Over the past six months, Cohen & Steers’s stock price fell to $66.16. Shareholders have lost 15.1% of their capital, which is disappointing considering the S&P 500 has climbed by 7.3%. This might have investors contemplating their next move.

Is now the time to buy Cohen & Steers, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Cohen & Steers Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are two reasons you should be careful with CNS and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

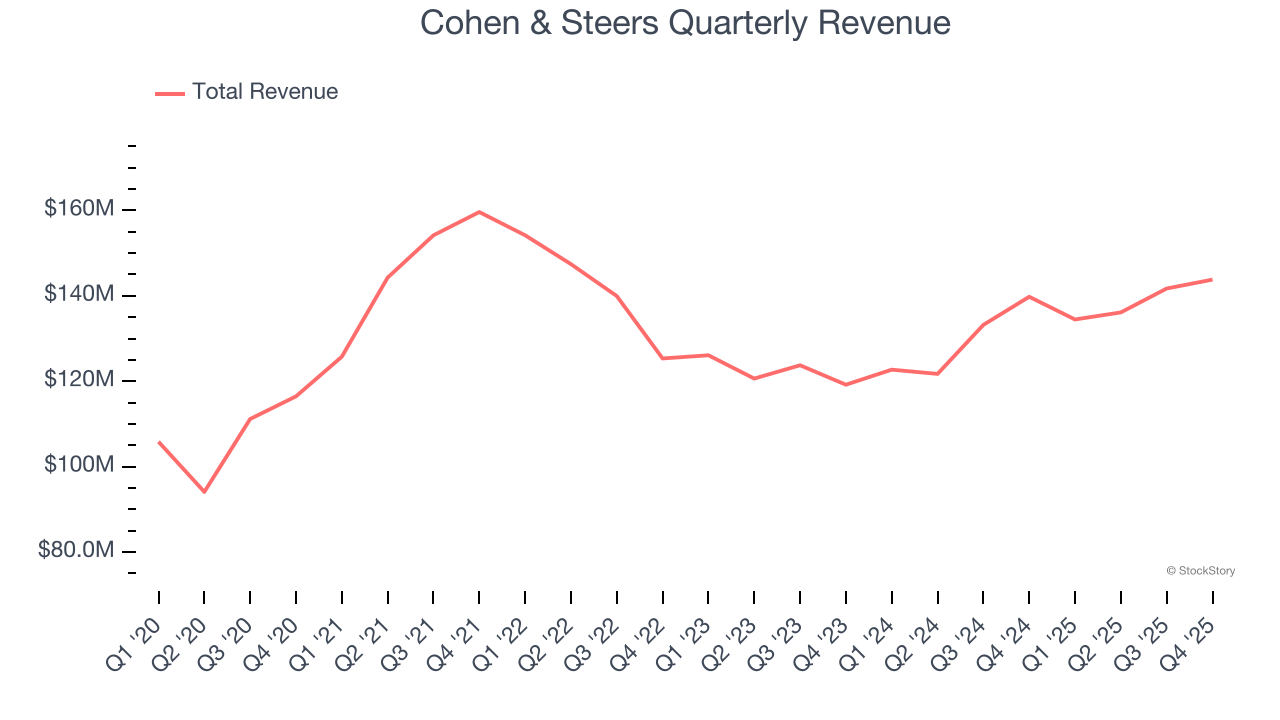

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

Unfortunately, Cohen & Steers’s 5.4% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the financials sector.

2. EPS Barely Growing

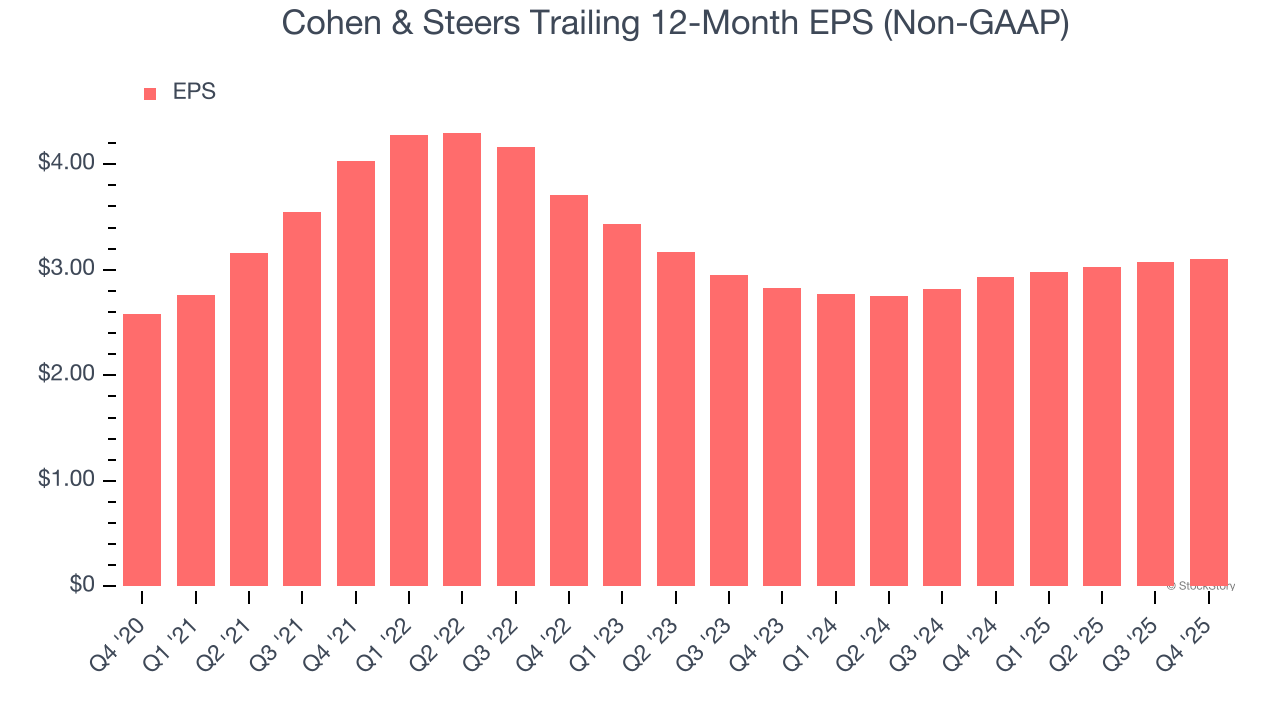

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Cohen & Steers’s weak 3.7% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Final Judgment

Cohen & Steers isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 19.5× forward P/E (or $66.16 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Cohen & Steers

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.