Semiconductor testing company Teradyne (NASDAQ: TER) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 10.7% year on year to $651.8 million. On the other hand, next quarter’s revenue guidance of $740 million was less impressive, coming in 2.3% below analysts’ estimates. Its non-GAAP profit of $0.57 per share was 4.9% above analysts’ consensus estimates.

Is now the time to buy Teradyne? Find out by accessing our full research report, it’s free.

Teradyne (TER) Q2 CY2025 Highlights:

- Revenue: $651.8 million vs analyst estimates of $650.5 million (10.7% year-on-year decline, in line)

- Adjusted EPS: $0.57 vs analyst estimates of $0.54 (4.9% beat)

- Adjusted Operating Income: $98.2 million vs analyst estimates of $97.05 million (15.1% margin, 1.2% beat)

- Revenue Guidance for Q3 CY2025 is $740 million at the midpoint, below analyst estimates of $757.2 million

- Adjusted EPS guidance for Q3 CY2025 is $0.78 at the midpoint, below analyst estimates of $0.89

- Operating Margin: 13.9%, down from 28.8% in the same quarter last year

- Free Cash Flow Margin: 20.2%, down from 23.5% in the same quarter last year

- Inventory Days Outstanding: 114, down from 116 in the previous quarter

- Market Capitalization: $14.53 billion

“Our Semiconductor Test Group drove better than expected results in the second quarter. System-on-a-Chip (SOC), primarily for artificial intelligence applications, was the strongest growth driver,” said Teradyne CEO, Greg Smith.

Company Overview

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ: TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

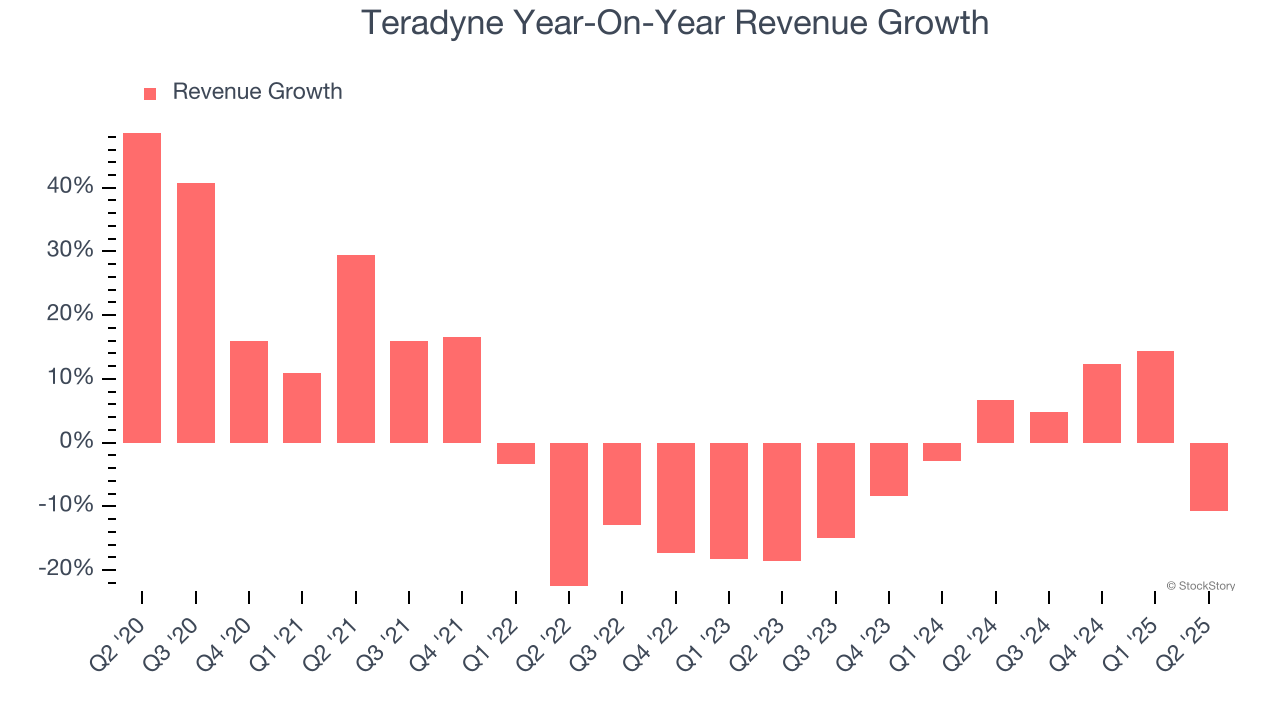

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Teradyne struggled to consistently increase demand as its $2.83 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a lower quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Just like its five-year trend, Teradyne’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, Teradyne reported a rather uninspiring 10.7% year-on-year revenue decline to $651.8 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.5% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

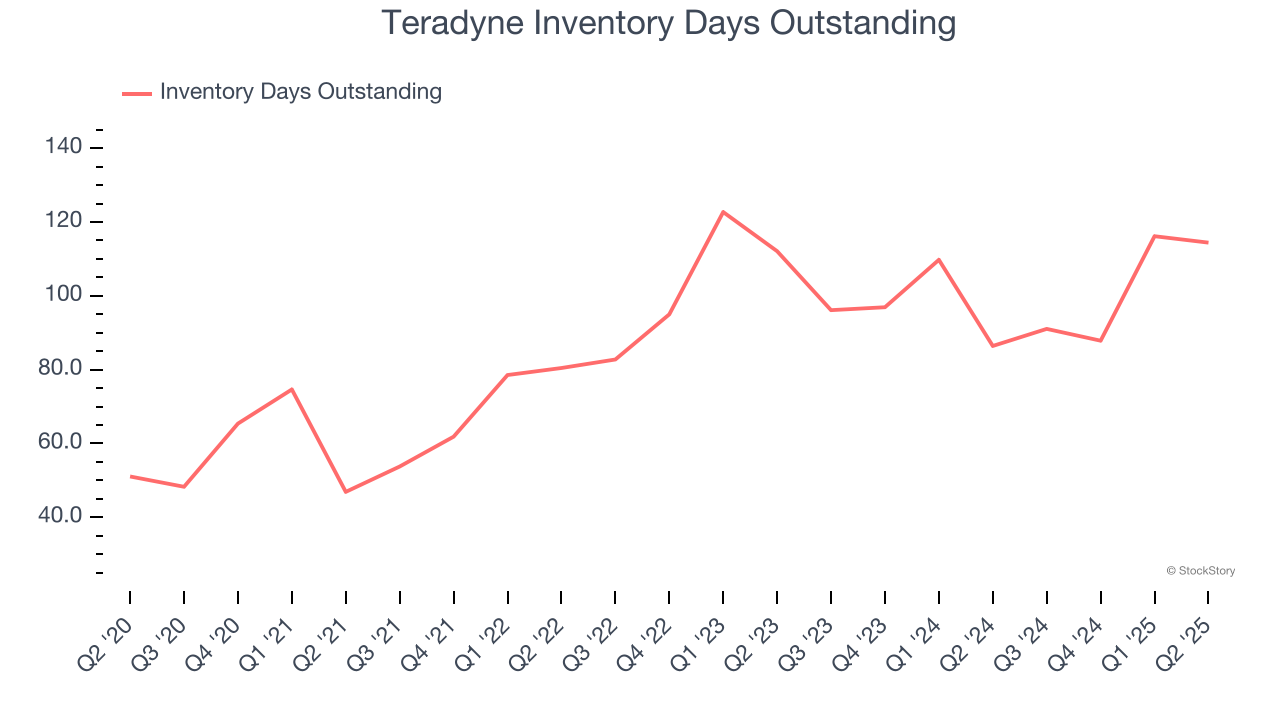

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Teradyne’s DIO came in at 114, which is 28 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

Key Takeaways from Teradyne’s Q2 Results

We enjoyed seeing Teradyne beat analysts’ EPS expectations this quarter. We were also happy its adjusted operating income narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Overall, this quarter was mixed. The stock traded up 3% to $93.36 immediately after reporting.

Big picture, is Teradyne a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.