Cognex has gotten torched over the last six months - since October 2024, its stock price has dropped 35.6% to $24.96 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Cognex, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're swiping left on Cognex for now. Here are three reasons why there are better opportunities than CGNX and a stock we'd rather own.

Why Do We Think Cognex Will Underperform?

Founded in 1981 when computer vision was in its infancy, Cognex (NASDAQ: CGNX) develops machine vision systems and software that help manufacturers and logistics companies automate quality inspection and tracking of products.

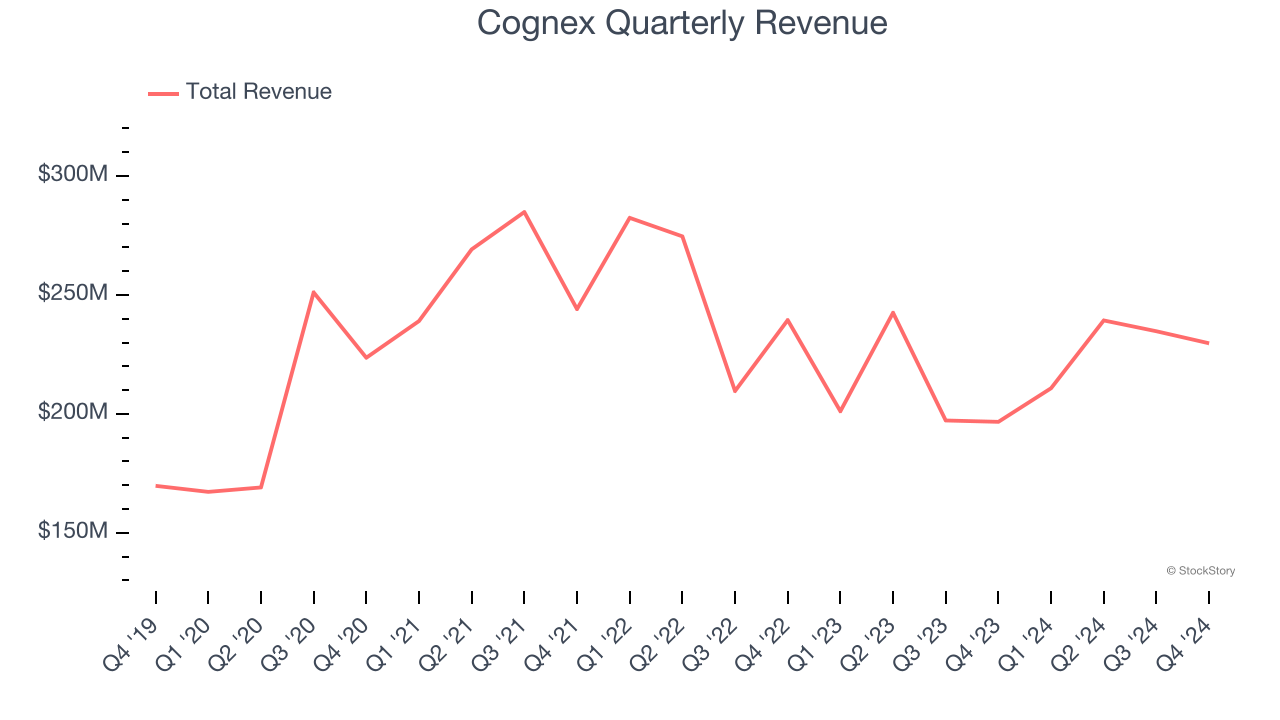

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Cognex’s sales grew at a mediocre 4.7% compounded annual growth rate over the last five years. This fell short of our benchmark for the business services sector.

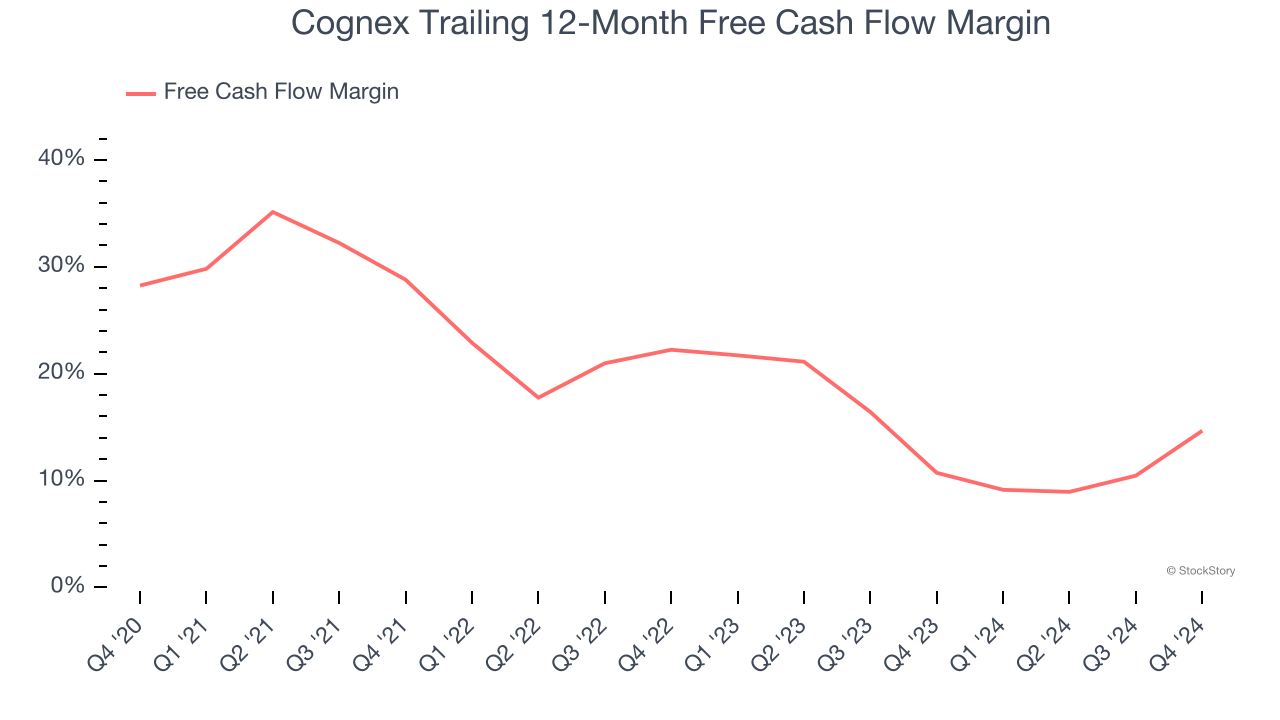

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Cognex’s margin dropped by 13.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Cognex’s free cash flow margin for the trailing 12 months was 14.7%.

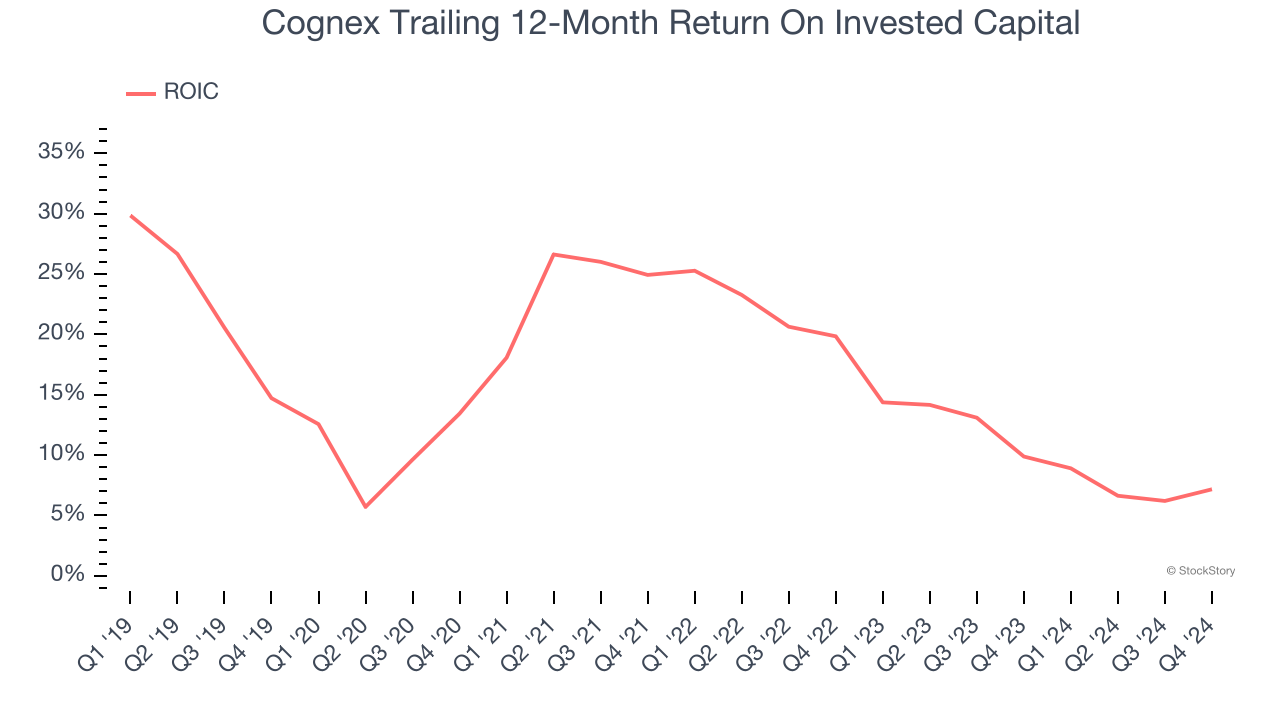

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Cognex’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Cognex falls short of our quality standards. After the recent drawdown, the stock trades at 25.3× forward price-to-earnings (or $24.96 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Cognex

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.