Financial automation software company BlackLine (NASDAQ: BL) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.1% year on year to $183.2 million. The company expects next quarter’s revenue to be around $181 million, close to analysts’ estimates. Its non-GAAP profit of $0.63 per share was 7.2% above analysts’ consensus estimates.

Is now the time to buy BlackLine? Find out by accessing our full research report, it’s free.

BlackLine (BL) Q4 CY2025 Highlights:

- Revenue: $183.2 million vs analyst estimates of $183 million (8.1% year-on-year growth, in line)

- Adjusted EPS: $0.63 vs analyst estimates of $0.59 (7.2% beat)

- Adjusted Operating Income: $45.18 million vs analyst estimates of $44.7 million (24.7% margin, 1.1% beat)

- Revenue Guidance for Q1 CY2026 is $181 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.43 at the midpoint, beating analyst estimates by 3.4%

- Operating Margin: 3.7%, in line with the same quarter last year

- Free Cash Flow Margin: 10.9%, down from 32% in the previous quarter

- Customers: 4,394, down from 4,424 in the previous quarter

- Net Revenue Retention Rate: 105%, up from 103% in the previous quarter

- Billings: $226.7 million at quarter end, up 9.4% year on year

- Market Capitalization: $2.56 billion

“Our fourth-quarter performance, highlighted by record bookings, provides encouraging validation of the strategic transformation we initiated over two years ago,” said Owen Ryan, CEO of BlackLine.

Company Overview

Born from the vision to eliminate tedious manual spreadsheet work for accountants, BlackLine (NASDAQ: BL) provides cloud-based software that automates and streamlines financial close, intercompany accounting, and invoice-to-cash processes for accounting departments.

Revenue Growth

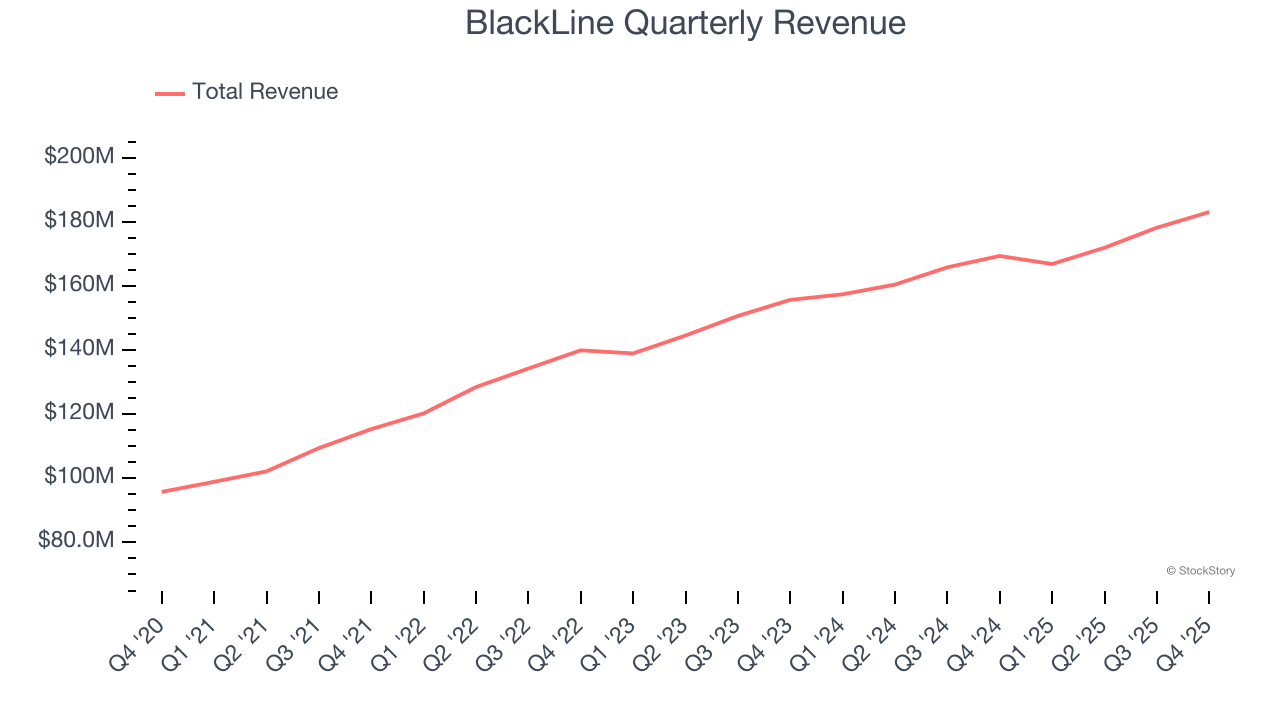

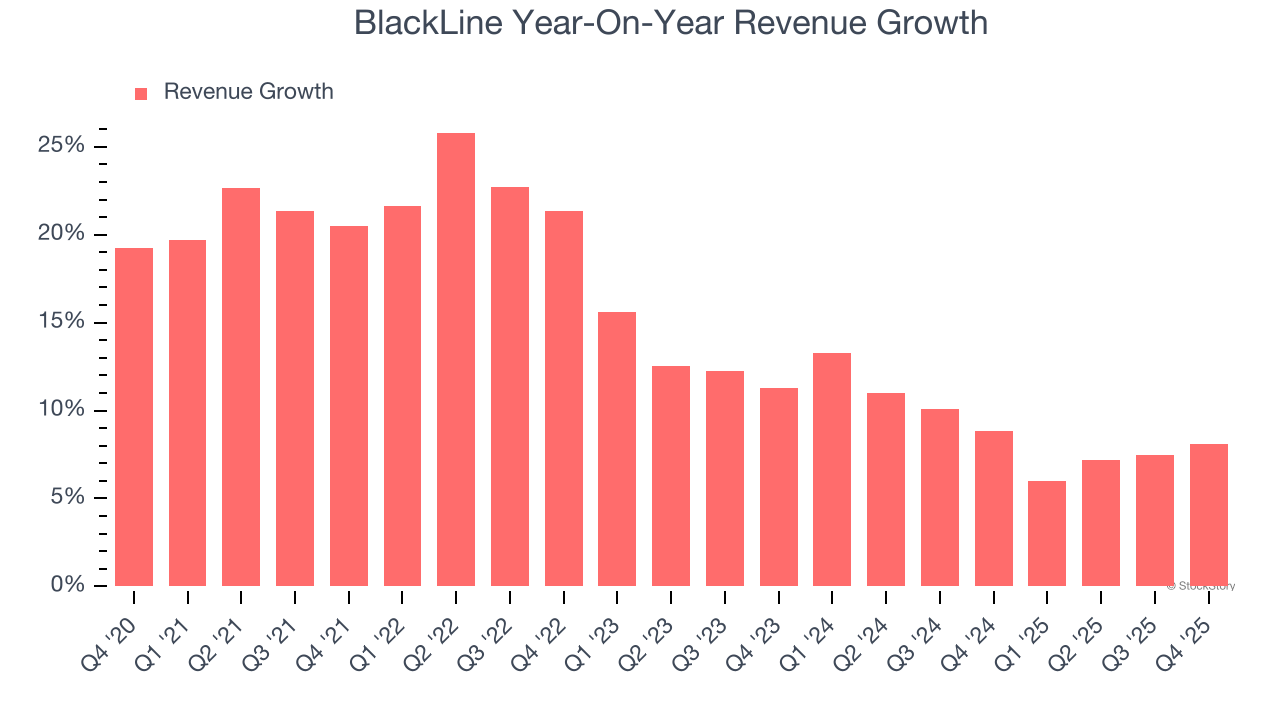

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, BlackLine grew its sales at a 14.8% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. BlackLine’s recent performance shows its demand has slowed as its annualized revenue growth of 9% over the last two years was below its five-year trend.

This quarter, BlackLine grew its revenue by 8.1% year on year, and its $183.2 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

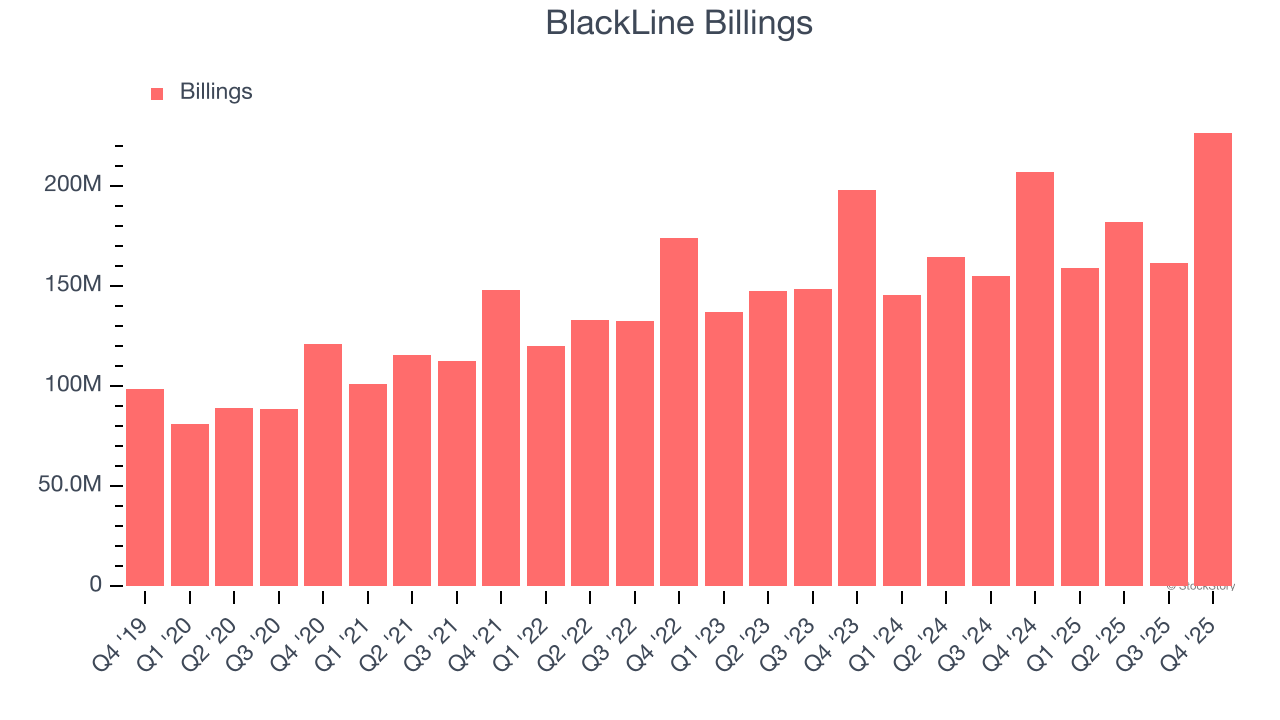

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

BlackLine’s billings came in at $226.7 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 8.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Customer Retention

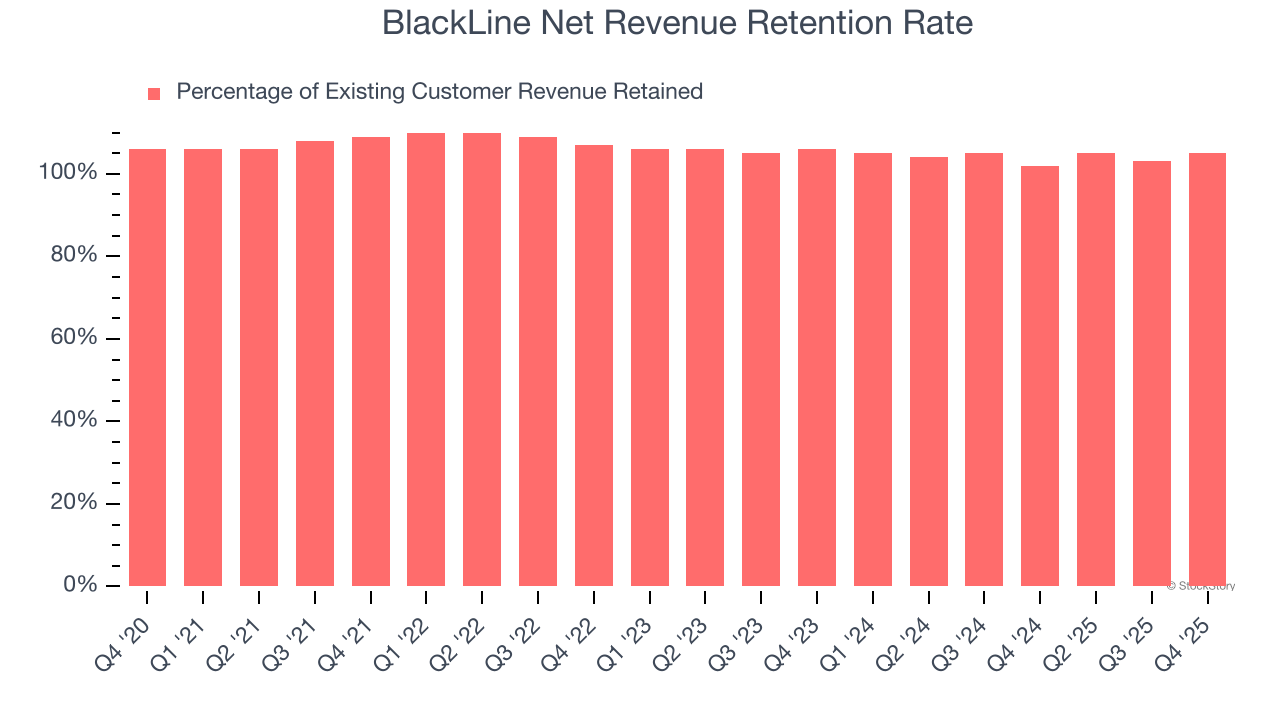

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

BlackLine’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 104% in Q4. This means BlackLine would’ve grown its revenue by 4.3% even if it didn’t win any new customers over the last 12 months.

BlackLine has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from BlackLine’s Q4 Results

Adjusted operating income and EPS in the quarter beat. We were also impressed by BlackLine’s optimistic full-year EPS guidance, which blew past analysts’ expectations. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a mixed but positive quarter. The stock traded up 1.5% to $45.06 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).