Ophthalmology biopharmaceutical company Ocular Therapeutix (NASDAQ: OCUL) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 22.4% year on year to $13.25 million. Its non-GAAP loss of $0.29 per share was 13.9% above analysts’ consensus estimates.

Is now the time to buy Ocular Therapeutix? Find out by accessing our full research report, it’s free.

Ocular Therapeutix (OCUL) Q4 CY2025 Highlights:

- Revenue: $13.25 million vs analyst estimates of $14.89 million (22.4% year-on-year decline, 11% miss)

- Adjusted EPS: -$0.29 vs analyst estimates of -$0.34 (13.9% beat)

- Adjusted EBITDA: -$68.51 million (-517% margin, 38.1% year-on-year decline)

- Operating Margin: -526%, down from -296% in the same quarter last year

- Free Cash Flow was -$57.09 million compared to -$39.63 million in the same quarter last year

- Market Capitalization: $1.82 billion

Company Overview

Pioneering a drug delivery platform that can eliminate the need for monthly eye injections, Ocular Therapeutix (NASDAQ: OCUL) develops sustained-release treatments for eye diseases using its proprietary ELUTYX bioresorbable hydrogel technology that gradually releases medication.

Revenue Growth

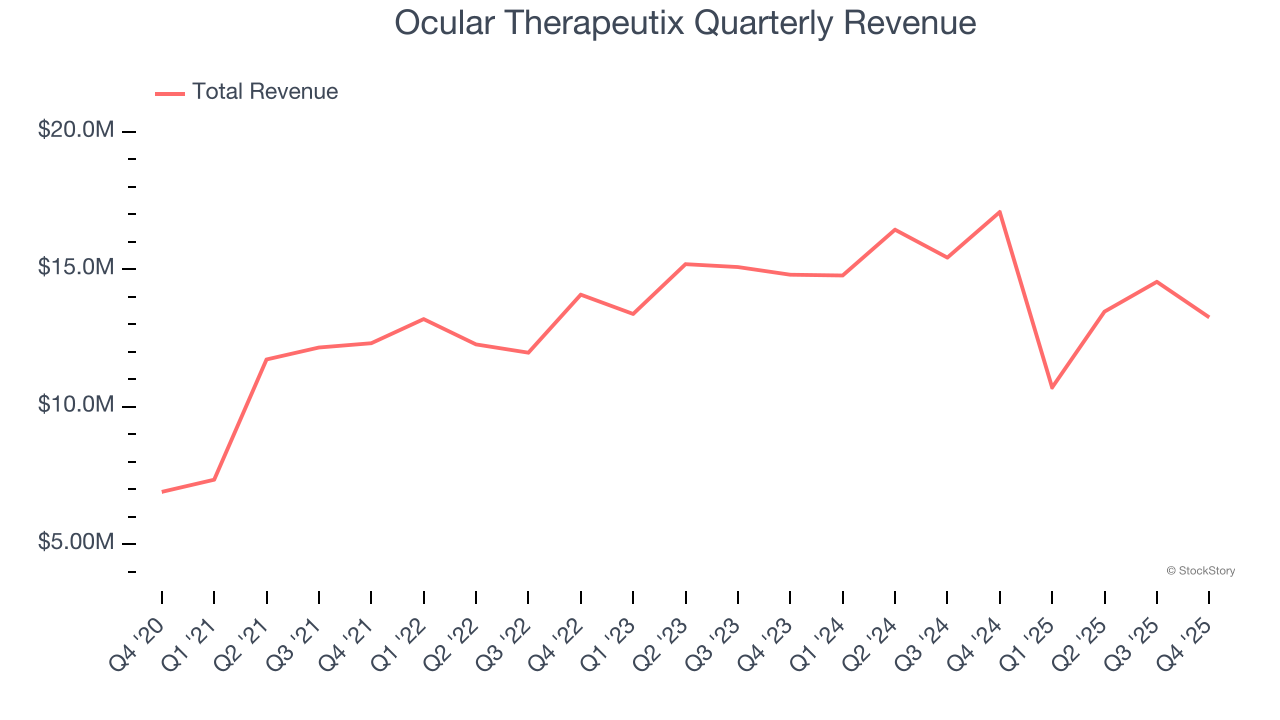

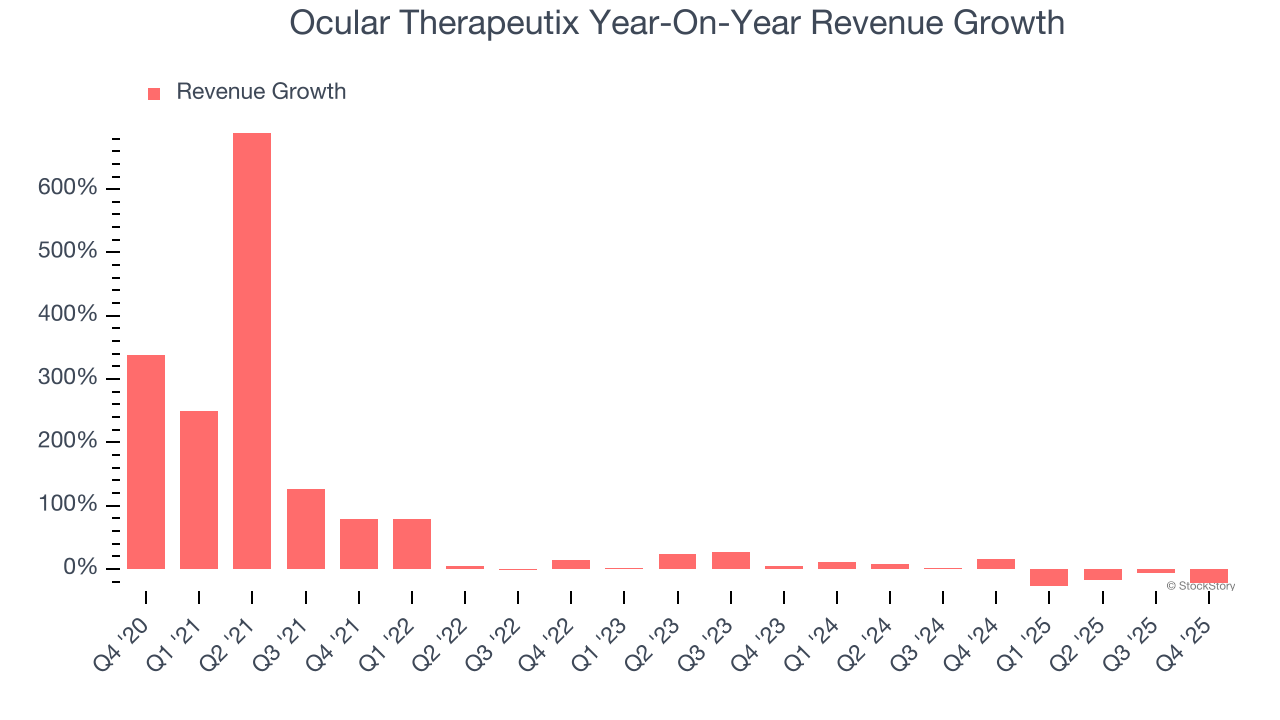

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Ocular Therapeutix’s sales grew at an exceptional 26.8% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Ocular Therapeutix’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.7% over the last two years.

This quarter, Ocular Therapeutix missed Wall Street’s estimates and reported a rather uninspiring 22.4% year-on-year revenue decline, generating $13.25 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

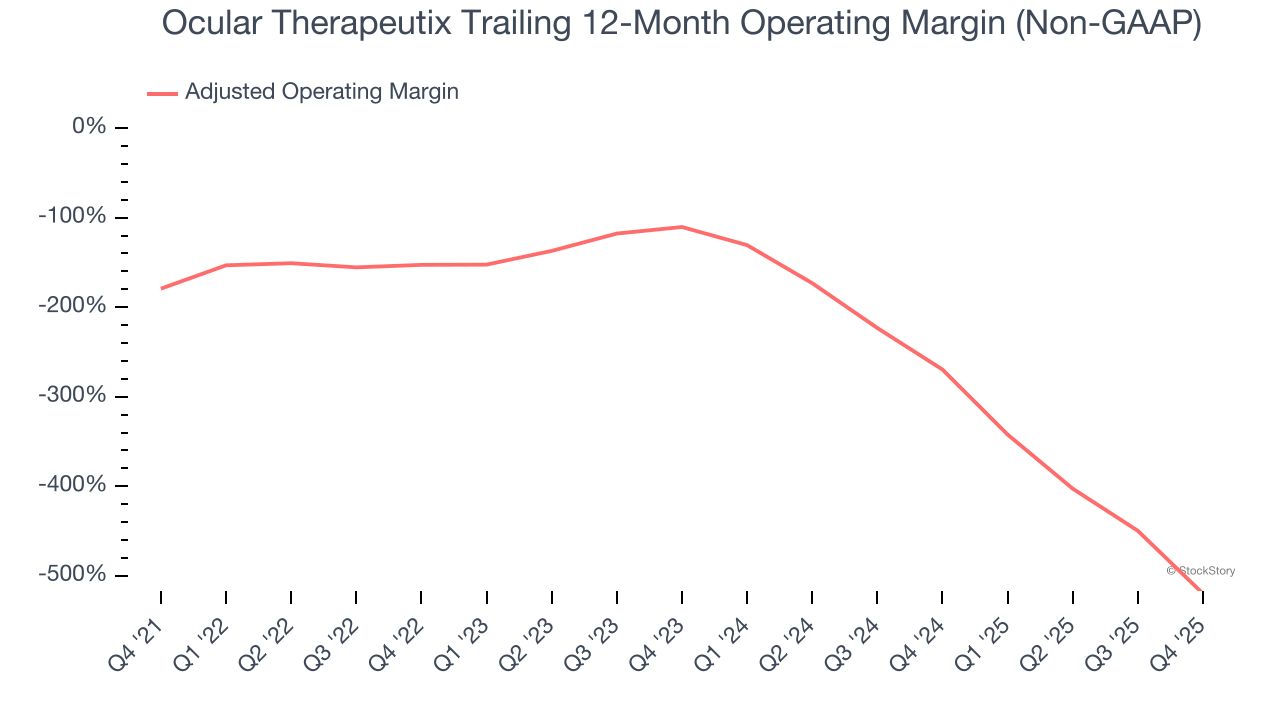

Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Ocular Therapeutix’s high expenses have contributed to an average adjusted operating margin of negative 246% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Ocular Therapeutix’s adjusted operating margin decreased significantly over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 409.3 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

Ocular Therapeutix’s adjusted operating margin was negative 526% this quarter.

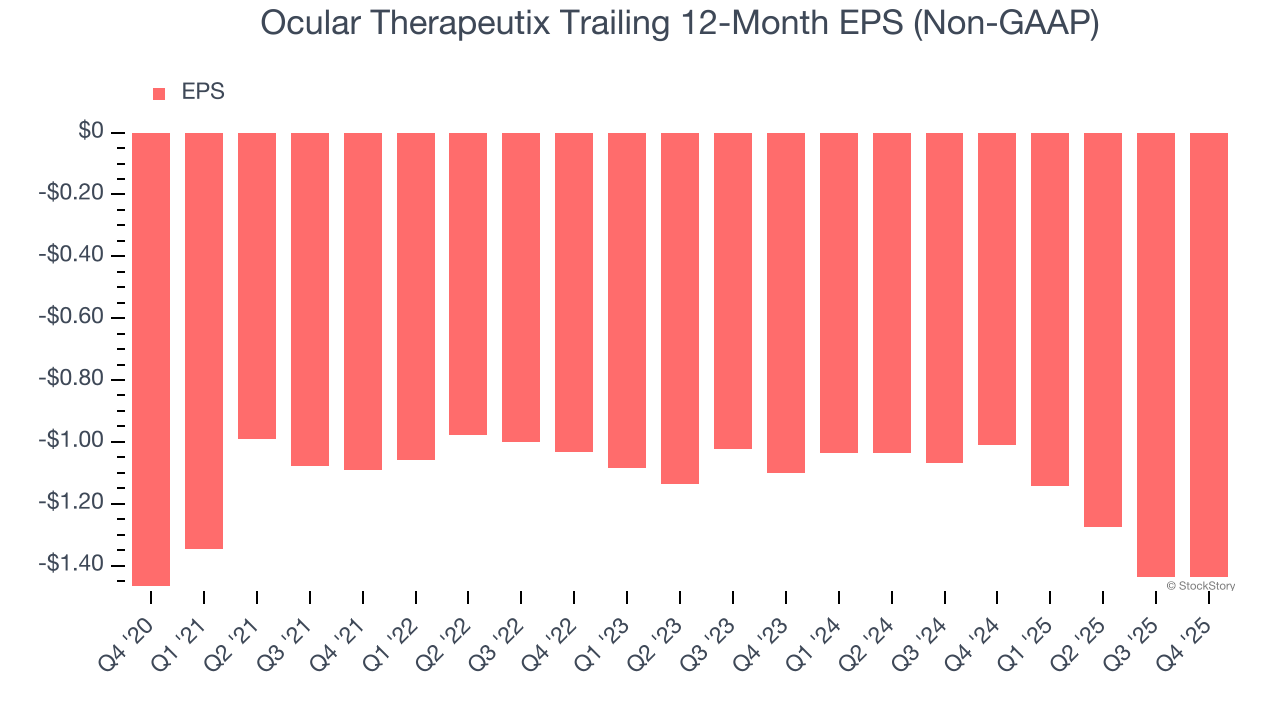

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Ocular Therapeutix’s full-year EPS was flat over the last five years. This performance was underwhelming across the board.

In Q4, Ocular Therapeutix reported adjusted EPS of negative $0.29, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ocular Therapeutix to perform poorly. Analysts forecast its full-year EPS of negative $1.44 will tumble to negative $1.50.

Key Takeaways from Ocular Therapeutix’s Q4 Results

It was good to see Ocular Therapeutix beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a softer quarter. The stock remained flat at $8.96 immediately after reporting.

Big picture, is Ocular Therapeutix a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).