Mobile app technology company AppLovin (NASDAQ: APP) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 20.8% year on year to $1.66 billion. Guidance for next quarter’s revenue was optimistic at $1.76 billion at the midpoint, 3% above analysts’ estimates. Its GAAP profit of $3.24 per share was 10.1% above analysts’ consensus estimates.

Is now the time to buy AppLovin? Find out by accessing our full research report, it’s free.

AppLovin (APP) Q4 CY2025 Highlights:

- Revenue: $1.66 billion vs analyst estimates of $1.62 billion (20.8% year-on-year growth, 2.2% beat)

- EPS (GAAP): $3.24 vs analyst estimates of $2.94 (10.1% beat)

- Adjusted EBITDA: $1.40 billion vs analyst estimates of $1.33 billion (84.4% margin, 5.3% beat)

- Revenue Guidance for Q1 CY2026 is $1.76 billion at the midpoint, above analyst estimates of $1.71 billion

- EBITDA guidance for Q1 CY2026 is $1.48 billion at the midpoint, above analyst estimates of $1.39 billion

- Operating Margin: 76.9%, up from 44.3% in the same quarter last year

- Free Cash Flow Margin: 79%, up from 75% in the previous quarter

- Market Capitalization: $159.8 billion

Company Overview

Sitting at the crossroads of the mobile advertising ecosystem with over 200 free-to-play games in its portfolio, AppLovin (NASDAQ: APP) provides software solutions that help mobile app developers market, monetize, and grow their apps through AI-powered advertising and analytics tools.

Revenue Growth

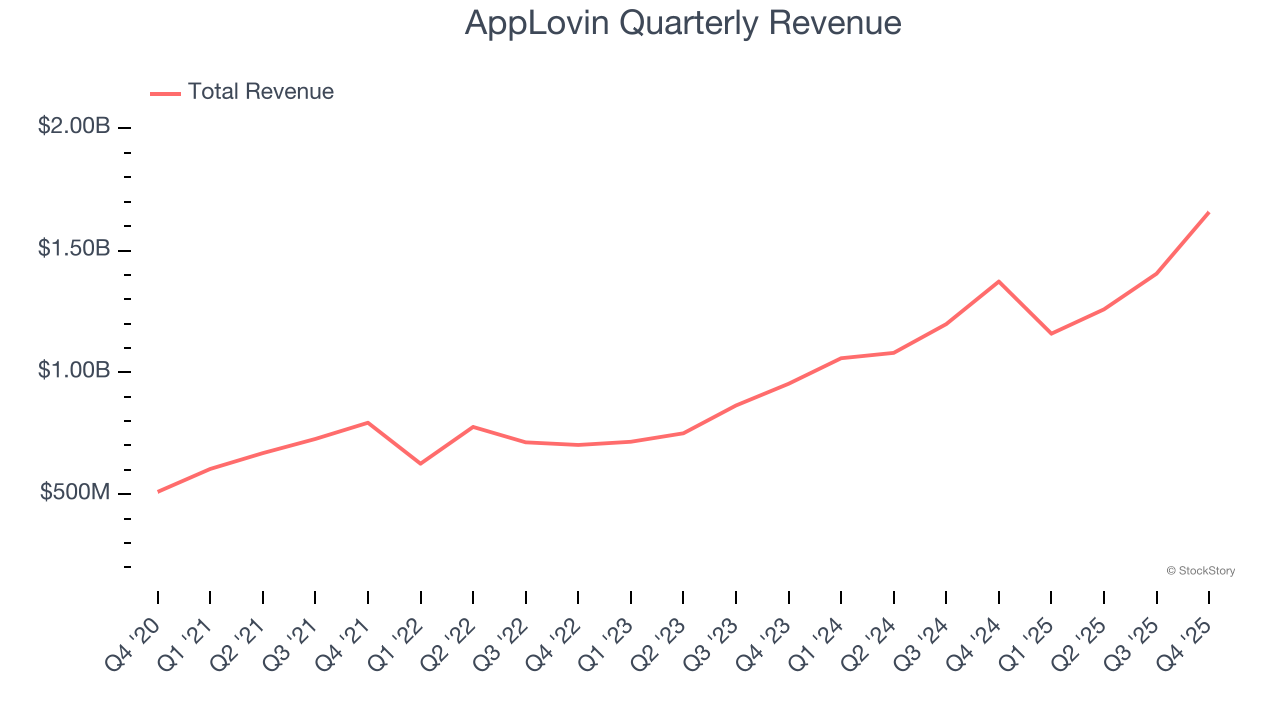

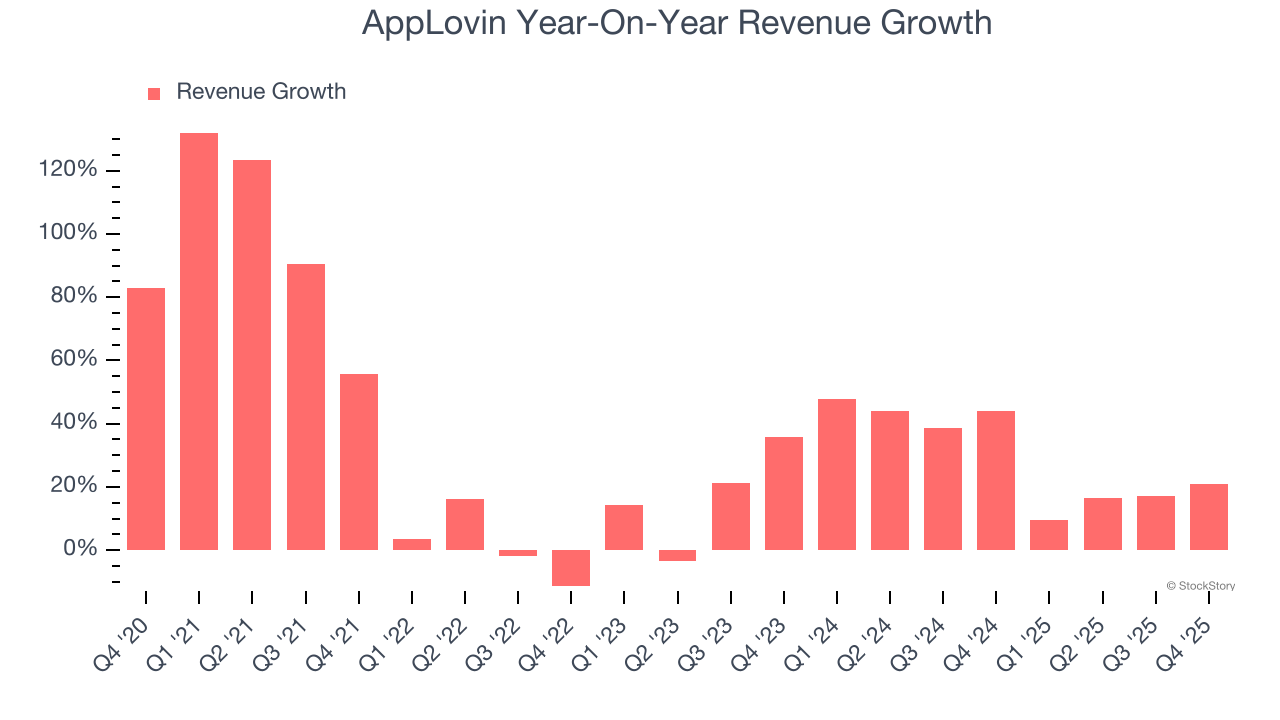

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, AppLovin’s sales grew at an impressive 30.4% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. AppLovin’s annualized revenue growth of 29.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, AppLovin reported robust year-on-year revenue growth of 20.8%, and its $1.66 billion of revenue topped Wall Street estimates by 2.2%. Company management is currently guiding for a 51.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 43.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

AppLovin is extremely efficient at acquiring new customers, and its CAC payback period checked in at 0.1 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give AppLovin more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from AppLovin’s Q4 Results

We were impressed by AppLovin’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 1.2% to $453.69 immediately following the results.

So do we think AppLovin is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).