Chicken producer Pilgrim’s Pride (NASDAQ: PPC) announced better-than-expected revenue in Q4 CY2025, with sales up 3.3% year on year to $4.52 billion. Its non-GAAP profit of $0.68 per share was 9.9% below analysts’ consensus estimates.

Is now the time to buy Pilgrim's Pride? Find out by accessing our full research report, it’s free.

Pilgrim's Pride (PPC) Q4 CY2025 Highlights:

- Revenue: $4.52 billion vs analyst estimates of $4.40 billion (3.3% year-on-year growth, 2.8% beat)

- Adjusted EPS: $0.68 vs analyst expectations of $0.76 (9.9% miss)

- Adjusted EBITDA: $415.1 million vs analyst estimates of $396.8 million (9.2% margin, 4.6% beat)

- Operating Margin: 4.5%, down from 7% in the same quarter last year

- Free Cash Flow Margin: 0.5%, down from 4.3% in the same quarter last year

- Market Capitalization: $10.16 billion

“During 2025, market conditions remained attractive as input costs were relatively stable and the affordability of chicken continued to resonate among consumers,” said Fabio Sandri, Pilgrim’s CEO.

Company Overview

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ: PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $18.5 billion in revenue over the past 12 months, Pilgrim's Pride is larger than most consumer staples companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. Its size also gives it negotiating leverage with distributors, allowing its products to reach more shelves. However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. To accelerate sales, Pilgrim's Pride likely needs to optimize its pricing or lean into new products and international expansion.

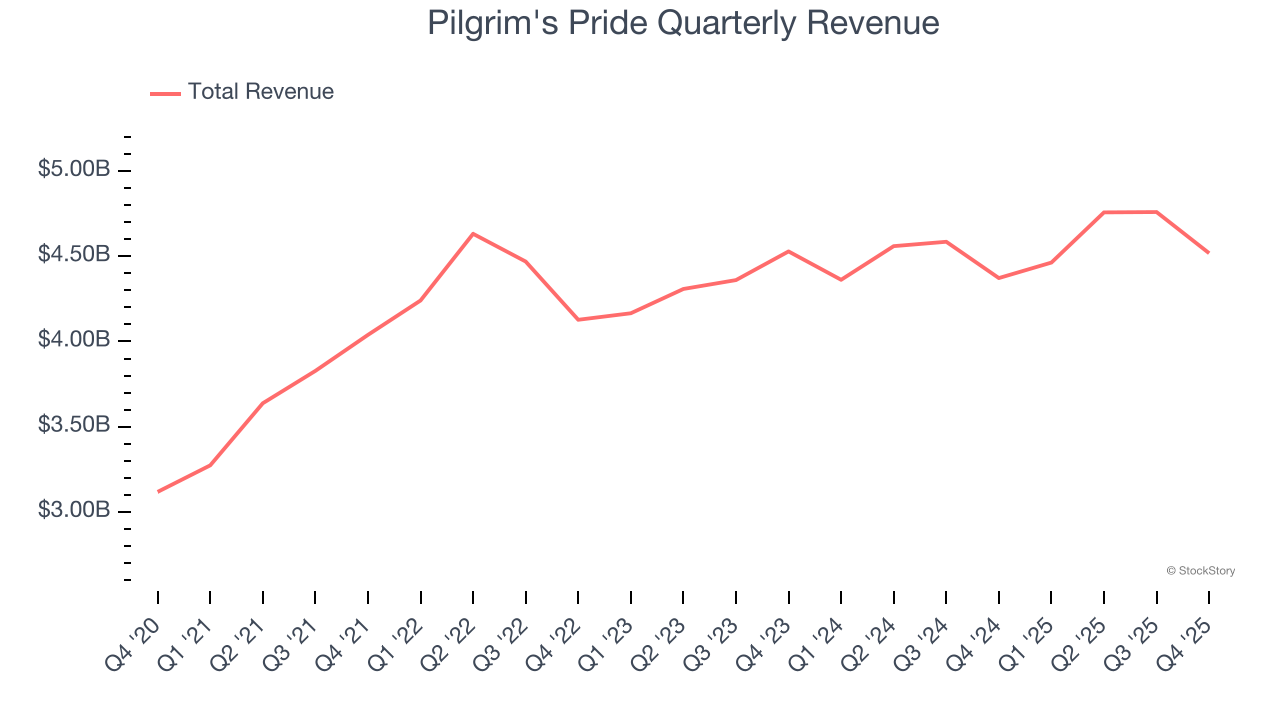

As you can see below, Pilgrim's Pride’s 1.9% annualized revenue growth over the last three years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Pilgrim's Pride reported modest year-on-year revenue growth of 3.3% but beat Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and indicates its products will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

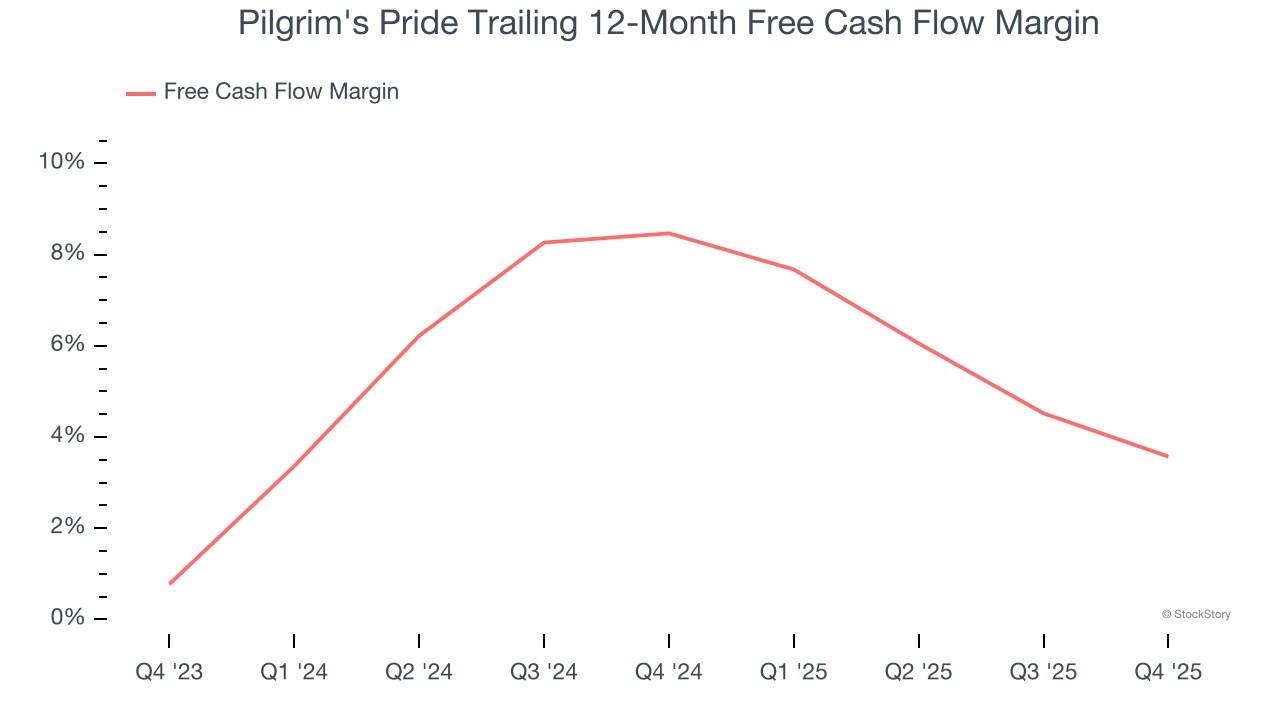

Pilgrim's Pride has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that Pilgrim's Pride’s margin dropped by 4.9 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Pilgrim's Pride broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 3.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Pilgrim's Pride’s Q4 Results

We enjoyed seeing Pilgrim's Pride beat analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $43.20 immediately following the results.

Big picture, is Pilgrim's Pride a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).