Household products company Church & Dwight (NYSE: CHD) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 5% year on year to $1.59 billion. The company expects next quarter’s revenue to be around $1.64 billion, close to analysts’ estimates. Its non-GAAP profit of $0.81 per share was 10.1% above analysts’ consensus estimates.

Is now the time to buy Church & Dwight? Find out by accessing our full research report, it’s free for active Edge members.

Church & Dwight (CHD) Q3 CY2025 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.53 billion (5% year-on-year growth, 3.3% beat)

- Adjusted EPS: $0.81 vs analyst estimates of $0.74 (10.1% beat)

- Revenue Guidance for Q4 CY2025 is $1.64 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the full year is $3.49 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 51.2%, up from -6.1% in the same quarter last year

- Organic Revenue rose 3.4% year on year vs analyst estimates of 1.5% growth (185.4 basis point beat)

- Market Capitalization: $19.93 billion

Rick Dierker, Chief Executive Officer, commented, “In a challenging environment, we are pleased to deliver another quarter of strong results. We continue to drive both dollar and volume share gains across most of our brands. Our balanced portfolio of value and premium products and our relentless focus on innovation continue to position us well for the future. We also were encouraged with our first quarter of ownership of TOUCHLAND, as our results exceeded our initial expectations.

Company Overview

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE: CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.14 billion in revenue over the past 12 months, Church & Dwight carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

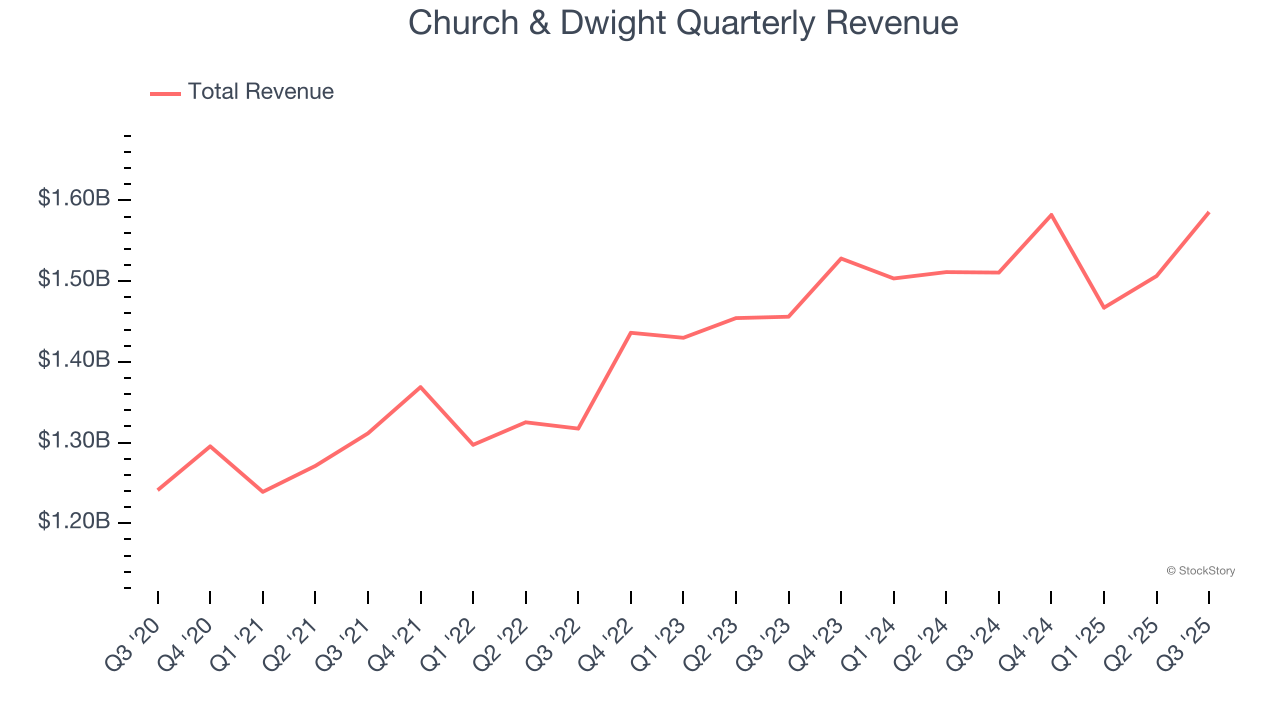

As you can see below, Church & Dwight grew its sales at a tepid 5% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, Church & Dwight reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 3.3%. Company management is currently guiding for a 3.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

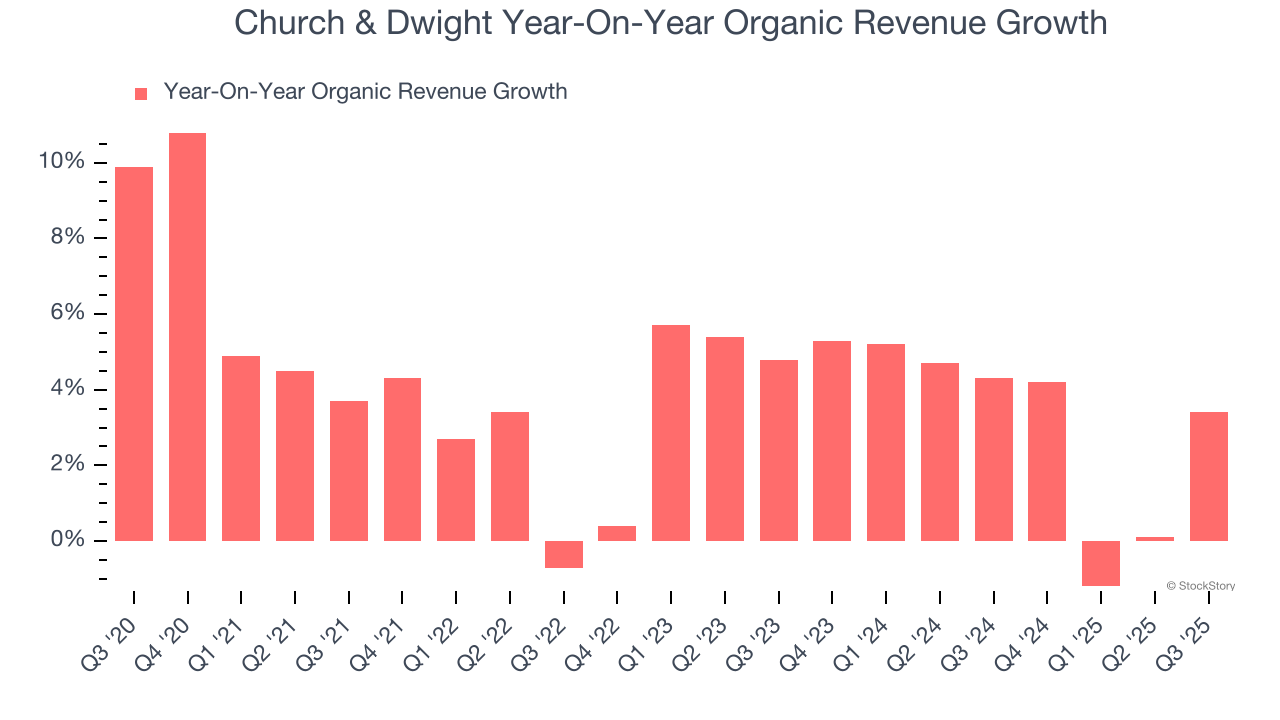

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Church & Dwight’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 3.3% year on year.

In the latest quarter, Church & Dwight’s organic sales rose by 3.4% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Church & Dwight’s Q3 Results

We enjoyed seeing Church & Dwight beat analysts’ revenue expectations this quarter. We were also happy its organic revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 3% to $84.20 immediately following the results.

Is Church & Dwight an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.