As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at sales and marketing software stocks, starting with Sprinklr (NYSE: CXM).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 21 sales and marketing software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

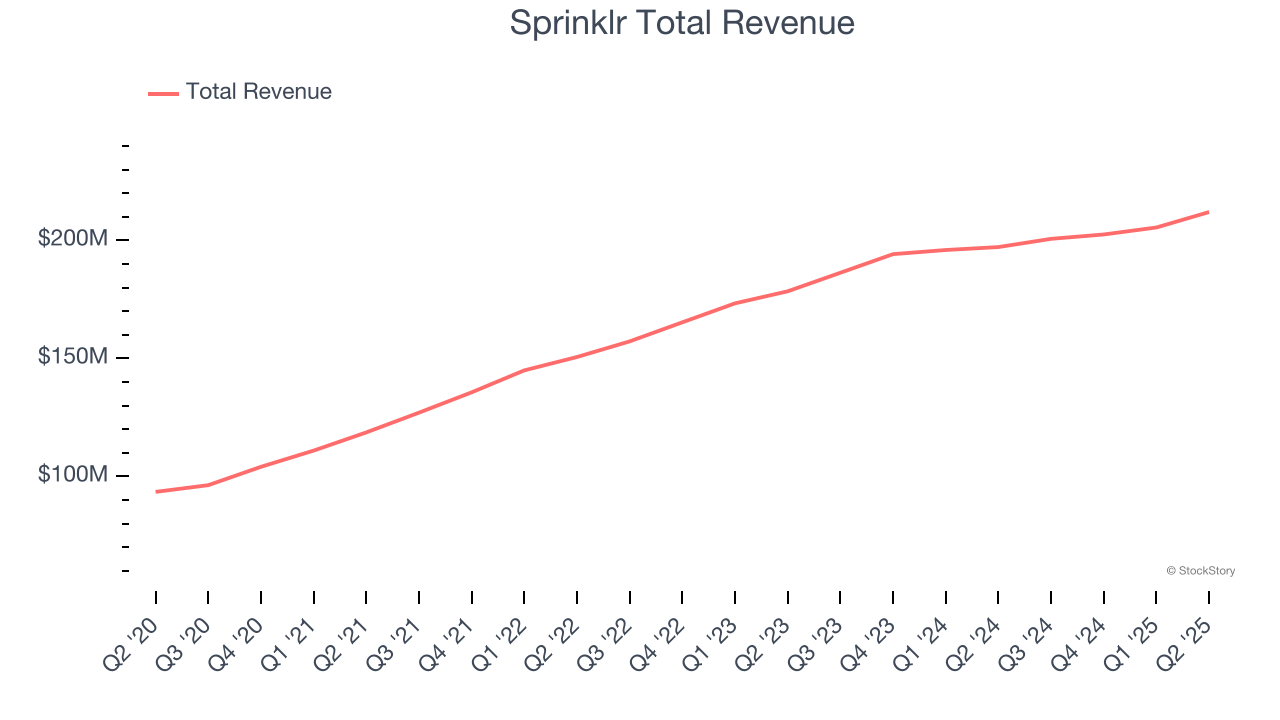

Sprinklr (NYSE: CXM)

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr (NYSE: CXM) provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

Sprinklr reported revenues of $212 million, up 7.5% year on year. This print exceeded analysts’ expectations by 3.2%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

“Our Q2 results reflect the continued and intentional progress we are making in our transformation to better serve our customers and partners. And while we still have work to do, we are encouraged by the increasing quality of our customer engagements, and upcoming impactful R&D innovations,” said Rory Read, Sprinklr President and CEO.

The stock is down 10.4% since reporting and currently trades at $7.72.

Is now the time to buy Sprinklr? Access our full analysis of the earnings results here, it’s free.

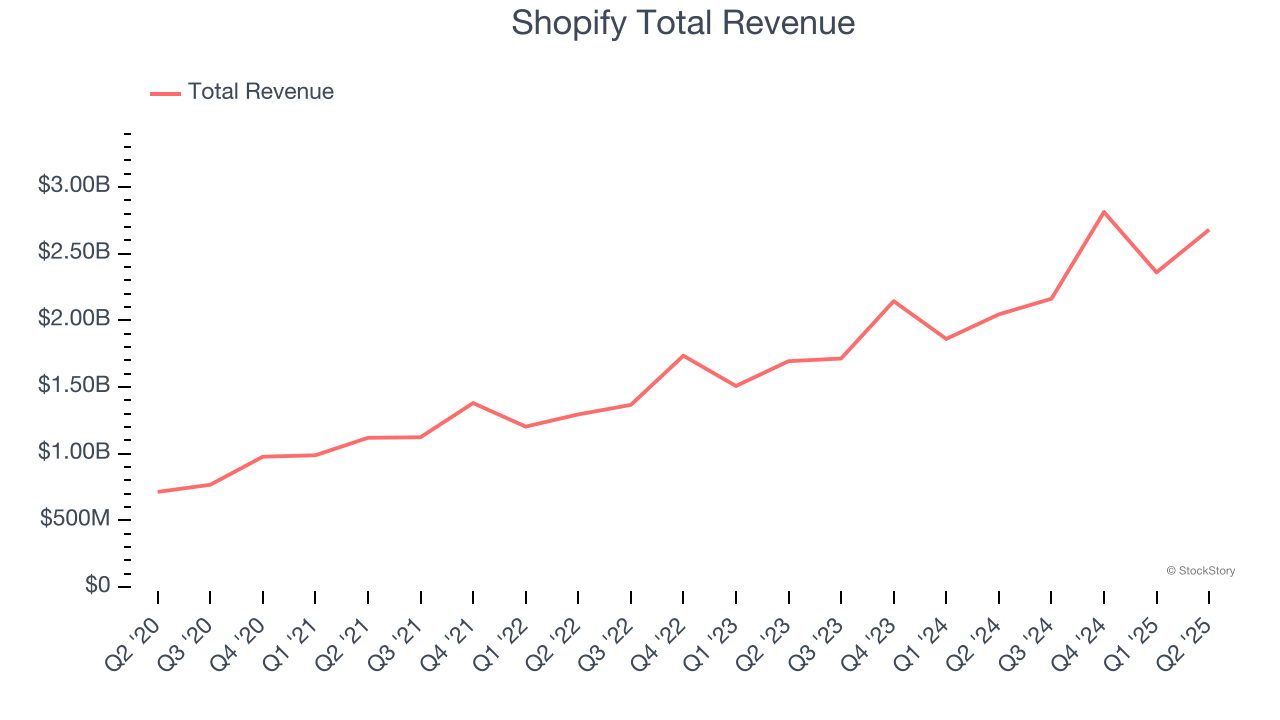

Best Q2: Shopify (NASDAQ: SHOP)

Starting with just three people selling snowboards online in 2004, Shopify (NYSE: SHOP) provides a comprehensive platform that enables merchants of all sizes to create, manage and grow their businesses across multiple sales channels.

Shopify reported revenues of $2.68 billion, up 31.1% year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with a solid beat of analysts’ gross merchandise volume and EBITDA estimates.

Shopify delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 12.9% since reporting. It currently trades at $143.53.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it’s free.

AppLovin (NASDAQ: APP)

Sitting at the crossroads of the mobile advertising ecosystem with over 200 free-to-play games in its portfolio, AppLovin (NASDAQ: APP) provides software solutions that help mobile app developers market, monetize, and grow their apps through AI-powered advertising and analytics tools.

AppLovin reported revenues of $1.26 billion, up 16.5% year on year, falling short of analysts’ expectations by 1.2%. It was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations.

AppLovin delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 49% since the results and currently trades at $582.90.

Read our full analysis of AppLovin’s results here.

Semrush (NYSE: SEMR)

Born from the need to make sense of the complex digital marketing landscape, Semrush (NYSE: SEMR) is a software-as-a-service platform that helps companies improve their online visibility, analyze digital marketing efforts, and optimize content across search engines and social media.

Semrush reported revenues of $108.9 million, up 19.7% year on year. This result was in line with analysts’ expectations. More broadly, it was a slower quarter as it logged decelerating customer growth and a slight miss of analysts’ annual recurring revenue estimates.

Semrush had the weakest full-year guidance update among its peers. The company lost 2,000 customers and ended up with a total of 116,000. The stock is down 19.9% since reporting and currently trades at $7.41.

Read our full, actionable report on Semrush here, it’s free.

Braze (NASDAQ: BRZE)

With its technology powering interactions with 6.2 billion monthly active users across the digital landscape, Braze (NASDAQ: BRZE) provides a platform that helps brands build and maintain direct relationships with their customers through personalized, cross-channel messaging and engagement.

Braze reported revenues of $180.1 million, up 23.8% year on year. This number surpassed analysts’ expectations by 5%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ billings estimates and accelerating customer growth.

Braze delivered the highest full-year guidance raise among its peers. The company added 80 customers to reach a total of 2,422. The stock is up 9.8% since reporting and currently trades at $30.41.

Read our full, actionable report on Braze here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.