Biotechnology company Moderna (NASDAQ: MRNA) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 29.8% year on year to $678 million. Its GAAP loss of $2.11 per share was 18.9% above analysts’ consensus estimates.

Is now the time to buy Moderna? Find out by accessing our full research report, it’s free.

Moderna (MRNA) Q4 CY2025 Highlights:

- Revenue: $678 million vs analyst estimates of $660.2 million (29.8% year-on-year decline, 2.7% beat)

- EPS (GAAP): -$2.11 vs analyst estimates of -$2.60 (18.9% beat)

- Reiterates "up to 10% revenue growth" and GAAP operating expense reductions in 2026

- US regulators announced they will not review Moderna's flu vaccine application, arguing that its trial was flawed

- Operating Margin: -126%, up from -129% in the same quarter last year

- Free Cash Flow Margin: 131%, up from 31.4% in the same quarter last year

- Market Capitalization: $15.67 billion

Company Overview

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ: MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Revenue Growth

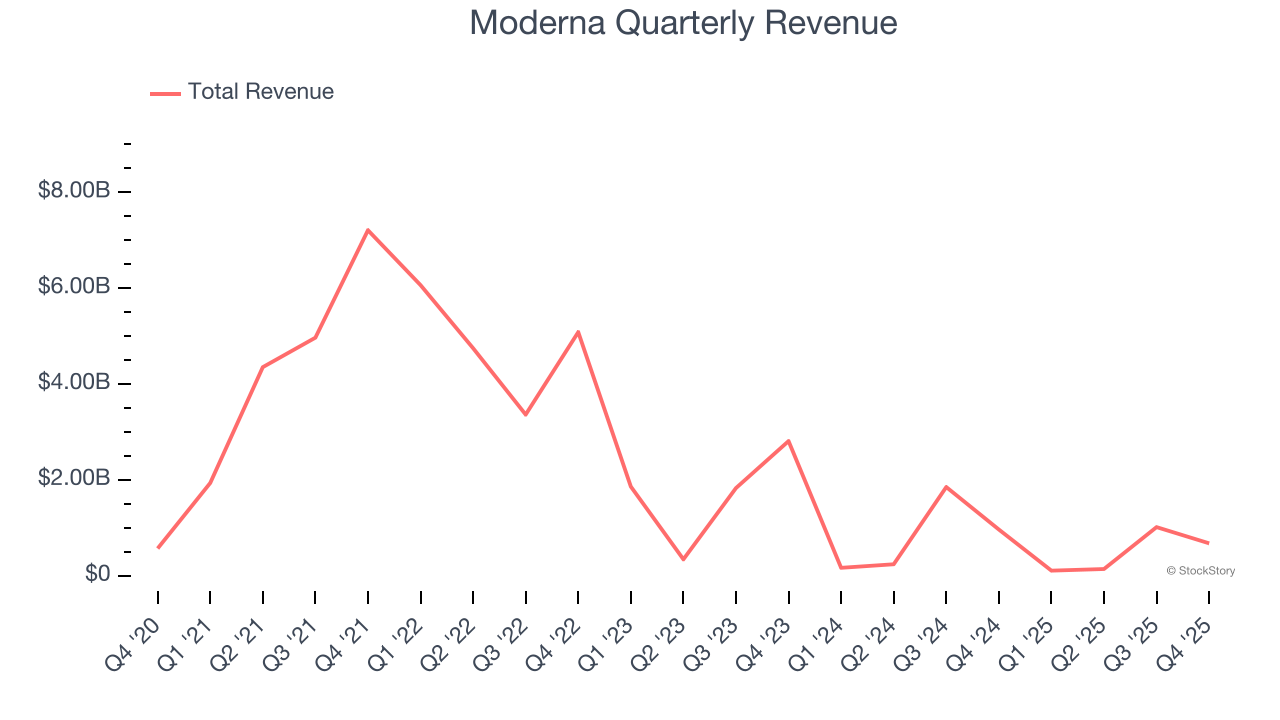

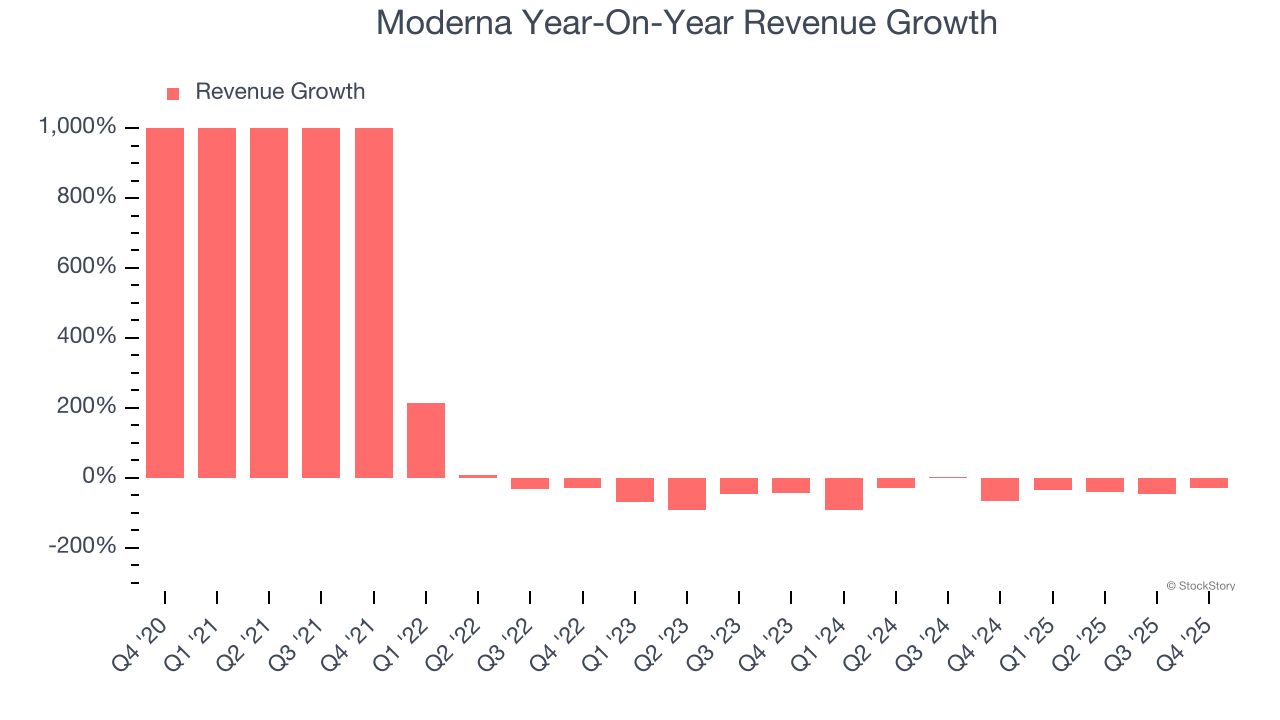

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Moderna’s 19.3% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Moderna’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 46.7% over the last two years.

This quarter, Moderna’s revenue fell by 29.8% year on year to $678 million but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

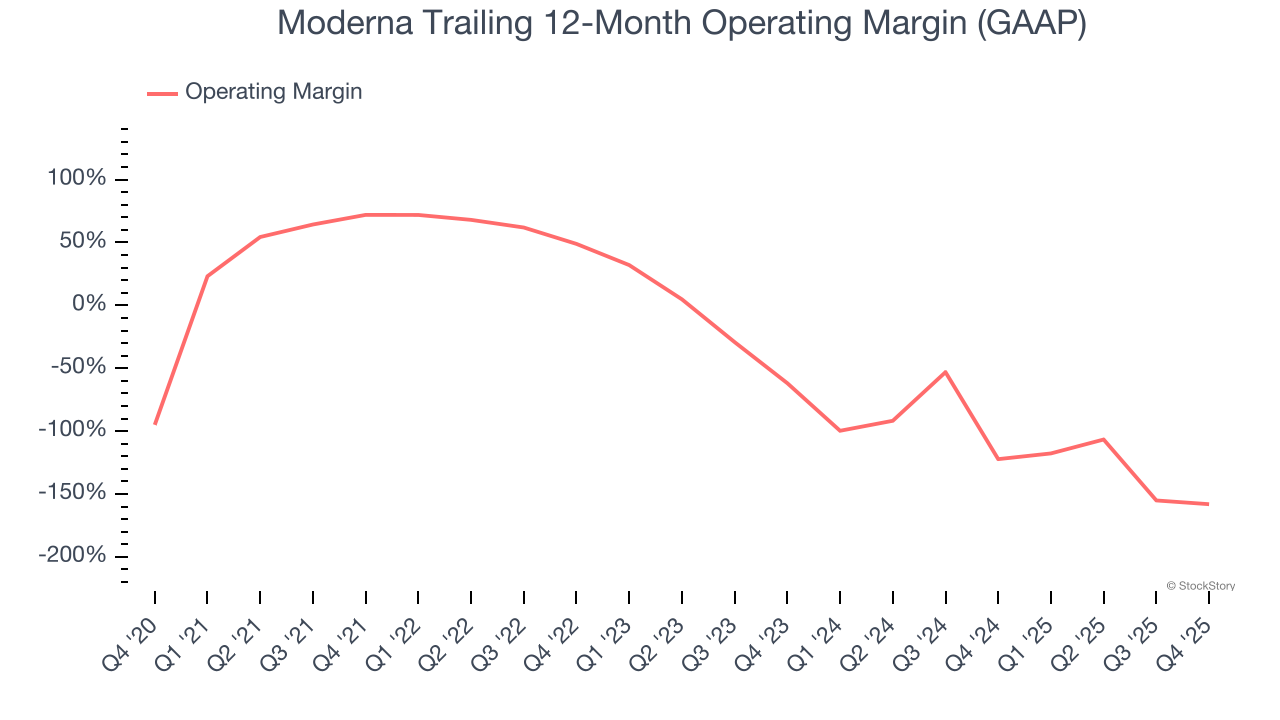

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Moderna has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 23%.

Analyzing the trend in its profitability, Moderna’s operating margin decreased significantly over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 96.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Moderna generated an operating margin profit margin of negative 126%, up 2.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

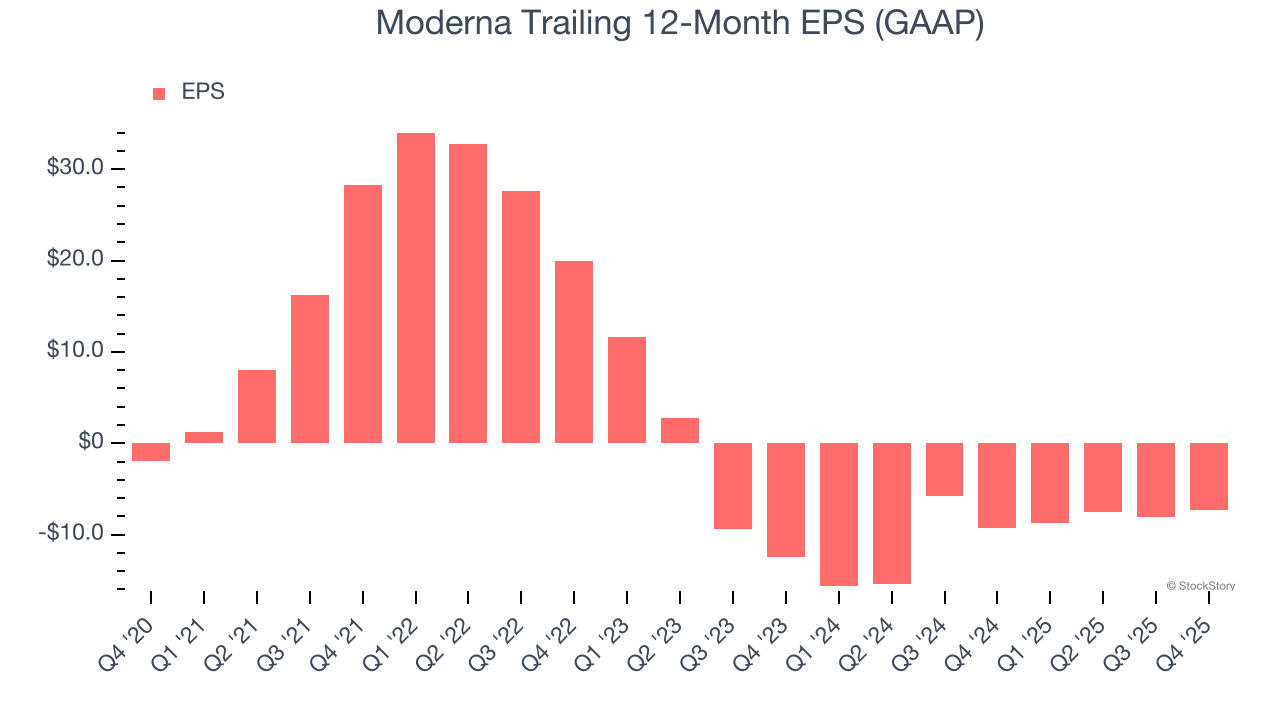

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Moderna’s earnings losses deepened over the last five years as its EPS dropped 30.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Moderna’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, Moderna reported EPS of negative $2.11, up from negative $2.91 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Moderna to improve its earnings losses. Analysts forecast its full-year EPS of negative $7.26 will advance to negative $6.68.

Key Takeaways from Moderna’s Q4 Results

It was good to see Moderna beat analysts’ revenue and EPS expectations this quarter. The company also reiterated previously-stated financial targets for 2026. On the negative side, US regulators are refusing to review the company's influenza vaccine. Investors were likely hoping for more, and shares traded down 1.5% to $39.52 immediately after reporting.

Is Moderna an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).