Electric vehicle manufacturer Rivian (NASDAQ: RIVN) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 25.8% year on year to $1.29 billion. Its GAAP loss of $0.66 per share was 16.7% above analysts’ consensus estimates.

Is now the time to buy Rivian? Find out by accessing our full research report, it’s free.

Rivian (RIVN) Q4 CY2025 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.28 billion (25.8% year-on-year decline, 0.7% beat)

- EPS (GAAP): -$0.66 vs analyst estimates of -$0.79 (16.7% beat)

- Adjusted EBITDA: -$465 million (-36.2% margin, 67.9% year-on-year decline)

- EBITDA guidance for the upcoming financial year 2026 is -$1.95 billion at the midpoint, below analyst estimates of -$1.81 billion

- Adjusted EBITDA Margin: -36.2%, down from -16% in the same quarter last year

- Free Cash Flow was -$1.14 billion, down from $856 million in the same quarter last year

- Sales Volumes fell 31.3% year on year (1.5% in the same quarter last year)

- Market Capitalization: $18.09 billion

Company Overview

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ: RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

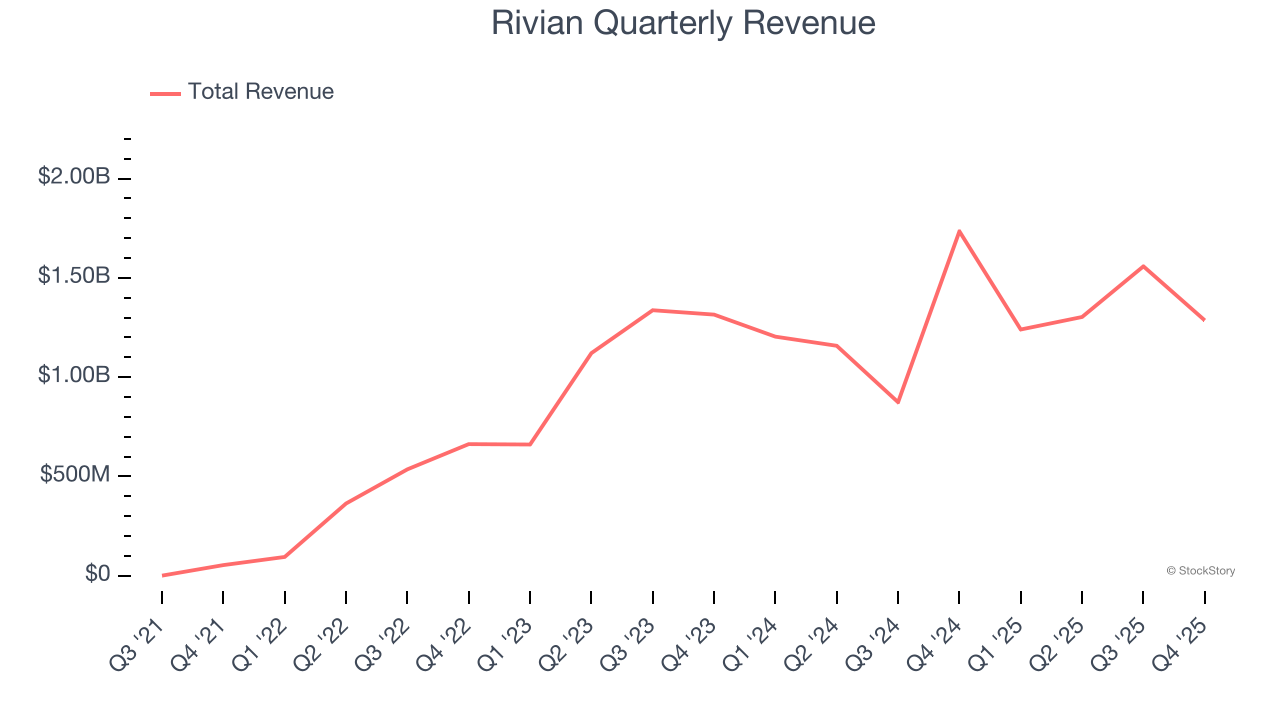

Revenue Growth

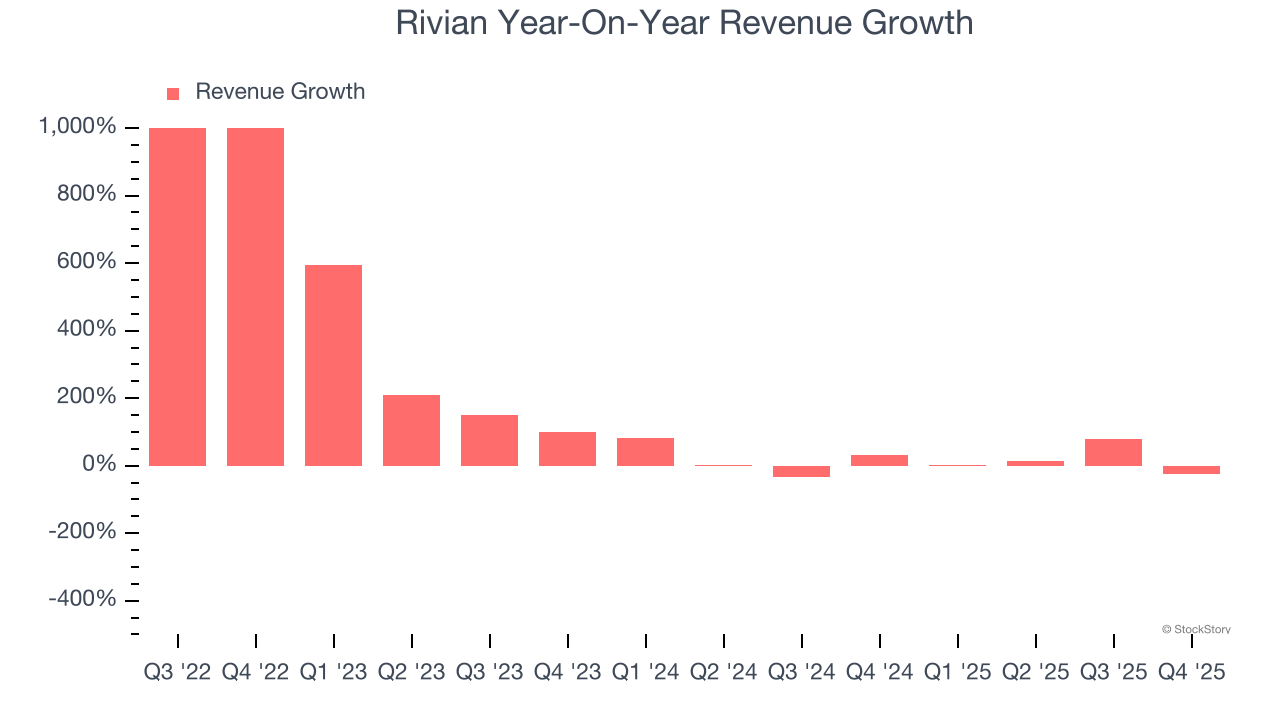

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Rivian’s sales grew at an incredible 168% compounded annual growth rate over the last four years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Rivian’s annualized revenue growth of 10.2% over the last two years is below its four-year trend, but we still think the results suggest healthy demand. Rivian’s recent performance shows it’s one of the better Automobile Manufacturing businesses as many of its peers faced declining sales because of cyclical headwinds.

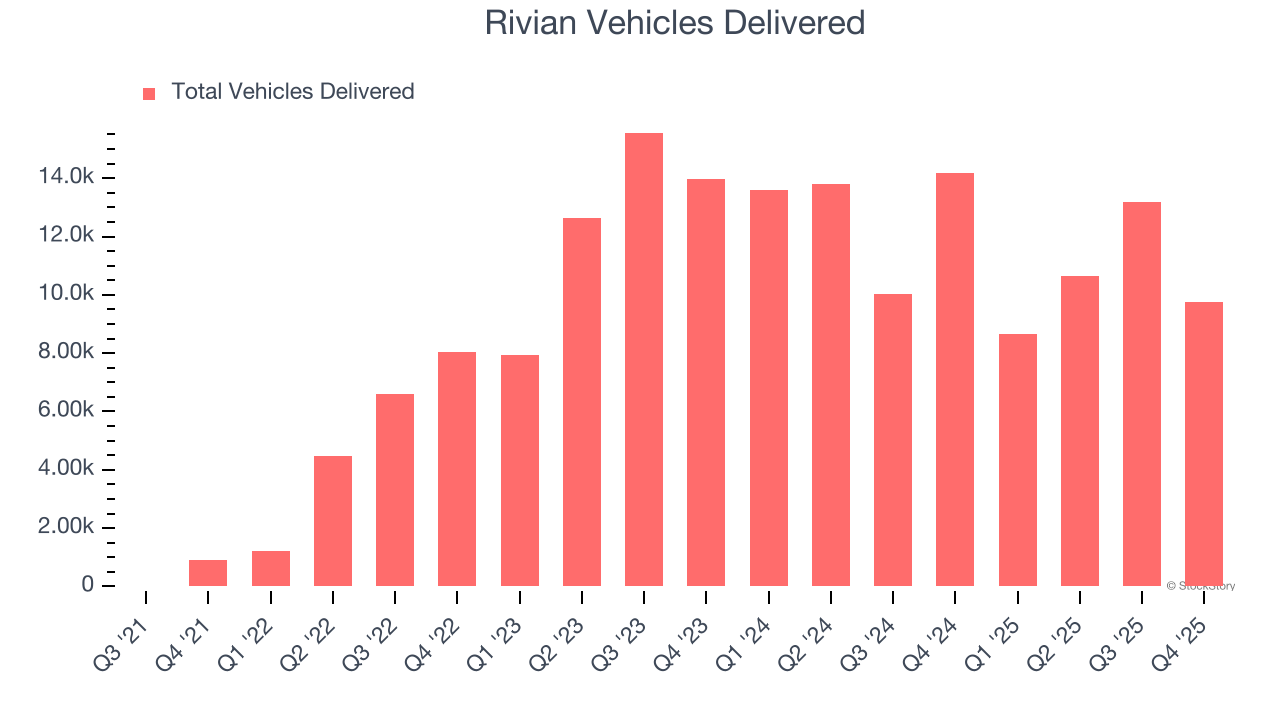

Rivian also reports its number of vehicles delivered, which reached 9,745 in the latest quarter. Over the last two years, Rivian’s vehicles delivered declined by 8.2% annually. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Rivian’s revenue fell by 25.8% year on year to $1.29 billion but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 25.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

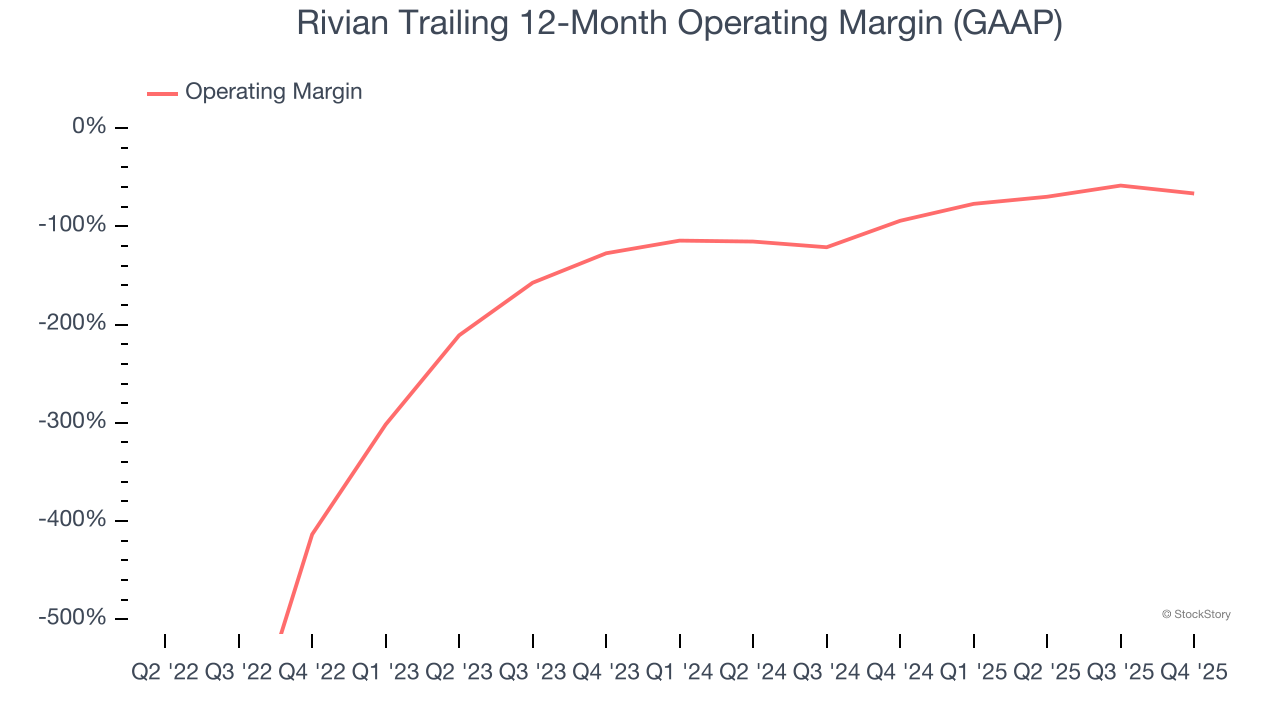

Operating Margin

Rivian’s high expenses have contributed to an average operating margin of negative 141% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Rivian’s operating margin rose over the last five years, as its sales growth gave it operating leverage. We’ll take Rivian’s improvement as many Automobile Manufacturing companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

In Q4, Rivian generated a negative 64.8% operating margin.

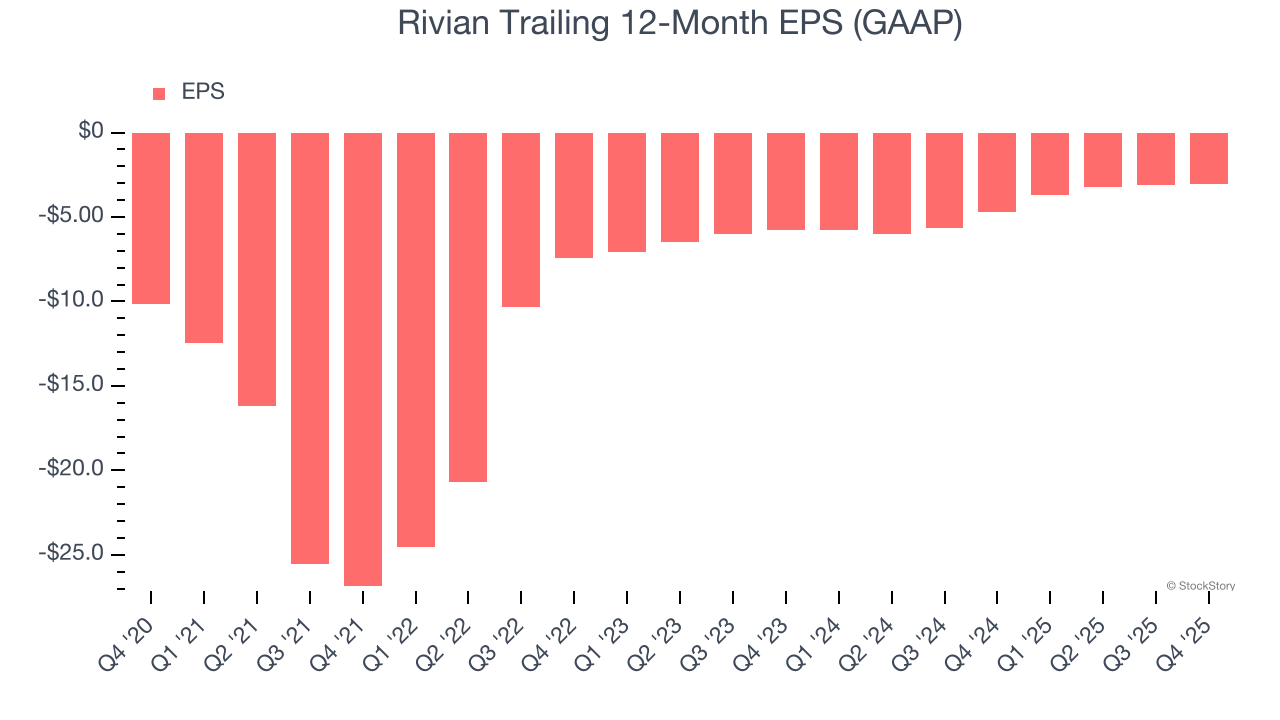

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Rivian’s full-year earnings are still negative, it reduced its losses and improved its EPS by 21.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon, especially since it recently diluted shareholders by forming a $5.8 billion joint venture with Volkswagen in November 2024.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Rivian, its two-year annual EPS growth of 27% was higher than its five-year trend. We love it when earnings improve, but a caveat is that its EPS is still in the red.

In Q4, Rivian reported EPS of negative $0.66, up from negative $0.70 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Rivian to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.07 will advance to negative $2.91.

Key Takeaways from Rivian’s Q4 Results

We were impressed by how significantly Rivian blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed. Overall, this print had some key positives. The stock traded up 7.6% to $15.09 immediately after reporting.

Rivian had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).