As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at home builders stocks, starting with Tri Pointe Homes (NYSE: TPH).

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 11 home builders stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 99.9% below.

While some home builders stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.1% since the latest earnings results.

Tri Pointe Homes (NYSE: TPH)

Established in 2009 in California, Tri Pointe Homes (NYSE: TPH) is a United States homebuilder recognized for its innovative and sustainable approach to creating premium, life-enhancing homes.

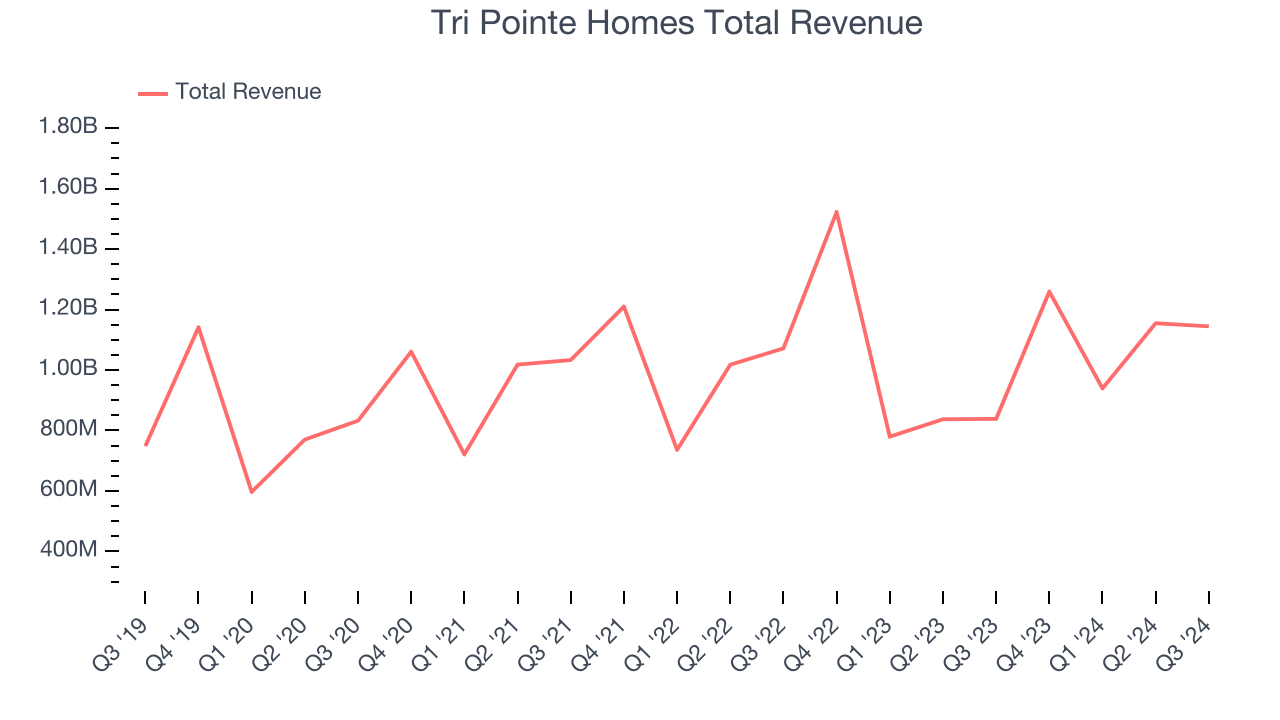

Tri Pointe Homes reported revenues of $1.14 billion, up 36.5% year on year. This print exceeded analysts’ expectations by 8.7%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ earnings estimates.

“Tri Pointe Homes once again delivered excellent financial results for the third quarter,” said Doug Bauer, Tri Pointe Homes Chief Executive Officer.

Tri Pointe Homes pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 3% since reporting and currently trades at $41.23.

Is now the time to buy Tri Pointe Homes? Access our full analysis of the earnings results here, it’s free.

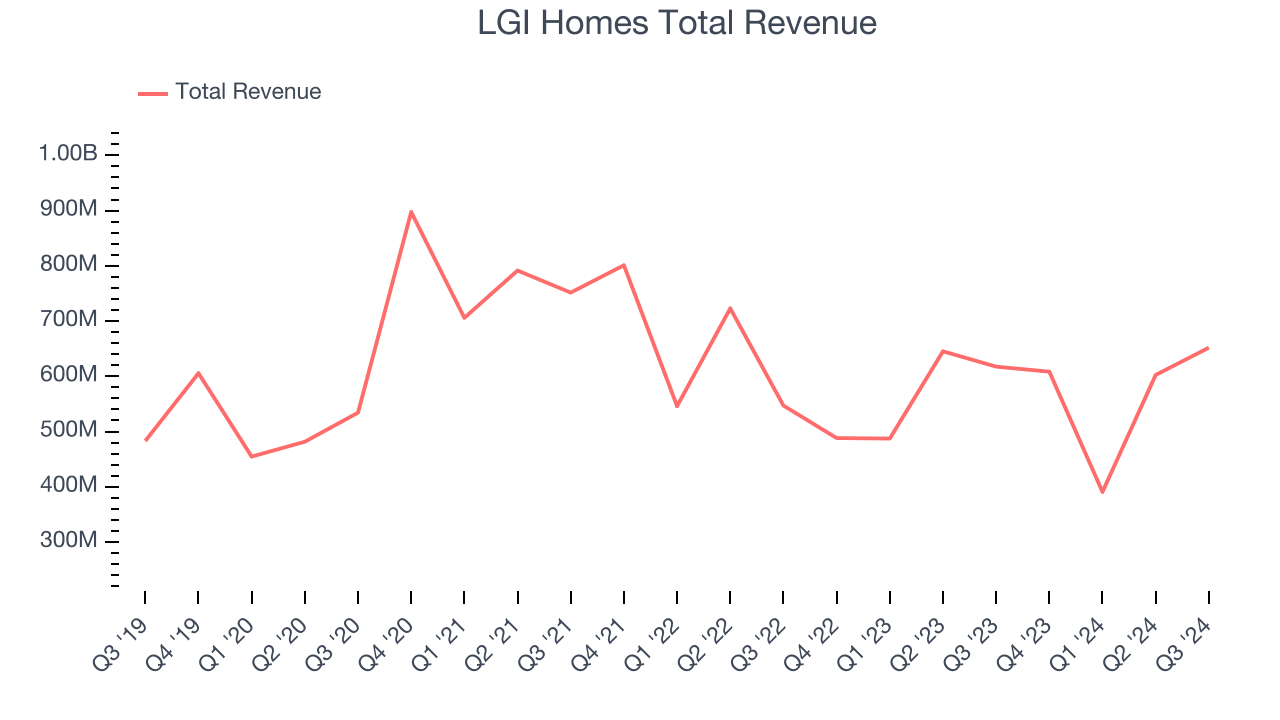

Best Q3: LGI Homes (NASDAQ: LGIH)

Based in Texas, LGI Homes (NASDAQ: LGIH) is a homebuilding company specializing in constructing affordable, entry-level single-family homes in desirable communities across the United States.

LGI Homes reported revenues of $651.9 million, up 5.6% year on year, outperforming analysts’ expectations by 1.6%. The business had a stunning quarter with an impressive beat of analysts’ backlog sales and operating margin estimates.

The market seems content with the results as the stock is up 2.5% since reporting. It currently trades at $105.90.

Is now the time to buy LGI Homes? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: D.R. Horton (NYSE: DHI)

One of the largest homebuilding companies in the U.S., D.R. Horton (NYSE: DHI) builds a variety of new construction homes across multiple markets.

D.R. Horton reported revenues of $10 billion, down 4.8% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations and a miss of analysts’ EBITDA estimates.

D.R. Horton delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 10.4% since the results and currently trades at $161.61.

Read our full analysis of D.R. Horton’s results here.

Taylor Morrison Home (NYSE: TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE: TMHC) builds single family homes and communities across the United States.

Taylor Morrison Home reported revenues of $2.12 billion, up 26.6% year on year. This number beat analysts’ expectations by 7.8%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates.

The stock is up 9.1% since reporting and currently trades at $70.80.

Read our full, actionable report on Taylor Morrison Home here, it’s free.

NVR (NYSE: NVR)

Known for its unique land acquisition strategy, NVR (NYSE: NVR) is a respected homebuilder and mortgage company in the United States.

NVR reported revenues of $2.73 billion, up 6.4% year on year. This result surpassed analysts’ expectations by 1.2%. Aside from that, it was a satisfactory quarter as it also produced an impressive beat of analysts’ backlog sales estimates but a miss of analysts’ EBITDA estimates.

The stock is down 5.5% since reporting and currently trades at $9,114.

Read our full, actionable report on NVR here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.