Airline company United Airlines Holdings (NASDAQ: UAL) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 2.6% year on year to $15.23 billion. Its non-GAAP profit of $2.78 per share was 4% above analysts’ consensus estimates.

Is now the time to buy United Airlines? Find out by accessing our full research report, it’s free for active Edge members.

United Airlines (UAL) Q3 CY2025 Highlights:

- Revenue: $15.23 billion vs analyst estimates of $15.3 billion (2.6% year-on-year growth, in line)

- Adjusted EPS: $2.78 vs analyst estimates of $2.67 (4% beat)

- Adjusted EBITDA: $2.08 billion vs analyst estimates of $2.05 billion (13.7% margin, 1.3% beat)

- Adjusted EPS guidance for Q4 CY2025 is $3.25 at the midpoint, above analyst estimates of $2.83

- Operating Margin: 9.2%, down from 10.5% in the same quarter last year

- Free Cash Flow was -$153 million, down from $88 million in the same quarter last year

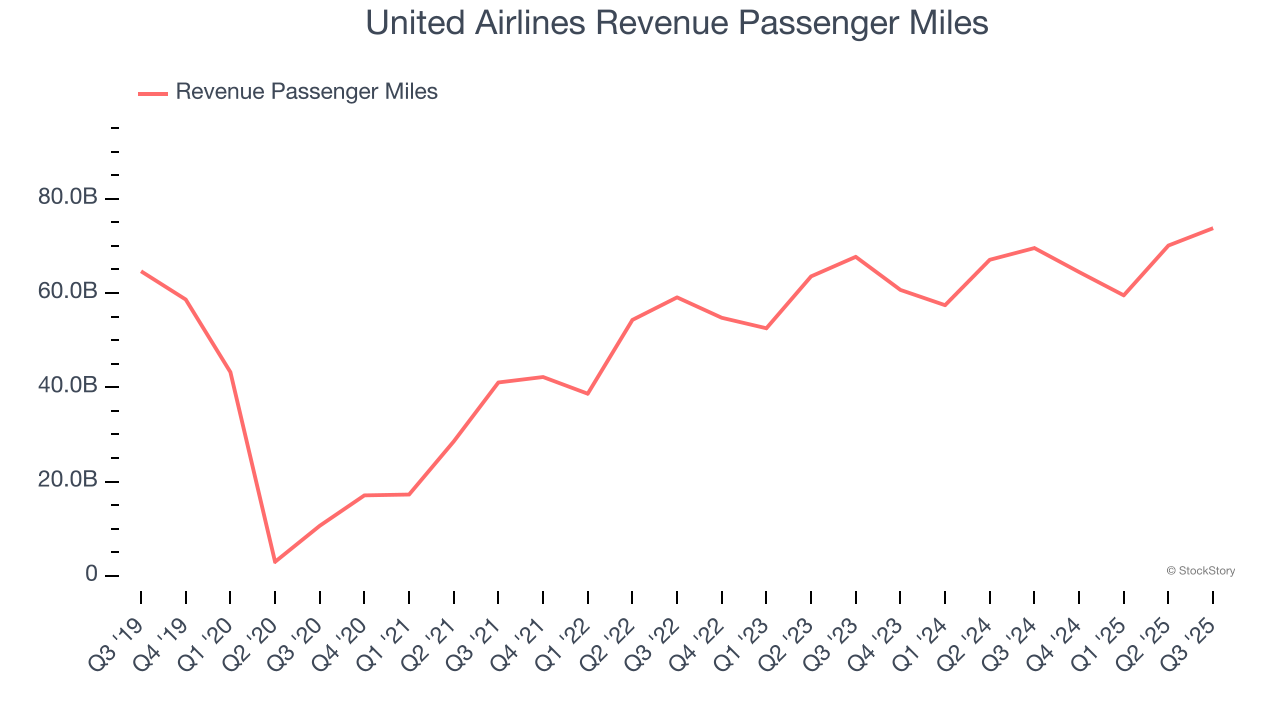

- Revenue Passenger Miles: 73.77 billion, up 4.22 billion year on year

- Market Capitalization: $33.39 billion

"We've invested in customers at every price point: Seatback screens, an industry-leading mobile app, extra legroom, a lie-flat United Polaris seat, and fast, free, reliable Starlink on every plane by 2027. Our customers value the United experience, making them increasingly loyal to United," CEO Scott Kirby said.

Company Overview

Founded in 1926, United Airlines Holdings (NASDAQ: UAL) operates a global airline network, providing passenger and cargo air transportation services across domestic and international routes.

Revenue Growth

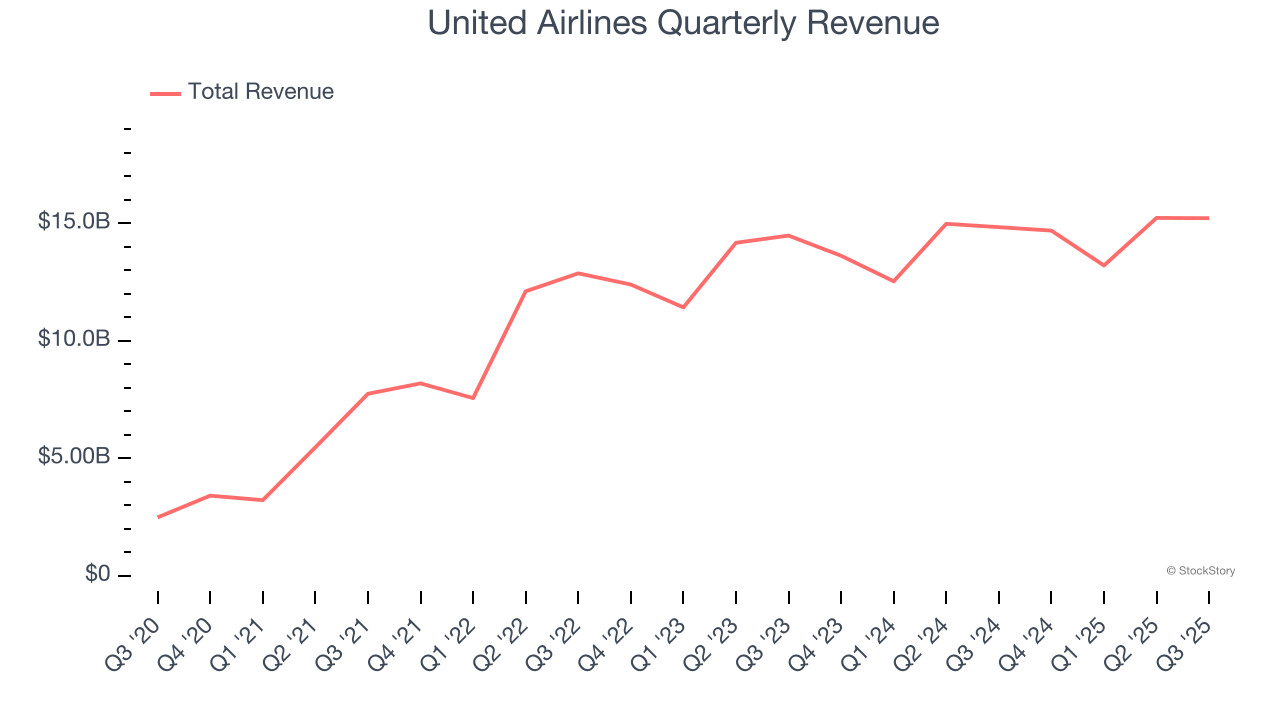

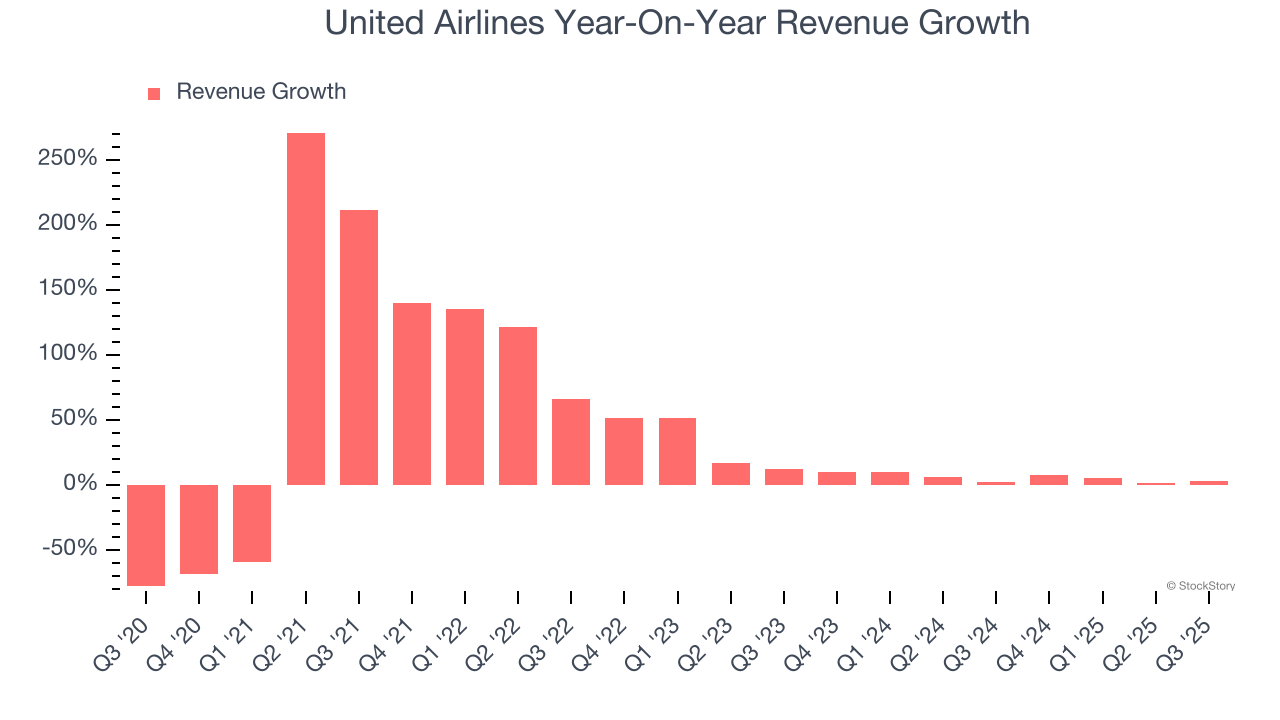

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, United Airlines’s sales grew at a solid 20.7% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. United Airlines’s recent performance shows its demand has slowed as its annualized revenue growth of 5.4% over the last two years was below its five-year trend.

United Airlines also discloses its number of revenue passenger miles, which reached 73.77 billion in the latest quarter. Over the last two years, United Airlines’s revenue passenger miles averaged 6.1% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, United Airlines grew its revenue by 2.6% year on year, and its $15.23 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

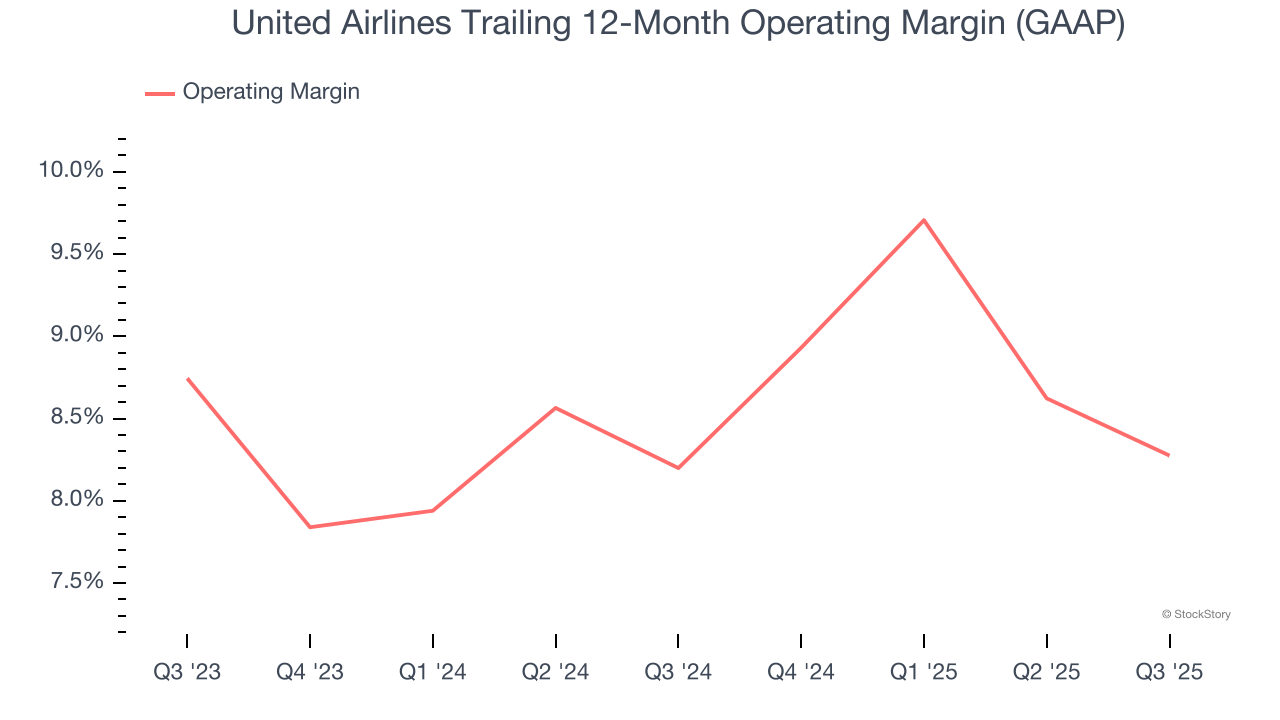

United Airlines’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 8.2% over the last two years. This profitability was mediocre for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, United Airlines generated an operating margin profit margin of 9.2%, down 1.4 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

In the coming year, Wall Street expects United Airlines to maintain its trailing 12-month operating margin of 8.3%.

Earnings Per Share

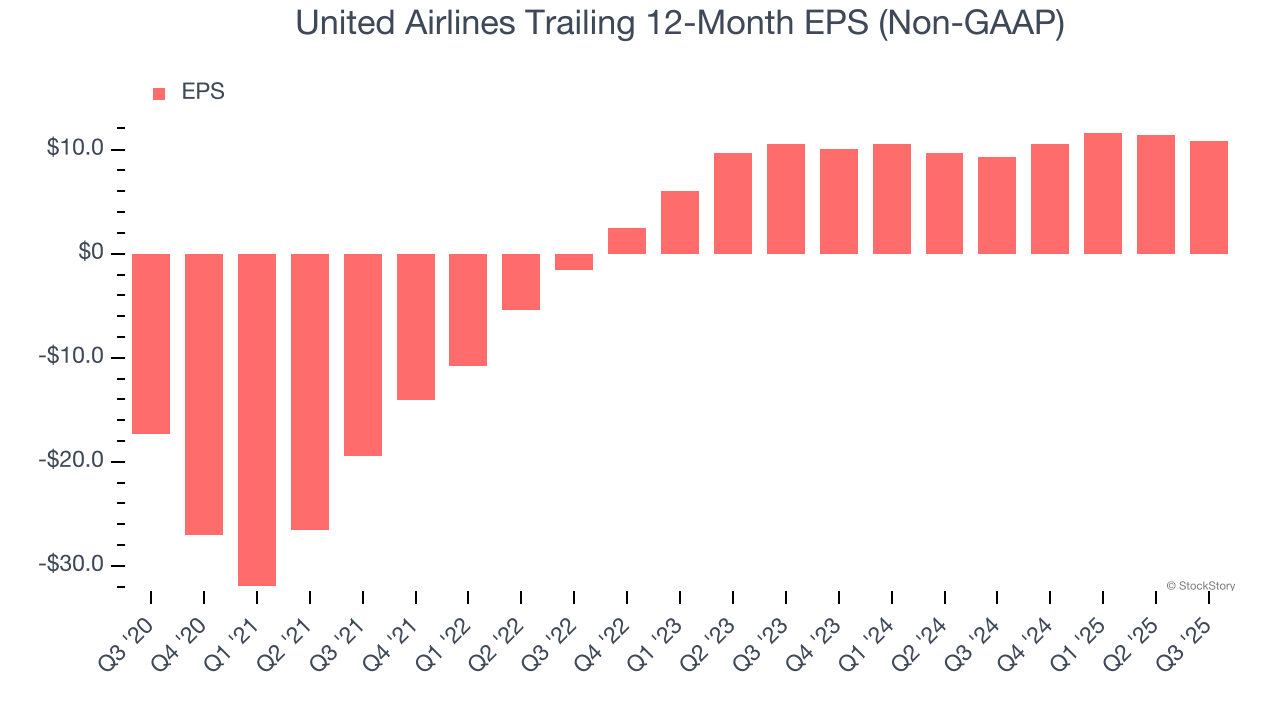

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

United Airlines’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, United Airlines reported adjusted EPS of $2.78, down from $3.33 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects United Airlines’s full-year EPS of $10.82 to grow 11%.

Key Takeaways from United Airlines’s Q3 Results

We were impressed by United Airlines’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue was just in line. Investors were likely hoping for more, and shares traded down 2.3% to $101.81 immediately following the results.

So do we think United Airlines is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.