E-commerce and gaming company Sea (NYSE: SE) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 31.6% year on year to $5.26 billion. Its GAAP profit of $0.65 per share was 6.4% below analysts’ consensus estimates.

Is now the time to buy Sea? Find out by accessing our full research report, it’s free.

Sea (SE) Q2 CY2025 Highlights:

- Revenue: $5.26 billion vs analyst estimates of $5.01 billion (31.6% year-on-year growth, 5% beat)

- EPS (GAAP): $0.65 vs analyst expectations of $0.69 (6.4% miss)

- Adjusted EBITDA: $829.2 million vs analyst estimates of $794 million (15.8% margin, 4.4% beat)

- Operating Margin: 9.3%, up from 2.1% in the same quarter last year

- Paying Users: 61.8 million, up 9.3 million year on year

- Market Capitalization: $86.57 billion

“The momentum from our strong start to 2025 has continued into the second quarter. All three of our businesses have delivered robust, healthy growth, giving us greater confidence of delivering another great year,” said Forrest Li, Sea’s Chairman and Chief Executive Officer.

Company Overview

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE: SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

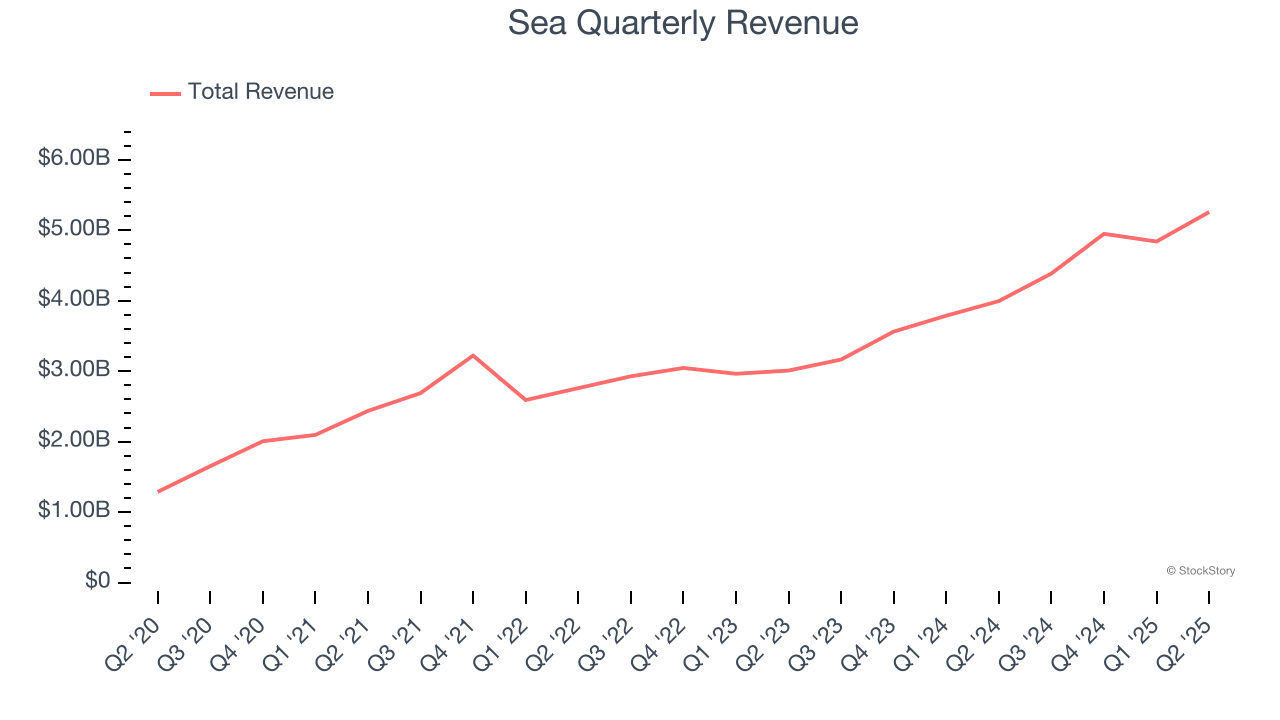

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Sea’s 20% annualized revenue growth over the last three years was impressive. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Sea reported wonderful year-on-year revenue growth of 31.6%, and its $5.26 billion of revenue exceeded Wall Street’s estimates by 5%.

Looking ahead, sell-side analysts expect revenue to grow 19.3% over the next 12 months, similar to its three-year rate. This projection is particularly healthy for a company of its scale and implies the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Paying Users

User Growth

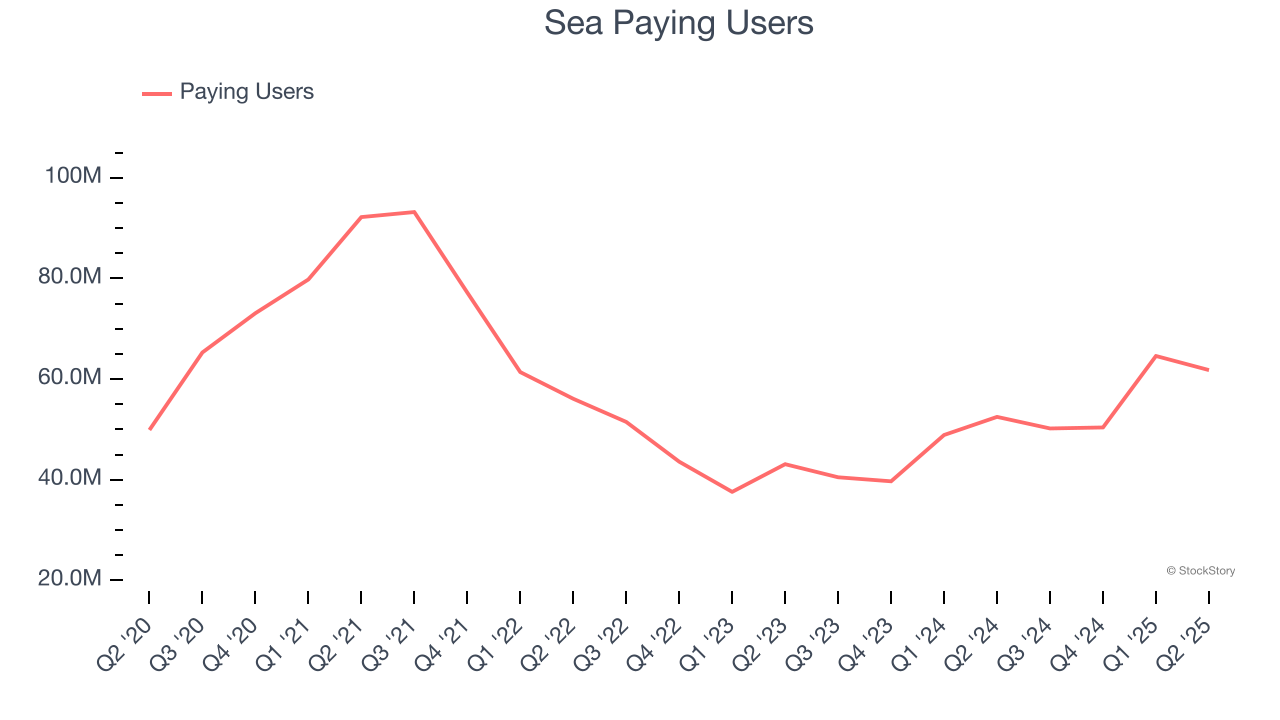

As an online marketplace, Sea generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Sea’s paying users, a key performance metric for the company, increased by 15.3% annually to 61.8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q2, Sea added 9.3 million paying users, leading to 17.7% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

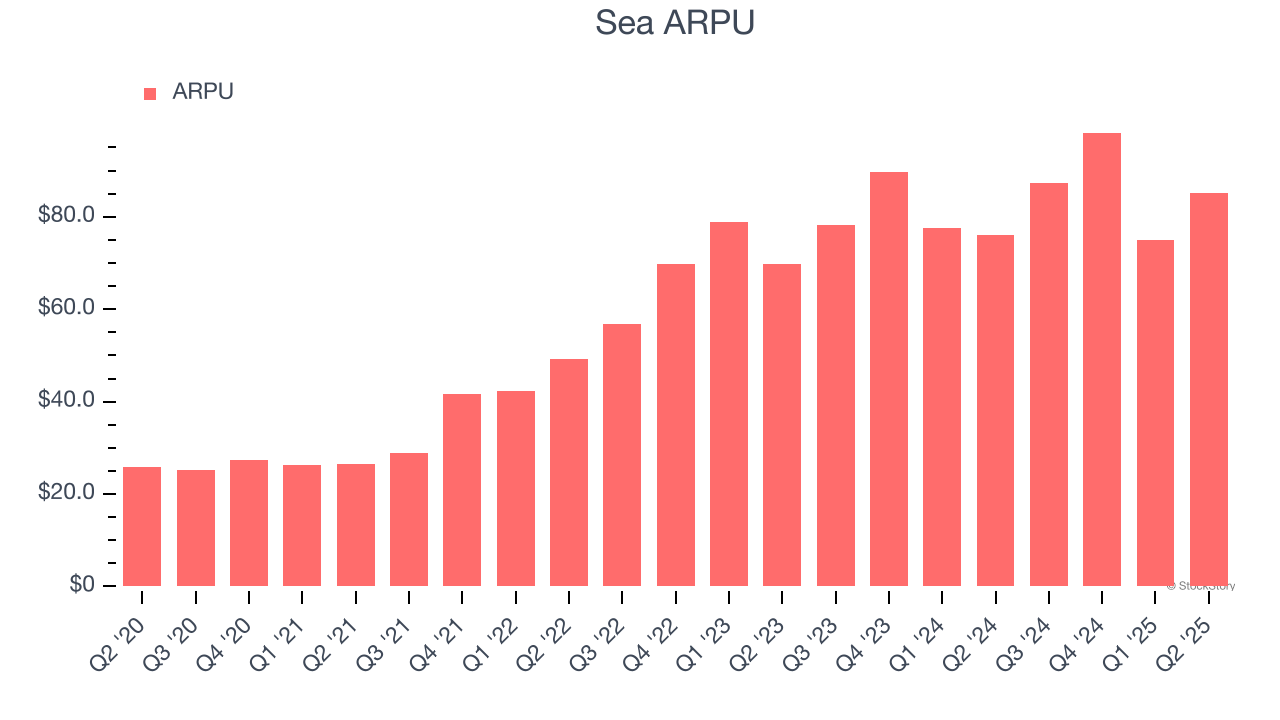

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Sea’s take rate, or "cut", on each order.

Sea’s ARPU growth has been exceptional over the last two years, averaging 12.9%. Its ability to increase monetization while growing its paying users at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

This quarter, Sea’s ARPU clocked in at $85.10. It grew by 11.8% year on year, slower than its user growth.

Key Takeaways from Sea’s Q2 Results

We enjoyed seeing Sea beat analysts’ number of paying users expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 8.1% to $158.24 immediately after reporting.

Sure, Sea had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.