Golf entertainment and gear company Topgolf Callaway (NYSE: MODG) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 7.8% year on year to $934 million. The company expects next quarter’s revenue to be around $783 million, close to analysts’ estimates. Its non-GAAP loss of $0.05 per share was 76.9% above analysts’ consensus estimates.

Is now the time to buy Topgolf Callaway? Find out by accessing our full research report, it’s free for active Edge members.

Topgolf Callaway (MODG) Q3 CY2025 Highlights:

- Revenue: $934 million vs analyst estimates of $913.2 million (7.8% year-on-year decline, 2.3% beat)

- Adjusted EPS: -$0.05 vs analyst estimates of -$0.22 (76.9% beat)

- Adjusted EBITDA: $114.4 million vs analyst estimates of $87.63 million (12.2% margin, 30.5% beat)

- Revenue Guidance for Q4 CY2025 is $783 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $500 million at the midpoint, above analyst estimates of $468.1 million

- Operating Margin: 3%, in line with the same quarter last year

- Free Cash Flow Margin: 17.4%, up from 10.8% in the same quarter last year

- Market Capitalization: $1.70 billion

"We are pleased with our third quarter results, with both revenue and Adjusted EBITDA exceeding our expectations," commented Chip Brewer, President and Chief Executive Officer of Topgolf Callaway Brands Corp.

Company Overview

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Revenue Growth

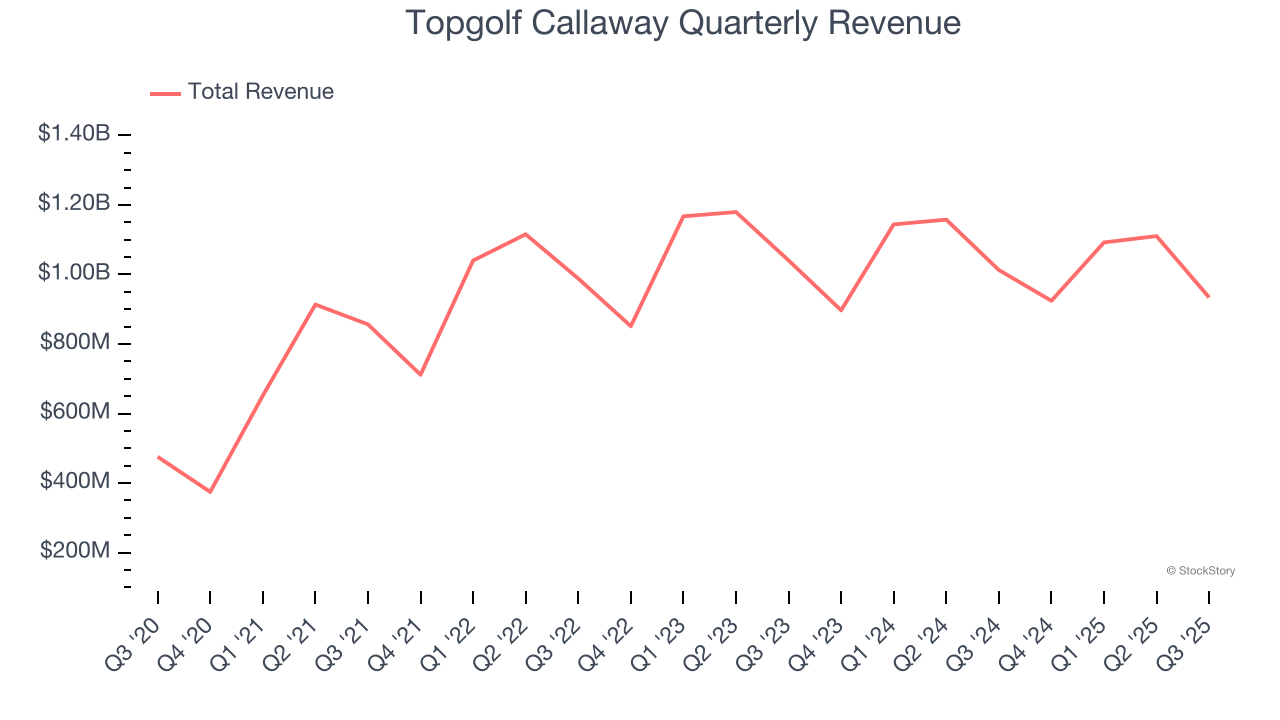

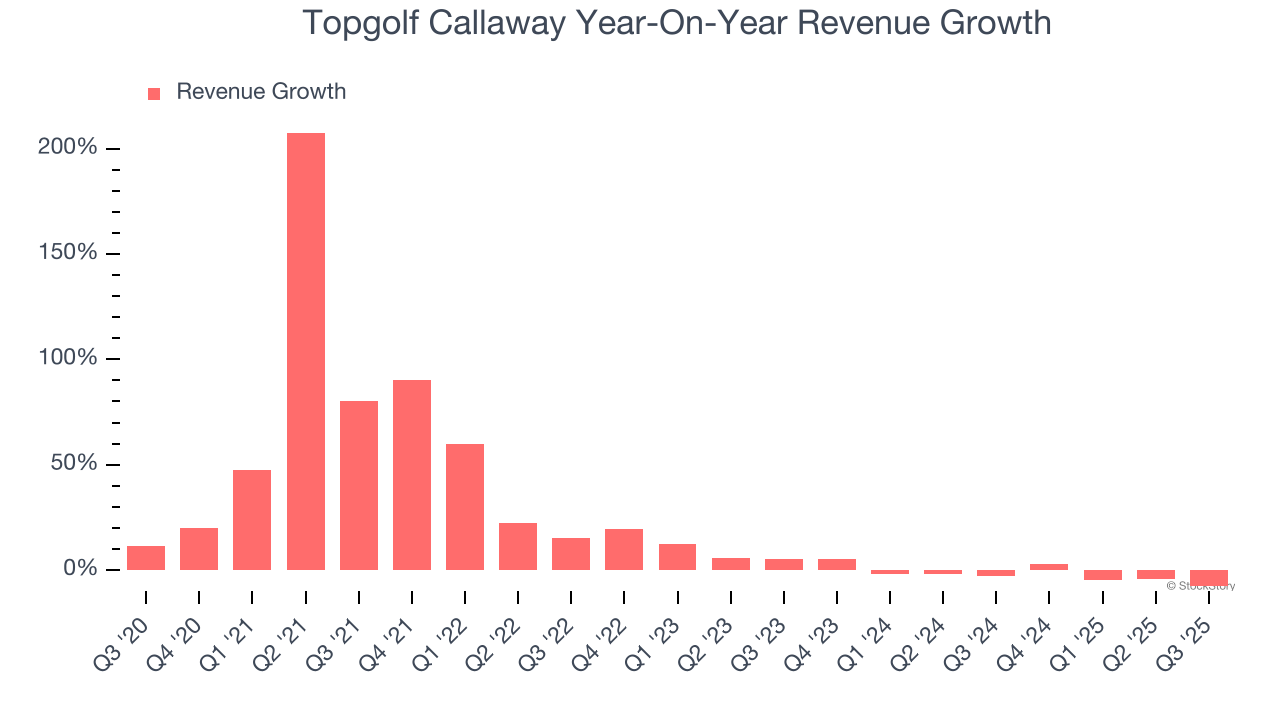

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Topgolf Callaway’s 21.6% annualized revenue growth over the last five years was impressive. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Topgolf Callaway’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.1% over the last two years. Note that COVID hurt Topgolf Callaway’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Topgolf Callaway’s revenue fell by 7.8% year on year to $934 million but beat Wall Street’s estimates by 2.3%. Company management is currently guiding for a 15.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 4.2% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

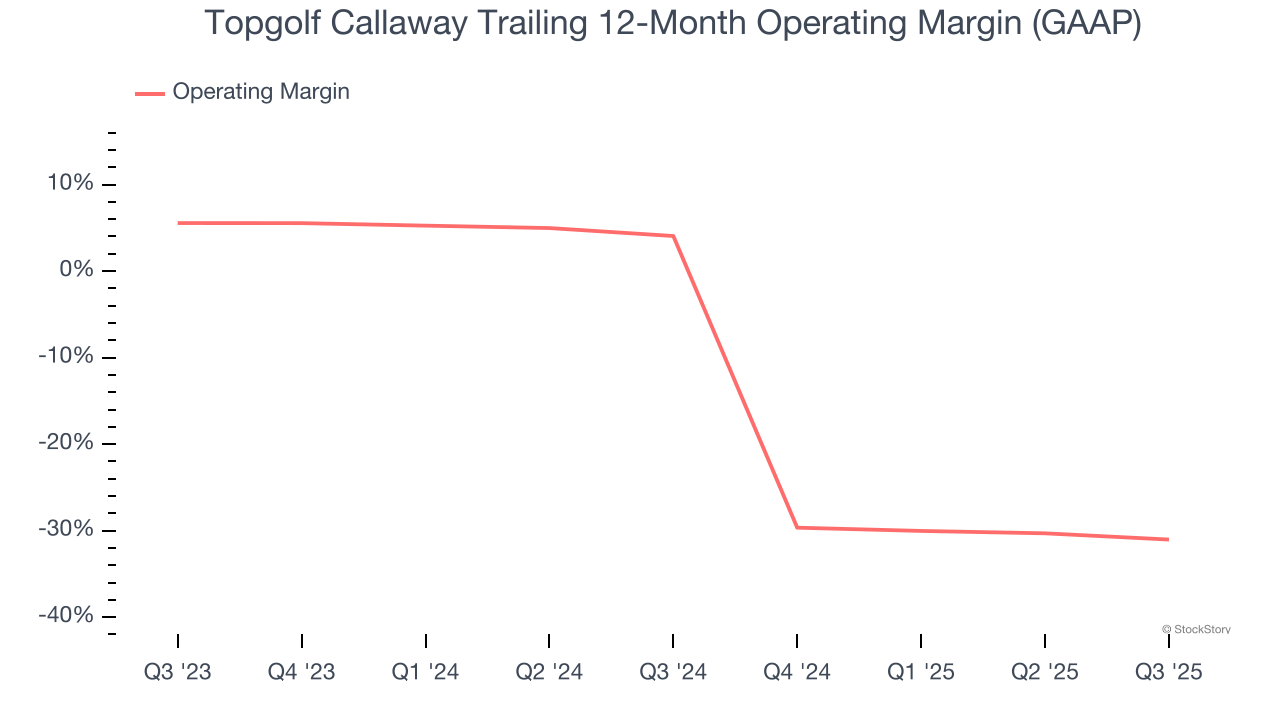

Operating Margin

Topgolf Callaway’s operating margin has shrunk over the last 12 months and averaged negative 13.2% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q3, Topgolf Callaway generated an operating margin profit margin of 3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

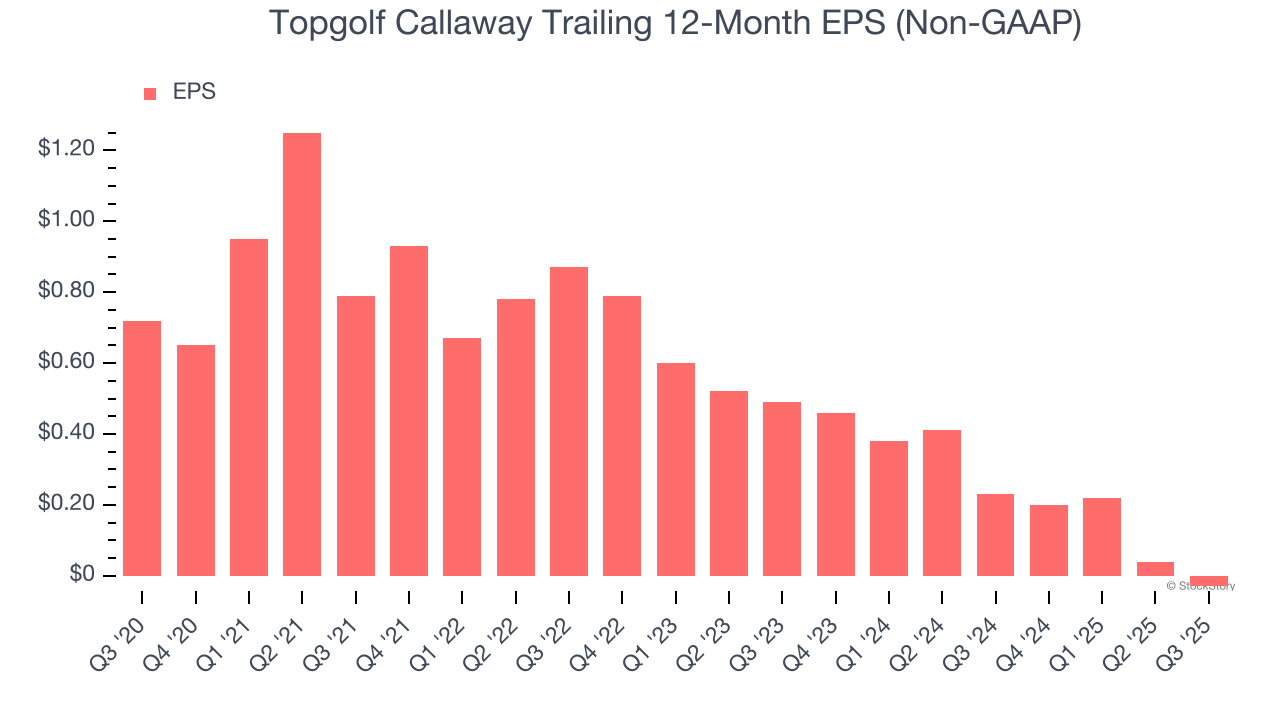

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Topgolf Callaway, its EPS declined by 15.3% annually over the last five years while its revenue grew by 21.6%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Topgolf Callaway reported adjusted EPS of negative $0.05, down from $0.02 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Topgolf Callaway to perform poorly. Analysts forecast its full-year EPS of negative $0.03 will tumble to negative $0.48.

Key Takeaways from Topgolf Callaway’s Q3 Results

We were impressed by Topgolf Callaway’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its Active Lifestyle revenue missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 6.8% to $9.90 immediately after reporting.

Indeed, Topgolf Callaway had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.