BellRing Brands’s stock price has taken a beating over the past six months, shedding 52.9% of its value and falling to $18.31 per share. This may have investors wondering how to approach the situation.

Given the weaker price action, is this a buying opportunity for BRBR? Find out in our full research report, it’s free.

Why Does BellRing Brands Spark Debate?

Spun out of Post Holdings in 2019, Bellring Brands (NYSE: BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

Two Positive Attributes:

1. Elevated Demand Drives Higher Sales Volumes

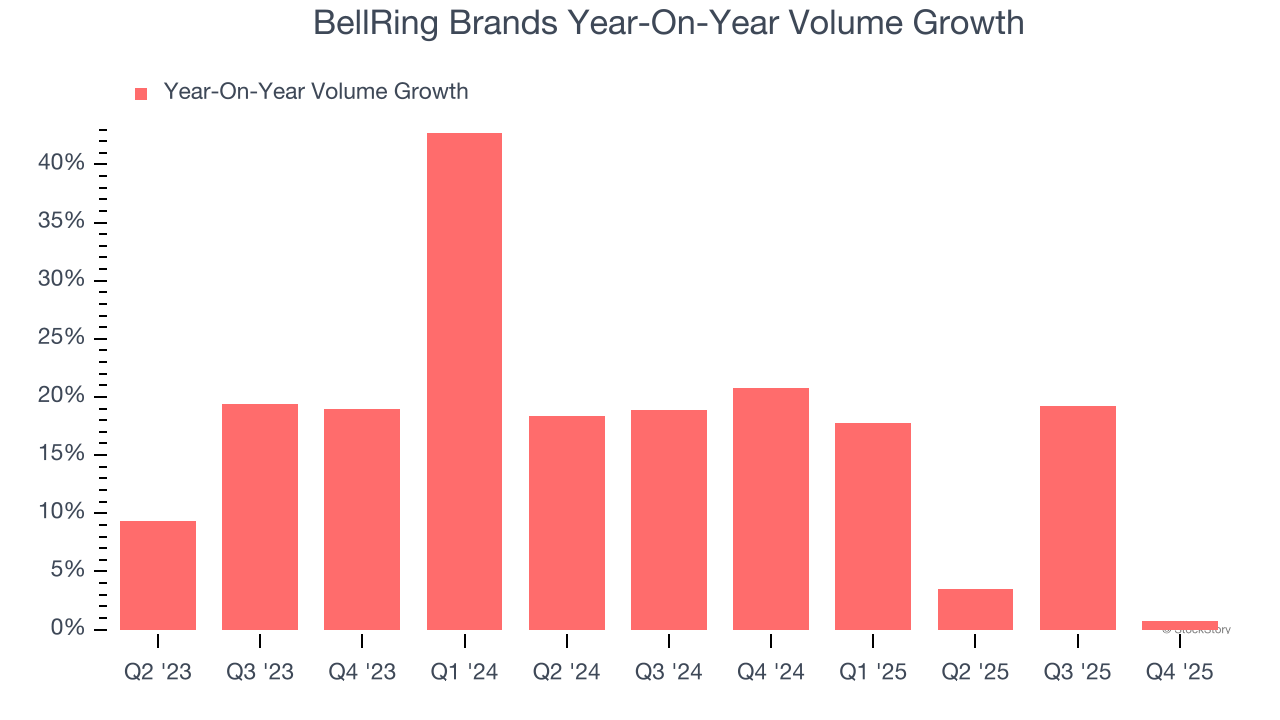

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

BellRing Brands’s average quarterly volume growth of 17.8% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

2. Stellar ROIC Showcases Lucrative Growth Opportunities

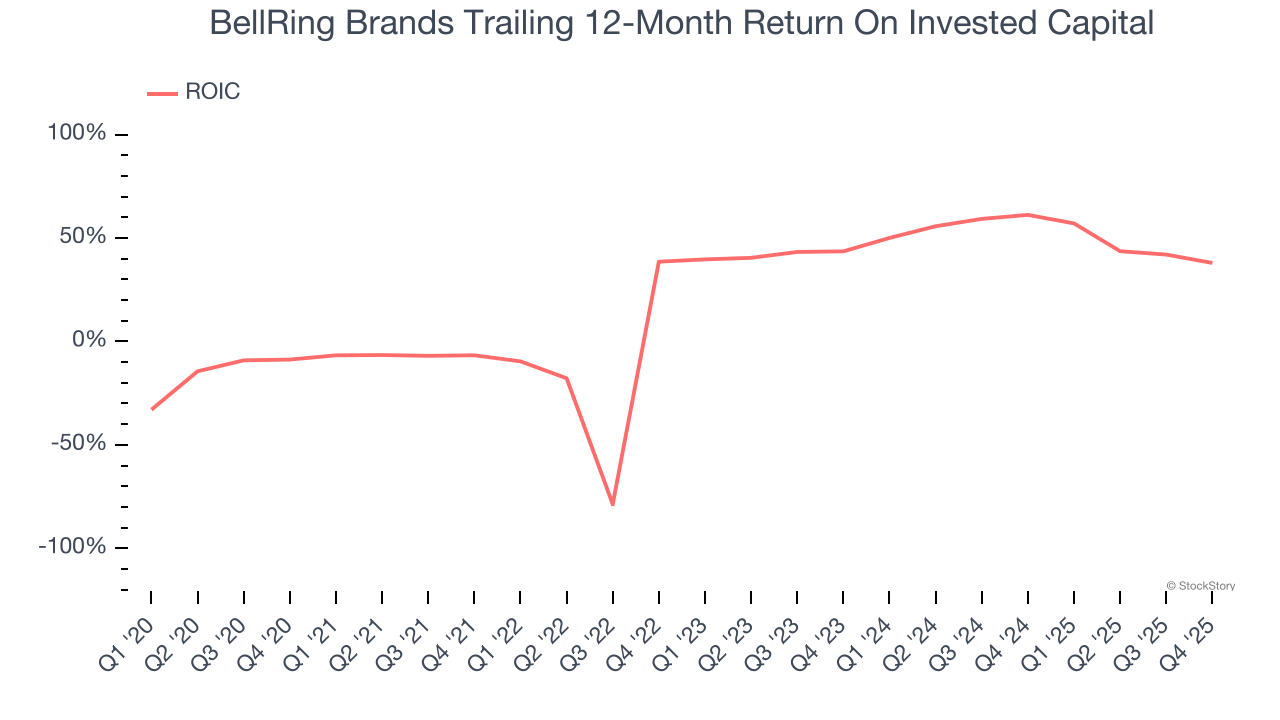

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

BellRing Brands’s four-year average ROIC was 45.3%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Shrinking Operating Margin

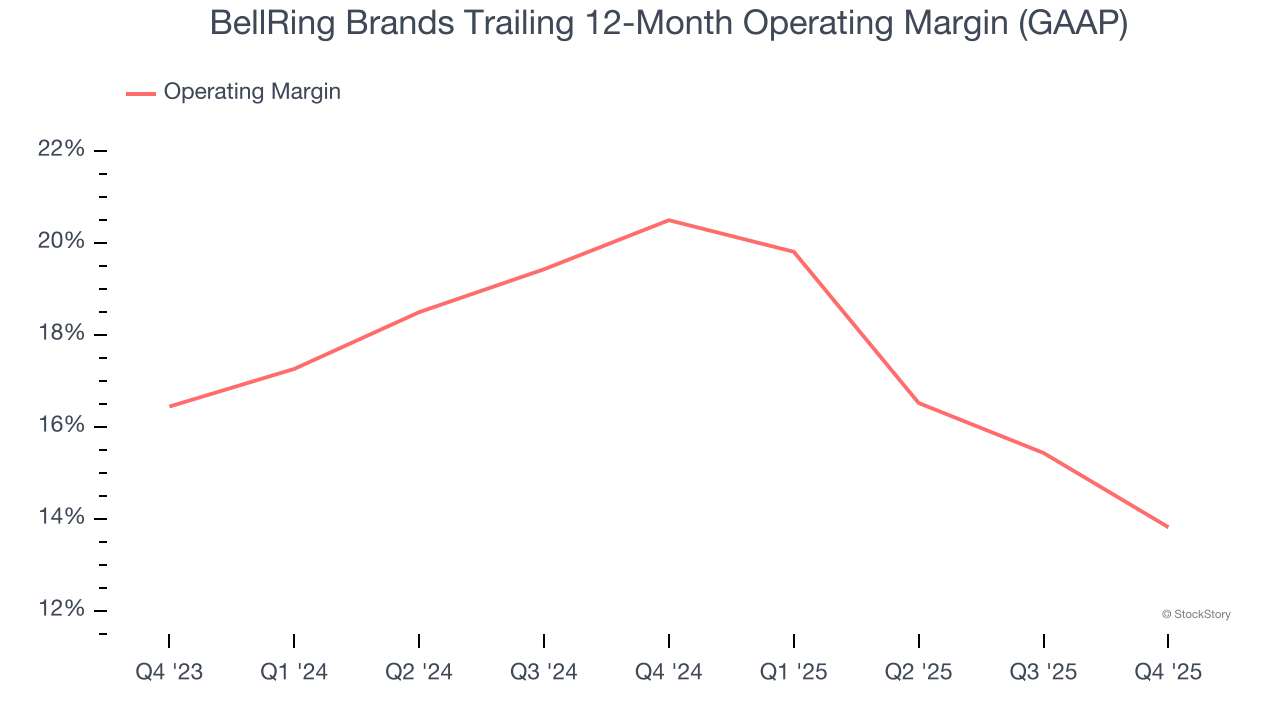

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, BellRing Brands’s operating margin decreased by 6.7 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 13.8%.

Final Judgment

BellRing Brands has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 9.5× forward P/E (or $18.31 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than BellRing Brands

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.