Since September 2020, the S&P 500 has delivered a total return of 96.5%. But one standout stock has more than doubled the market - over the past five years, PJT has surged 203% to $180.50 per share. Its momentum hasn’t stopped as it’s also gained 29.2% in the last six months thanks to its solid quarterly results, beating the S&P by 12.9%.

Is it too late to buy PJT? Find out in our full research report, it’s free.

Why Does PJT Stock Spark Debate?

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE: PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

Two Positive Attributes:

1. Long-Term Revenue Growth Shows Strong Momentum

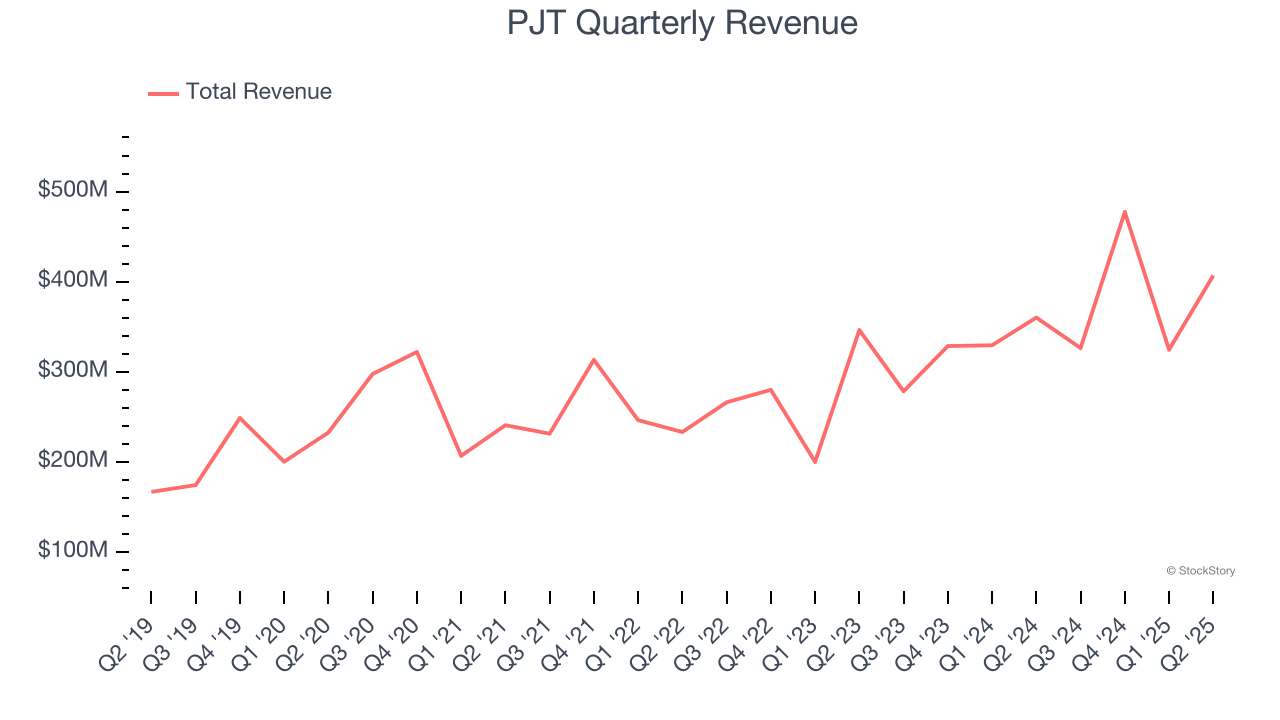

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Thankfully, PJT’s 12.4% annualized revenue growth over the last five years was solid. Its growth surpassed the average financials company and shows its offerings resonate with customers.

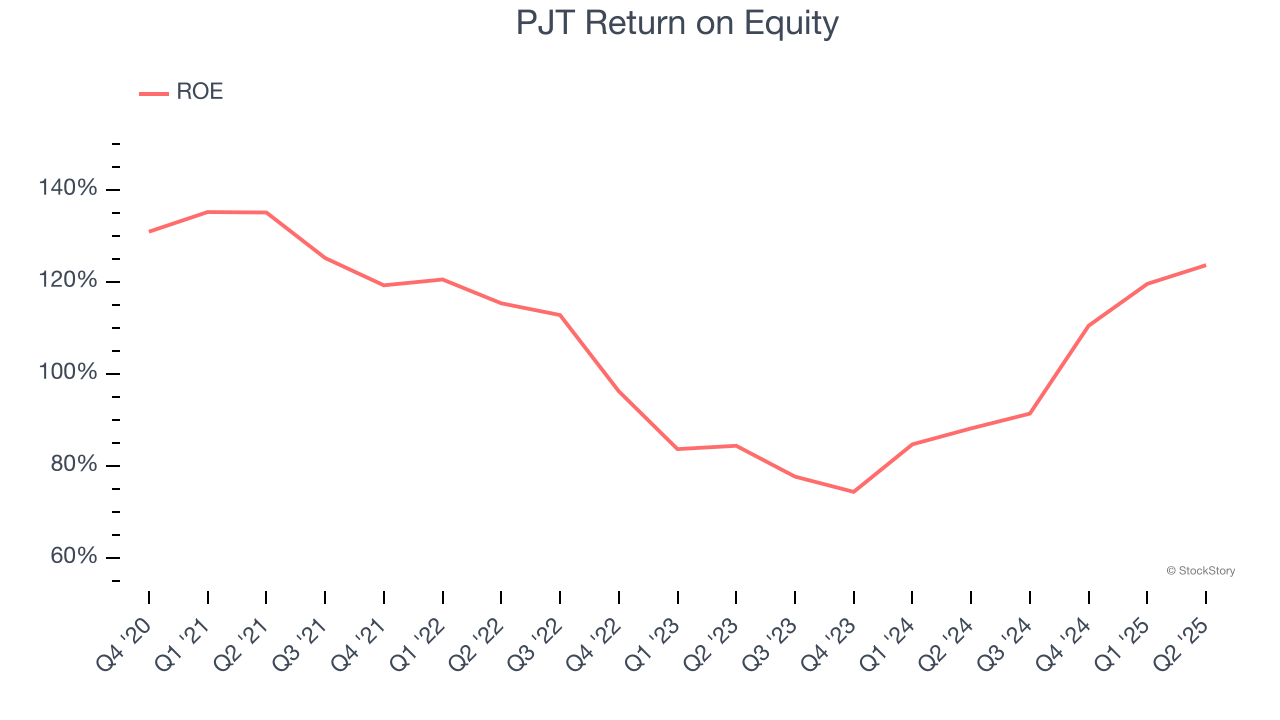

2. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, PJT has averaged an ROE of 27.3%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows PJT has a strong competitive moat.

One Reason to be Careful:

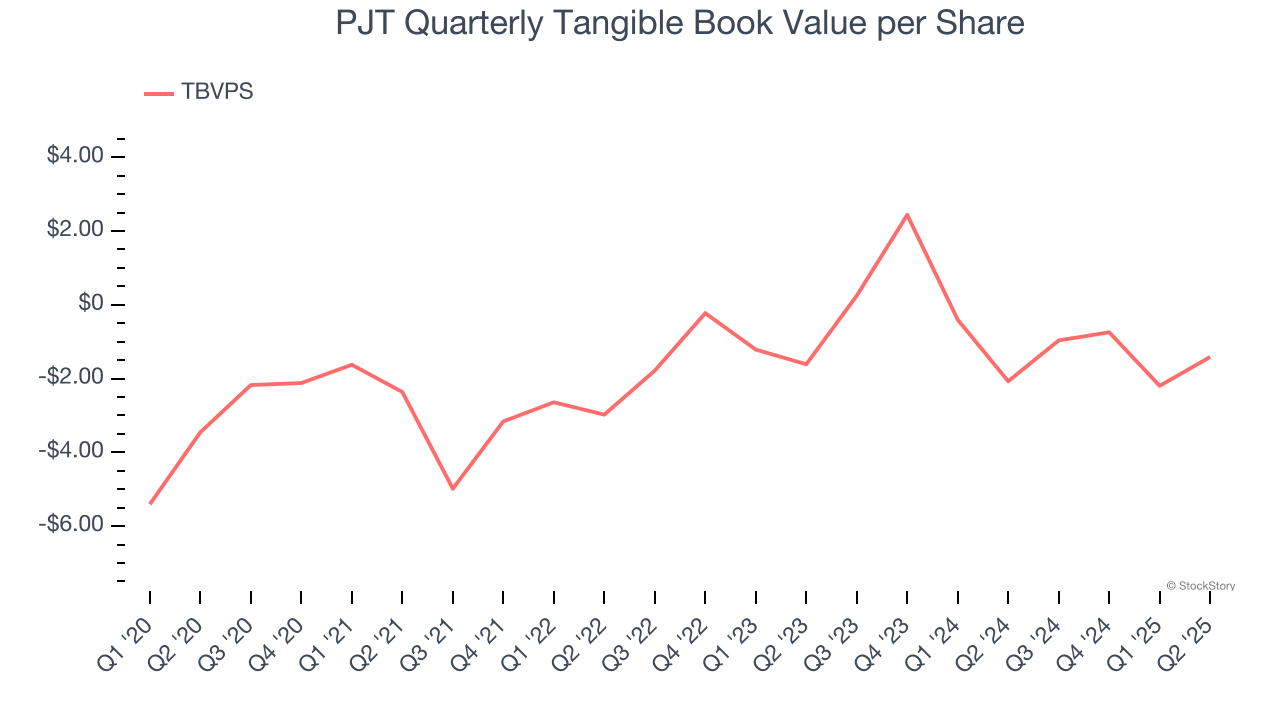

Declining TBVPS Reflects Erosion of Asset Value

Tangible book value per share (TBVPS) serves as a key indicator of a financial institution’s strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during economic distress.

To the detriment of investors, PJT’s TBVPS declined at a 6.4% annual clip over the last two years.

Final Judgment

PJT’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 26.7× forward P/E (or $180.50 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.