Manufacturing equipment and systems provider Advanced Energy (NASDAQ: AEIS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 17.8% year on year to $489.4 million. On top of that, next quarter’s revenue guidance ($500 million at the midpoint) was surprisingly good and 5.3% above what analysts were expecting. Its non-GAAP profit of $1.94 per share was 8.8% above analysts’ consensus estimates.

Is now the time to buy Advanced Energy? Find out by accessing our full research report, it’s free.

Advanced Energy (AEIS) Q4 CY2025 Highlights:

- Revenue: $489.4 million vs analyst estimates of $473.7 million (17.8% year-on-year growth, 3.3% beat)

- Adjusted EPS: $1.94 vs analyst estimates of $1.78 (8.8% beat)

- Revenue Guidance for Q1 CY2026 is $500 million at the midpoint, above analyst estimates of $474.8 million

- Adjusted EPS guidance for Q1 CY2026 is $1.94 at the midpoint, above analyst estimates of $1.68

- Operating Margin: 11.6%, up from 8.2% in the same quarter last year

- Free Cash Flow was -$82.77 million, down from $69.76 million in the same quarter last year

- Market Capitalization: $10.54 billion

“Fourth quarter results exceeded our guidance, primarily driven by increased demand in the semiconductor market,” said Steve Kelley, president and CEO of Advanced Energy.

Company Overview

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ: AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Revenue Growth

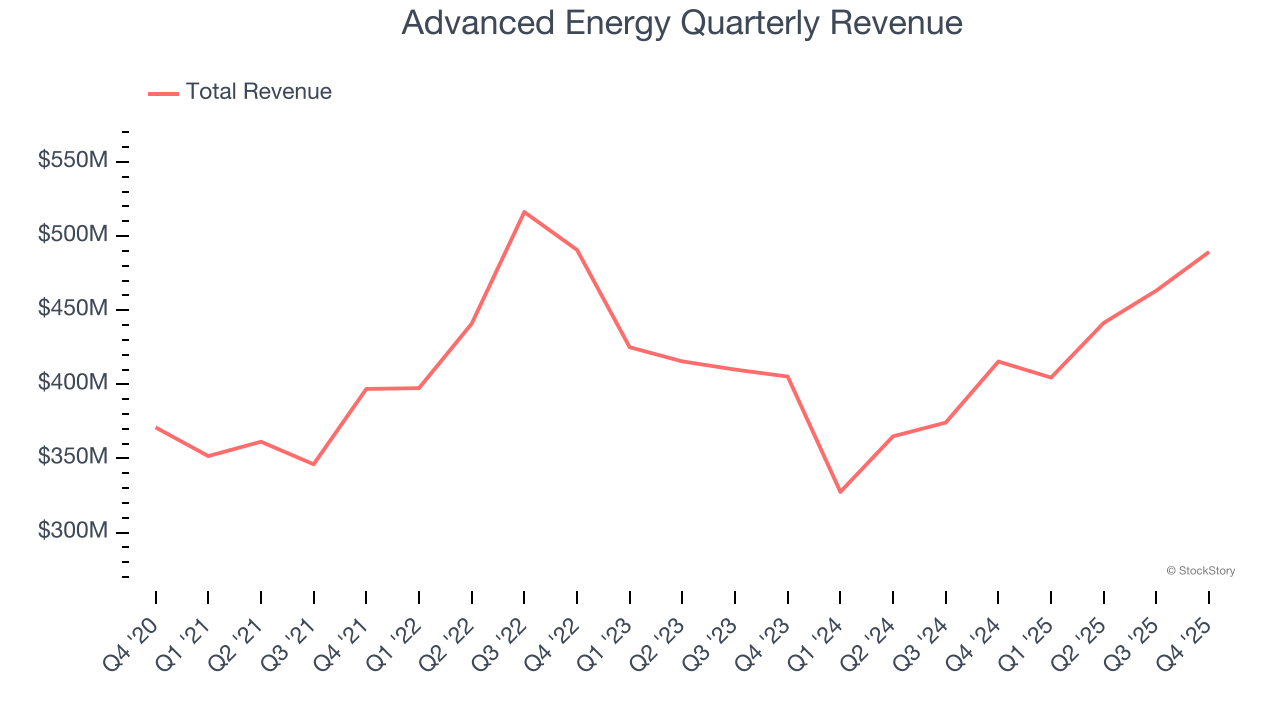

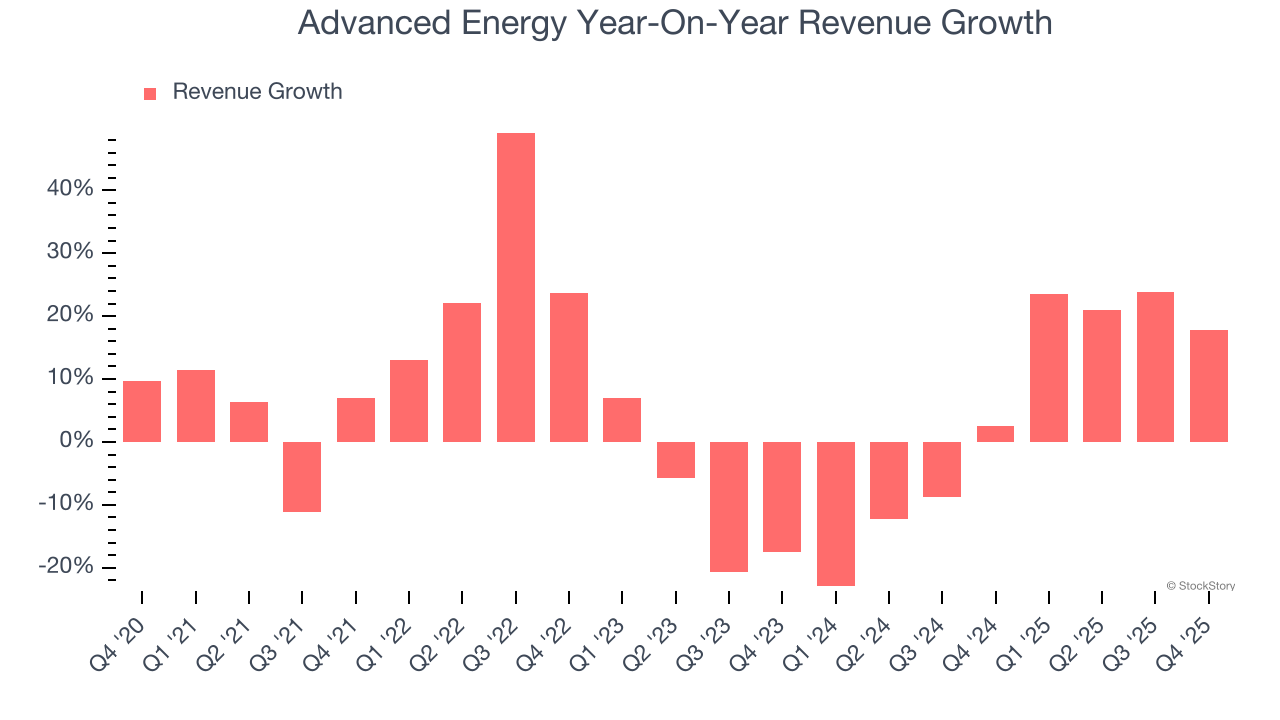

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Advanced Energy grew its sales at a tepid 4.9% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Advanced Energy’s annualized revenue growth of 4.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

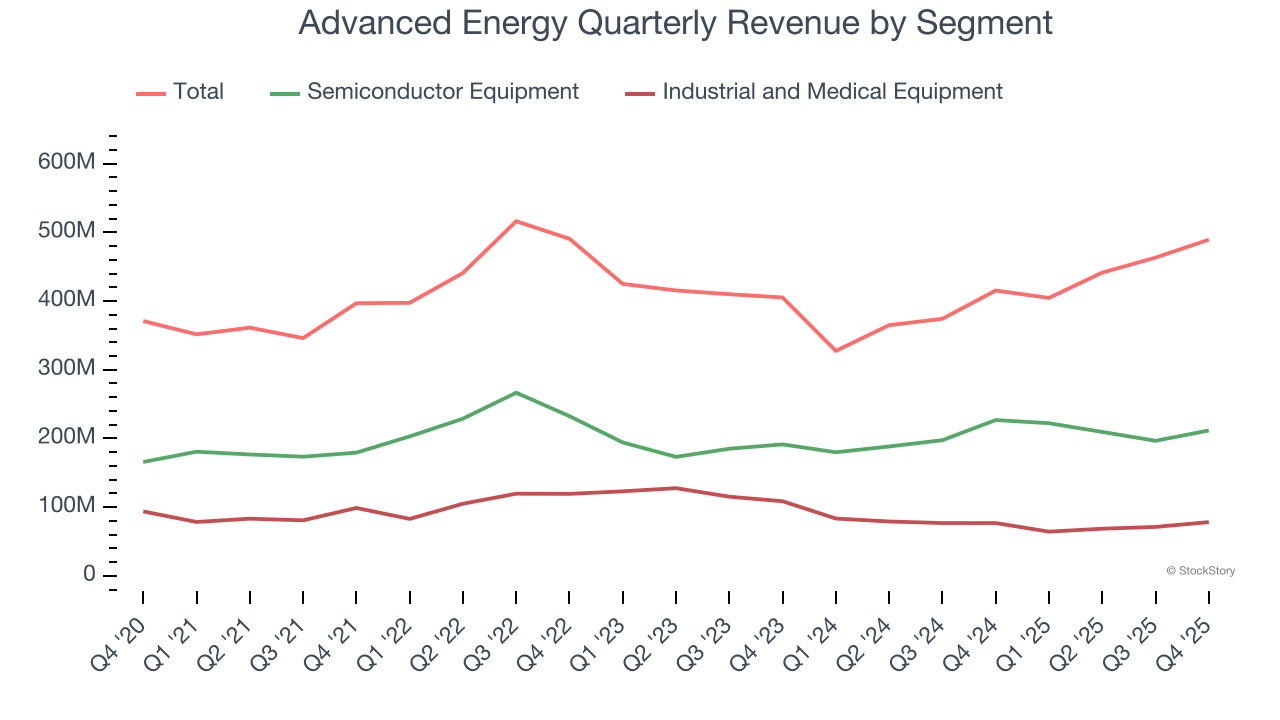

Advanced Energy also breaks out the revenue for its most important segments, Semiconductor Equipment and Industrial and Medical Equipment, which are 43.2% and 16% of revenue. Over the last two years, Advanced Energy’s Semiconductor Equipment revenue (i.e., plasma power) averaged 6.8% year-on-year growth. On the other hand, its Industrial and Medical Equipment revenue (i.e., robotics) averaged 21.8% declines.

This quarter, Advanced Energy reported year-on-year revenue growth of 17.8%, and its $489.4 million of revenue exceeded Wall Street’s estimates by 3.3%. Company management is currently guiding for a 23.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, an improvement versus the last two years. This projection is admirable and implies its newer products and services will catalyze better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

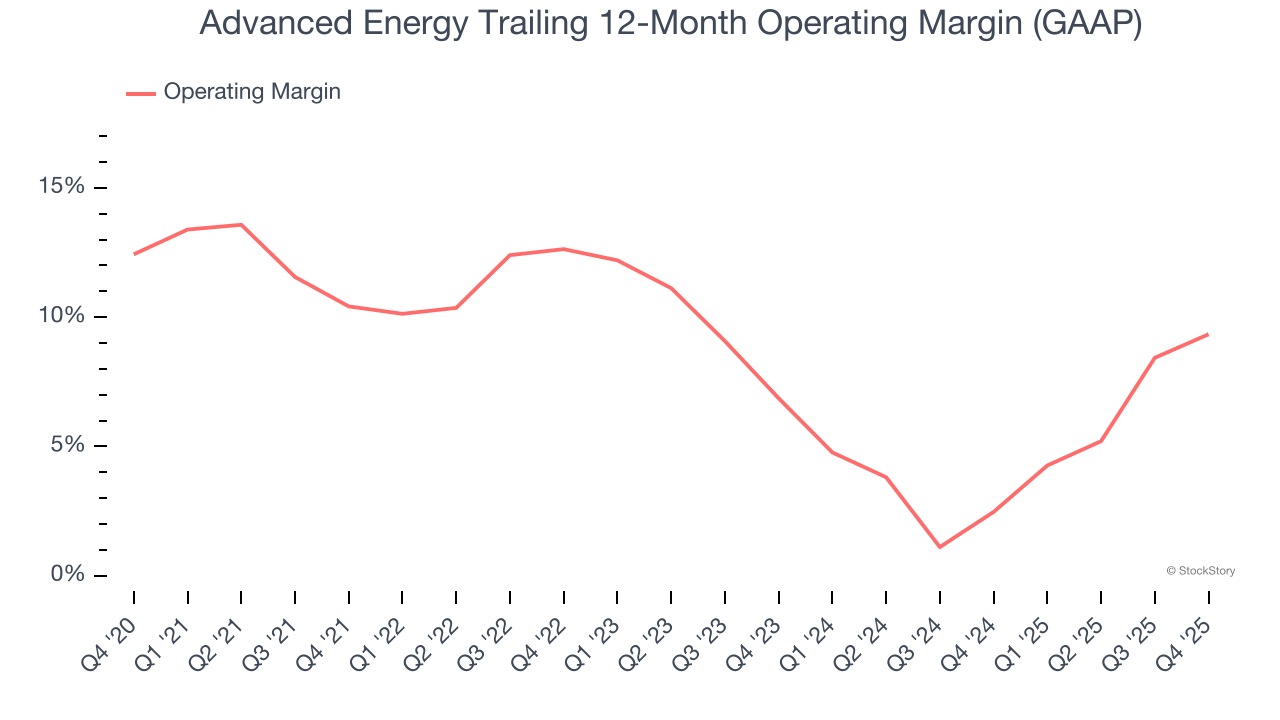

Advanced Energy has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.5%, higher than the broader industrials sector.

Looking at the trend in its profitability, Advanced Energy’s operating margin decreased by 1.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Advanced Energy generated an operating margin profit margin of 11.6%, up 3.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

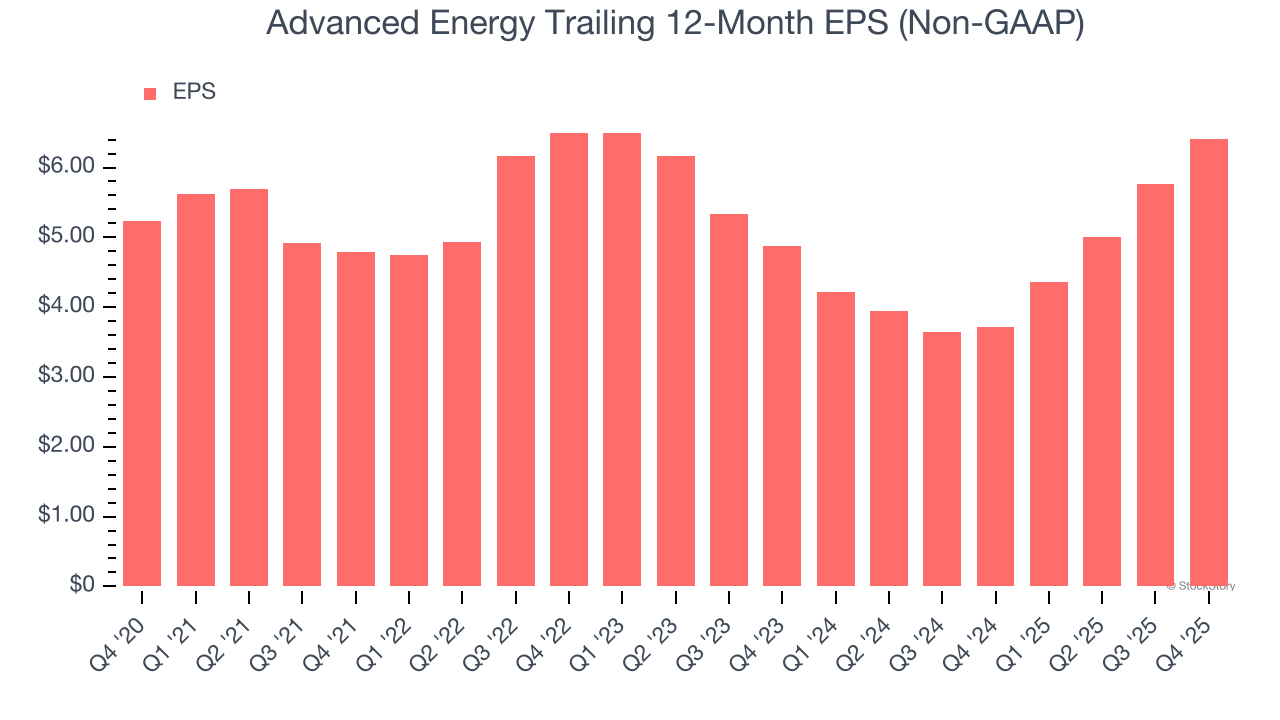

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Advanced Energy’s unimpressive 4.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Advanced Energy’s two-year annual EPS growth of 14.7% was great and topped its 4.2% two-year revenue growth.

Diving into Advanced Energy’s quality of earnings can give us a better understanding of its performance. Advanced Energy’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Advanced Energy reported adjusted EPS of $1.94, up from $1.30 in the same quarter last year. This print beat analysts’ estimates by 8.8%. Over the next 12 months, Wall Street expects Advanced Energy’s full-year EPS of $6.41 to grow 25.3%.

Key Takeaways from Advanced Energy’s Q4 Results

We were impressed by Advanced Energy’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.7% to $284.00 immediately after reporting.

Advanced Energy put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).