Wrapping up Q2 earnings, we look at the numbers and key takeaways for the engineering and design services stocks, including AECOM (NYSE: ACM) and its peers.

Companies providing engineering and design services boast ever-evolving technical expertise. Compared to their counterparts who manufacture and sell physical products, these companies can also pivot faster to more trending areas due to their smaller physical asset bases. Green energy and water conservation, for example, are current themes driving incremental demand in this space. On the other hand, those providing engineering and design services are at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 5 engineering and design services stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

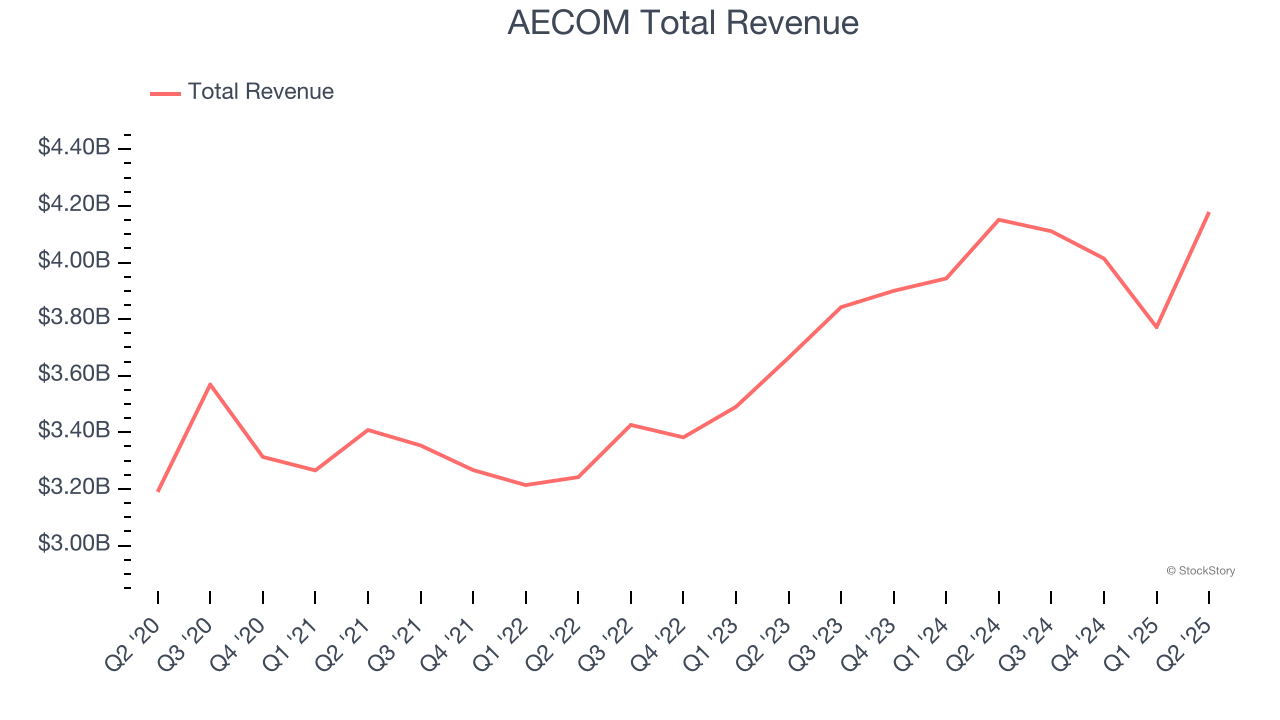

Slowest Q2: AECOM (NYSE: ACM)

Founded in 1990 when a group of engineers from five companies decided to merge, AECOM (NYSE: ACM) provides various infrastructure consulting services.

AECOM reported revenues of $4.18 billion, flat year on year. This print fell short of analysts’ expectations by 3.3%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates.

“The strength of our third quarter results, which included outperformance on all key financial metrics, demonstrated the benefits of our competitive edge platform and the high returns we earn on our growth investments,” said Troy Rudd, AECOM’s chairman and chief executive officer.

AECOM delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 11.9% since reporting and currently trades at $125.40.

Is now the time to buy AECOM? Access our full analysis of the earnings results here, it’s free.

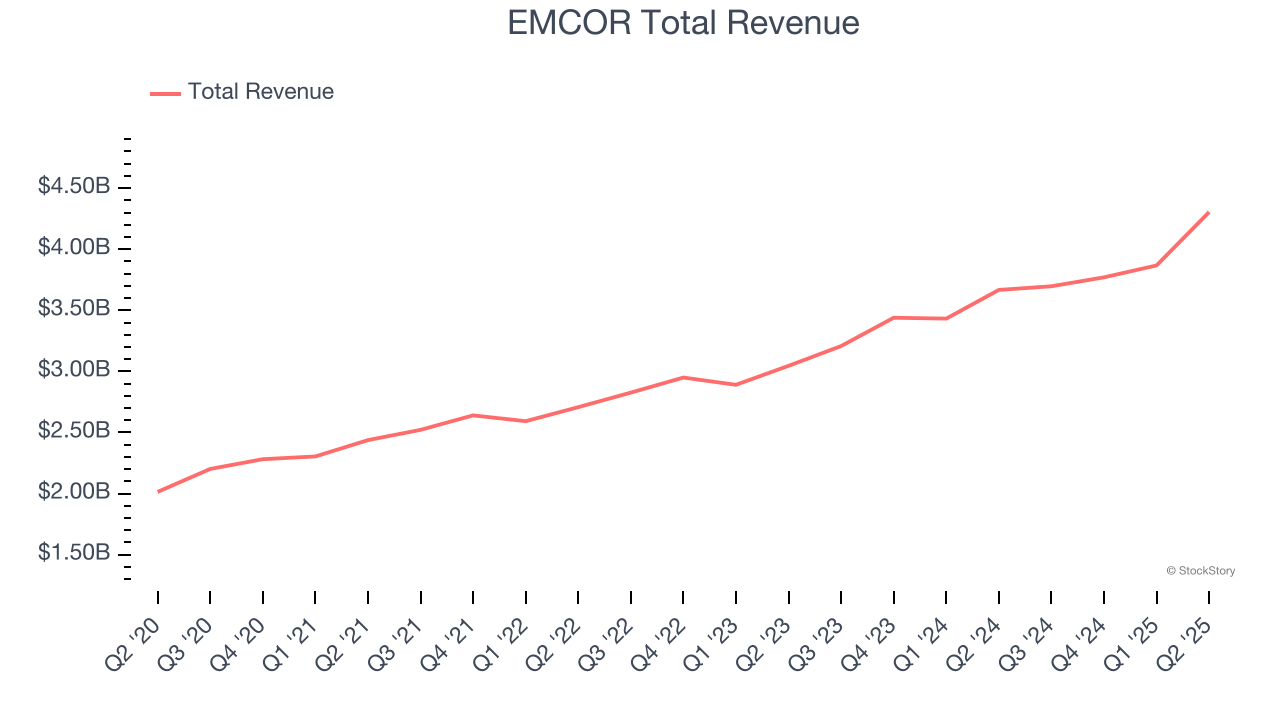

Best Q2: EMCOR (NYSE: EME)

Through its network of over 70 subsidiaries, EMCOR (NYSE: EME) provides electrical, mechanical, and building construction and services

EMCOR reported revenues of $4.30 billion, up 17.4% year on year, outperforming analysts’ expectations by 4.9%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.9% since reporting. It currently trades at $627.28.

Is now the time to buy EMCOR? Access our full analysis of the earnings results here, it’s free.

Dycom (NYSE: DY)

Working alongside some of the most popular mobile carriers in the world, Dycom (NYSE: DY) builds and maintains telecommunications infrastructure.

Dycom reported revenues of $1.38 billion, up 14.5% year on year, falling short of analysts’ expectations by 2.5%. Still, its results were good as it locked in an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

As expected, the stock is down 7.6% since the results and currently trades at $248.99.

Read our full analysis of Dycom’s results here.

MasTec (NYSE: MTZ)

Involved in the 1996 Olympic Games MasTec (NYSE: MTZ) is an infrastructure construction company that specializes in the telecommunications, energy, and utility industries.

MasTec reported revenues of $3.54 billion, up 19.7% year on year. This number beat analysts’ expectations by 4.2%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates and full-year revenue guidance beating analysts’ expectations.

MasTec achieved the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 4.7% since reporting and currently trades at $180.37.

Read our full, actionable report on MasTec here, it’s free.

Sterling (NASDAQ: STRL)

Involved in the construction of a major highway, the Grand Parkway in Houston, TX, Sterling Infrastructure (NASDAQ: STRL) provides civil infrastructure construction.

Sterling reported revenues of $614.5 million, up 5.4% year on year. This print surpassed analysts’ expectations by 10.8%. It was an exceptional quarter as it also put up an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Sterling delivered the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is flat since reporting and currently trades at $275.

Read our full, actionable report on Sterling here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.