Doughnut chain Krispy Kreme (NASDAQ: DNUT) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, but sales fell by 13.5% year on year to $379.8 million. Its non-GAAP loss of $0.15 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Krispy Kreme? Find out by accessing our full research report, it’s free.

Krispy Kreme (DNUT) Q2 CY2025 Highlights:

- Revenue: $379.8 million vs analyst estimates of $377.7 million (13.5% year-on-year decline, 0.6% beat)

- Adjusted EPS: -$0.15 vs analyst estimates of -$0.03 (significant miss)

- Adjusted EBITDA: $20.11 million vs analyst estimates of $35.17 million (5.3% margin, 42.8% miss)

- Operating Margin: -114%, down from 1.6% in the same quarter last year

- Free Cash Flow was -$60.75 million, down from $1.56 million in the same quarter last year

- Locations: 18,113 at quarter end, up from 15,853 in the same quarter last year

- Market Capitalization: $584.1 million

“Looking ahead, we have implemented a comprehensive turnaround plan aimed at unlocking our two biggest opportunities: profitable U.S. expansion and capital-light international franchise growth. This plan is designed to reduce leverage and deliver sustainable, profitable growth through refranchising, improving returns on capital, expanding margins, and driving sustainable, profitable U.S. growth,” said Krispy Kreme CEO Josh Charlesworth.

Company Overview

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ: DNUT) is one of the most beloved and well-known fast-food chains in the world.

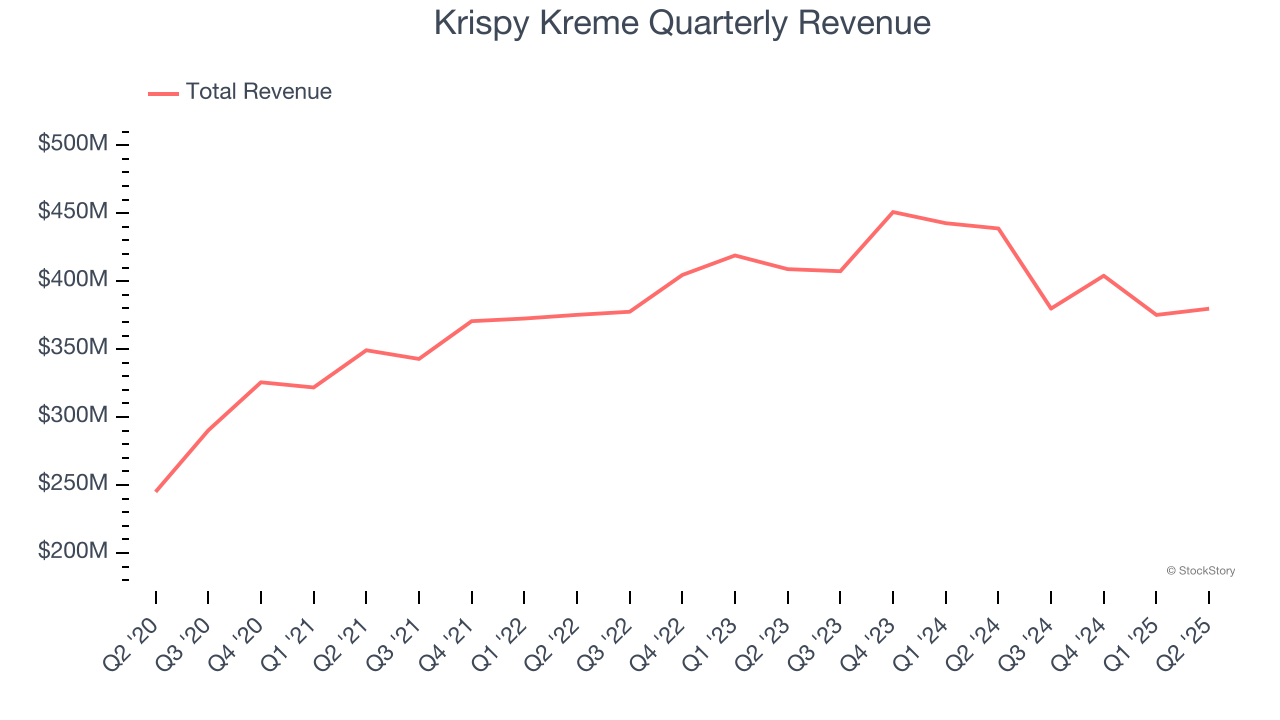

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.54 billion in revenue over the past 12 months, Krispy Kreme is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Krispy Kreme grew its sales at a decent 8.6% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and expanded its reach.

This quarter, Krispy Kreme’s revenue fell by 13.5% year on year to $379.8 million but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and indicates its menu offerings will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

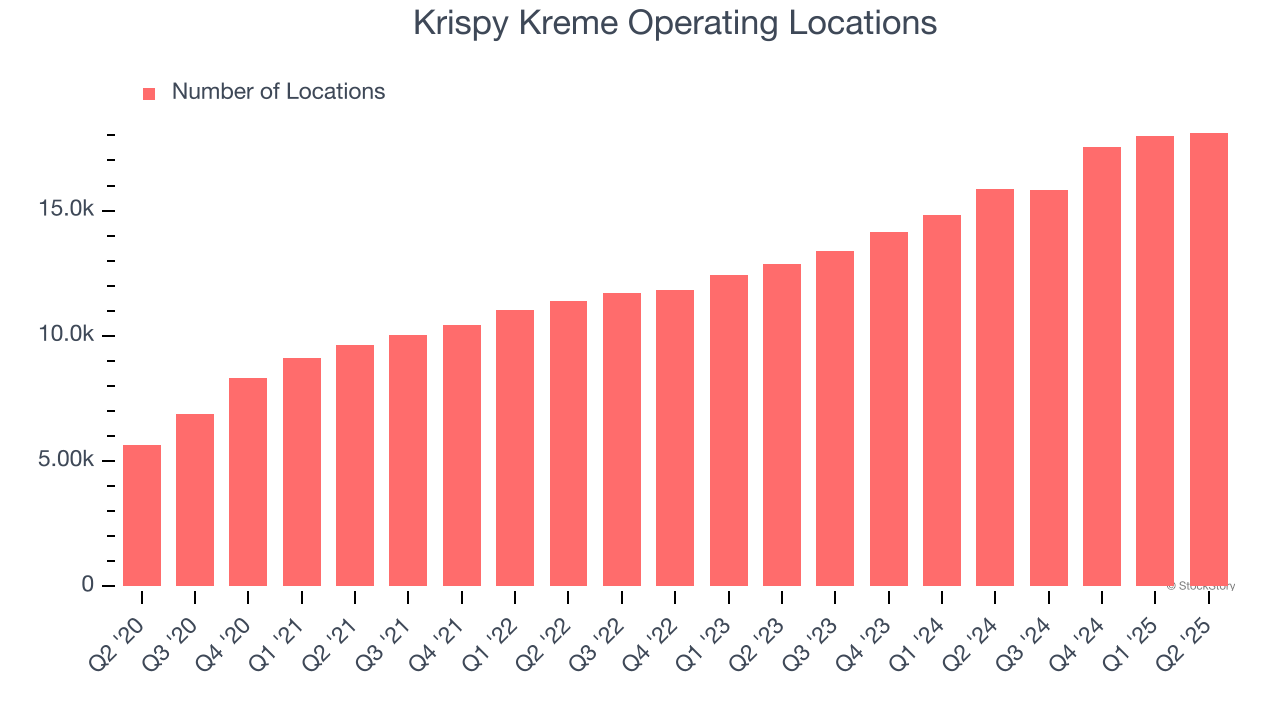

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Krispy Kreme sported 18,113 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 19.3% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Key Takeaways from Krispy Kreme’s Q2 Results

It was good to see Krispy Kreme narrowly top analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 11.1% to $3.04 immediately after reporting.

Krispy Kreme may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.