bond investing — and bond exchange-traded fund (ETF) trading. Because bonds have been doing a dance since last year, after rates went from zero to a very respectable amount.

That, for the first time since around 2009, is creating some potentially massive opportunities. And believe it or not, some of those opportunities are in the bond market. It might just rival the S&P 500 Index ($SPX) in terms of returns over the next few years. Here’s why.

While the equity market spent much of 2025 setting records, early 2026 data shows that fixed income is finally finding its footing. Central banks are transitioning from inflation-fighting mode to policy normalization.

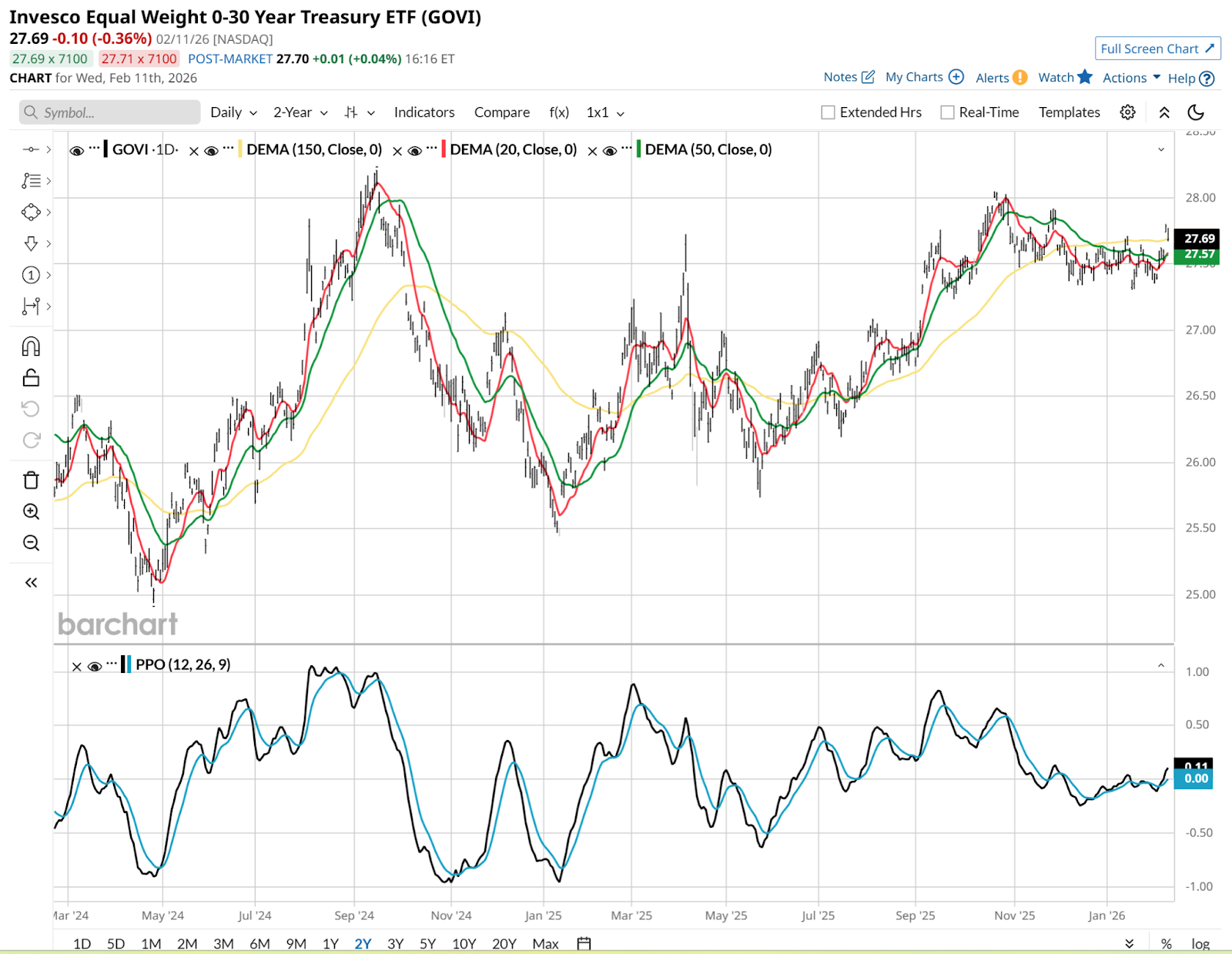

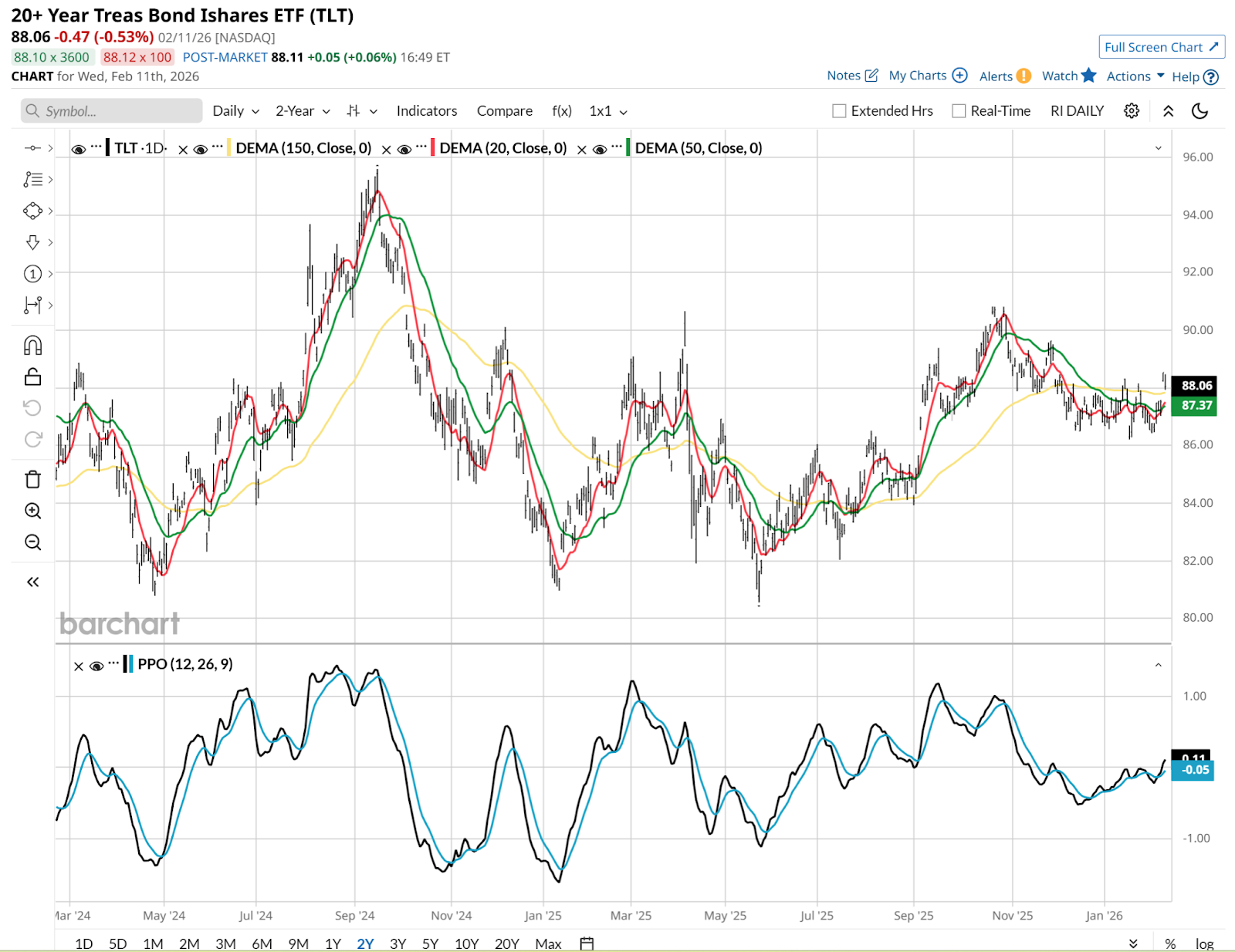

I tend to use the Invesco Equal Weight 0-30 Year Treasury ETF (GOVI) as a bond market proxy. Others will use the 20+ Year Treas Bond Ishares ETF (TLT), but as we saw in 2022, those longest-term bonds can be vulnerable to massive price swings. The flipside is that the same feature makes them huge winners when rates decline.

Here are the charts of both GOVI and TLT. They correlate, as we’d expect. But TLT is more volatile.

That’s because it owns just the 20-30 year portion of the yield curve. GOVI is “laddered” to include U.S. Treasury securities from 0-30 years’ maturity. So it is essentially a third just like TLT, and filled with much less volatile bonds.

The Case for Bond Outperformance in 2026

The argument for bonds outperforming stocks this year rests on two primary trends. One is already in place, and the other is still making up its mind. In order, I’m talking about yield attractiveness (the raw yield level is high compared to most of the past two decades) and a steepening yield curve.

The market is currently grappling with a K-shaped — or, dare I say, Nike (NKE) swoosh — yield curve where short-term segments remain inverted while long-term segments slope upward. It makes sense to expect this curve to fully steepen, assuming the Fed cuts rates even a little later this year or next.

But despite the tailwinds, outperformance is far from a guarantee. Several factors could cap the bond rally. Stocks could keep rising at double-digit annual rates of return, stealing bonds’ thunder as they have the past few years. And, there might just be an “equity culture” that makes investors incapable of seeing bonds as a total-return asset class as opposed to something akin to a money market fund.

Plus, there’s what they call the "term premium" risk. Investors are starting to demand higher yields to compensate for long-term concerns like persistently high debt and expansionary fiscal policies. That worry could put downward pressure on bond prices in the second half of the year.

My Strategy

I have a bond ladder as one of my core portfolio holdings. It is designed to have a certain amount of dollars mature every year between the starting year and ending year, which will take me to a ripe old age. As much as that is a long-term investment, if rates finally start to give way and fall across the yield curve, bond math is very favorable.

How favorable? Longer-term bonds could rally 20% to 30% in a matter of months. All while having the backstop of the U.S. government owing me a certain amount of money at a certain date. If the stock market waffles near all-time highs, that will look very enticing. It's not upon us just yet, but it is at the top of my watchlist for action when the path lower in rates becomes more apparent.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Will Bonds Outperform Stocks in 2026? Why the Timing Might Be Right To Double Down on Bonds.

- Ahead of U.S. Fed Rate Cuts in 2026, Make This 1 Trade Now

- Stocks Rise Before the Open on U.S. Economic Optimism, Earnings and Jobless Claims Data in Focus

- Stocks Climb as January Jobs Growth Eases Economic Concerns