As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the multi-line insurance industry, including Chubb (NYSE: CB) and its peers.

Multi-line insurance companies operate a diversified business model, offering a broad suite of products that span both Property & Casualty (P&C) and Life & Health (L&H) insurance. This diversification allows them to generate revenue from multiple, often uncorrelated, underwriting pools while also earning investment income on their combined float. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. The market environment also matters for P&C operations specifically, with a 'hard market' characterized by pricing increases that outstrip claim costs, resulting in higher profits while a 'soft market' is the opposite. On the other hand, a key headwind is increasing volatility and severity of catastrophe losses, driven by climate change, which poses a significant threat to P&C underwriting results.

The 7 multi-line insurance stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 6.8%.

In light of this news, share prices of the companies have held steady as they are up 2.4% on average since the latest earnings results.

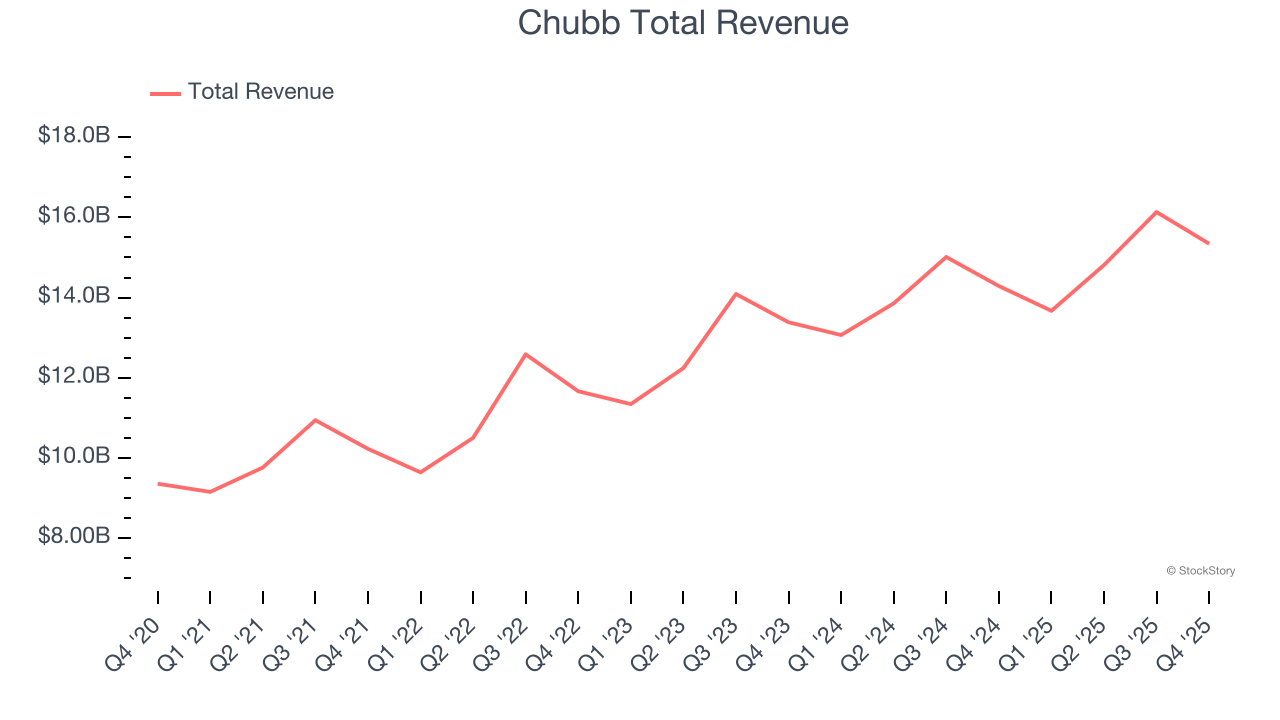

Chubb (NYSE: CB)

Dating back to when a Civil War veteran created a frost-proof water meter, Chubb Limited (NYSE: CB) provides commercial and personal property and casualty insurance, reinsurance, and life insurance products to a diverse client base across 54 countries.

Chubb reported revenues of $15.34 billion, up 7.4% year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ book value per share estimates and net premiums earned in line with analysts’ estimates.

Chubb achieved the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 5.5% since reporting and currently trades at $330.56.

Read our full report on Chubb here, it’s free.

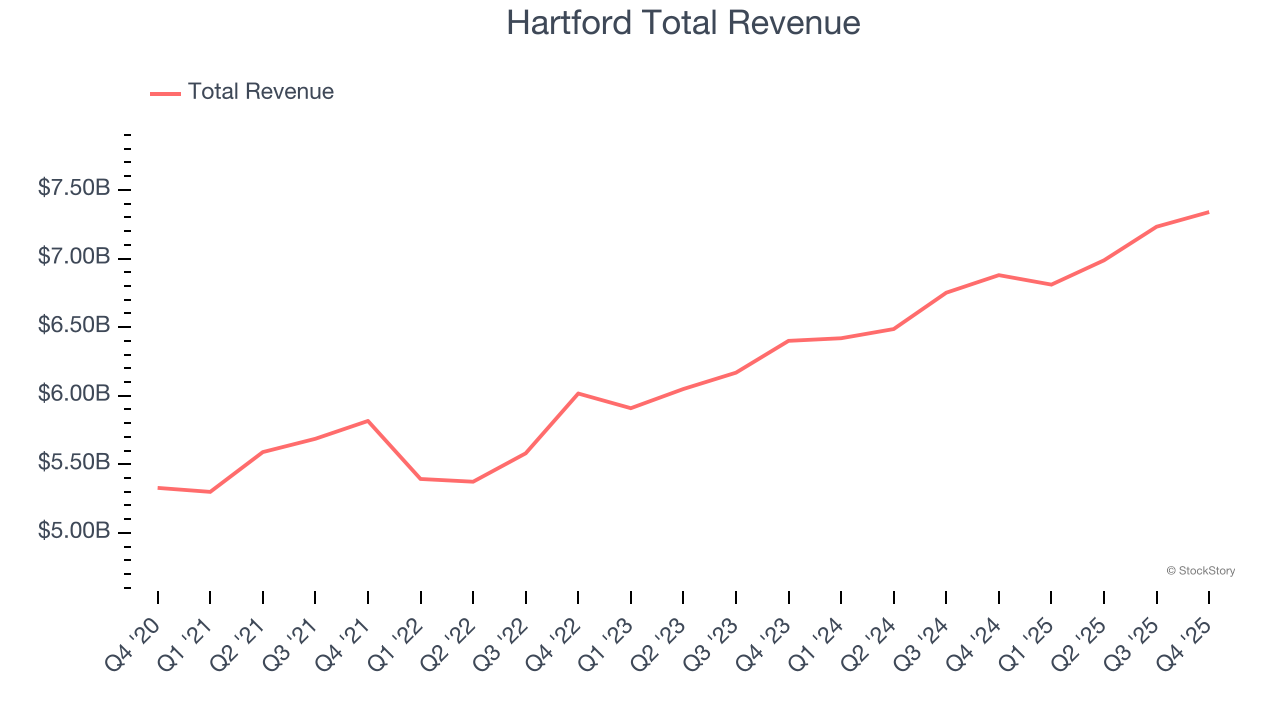

Best Q4: Hartford (NYSE: HIG)

Recognizable by its iconic stag logo that dates back to 1810, The Hartford (NYSE: HIG) provides property and casualty insurance, group benefits, and investment products to individuals and businesses across the United States.

Hartford reported revenues of $7.34 billion, up 6.7% year on year, outperforming analysts’ expectations by 49.9%. The business had a very strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net premiums earned estimates.

Hartford achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 6.5% since reporting. It currently trades at $140.96.

Is now the time to buy Hartford? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Kemper (NYSE: KMPR)

Originally known as Unitrin until rebranding in 2011, Kemper (NYSE: KMPR) is an insurance holding company that provides automobile, homeowners, life, and other insurance products to individuals and businesses across the United States.

Kemper reported revenues of $1.14 billion, down 4.3% year on year, falling short of analysts’ expectations by 5.6%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net premiums earned estimates.

Kemper delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 16.4% since the results and currently trades at $32.20.

Read our full analysis of Kemper’s results here.

AIG (NYSE: AIG)

With roots dating back to 1919 when it began as a small insurance agency in Shanghai, China, AIG (NYSE: AIG) is a global insurance organization that provides commercial and personal insurance solutions to businesses and individuals across more than 200 countries.

AIG reported revenues of $6.95 billion, up 1.4% year on year. This number met analysts’ expectations. Zooming out, it was a softer quarter as it recorded a significant miss of analysts’ EPS estimates and a significant miss of analysts’ book value per share estimates.

The stock is up 4.5% since reporting and currently trades at $78.37.

Read our full, actionable report on AIG here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.