Revenue of $6.7 Million Reflects 1,027% Year-Over-Year Growth; Fourth Consecutive Record-Setting Quarter

SAN DIEGO, Nov. 11, 2025 — NeoVolta Inc. (NASDAQ:NEOV), a U.S.-based energy technology company delivering scalable storage, for resilient residential and commercial power infrastructure, today announced financial results for its first quarter of fiscal 2026, which ended September 30, 2025.

“Our first quarter performance demonstrates the strength of our multi-channel growth strategy and the increasing market adoption of distributed energy storage solutions,” said Ardes Johnson, Chief Executive Officer of NeoVolta. “We delivered $6.7 million in revenue, representing over 1,000% year-over-year growth and marking our fourth consecutive record quarter. This momentum reflects successful expansion beyond our traditional Southern California installer base into broader U.S. distribution networks, increased approvals on utility vendor lists beyond California, and an expanded installer footprint with existing distributors.”

“The closing of our acquisition of select assets from Neubau Energy in October marks a pivotal milestone for NeoVolta’s growth strategy. By integrating modular battery technologies and next-generation manufacturing capabilities, NeoVolta is expanding its addressable market, strengthening margins, and enhancing its ability to deliver industry-leading energy storage solutions. The newly appointed executive leaders, previously with Neubau, bring valuable expertise to support product development and innovation. The first neuClick modular battery systems, benefiting from fast installation and tariff-free access, are already generating strong pre-order demand and are expected to ship early next year. Complementing these initiatives, NeoVolta continues improving its domestic manufacturing footprint and expanding software offerings, laying a strong foundation for sustainable, long-term growth,” Johnson said.

Recent Operating Highlights

- Expanded Distribution and Financing Networks – Continued rapid growth in new sales channels beyond the Southern California market, supported by expanded financing channels that improve accessibility and affordability for customers nationwide.

- Closed Neubau Energy Asset Acquisition – On October 15, 2025, NeoVolta completed the acquisition of strategic assets from Neubau Energy, including its proprietary neuClick™ modular battery platform protected by over a dozen patents, Austrian-based manufacturing capabilities providing tariff-free access to advanced battery technology, and key intellectual property. The transaction is immediately accretive to both revenue and gross margins.

- Strengthened Executive Leadership Team – Appointed Amany Ibrahim as Chief Operating Officer and Thomas Enzendorfer as Chief Technology Officer, both joining from Neubau Energy. Michael Mendik transitioned to Chief Product Officer, strengthening the company’s product development and innovation capabilities.

- Launched neuClick™ Modular Battery Platform – Introduced revolutionary 30-minute installation systems under the NeoVolta brand, reducing typical deployment costs by up to 75% and expanding the installer base from specialized technicians to any licensed electrician. Targeting over 1,000 pre-orders by December 2025 with shipments beginning January 2026.

- Extended Manufacturing Facility Lease – Secured long-term manufacturing capacity by extending the Poway, California facility lease through March 2031, providing operational stability to meet rising demand.

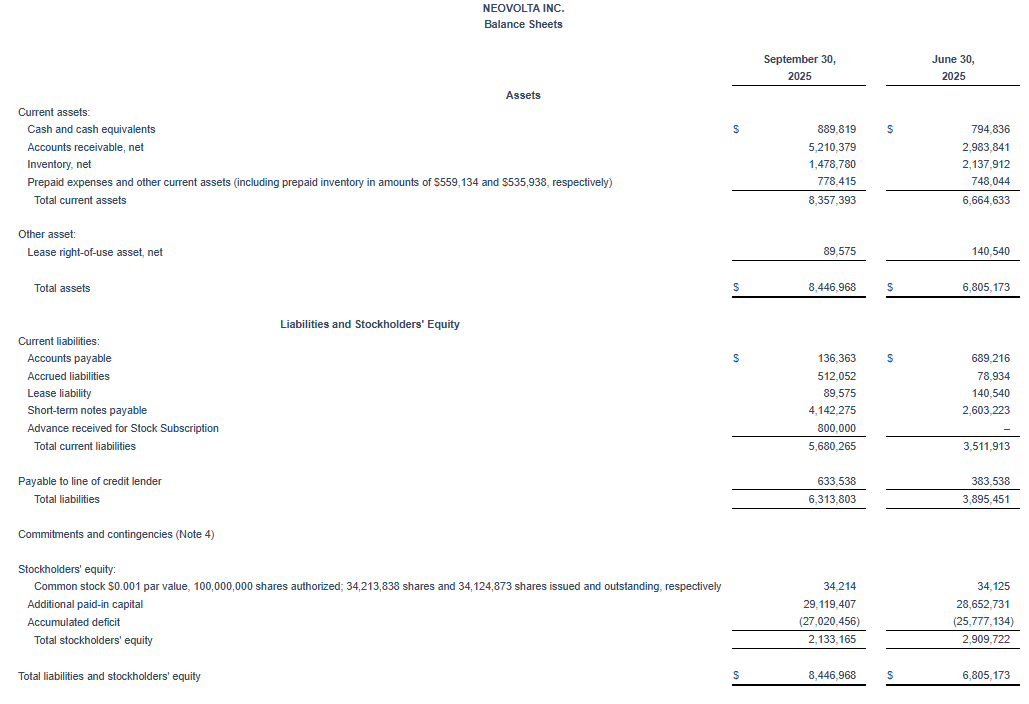

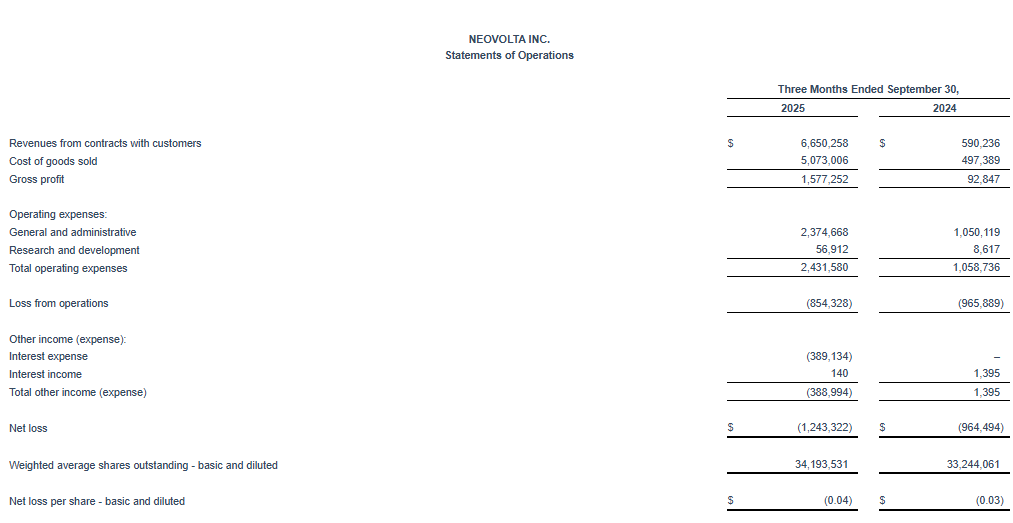

Q1 2026 Financial Highlights

- Revenue of $6.7 million, up 1,027% from $590,000 in the prior-year quarter, driven by successful expansion into broader U.S. distribution and installer networks outside the traditional Southern California market, as well as expanded financing channels making energy storage solutions more accessible to customers

- Gross margin of 24%, compared to 16% in the prior-year quarter. The improvement reflects manufacturing efficiencies from higher production volumes and the correction of a prior period accounting entry. As the company scales operations and integrates Neubau’s higher-margin product portfolio, management expects continued gross margin expansion.

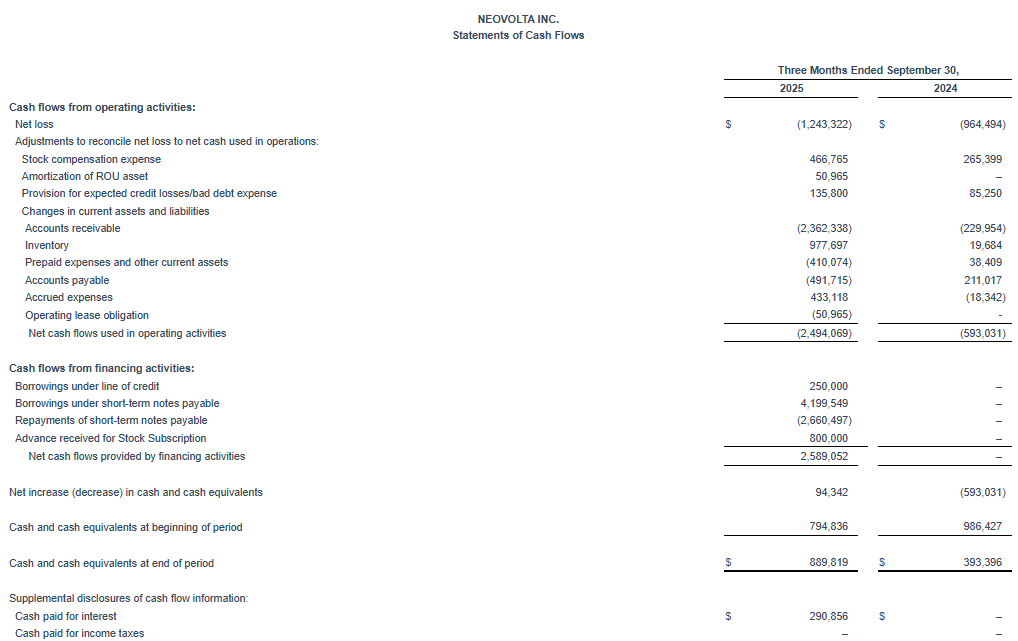

- Operating expenses totaled $2.4 million, up from $1.1 million in the prior-year quarter, primarily driven by investments in executive leadership, personnel, and infrastructure to support rapid growth and market expansion. Operating expenses included non-cash stock compensation of $467,000, primarily related to employee stock options and marketing incentive programs.

- Loss from operations of $854,000, compared to a loss of $966,000 in the prior-year quarter, reflecting the benefit of significant revenue growth and gross margin expansion partially offset by planned investments in personnel and infrastructure to support the company’s aggressive growth strategy.

- Net loss of $1.2 million, or $(0.04) per basic share, compared to a net loss of $964,000, or $(0.03) per basic share, in the prior-year quarter. The current quarter included $389,000 in interest expense related to credit facilities established since September 2024 to finance inventory purchases and working capital needs.

- Cash balance of approximately $890,000 as of September 30, 2025, with net working capital of approximately $2.7 million. The company maintains access to a $5 million line of credit and a $4 million asset-based lending facility to support ongoing operations and growth initiatives. Management believes current liquidity combined with available credit facilities provides sufficient resources to fund operations for the next 12 months.

About NeoVolta

NeoVolta is a leading innovator in energy storage solutions dedicated to advancing the future of clean energy. Founded to provide reliable, sustainable, and high-performance energy storage systems, the company has quickly established itself as a critical player in the industry. NeoVolta’s flagship products are designed to meet the growing demand for efficient energy management in residential and commercial applications. With a focus on cutting-edge technology and strategic partnerships, NeoVolta is committed to driving progress in renewable energy and enhancing how the world stores and uses power.

For more information visit: www.NeoVolta.com

Forward-Looking Statements

Some of the statements in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties. Forward-looking statements in this release include, without limitation, the success of the newly launched commercial and industrial solution battery energy storage systems, increasing domestic battery manufacturing, and the closing of the announced the asset acquisition with Neubau Energy. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. The Company has attempted to identify forward-looking statements by terminology including ‘believes,’ ‘estimates,’ ‘anticipates,’ ‘expects,’ ‘plans,’ ‘projects,’ ‘intends,’ ‘potential,’ ‘may,’ ‘could,’ ‘might,’ ‘will,’ ‘should,’ ‘approximately’ or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including those discussed under Item 1A. “Risk Factors” in the Company’s most recently filed Form 10-K filed with the Securities and Exchange Commission (“SEC”) and updated from time to time in its Form 10-Q filings and in its other public filings with the SEC. Any forward-looking statements contained in this release speak only as of its date. The Company undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events.

Contacts

Investors

Alliance Advisors IR

ir@neovolta.com

Media

Email: press@neovolta.com

Phone: 800-364-5464

Featured Image @ Freepik