1st Source has had an impressive run over the past six months as its shares have beaten the S&P 500 by 10.8%. The stock now trades at $70.10, marking a 19.4% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is SRCE a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does 1st Source Spark Debate?

Tracing its roots back to 1863 during the Civil War era, 1st Source Corporation (NASDAQ: SRCE) is a regional bank holding company that provides commercial, consumer, specialty finance, and wealth management services across Indiana, Michigan, and Florida.

Two Positive Attributes:

1. Increasing Net Interest Margin Juices Financials

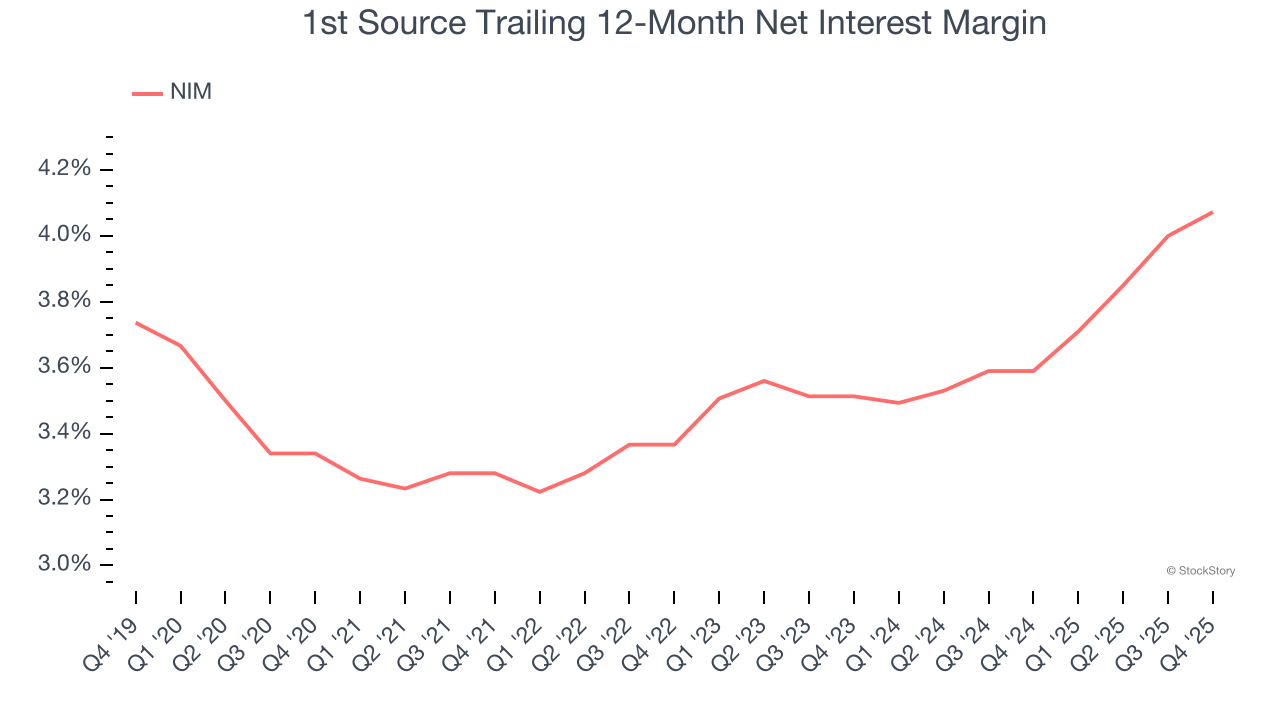

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, 1st Source’s net interest margin averaged 3.9%, climbing by 55.9 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

2. Growing TBVPS Reflects Strong Asset Base

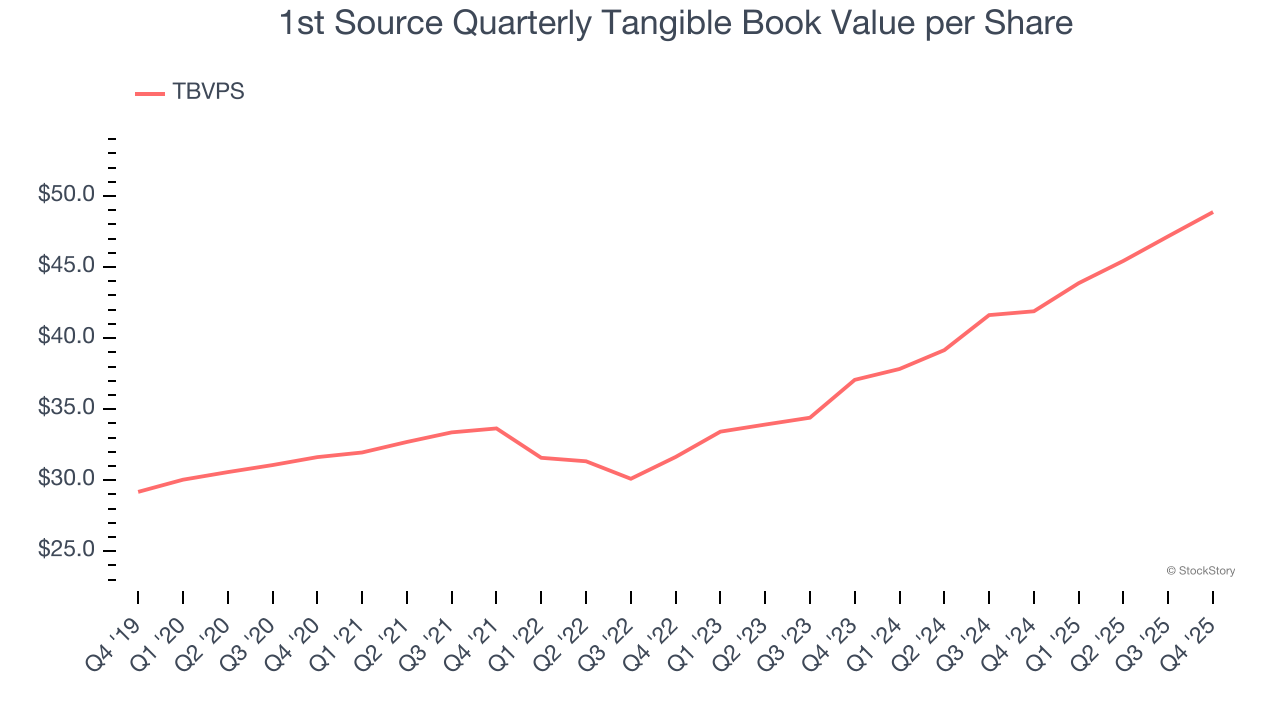

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

1st Source’s TBVPS increased by 9.1% annually over the last five years, and growth has recently accelerated as TBVPS grew at an impressive 14.8% annual clip over the past two years (from $37.06 to $48.88 per share).

One Reason to be Careful:

Net Interest Income Points to Soft Demand

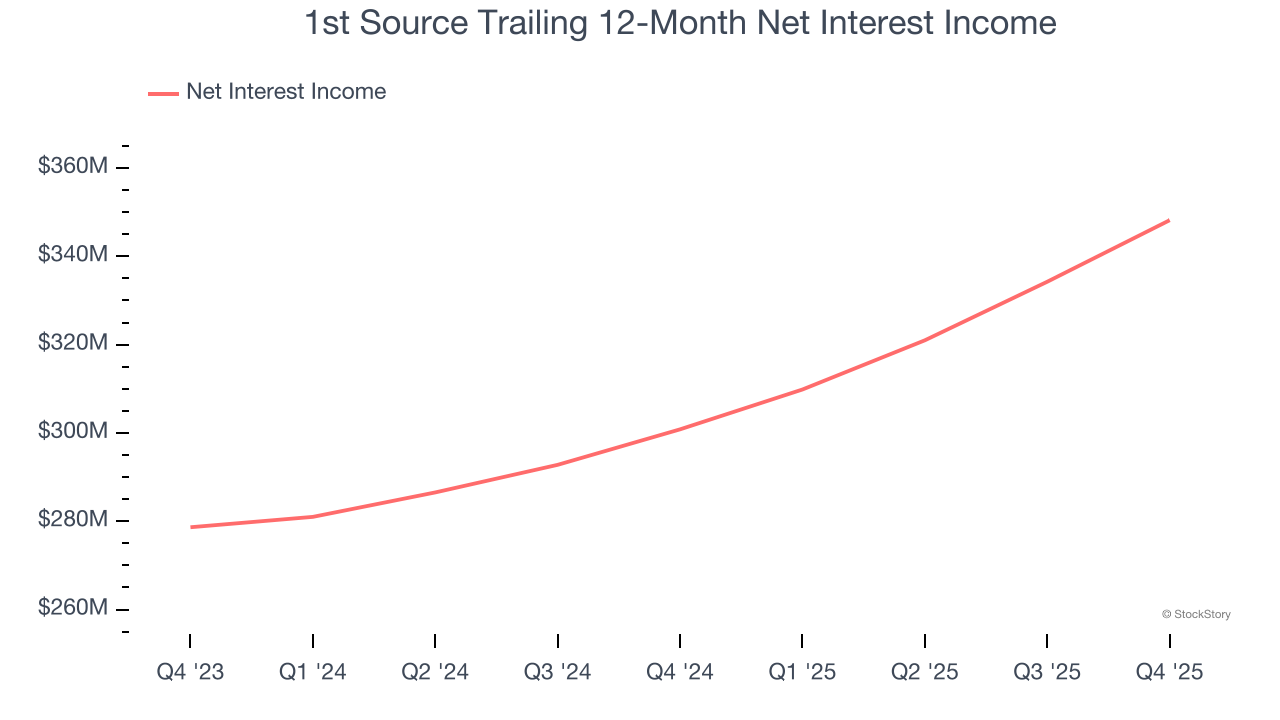

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

1st Source’s net interest income has grown at a 9% annualized rate over the last five years, slightly worse than the broader banking industry.

Final Judgment

1st Source’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 1.2× forward P/B (or $70.10 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than 1st Source

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.