Private corrections company GEO Group (NYSE: GEO) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 16.5% year on year to $707.7 million. On the other hand, next quarter’s revenue guidance of $685 million was less impressive, coming in 1.2% below analysts’ estimates. Its GAAP profit of $0.23 per share was in line with analysts’ consensus estimates.

Is now the time to buy GEO Group? Find out by accessing our full research report, it’s free.

GEO Group (GEO) Q4 CY2025 Highlights:

- Revenue: $707.7 million vs analyst estimates of $669.1 million (16.5% year-on-year growth, 5.8% beat)

- EPS (GAAP): $0.23 vs analyst estimates of $0.23 (in line)

- Adjusted EBITDA: $126 million vs analyst estimates of $120.3 million (17.8% margin, 4.7% beat)

- Revenue Guidance for Q1 CY2026 is $685 million at the midpoint, below analyst estimates of $693.6 million

- EPS (GAAP) guidance for the upcoming financial year 2026 is $1.03 at the midpoint, missing analyst estimates by 17.4%

- EBITDA guidance for the upcoming financial year 2026 is $500 million at the midpoint, below analyst estimates of $536.1 million

- Operating Margin: 11.8%, in line with the same quarter last year

- Market Capitalization: $2.16 billion

George C. Zoley, GEO’s Chairman, Chief Executive Officer and Founder, said, “We are pleased with our strong fourth quarter financial results, which were underpinned by strong operational performance across our diversified business segments. In 2025, we made significant progress towards meeting our financial and strategic objectives. We entered into new or expanded contracts, which are expected to generate up to approximately $520 million in annualized revenues, making it the most successful year for new business wins in our Company’s history.”

Company Overview

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.63 billion in revenue over the past 12 months, GEO Group is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

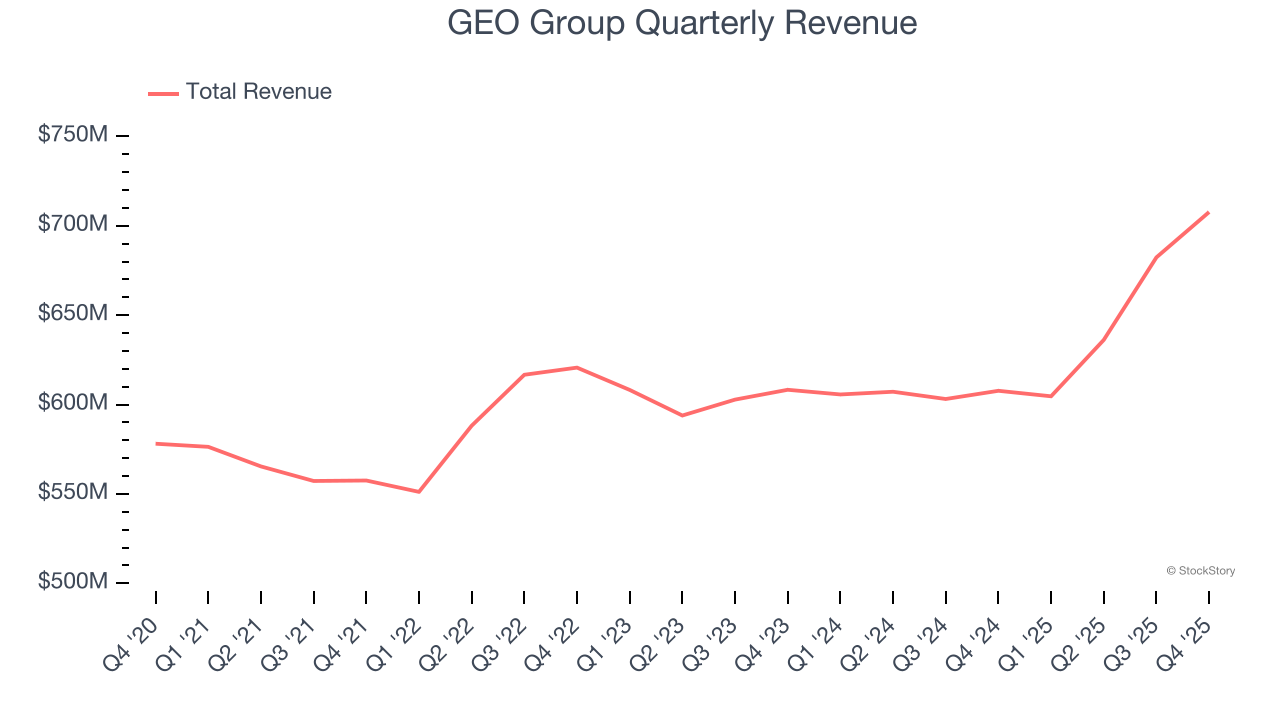

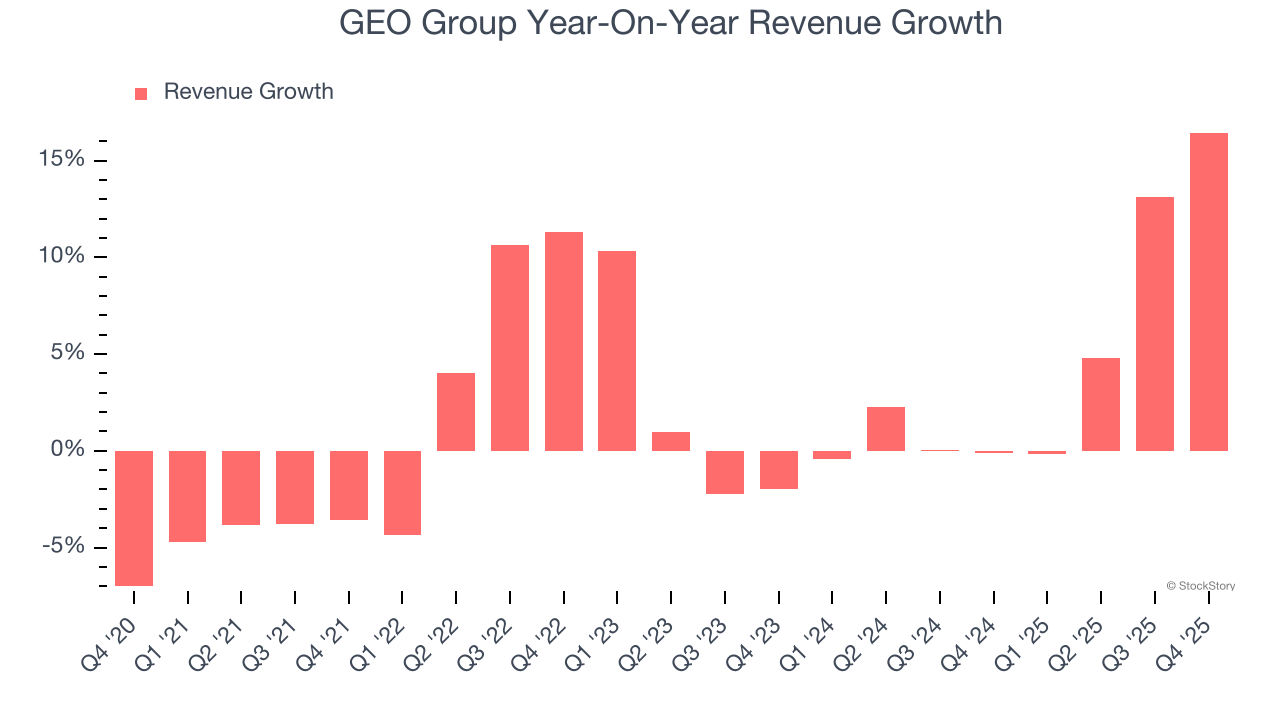

As you can see below, GEO Group’s 2.3% annualized revenue growth over the last five years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. GEO Group’s annualized revenue growth of 4.4% over the last two years is above its five-year trend, which is encouraging.

This quarter, GEO Group reported year-on-year revenue growth of 16.5%, and its $707.7 million of revenue exceeded Wall Street’s estimates by 5.8%. Company management is currently guiding for a 13.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.1% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates its newer products and services will spur better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

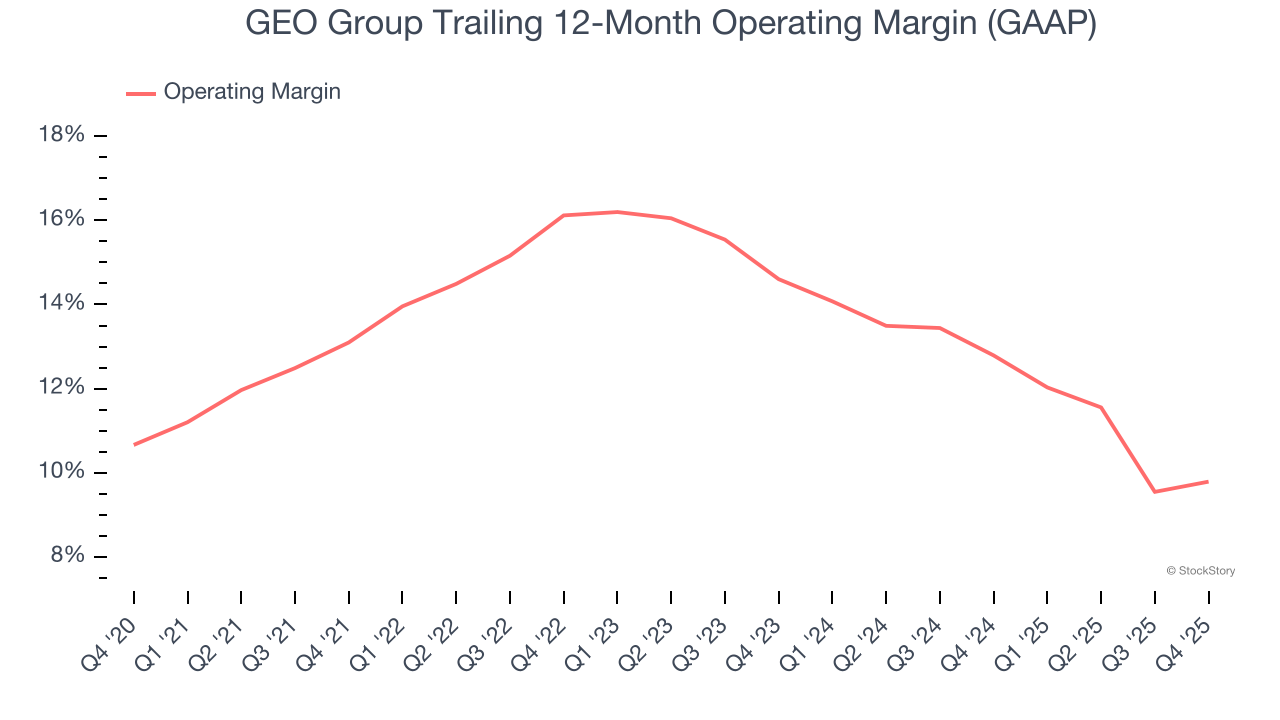

GEO Group has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 13.2%.

Analyzing the trend in its profitability, GEO Group’s operating margin decreased by 3.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, GEO Group generated an operating margin profit margin of 11.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

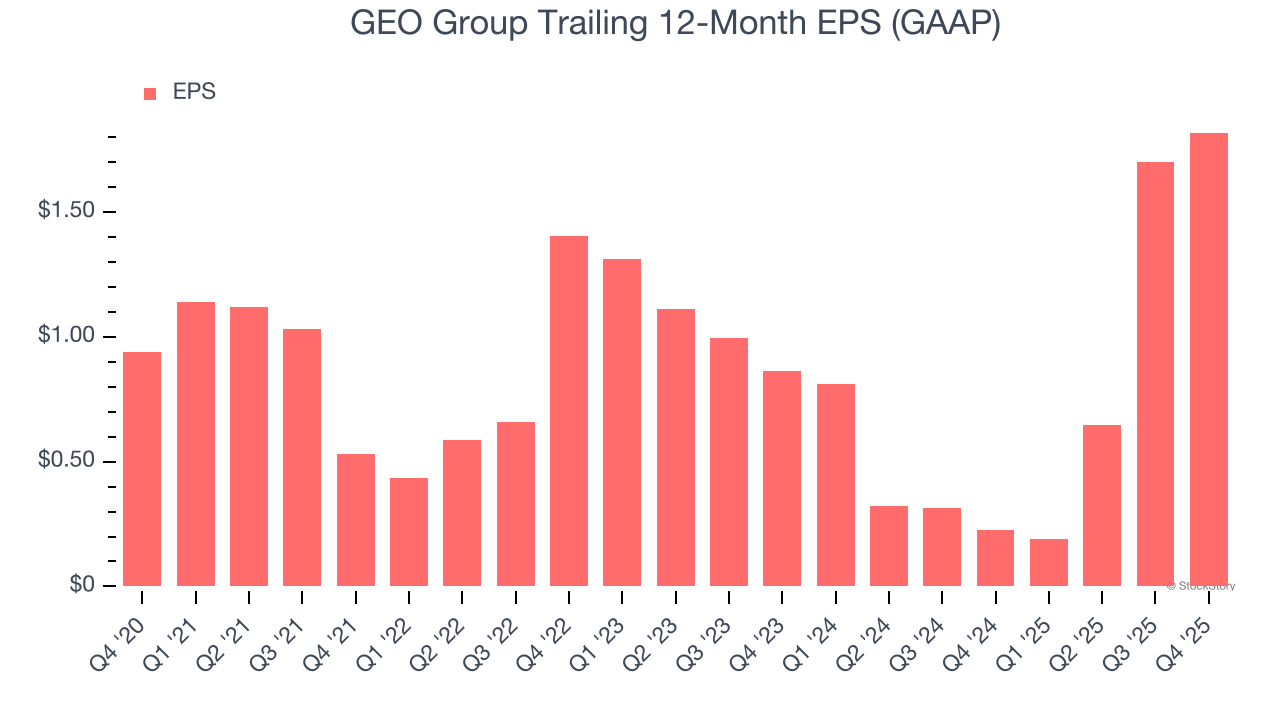

GEO Group’s EPS grew at a spectacular 14.1% compounded annual growth rate over the last five years, higher than its 2.3% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For GEO Group, its two-year annual EPS growth of 45.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, GEO Group reported EPS of $0.23, up from $0.11 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects GEO Group’s full-year EPS of $1.82 to shrink by 32.4%.

Key Takeaways from GEO Group’s Q4 Results

We were impressed by how significantly GEO Group blew past analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.1% to $15.50 immediately after reporting.

GEO Group’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).