Goldman Sachs (GS) stock has been in a steady uptrend with returns of 38% in the last 52 weeks. This rally has been supported by healthy quarterly results, with Goldman dominating the dealmaking market in 2025. As a matter of fact, the investment bank has advised on more than 50% of deals exceeding $10 billion in 2025.

While merger and acquisition deals increased by 10% in 2025, they're likely to rise by another 3% in 2026. Further, with the likelihood of larger deals, the deal value is expected to surpass $2 trillion in the United States.

It’s therefore not surprising that there has been an increased amount of investor interest in GS stock. According to recent reports, Stanley Druckenmiller's Duquesne Family Office has initiated a position in Goldman Sachs with an exposure of 28,000 common stock. With factors of strong fundamentals, growth tailwinds, and relatively lower interest rates, GS stock still seems attractive.

About Goldman Sachs Stock

Goldman Sachs is among the leading financial institutions with a global presence. The investment bank provides a wide range of services to corporations, financial institutions, governments, and individuals. Goldman’s key business segments include global banking & markets and asset & wealth management.

For FY25, Goldman reported net revenue of $58.28 billion and net earnings of $17.18 billion. Further, the book value per share increased by 6.2% to $357.6.

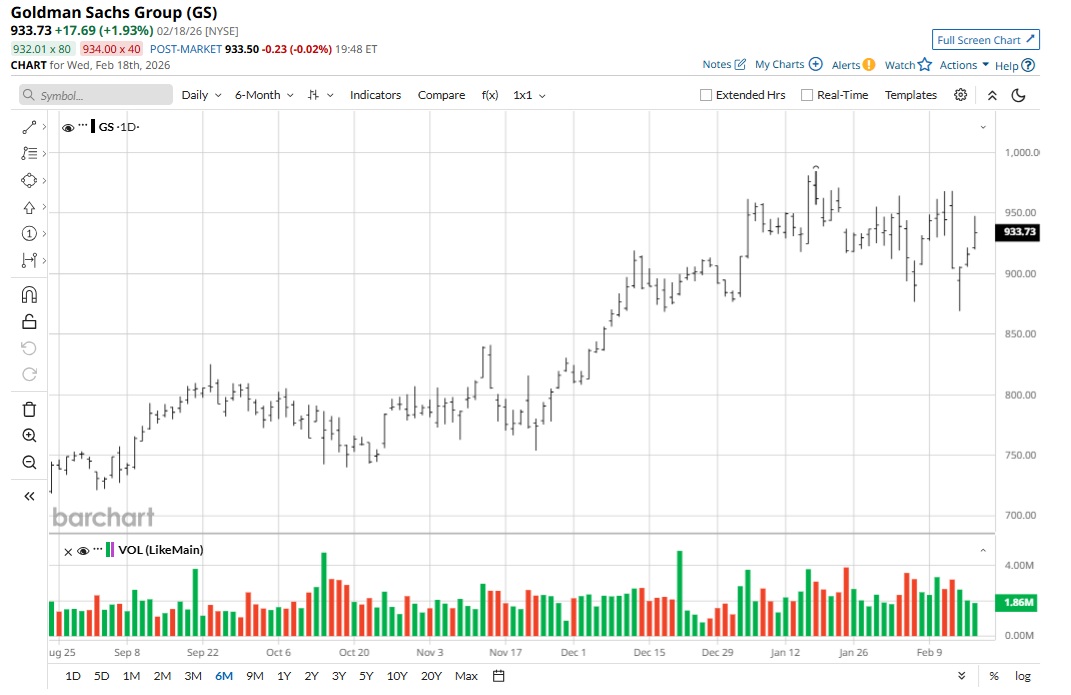

With steady growth coupled with heightened dealmaking activity, GS stock has trended higher by 28% in the last six months. With dealmaking expected to remain strong in 2026 and considering the growth in EMEA, it’s likely that GS stock will remain in an uptrend.

Healthy Growth Likely to Sustain

For 2026 and beyond, Goldman Sachs has multiple catalysts for growth. In January 2026, Goldman completed the acquisition of Industry Ventures, which is a venture capital platform. The acquired entity manages $7 billion of assets under supervision. With significant investment in technology and artificial intelligence, Goldman is likely to leverage this acquisition to offer “advisory, financing, innovative capital solutions.” At the same time, the acquisition will provide Goldman clients with attractive investment opportunities.

Another point to note is that for FY25, Goldman reported 6.1% year-on-year (YoY) growth in the Americas. For the same period, growth in EMEA and Asia was 15.6% and 11.2%. Geographical diversification is likely to ensure that healthy growth is sustained. Of course, heightened M&A activity is among the key growth drivers. The company’s investment banking fee backlog has “increased significantly” as compared to the end of FY24. This provides revenue visibility into FY26.

From a balance sheet perspective, Goldman has a CET 1 capital ratio of 14.4% as of Q4 2025. This is well above the regulatory requirement of 11.4%. Backed by strong credit metrics, Goldman has also pursued share repurchase of $12 billion for 2025. With 2026 expected to be good, it’s likely that aggressive share repurchases will continue.

What Analysts Say About GS Stock

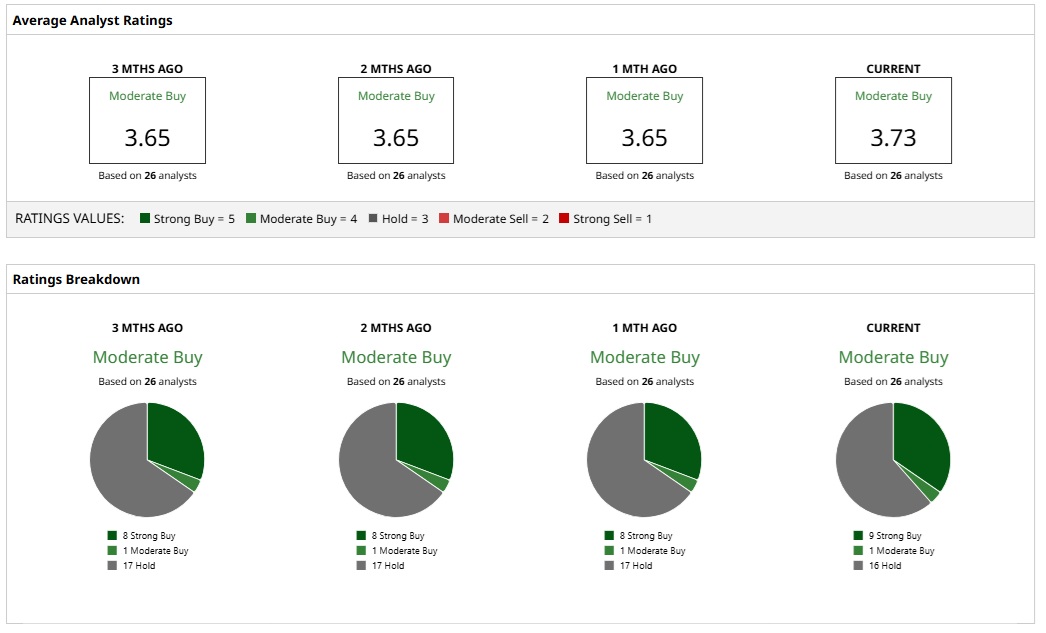

Given the ratings of 26 analysts, GS stock is a consensus “Moderate Buy.” While nine analysts assign a “Strong Buy” rating to GS, one analyst believes that the stock is a “Moderate Buy.” Further, 16 analysts believe that the stock is a “Hold.”

Based on these ratings, analysts have a mean price target of $968.45 currently, which would imply an upside potential of 6%. Further, the most bullish price target of $1,125 suggests that GS stock could rise as much as 23% from here.

From a valuation perspective, GS stock trades at an attractive forward price-earnings ratio of 15.99. Goldman Sachs also offers an attractive return on equity (ROE) of 15.19%. Further, the investment banking firm recently increased quarterly dividends by 12.5% to $4.5. At the current stock price, it implies a healthy annualized dividend yield of 1.9%.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart