Valued at a market cap of $12.6 billion, Domino's Pizza, Inc. (DPZ) is a pizza restaurant chain and one of the world’s largest quick-service restaurant (QSR) brands. The Ann Arbor, Michigan-based company generates revenue from royalty payments, supply chain operations, and company-owned stores.

This pizza restaurant chain has underperformed the broader market over the past 52 weeks. Shares of DPZ have declined 19.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a YTD basis, the stock is down 8.1%, compared to SPX’s marginal rise.

Narrowing the focus, DPZ has also lagged behind the AdvisorShares Restaurant ETF (EATZ), which decreased 9.5% over the past 52 weeks and gained 6.5% on a YTD basis.

On Jan. 5, DPZ fell 3.3% after The Toronto-Dominion Bank (TD) downgraded the stock from “Buy” to “Hold,” citing more challenging growth prospects ahead. The firm pointed to weakening same-store sales momentum, higher input costs impacting franchisees, and intensifying competition within the delivery and quick-service pizza segment as key concerns.

For the current fiscal year, ending in December, analysts expect DPZ’s EPS to grow 5% year over year to $17.52. The company’s earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters, while missing on two other occasions.

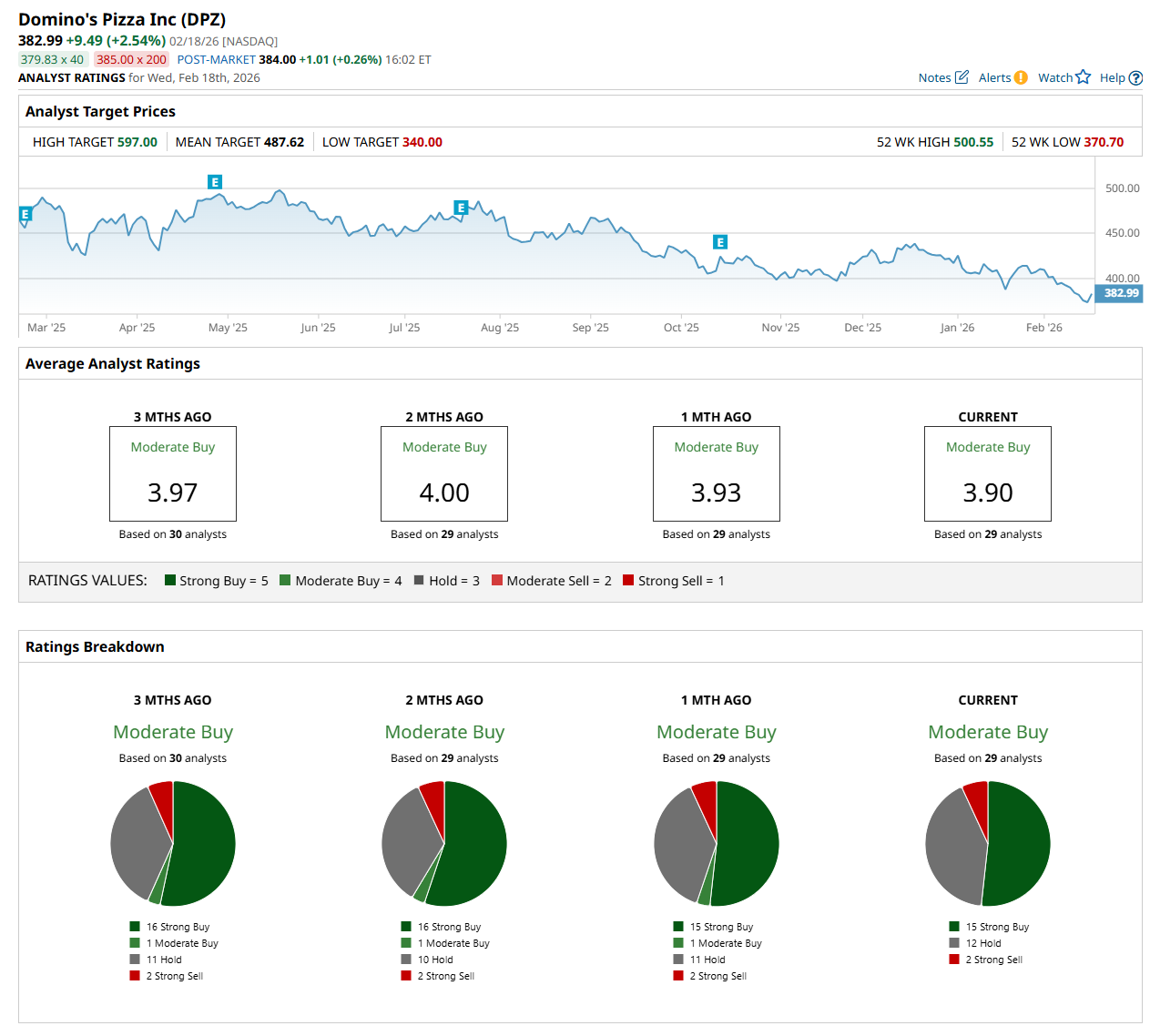

Among the 29 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 15 “Strong Buy,” 12 "Hold,” and two “Strong Sell” ratings.

The configuration is less bullish than two months ago, with 16 analysts suggesting a “Strong Buy” rating.

On Feb. 13, UBS analyst Dennis Geiger maintained a "Buy" rating on DPZ but lowered its price target to $500, indicating a 30.6% potential upside from the current levels.

The mean price target of $487.62 suggests a 27.3% potential upside from the current levels, while its Street-high price target of $597 suggests a 55.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart